Rare elements are poised for a bull run that’s long overdue. And now it’s a matter of defense and national security.

The hottest metal right now is definitively vanadium—not only is it a major additive for steel…

Now it’s the future of our electricity storage revolution: It’s the key to making “liquid electricity” and if we thought lithium was a mouth-watering investment thanks to the electric vehicle boom, vanadium should be much bigger.

It’s where the enormous potential of electric storage becomes a reality. It does everything lithium can’t do in the large battery market. That’s because the batteries are giant—as ‘small’ as a shipping container or as big as a football field.

And prices are soaring as vanadium—Element 23—becomes the backbone of the looming $13-billion energy storage market by 2025.

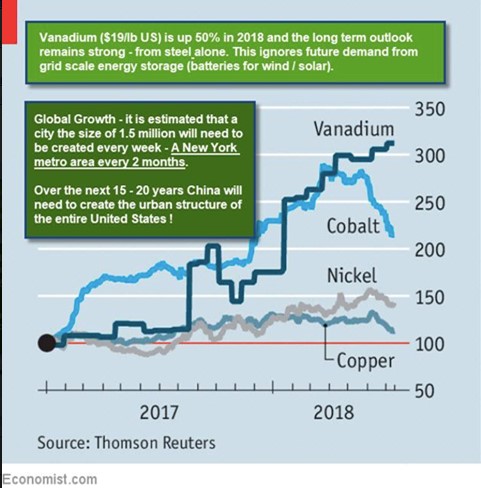

Vanadium has soared more than 130 percent in the past year, outperforming other battery bets like cobalt, lithium and nickel. That’s because Vanadium Redox Flow Batteries are

closing in on the cost of lithium-ion batteries, and are expected to become cheaper real soon.

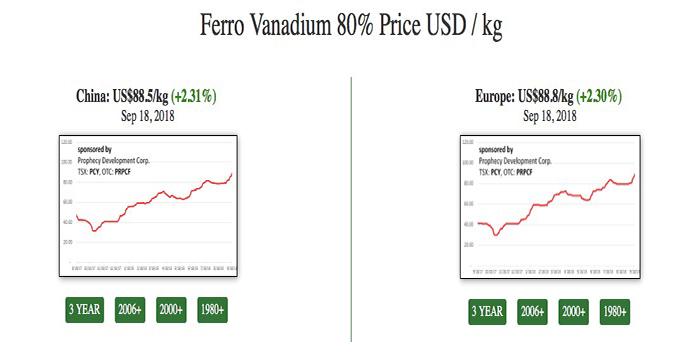

By January of this year, prices of ferro-vanadium (VAN-FERRO-LON) had hit a nine-year high of $59/kg. They’ve gained some $20 since then.

We don’t just need a ton of batteries anymore—we need utility scale, and lithium won’t cut it. It will be vanadium. It’s catching up to lithium quickly, and because of cheaper scaling, it will soon overtake it as the far superior element.

With that in mind … here are 5 mining stocks poised to take advantage of the rare element’s bonanza:

#1 BHP Billiton (NYSE:BBL)

If you’ve been on the fence over BHP Billiton, it’s probably time to get off. In late July, BHP announced the sale of its onshore U.S. assets for a whopping $10.8 billion, and those funds will likely make their way back to shareholders in the form of buybacks or dividends. That makes it a good play for income investors. It’s seen a 42-percent jump in final dividends, hitting a record 63 U.S. cents a share. That means the total payout for the year is $2.5 billion.

But this isn’t just for income investors … there’s also a big global growth outlook here, and the general sentiment is that BHP is going to now grow earnings steadily.

The pain for the company has subsided, and the timing is now ripe as we see a confluence of rising commodity prices and asset sales.

In terms of recovery stories in the mining sector, this is the biggest one.

#2 United Battery Metals (CSE:UBM, OTC: UBMCF)

If you want a direct hit on vanadium—this is it. This little-known company just put America on the map for vanadium with a discovery in Colorado.

UBM is now aiming to be the single U.S. source of this most precious of rare element metals.

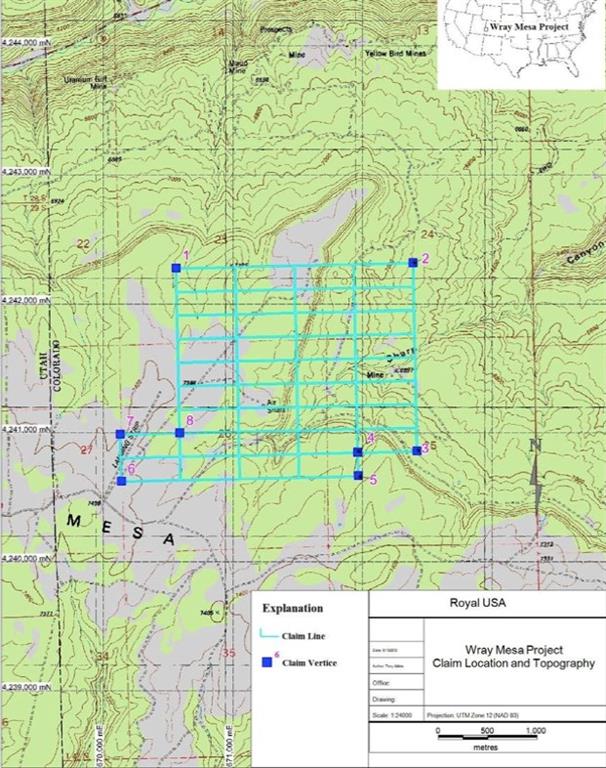

Welcome to the Wray Mesa Project in Montrose County, Colorado, where UBM is sitting on an estimated massive 2.7 million pounds of vanadium (along with over 356,000 pounds of uranium as a bonus).

That should mean an American source for the rare element metal powering the “liquid electricity” breakthrough. It makes the electric vehicle push look like child’s play.

The worldwide battle for vanadium is about to ramp up. The world’s largest battery is being constructed right now in China, while the U.S. has zero production of this strategic mineral.

We already know there’s a lot of uranium and vanadium at UBM’s Wray Mesa Project in Colorado. It was extensively explored in the 1940s for nuclear bombs, and then in the 70s and 80s for nuclear power. Now we have new tech that are hoped to revise these numbers upward significantly.

The mineral resource base estimate here was made using a 739-drill hole database showing an indicated resource of approximately 217,000 pounds of contained uranium and some 2.7 million pounds of vanadium. And it’s easy to mine because you can just scrape it off the exposed sandstone.

With current ferro vanadium prices at over $88 per kilogram, 2.7 million pounds (1,227,000 Kg) would be a $96M gross take for a company that has a market cap of just over $10 million. And that’s just for what’s expected to be already there. When UBM starts looking at new exploration …

#3 Rio Tinto (NYSE:RIO)

We’re bullish on RIO because the No. 2 miner has now reorganized its marketing division to catch up to Glencore and Anglo for commodities trading.

But RIO’s iron ore business is also set to expand. Last year, iron ore accounted for 44% of Rio’s revenues, and it’s a pretty good time for iron producers.

RIO’s also got uranium in its portfolio in Australia, Namibia and Canada—and where there’s uranium, there’s usually vanadium. RIO already has vanadium in its portfolio, but the timing isn’t quite right yet to buy into RIO just for vanadium: investors won’t feel the price bump in vanadium through RIO just yet. But patience is a virtue.

This isn’t a pure vanadium play by any stretch, but it’s a safe bet on a world class miner whose margins are looking more than healthy and whose iron ore prospects are driving it forward.

Much like BHP, Rio Tinto has been busy offloading non-core assets of its own this year and is likely to return these funds to shareholders. This is a great play with a positive earnings outlook on the back of solid global growth for investors looking for broad exposure to the sector, with a potential vanadium bump in the near future.

#4 Freeport-McMoRan (NYSE:FCX)

If it’s lithium you’re still stuck on, this is by far the best performer out there.

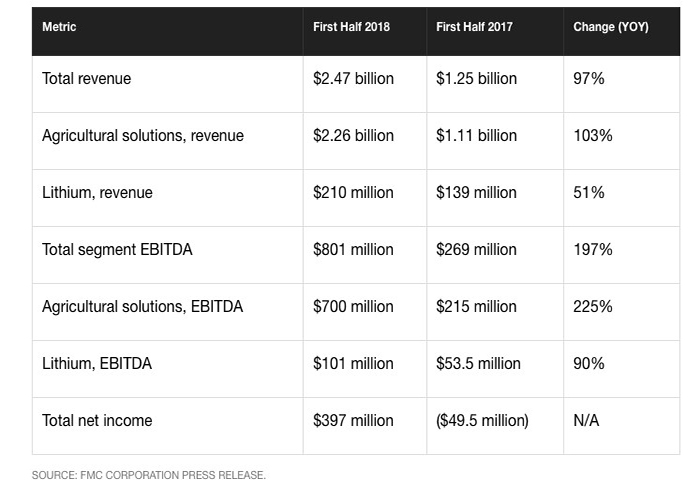

But again, this isn’t just about lithium, and FCX depends quite a lot on its pesticide sales, seeing 92 percent of revenue in the first half of this year from its agricultural solutions business. And in March last year, FCX bought up a significant portion of DuPont’s crop protection business in a deal that closed last November. That deal turned Freemont into one of the largest agro-tech companies in the world.

Trading as a $20.23-billion market cap company, FCX was also one of the biggest producers of cobalt in the world until it sold its stake in Congolese Tenke Fungurume to China Molybendum for $2.65 billion, though it still has its hands in the cobalt trade through a subsidiary called Freeport Cobalt.

But in October, things are about to getting more interesting because FCX is planning to spin-off it’s lithium segment. FMC Corp’s lithium segment will become Livent Corp. next month. Management expects the lithium segment to generate full-year 2018 revenue in the neighborhood of $445 million and EBITDA of around $200 million.

Look for the IPO this fall, but also watch this …

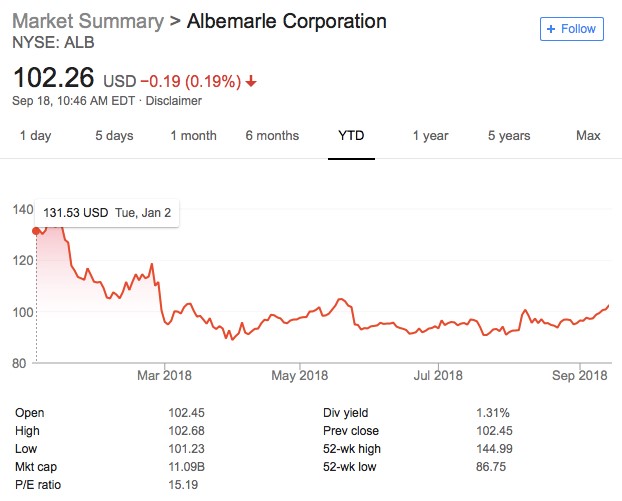

#5 Albemarle Corp. (NYSE:ALB)

This is the largest lithium producer in the world, so—again—it’s a risk with vanadium emerging as the superior element for the battery race and the much bigger energy storage question.

But Albemarle is flexible. And this could tie in to FMC Corp’s lithium plans. In the first week of September, Albemarle said it might consider buying FMC’s lithium spin-off (Livent) if the Livent IPO flounders. It’s also significant because this IPO would be the first major U.S. lithium producer to go public.

Albemarle stock isn’t faring too well this year, having lost around 27 percent of its value.

Other companies taking the mining sector by storm:

Turquoise Hill Resources (TSX:TRQ) is a mid-cap Canadian mineral exploration and development company headquartered in Vancouver, British Columbia. Its focus is on the Pacific Rim where it is in the process of developing several large mines.

The company mines a diversified set of metals/minerals including coal, gold, copper, molybdenum, silver, rhenium, Uranium, Lead and Zinc. One of the fortes of Turquoise hill is its good relationship with mining giant Rio Tinto.

In September, Turquoise announced a new addition to its board, with industry veteran Alan Chirgwin filling out the team. Chairman Peter Gillin noted, “Alan’s appointment further enhances the board’s subject matter expertise through his extensive commercial background, proven track record in the resources sector and experience, specifically, in the Asia Pacific region.

First Quantum Minerals (TSX:FM) is a Canadian mining company specializing in copper. While copper may be the company’s primary focus, it also owns several gold, cobalt, and zinc producing mines. First Quantum operates mines and development projects all over the world, including Australia, Africa, Spain, Finland, Turkey, and Latin America.

Though First Quantum has had a noteworthy year so far, new tax laws in Zambia hit miners in the region particularly hard, with First Quantum commenting recently, “It is expected that there would also be an impact of the non-refundable Sales Tax on C1 and AISC however the rate is not yet known.”

Centerra Gold (TSX:CG): This big mid-tier gold Canadian miner realized a very competitive cost per ounce in 2016 and expects to cut costs even further in 2017. Its Kyrgyzstan operation yielded a very strong result in 2016. Next to gold, Centerra’s copper production is worth noting as prices for this metal just leapt to two-year highs, providing a nice extra income for Centerra this year. Additionally, copper is set to play a huge role in the inevitable battery boom that will transform energy markets once and for all.

It would be unfair to label Centerra as solely a gold producer, and with new deals in the making, Centerra stands to continue to be a force in the Canadian stock market.

Orocobre (TSX:ORL) has had some serious problems and its stocks have seen major extremes. But the company still must be viewed as the first brine concentrate lithium project in 20 years, and a new catalyst may end up being the ability to self-fund the expansion of its Olaroz lithium hydroxide plant in Japan.

In late September, Orocobre announced a leadership shakeup, with Martin Perez de Solay joining the team as Chief Executive Officer and Managing Director. Chairman Robert Hubbard noted, "Martin is a highly accomplished Chief Executive with the ideal blend of skills, experience and knowledge to lead Orocobre though the next stages of its development.

Agnico Eagle Mines Ltd (TSX:AEM) Canadian based miner, Agnico Eagle Mines is an especially noteworthy company for investors. Why? Between 1991-2010, the company paid out dividends every year. With operations in Quebec, Mexico, and Finland, the company also is taking place in exploration activities in Europe, Latin America, and the United States. This is certainly a company with tremendous potential that grows better by the day.

In July, Agnico shed a positive update for shareholders on the progress being made on its 100% owned Nunavut projects. CEO Sean Boyd noted, "Elsewhere in Nunavut, development activities at Meliadine are progressing on schedule and on budget, which continues to support the start of production in the second quarter of 2019."

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This article contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this article include that prices for vanadium will retain value in future as currently expected; that UBM can fulfill all its obligations to maintain its property; that UBM’s property can achieve drilling and mining success for vanadium, and potentially sell 2.7M pounds of vanadium; that the vanadium extraction process being developed will be cost effective; that the vanadium battery process can be commercialized for large scale production; that high grades found in samples are indicative of a high grade deposit; that high-grade vanadium is in sufficient quantities to make drilling economic; that batteries and EVs will start using large amounts of vanadium; that vanadium system costs will be reduced quickly and dramatically; and that UBM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling programs, aspects or all of the property’s development may not be successful, mining of the vanadium may not be cost effective; even if mining is successful, UBM’s property may not yield 2.7M pounds of vanadium; UBM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper vanadium; more production of vanadium could reduce its price, or the price may drop for other reasons; technological advances to reduce vanadium system costs may not occur as expected; alternatives could be found for vanadium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by UBM fifty nine thousand two hundred and eighty six US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by UBM to conduct investor awareness advertising and marketing for CSE: UBM; OTC:UBMCF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.