In October, Leidos is expected to finish construction of a 2 metric ton/hour coal-treating plant that will prove Clean Coal Technologies’ (CCTC) Pristine-M process can efficiently and economically remove moisture and volatiles from low-grade coal. If successful, Pristine-M could transform the alternative energy landscape and coal industry, simultaneously. In our view, CCTC is nearing commercialization of one of the most exciting, and potentially important, technological advances seen in years. This advance could be worth billions, and conservatively, create tremendous upside for this emerging Company.

‘Fixing’ One of the Most Important Commodities in Global Energy Security

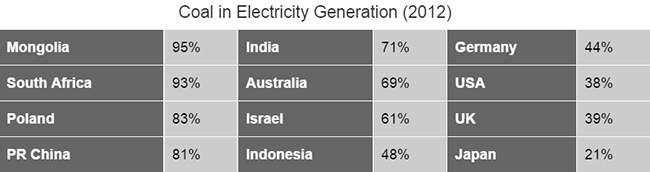

Coal is the most abundant fossil fuel on the planet, used to generate over 40% of the world’s electricity and in production of 70% of steel. In the world’s two most populous countries, where coal is used in 81% and 71% of electricity production, respectively, coal is even more important to the energy grid and in meeting growing demand for electricity (as shown, below).

Source: World Coal Association

Consumption of coal increased 70% from 2000 – 2013, according to the International Energy Agency (IEA), which predicts China will continue to grow its coal consumption, but is expected to be overtaken in demand by India in 10 years.

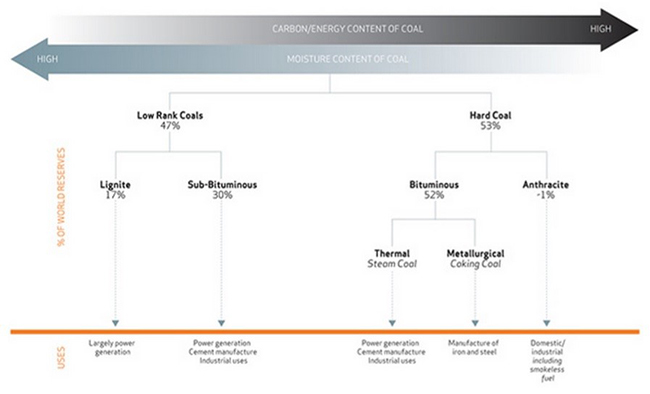

The problem is that 47% of proven reserves are ‘low-grade’ coal which burns inefficiently and emits large[r] amounts of carbon than high-grade or ‘ranking’ coal. As shown in the graph, below, ‘grade’ and ‘moisture content’ [in coal] are inversely-related.

Distribution of Proven Coal Reserves

Source: World Coal Association

The world is increasingly taking measures to reduce carbon emissions. Burning of low-grade coal is one of the biggest contributors to this environmental issue. Consequently, a technology that could ‘upgrade’ low-grade coal inexpensively would be transformational on a global scale and offset events like China’s ban on import of low-grade coal.

CCTC predicts that energy production will increase 67% when ‘upgrading’ coal using Pristine-M, at a cost of $7.50 per ton. The IEA states that for every one percentage point gain in efficiency, there is a 2 to 3 per cent reduction in the amount of greenhouse gasses produced. This would imply that Pristine-M could materially cut emissions by upgrading existing coal-burning plants. In Australia, for example, 21 of 25 coal-burning power plants waste 65%+ of the coal that they burn, according to their government. Retrofitting these dated plants with Pristine-M would be an economically sensible and cost-effective solution for (i) reducing greenhouse gas emissions, and (ii) lowering cost of kWh by improving efficiency of coal input.

Importantly, Pristine-M is economically additive, not only improving outcomes for energy producers, eg. coal-burning power plants, but also for coal miners and, ultimately, for end consumers of electricity, who benefit from lower energy prices. One of the largest cost components of coal extraction is transportation. If CCTC’s technology removes moisture, and consequently shrinks the size and weight of the coal, the cost of transporting the fossil fuel plummets. This would [once again] make coal far cheaper than oil and natural gas-burning power plants, specifically, for example, in the United States (where price of natural gas is competitive with coal).

Leidos, Jindal Partner To Validate CCTC’s Technology

Leidos, formerly known as Science Applications International Corporation (SAIC), is one of the world’s largest defense contractors and employs some of most qualified and experienced researchers, scientists and engineers among its 19,000 employees. Leidos and CCTC have agreed to work together in the construction of commercial 1MM ton/year plants once Pristine-M in proven in October. This partnership is validating of CCTC’s technology because of the seemingly slim economics Leidos has enjoyed to-date, in exchange for years of design, engineering and actual construction work on the 2MT/hour plant in Oklahoma. Indeed, Leidos’ involvement suggests that the defense giant believes Pristine-M is more than likely ‘to work’ and commercial roll-out will be hugely successful.

To put commercialization into perspective, Jindal Steel & Power, India’s 3rd-largest steel producer and a large coal miner, has already licensed Pristine-M for 25 years and expects to build a 1MM ton/year plant following October’s outcome. Duly, this suggests that another industry conglomerate believes Pristine-M is viable on a commercial scale and likely to succeed in transforming the coal industry.

How CCTC Generates Revenue for Adding Value to the Global Coal Supply Chain

CCTC makes money in 3 ways: licensing of its technology and ‘know-how’; a royalty on every ton of coal upgraded using the Company’s Pristine-M technology; through the sale of interest in joint-ventures partnerships in specific territories. Let’s elaborate on each.

License. A license is granted in exchange for cash consideration. The transaction is straight-forward and involves little to no additional overhead, therefore accreting to the bottom-line immediately.

Royalty. To use Jindal as an example, after licensing Pristine-M from CCTC, the conglomerate will pay the Company $1 per metric ton of coal processed using CCTC’s methodology for upgrading coal. Similarly, a royalty stream would [presumably] involve little to no additional cost for CCTC to earn it, and therefore also add to the bottom line.

Joint Ventures. Should CCTC successfully commercialize Pristine-M, it will be faced with a gigantic task of reaching thousands of potential end users, including power plants, steel/iron producers and miners. Regional partners could be a better way to reach the largest and most lucrative customers, quicker. Presumably, CCTC would be paid an up-front fee in exchange for a % interest in the joint venture. Again, this would take the form of high-margin cash flow to the Company and, consequently, its shareholders.

To put all of this in perspective, as of the last update CCTC had ~40M shares outstanding (not including dilutive securities). Shares recently traded hands at a valuation of just ~$10 Million. If in October, Pristine-M is successfully tested, CCTC would need to enter into perhaps one licensing deal or joint venture to realize revenue equal to its current valuation. Even if global roll-out demands allocation of several million to overhead expenditure in 2016/2017, any revenue generated above that fixed cost is profit.

Total coal production was 7,823 million tons in 2013. If we estimate ~10% of that was low-grade coal that could be upgraded with Pristine-M, there’s a 782 Million ton annual market that CCTC’s technology can address today. Production is growing, notwithstanding - even capturing 1% of this opportunity would yield ~8M in royalties/annum, not to mention several million in licensing fees. But if the technology is as transformational as it appears, penetration should be considerably higher. We should also add that most low-grade coal is not consumed or burned, for example, in the production of electricity. But Pristine-M would enable this to happen through the upgrading process. This means our estimate for annual consumption is itself, very conservative. Let’s run through a potential valuation scenario, before we explain why even the most conservative investors might see opportunity in CCTC ahead of the October catalyst.

Worst-Case Valuation Scenario:

Suppose the testing of Pristine-M is positive – meaning in line with Company and Leidos’ and Jindal’s expectation – come October. But commercialization, beyond Jindal, doesn’t happen. Jindal will commission (per their licensing agreement) the construction of a 1MM ton/year facility. Jindal operates several plants/mines so it would be logical to assume they will roll-out Pristine-M everywhere where it’s additive to their operations. Jindal specifically negotiated for a $4M a year cap in their license (which explains their very early involvement). To service this one account, an aggressive overhead would be <$1M/year. Under this scenario, CCTC still makes $3M in cash flow. At 20X, the Company is worth $60M or 600% higher than where it is currently trading.

But if the technology ‘works’ as the Company and its partners suggest, why wouldn’t it see commercial traction?

Base-Case Valuation Scenario:

Assume CCTC makes $4M/year in royalties from Jindal and find 6 new clients per annum (one every two months). To make it easier on the Company, they enter into a joint venture (JV) with a Chinese company to capture that market, and 3 of the 6 new clients are a result of the JV. Each of the 3 clients that CCTC found independently pay $2M upfront as a licensing fee and set up 1M tons/year facilities. The license fees therefore total $2M * 3, and to that we add $1M * 3M ton/year plant royalties = $9M. CCTC’s JV partner buys a 50% interest in CCTC’s license and royalties in their territory and pays CCTC $10M for this interest. Plus, CCTC is entitled to 50% of the license and royalties from the 3 Chinese clients gained through their JV partner. Hence, $9M (royalties and license from 3 clients) + $10M (JV upfront payment) + $4.5M (50% of license and royalty revenue earned in the JV) = $23.5M in revenue. Even assuming overhead jumps to $5M, the rest is, presumably, profit. $23.5 – $5 = $18.5M profit or cash flow. At 20X $18.5M profit, CCTC is worth $370M, or 36X recent market prices.

We think the ‘base-case valuation’ really is a base case for a number of reasons (of course, assuming Pristine-M works as the Company believes it to). First, Pristine-M will have first-mover advantage. No other technology is as competitively priced and/or close to commercialization. Second, Leidos’ deal suggests the defense firm will aggressively market Pristine-M to its enormous client roster. Leidos’ economics in the deal rest on finding clients that will contract them to build coal-treating plants based on CCTC’s technology. This tells us that our assumption that CCTC will find 3 clients (in addition to Jindal) independently is likely a very safe assumption. Lastly, given the sheer size of the Chinese market, we believe that if management is capable of landing a serous JV partner, CCTC will easily find 3 end users for Pristine-M in a country that just happens to be the world’s largest consumer of coal.

Plug Power Signs Fortune 100 Companies Because Technology Makes Economic Sense, Like CCTC’s

We see a parallel in Plug Power (PLUG), who has signed numerous Fortune 100 companies to use its hydrogen fuel-cell ‘GenDrive’. Plug Power explains that not only does [GenDrive] reduce carbon footprint, it's actually more productive versus lead-acid batteries (GenDrive’s principal competitor). The Company illustrates this by discussing operating a warehouse forklift:

“Battery changing requires 15 minutes per shift compared to two minutes for hydrogen refueling. Over a year, that 13 minutes per shift saved represents over 156 hours of lost productivity per forklift truck in a 3-shift operation. One fuel cell for one truck - it's that simple.”

CCTC’s Pristine-M is tackling a huge emission problem with coal. Further, not only is clean coal fostering the idea of alternative or clean energy, but it actually makes economic sense. The Company explains the economics in its presentation [click here], where they break down the cost of Pristine-M and illustrate the impressive return on investment (ROI) for clients who adopt the technology for upgrading coal.

Why Even Conservative Investors Will Want To Watch CCTC Ahead of Imminent Catalyst

We think even the most conservative of investors will see value in Clean Coal Technologies, if put another way.

If you purchase securities in an oil & gas producer, you have direct exposure to the fluctuations in the price of oil and gas. But if you buy names that sell equipment or technology to oil & gas companies, your exposure to the commodity is indirect, or at the very least far less levered. We think conservative investors will rival CCTC to companies that sell equipment and/or technology to alternative energy names. And why not? Companies like Fuel Systems Solutions (FSYS), Fuel-Tech (FTEK), MagneGas (MNGA), American Superconductor (AMSC) et al. foreshadow what CCTC might look like in the not-too-distant future…if dozens of [economically viable] competitors suddenly emerge in the clean coal space (as we’ve explained, the competitive landscape looks bleak).

For now, CCTC appears to have first-mover advantage in commercializing one of the most important technologies the trillion dollar coal industry has ever seen. We think that investors should be paying close attention to the October catalyst because Pristine-M could also be one of the biggest advances seen in alternative energy in years.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research, LLC on behalf of Clean Coal Technologies, Inc. as part of research coverage services. One Equity Research has received two hundred seventy five thousand restricted shares as consideration and may be issued an additional eight hundred twenty five thousand restricted shares during the course of research coverage. An affiliate is long shares of Clean Coal Technologies. This research note is not an offer or solicitation to buy or sell the securities of Integral Technologies. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation.