Coronary Artery Disease (CAD) is the leading cause of mortality in the United States, accounting for 1-in-6 deaths. The total cost for treatment & management of CAD is greater than $100 Billion per year[1] in the U.S. These costs can be offset with preventative measures such as earlier and more accurate diagnosis of disease. FluoroPharma (OTCQB: FPMI) offers novel PET-based imaging agents that could meaningfully advance diagnosis and lead to better patient outcomes. Importantly, this $10 Million Company has traded under-the-radar and is approaching an inflection point in its growth and valuation.

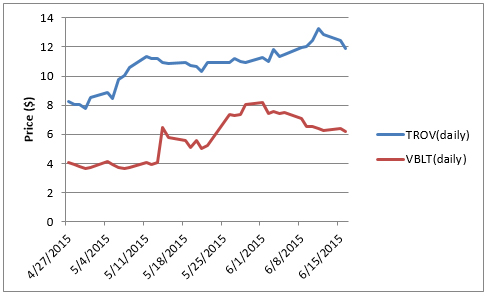

We see potential upside in FPMI of 500% from current market prices. Readout of phase II trial data, expected as early as this quarter, could cause a surge in price. To gauge the potential significance of this upcoming catalyst, consider the growth exhibited by Vascular Biogenics (NASDAQ: VBLT), which jumped over 115% (as shown below) on anticipation of Phase 1/2a data ahead of the annual ASCO meeting. Similarly, observe the 40%+ surge of Trovagene's (NASDAQ: TROV) stock following the release of favorable clinical data for their PCM diagnostic technology.

Superior Product For An Existing Multi-Billion Dollar Need

FPMI is a biopharmaceutical company specializing in PET scan imaging agents. With the PET radiopharmaceuticals market projected to be $4B by 2018[2], even marginal market penetration [on commercialization] of the company’s imaging agent would yield a significant return on investment. FluoroPharma has two candidates, BFPET and CardioPET, both in Phase II clinical trials for the diagnosis of Coronary Artery Disease (CAD).

CAD, the most common form of heart disease, occurs due to the build-up of plaque in the coronary arteries resulting in restricted blood flow to the heart muscles. It is responsible for 380,000 deaths annually, and therefore advances on the diagnostic front are desperately coveted. Imaging with SPECT and PET scans are among the diagnostic tests performed on patients for CAD. Patient health, among other factors, plays a role in the selection of an appropriate diagnostic test. BFPET is in development for patients who can tolerate both exercise and pharmacologic stress, whereas, CardioPET is intended for patients with angina (chest pain) or those who cannot exercise.

With a 75% accuracy in ‘SPECT’ imaging, the current gold standard in CAD diagnosis, FluoroPharma’s BFPET can potentially serve a $7 Billion clinical void with a potentially superior alternative. An estimated 5M PET tests could be performed in the US alone, at a rate of $1400 each. Under this scenario, FPMI would have an addressable market of $7 Billion. Similarly, CardioPET as an alternative to the current treatment paradigm can help relieve a financially burdened healthcare system of more than $25 Billion in costs incurred from unnecessary procedures. An estimated 1.5M applicable PET procedures with a cost in line with BFPET gives CardioPET an additional$2.1 Billion market opportunity.

A large, unaddressed need make for a compelling investment proposition in FPMI. But precedent set by Cardiolite creates a favorable and clear path to market, building on an already compelling story.

Past FDA Approval Sets Positive Precedence for FluoroPharma’s Late-Stage Candidates

According to A Review of Imaging Agent Development,

“...Cardiolite ([Tc-99m]), which is used to detect coronary artery disease, has a similar sensitivity and specificity compared to Thallium-201, the gold standard at the time of its approval. Yet the advantageous properties of the Tc-99m label improved image quality..."[3]

As one of FPMI’s main competitors, the approval of Cardiolite can shed some light on the FDA’s stance on imaging agents. Cardiolite was approved on the basis of a similar efficacy (sensitivity and specificity) and improved image quality (better resolution) compared to Thallium-201.

What does this mean for FPMI? Consider the phase I results of FPMI’s two agents:

BFPET

- No adverse events

-

No clinically significant changes noted in follow-up clinical and laboratory testing

-

[BFPET] images had qualitatively higher resolution than the current SPECT gold standard.

CardioPET

- Promising safety profile with no detected adverse events.

-

Clinical findings were consistent with SPECT.

-

Visually superior images than its SPECT counterpart.

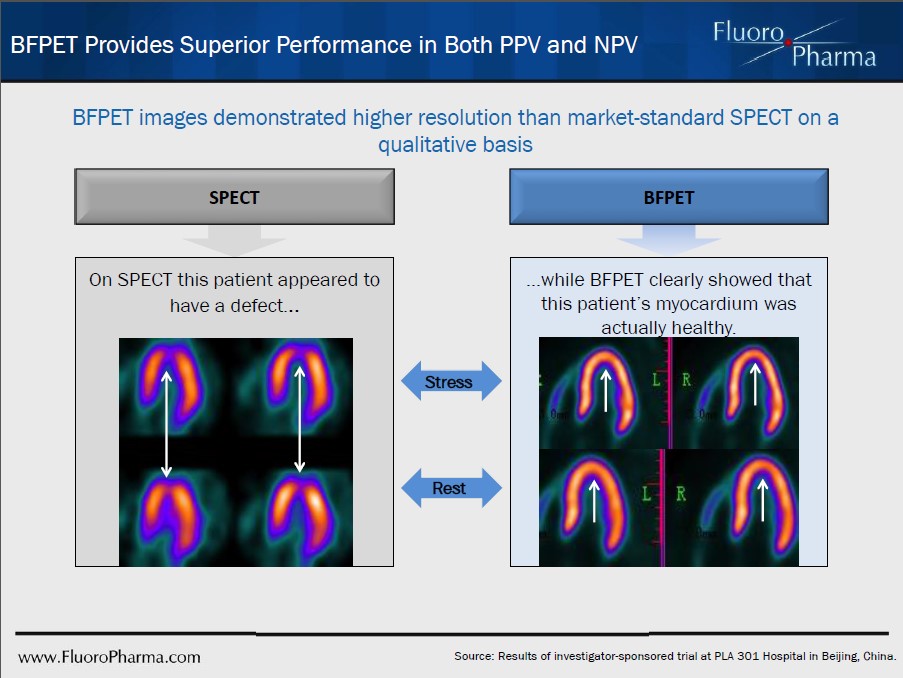

Figure 1. Suggestive of a superior sensitivity, BFPET does not identify the patient as having a myocardial defect [converse to the SPECT image], saving the healthcare system time and money.

Having successfully demonstrated a superior image quality in both BFPET’s and CardioPET’s clinical trials, the company should benefit from the positive precedent set by Cardiolite’s approval. Specifically, CardioPET’s clinical findings were in line with SPECT, suggesting that the improved image quality would lead to improved accuracy in detection of disease – for the $100 Billion CAD expenditure. As data from CardioPET’s Phase IIa clinical study is expected to readout this quarter, we expect results in line with the findings of Phase I will be a major catalyst for FPMI shares.

Why FPMI Shares Are Worth 6X Current Prices, On A Fully Diluted Basis

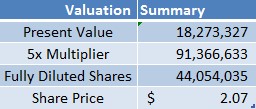

We believe FPMI is worth 6X current prices on a fully diluted basis. To compute fair value, we took U.S. sales of [Lantheus Medical Imaging’s] Cardiolite to use as a baseline. At the very minimum, we expect total sales of BFPET and CardioPET to be ~$8.5M, in line with the average revenue of Cardiolite for the last 3 years[4].

We assume commercialization in 2018 as well as zero sales growth to 2025, when patent protection expires, and use a 25% discount rate. Applying a modest multiplier of 5x present value, we arrive at a present valuation of ~$90M, roughly ~9X the current valuation of $10M. Inclusion of all outstanding common stock warrants yields a price of $2.07/share on a fully diluted basis, compared to recent prices of ~$0.35/share, or 6X current market price. The table (below) shows assumptions used in our computation of fair value.

Figure 2. Assumptions used in computing fair value of FPMI’s common shares on a fully diluted basis.

As a reminder, the above valuation is conservative. Cardiolite does not enjoy the same patent protection[6] or market exclusivity that BFPET and CardioPET would, if commercialized. The declining sales of Cardiolite are indicative of the competitive landscape of radiopharmaceutical imaging agents and highlight the importance of novel developments like FluoroPharma’s PET imaging agents. Thus, it would be reasonable to assume growth year-over-year as FPMI’s product(s) displace inferior alternative(s). Should this be the case, an adjusted computation of fair value for FPMI’s shares would demonstrate even greater upside today.

Comparable Diagnostics Companies Make FPMI Valuation Even More Compelling

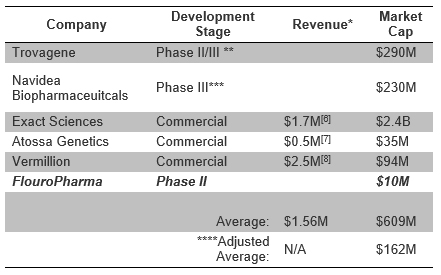

The need for clinical improvement in the diagnostic process for one of the most common diseases, CAD, has created a niche in which FPMI could thrive. The table below highlights FPMI’s large valuation discount, >93%, to other companies in the diagnostic space - Trovagene (TROV); Navidea (NAVB); Exact Sciences (EXAS); Atossa (ATOS); Vermillion (VRML).

We believe investors in any of the diagnostic companies named in the table (above) would take interest in FPMI, given the nearing catalyst and disconnect in its market and fair value. With shares trading at an 80% discount to fair value (as computed and explained earlier) ahead of their phase II data readout, we believe FPMI is poised to breakout and trend towards computed fair value of $2.07/share – or upwards by 500%.

References

*Annual Revenues from year end 10K filings

**Trovagene’s pipeline does not have FDA approval, however is commercial under CLIA regulations. Clinical studies are being conducted focusing on the efficacy of their diagnostics.

***Navidea has two neurological SPECT/PET diagnostic tracers in Phase III and a commercially ready FDA approved radioactive diagnostic imaging agent.

****Adjusted average corrects for skew from outliers.

[1] http://www.crnusa.org/CRNfoundation/HCCS/chapters/03-CRNFSHCCS-CHD+Omega-3sandBVitamins.pdf

[2]http://www.biotechsystems.com/reports/330/default.asp

[3] http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2691464/#CR11

[4] http://investor.lantheus.com/phoenix.zhtml?c=241435&p=irol-SECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTEwMTI0NTAxJkRTRVE9MSZTRVE9NjYmU1FERVNDPVNFQ1RJT05fUEFHRSZleHA9JnN1YnNpZD01Nw%3d%3d

[5] http://www.dicardiology.com/article/lantheus-use-competitive-pricing-against-generic-cardiac-agents

[6] http://www.sec.gov/Archives/edgar/data/1124140/000155837015000227/exas-20141231x10k.htm

[7] http://www.sec.gov/Archives/edgar/data/1488039/000114420415019344/v401337_10k.htm

[8] http://www.sec.gov/Archives/edgar/data/926617/000092661715000017/c617-20141231x10k.htm

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC on behalf of FluoroPharma Medical ("FluorPharma" or the "Company"), as part of research coverage services. One Equity Research expects to receive ten thousand dollars for coverage of FluoroPharma as of the date of this note. This research note is not an offer or solicitation to buy or sell the securities of the Company. The report is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/