A few weeks back, Lightlake Therapeutics (OTCQB: LLTP) announced that their partner, Adapt Pharma, had begun a rolling NDA submission for the Company’s intranasal naloxone, indicated for opioid overdose rescue. If you’ve followed Sarepta (SRPT), Intercept (ICPT), BioMarin (BMRN), or Alexion (ALXN), you might recall that rolling submissions are value-accreting because it allows regulators to review portions of the New Drug Application (“NDA”) on an ongoing or rolling basis, thereby shortening approval review time. In disease settings where potential peak sales are measured in the hundreds of million – or even billions – a decision by the FDA a month or two, or several months, ahead of schedule can literally transform a company.

LLTP’s partner filing for a NDA for the Company’s intranasal naloxone is transformative for this $13M biotech firm for 3 reasons:

1) LLTP appears to be the first company to file for intranasal naloxone approval. Being first to market would give their partner, Adapt Pharma, significant advantage over competitors in the $1B+ overdose ‘niche’. Presumably, NDA filing and/or regulatory approval will trigger a meaningful milestone payment from the upwards of $55 Million Adapt committed to Lightlake when they licensed intranasal naloxone.

2) LLTP has raised substantially all of its capital in the last 12 months by selling profit interests in future products at an implied valuation of $50 Million, from intranasal naloxone indicated for opioid overdose reversal and binge eating disorder treatment, respectively. The market has not credited LLTP with its ability to raise capital at a 300%+ premium to its [current] share price.

3) LLTP did not receive any credit for successfully completing a pivotal study of intranasal naloxone that was trialed versus the subcutaneously-injected naloxone. This event effectively de-risked the Company from a development stand-point and buoys well for commercialization, particularly with precedent set by Evzio’s approval in 2014 on a similar study design and outcome.

LLTP Management Raised Capital At >300% Premium to Current Market Price

We think LLTP shares should trade in line with the valuation at which capital was most recently raised. At $50M, shares would be worth $27. Instead, LLTP currently trades at a ~74% discount to where the Company raised capital. FDA approval, which could reasonably come in calendar 2015, would finally give LLTP much-deserved attention as one of the best value plays among small biotech firms and almost certainly one of the best drug reformulation companies in the marketplace.

LLTP’s development and commercialization partner – Adapt – is perhaps the best specialty pharma company Lightlake could have partnered with to market intranasal naloxone. Adapt is led by a group of experienced pharma executives whose track-record includes Elan (acquired by Perrigo (PRGO) for $8.6B in 2013) and Azur Pharma (merged with Jazz Pharmaceuticals (JAZZ) in a deal then worth $500M; now worth upwards of $2B).

Adapt was formed in 2014 with $95 Million in capital for the purpose of in-licensing, commercializing and marketing transformative products for specialty healthcare markets. Interestingly, the only product Adapt has focused on to-date is LLTP’s intranasal naloxone. By way of comparison, Titan Pharma (TTNP) out-licensed its opioid addiction treatment to Braeburn Pharmaceuticals, who committed $75 Million to the product’s development and commercialization. Titan – who recently saw its opioid addiction drug approved by the FDA – is valued at ~$94 Million versus LLTP’s ~$13 Million market valuation.

LLTP Advancing Superior Product in an Increasingly ‘Aware’ Market

Lightlake and Adapt will compete with companies like kaleo, who markets an ‘auto-injector’ version of naloxone for opioid overdose reversal, if their intranasal or nasal spray naloxone is approved. Kaleo’s auto-injector being rapidly approved by the FDA in 2014 not only set strong precedent for LLTP’s drug-candidate to be approved well ahead of [a normal FDA review] schedule, but has also conveniently increased market awareness of alternative version(s) of naloxone for treatment of opioid overdose. Logic dictates that if LLTP’s nasal naloxone is approved, it would likely be viewed by patients and physicians as significantly superior to an injection of any sort (even an ‘auto injector’). Moreover, kaleo borrowed $150M from PDL Biopharma at a 13% interest rate and secured the loan with 100% of its royalty in an unrelated product licensed to Sanofi. By way of comparison, Lightlake secured a best-in-class marketing partner, over $55 Million in potential sales and regulatory milestones and double-digit tiered royalties on sales of its nasal naloxone. In our view, the market has not credited LLTP with the value accreted from the partnership struck with Adapt Pharma whatsoever. We believe this could change upon potential FDA approval of LLTP’s nasal naloxone.

Strong Precedent for LLTP to Perform Handsomely Post FDA Approval

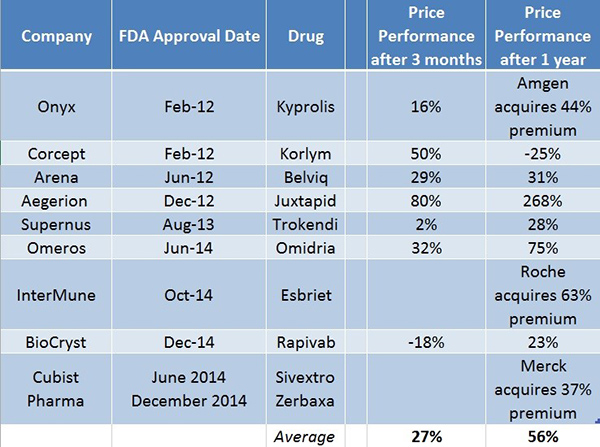

If you’re wondering how much LLTP shares could rise on an approval, we put together a few examples of companies that have cumulatively gained billions in market value upon FDA approval, and researched their performance (Figure 1, below) 3 and 12 months post-approval, respectively. This is shown in Figure 1, below.

Figure 1. Performance of Select Companies 3 and 12 Months Post-FDA Approval For Key Pipeline Drug(s)

Source: Bloomberg, SEC Filings

Even if investors were to throw valuation out the window, our research indicates that key drug approvals lead to significant share price appreciation 3 and 12 months post approval. It’s important to remember, however, that not all of the companies listed above successfully partnered their commercialized product(s). LLTP has partnered their product ahead of commercialization and has de-risked itself from requiring substantial capital, time and experience to build a sales and marketing team for intranasal naloxone.

Performance Among Companies That Submit Rolling NDAs: Sarepta, Synageva Cases Bode Well For LLTP

We note that the few examples of companies who filed for a rolling NDA submission perform even better nearing a ruling from the FDA. For instance, Sarepta has leaped over 70% since announcing that the Company would be filing a rolling NDA for their flagship Duchenne muscular dystrophy (DMD) drug, eteplirsen, in May. Similarly, Synageva (GEVA) rose >60% in under 3 months following the announcement that the company would submit a rolling BLA for their ultra-rare disease drug, sebelipase alfa. Synageva was recently acquired by Alexion (ALXN) for $8.4B, a premium of ~200% to where Synageva traded when the company announced the start of the rolling NDA submission.

Awareness of Opioid Overdose Growing; Market Opportunity for LLTP’s Drug Increasingly Visible

Last week, Fox Business ran a story titled, A Wonder Drug for Opioid Overdose, discussing the alarming rise in opioid overdose-related deaths in the United States and how naloxone could solve this problem. Our takeaway is two-fold, first that this isn't really news, since the CDC, President Obama, the FDA and numerous influencers have been calling opioid overdose an epidemic for several years, and second that the awareness created by these groups and companies lobbying for slightly-improved versions of naloxone are creating a highly-visible market for LLTP's nasal naloxone (which is good, very good in fact).

In a previous note, we briefly looked at drug reformulation companies, including a Toronto-based company called Cynapsus (CYNAD). For the better part of the last 3 years, Cynapsus existing in relative obscurity. The Company is in late-stages of developing an oral formulation (sound familiar?) of apomorphine, a drug used to treat ‘off episodes’ in Parkinson’s patients. The parallel to LLTP is this: ‘off episodes’ associated with Parkinson’s disease is a niche market, akin to opioid overdose. Apomorphine is only available as an injection and therefore rarely prescribed or used by Parkinson’s patients. Likewise, market adoption of injection naloxone is low. And up until one of Cynapsus’ competitors was acquired for $525M (Acorda paid $525M for Civitas’ oral reformulation of apomorphine), most investors knew little of Cynapsus. Since then, Cynapsus has raised significant capital at more than double its then-valuation (then ~$40M, now > $100M) from notable biotech investors. Our view is that investors who are aware of LLTP are unaware of the large market opportunity ($1B+) and unmet need for an effective opioid overdose reversal drug. Lightlake happens to be nearing commercialization with a product that not only fits this bill but is also conveniently administered through a nasal spray.

For investors who are new to LLTP, we would encourage reading our earlier notes, ‘Lightlake Partner De-Risks Drug Platform; Implies Shares Trade at 1/4 Fair Value’ and ‘FDA Fast-Track Should Accrete Significant Value to This Overlooked Biotech’.

Lightlake’s intranasal naloxone has received fast-track approval from the FDA and is also being developed for use as a treatment for addiction, notably in Binge Eating Disorder, Bulimia, and Cocaine Addiction. Each of these unmet needs represents either several hundred million or upwards of billion-dollar market opportunities. The Company’s product for Binge Eating Disorder, has shown positive results in a double-blinded Phase II study and supports proceeding to a registration or Phase III study. This product could also be partnered, and we suspect will carry enough weight to warrant an upfront milestone payment and perhaps, finally, investor awareness of Lightlake’s steady progress in building a commercial-stage drug company and tremendous shareholder value.

We continue to view LLTP as significantly undervalued, with upside potential greater than 300%. We believe the gap between market (~$7/share) and fair value (~$27/share) will narrow as LLTP approaches a potential approval decision from the FDA, expected later this year.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC on behalf of Lightlake Therapeutics (“Lightlake” or the “Company”) as part of research coverage services. We have received eighty thousand dollars as of the date of this report and expect to receive an additional forty thousand dollars for ongoing coverage of the Company. We have also received ten thousand restricted shares of Lightlake and may receive an additional forty thousand restricted shares for ongoing coverage. This research note is not an offer or solicitation to buy or sell the securities of Lightlake Therapeutics. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/