Some are ready to call it quits on the cannabis market.

But the Green Revolution has only just gotten started.

The big plays—Canopy Growth Corp, Aurora, Cronos Group—saw big gains in 2017 but slowed down in 2018 and seem to have stalled in 2019.

Some worry that it’s just a big bubble—but they’re not looking closely enough.

There are plenty of opportunities for investors looking to cash in on the cannabis boom—and TruTrace Technologies (CSE:TTT, OTCMKTS:BKKSF) is one of them.

The genius of TruTrace is simple - it’s taking tech solutions to the problems of the still under-developed, under-supported cannabis supply chain.

And where other cannabis plays have focused on production - which firms have the most product, the lowest prices, the biggest chunk of market - TruTrace hopes to make a splash by tackling the issues surrounding the emergence of a new market—one that could be worth billions of dollars.

Here are 5 reasons to keep an eye on TruTrace (CSE:TTT; OTC:TTTSF).

#1 The Cannabis Market is Still Growing

We’ve all read the headlines.

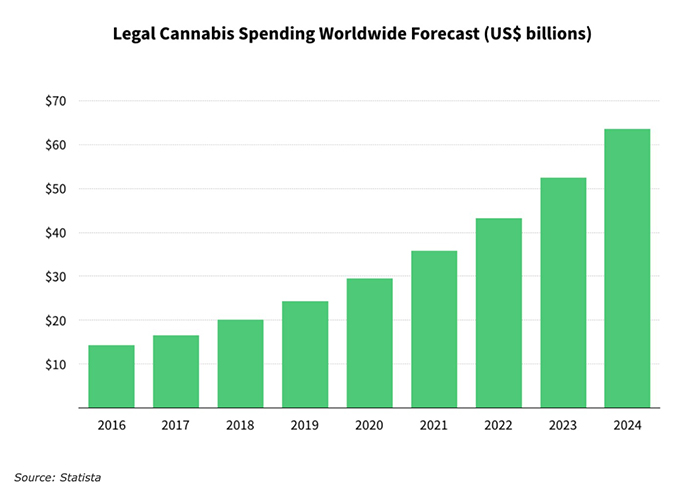

Cannabis produced $6 billion in deal value between 2015 and 2018.

Estimates peg the legal cannabis market at $66 billion by 2025.

But it could be much, much bigger.

Legislation, from Canada to Uruguay to the United Kingdom, has made cannabis more accessible. But most cannabis consumption is still managed through the illegal market—which could be much, much bigger than the current retail market.

Then there’s the growth potential.

Take alcohol. In 2017, the global alcohol market was $1.4 trillion.

But cannabis is in many ways a superior relaxant, with fewer religious and dietary restrictions.

If the potential exists for cannabis to exceed alcohol, that means the growth potential is colossal…we could be talking trillions, not billions.

What is happening is quite literally a once-in-a-lifetime investment opportunity. And while a few big names have dominated the conversation, the real profit lies beneath the industry giants…with smaller companies that have much larger growth potential.

TruTrace (CSE:TTT; OTC:TTTSF) is one of those companies.

#2 Major Mistakes of Cannabis Investors

What’s in fashion these days? Well, among the market-watchers and stock-jobbers, its cannabis bashing.

“It’s a bubble!”

“It’s flash-in-the-pan!”

“A dead-end!”

“Another Bitcoin Bubble!”

Sure, there’s some overvalued cannabis stocks out there. But a lot of investors looking to ride the Green Wave have made some pretty simple mistakes:

Mistake #1: Investing in raw product - the commodity. As any good investor knows, there’s nothing more volatile than the commodity markets. Prices oscillate every time supply or demand is questioned. There are better plays to be made than just investing in product.

Mistake #2: investing in THC stocks - in companies that are looking to get people high. That comes with a high risk. THC is still illegal according to federal law in the United States. The number one impediment to growth in the cannabis market is uncertainty over regulations - why take the risk?

Mistake #3: not being creative enough. It’s easy to grasp the business model of Canopy Growth Corp. or Aurora Cannabis - they’re basically firms using vertical integration to cut down on costs and get more product to market.

That’s fine. But there are other ways to capitalize on the cannabis boom - you just have to think outside the box.

To avoid these mistakes, investors should take a page out of history - and look at booms from the past.

Find the companies that are indispensable. The pick and shovel plays.

TruTrace (CSE:TTT; OTC:TTTSF) could be a better fit—because it’s going where no other cannabis firm has ever gone before.

#3 Solving the Marijuana Industry’s Biggest Problem

TruTrace is unique. It doesn’t deal in cannabis - it deals in information. Big Data.

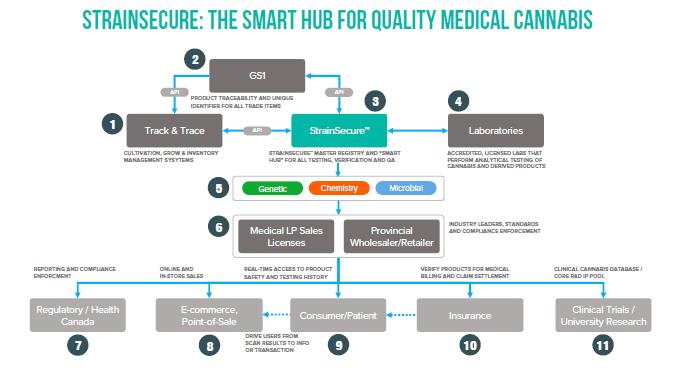

The company has two businesses.

First, there’s the company’s supply chain innovation: indexing and searching through a huge database that includes information from across the cannabis world.

Right now, every jurisdiction manages cannabis a little differently. The legal market is tightly regulated.

In California, for instance, there’s the California Cannabis Portal - a system for tracking changes in regulatory patterns that could affect California’s pot market—which will be worth $5 billion by 2020.

It’s no secret that companies and customers love this kind of service - it makes managing risks much easier, it protects the IP of different strains, and it makes sure there’s a level playing field, cutting out the black market.

But TruTrace is going one step further.

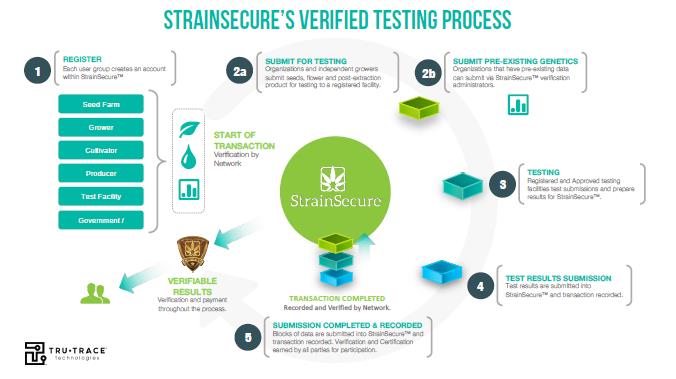

In 2018, the company created an elegant software platform for tracking the origins and quality of different cannabis strains, bringing accountability and authenticity to the market.

TruTrace’s platform, StrainSecure, uses sophisticated security protocols to collate and manage a large amount of cannabis data - from strain info to regulatory measures to consumer protection.

StrainSecure certifies and verifies all the information it collects and protects products from being tampered with. The platform also serves regulators and customers by offering “seed to sale” breakdowns of every cannabis strain - protecting IP while offering authorities and customers the chance to see exactly where each product originates, and what it can do.

But that’s not all.

TruTrace’s second business is a review service - a ‘social’ platform for the cannabis market that will allow users to rate and comment on any strains in the system.

As history illustrates, the first to move into this type of media can scale up quickly. Facebook YouTube, WhatsApp, Tinder, Twitter…each saw spectacular growth in a short period of time.

TruTrace (CSE:TTT; OTC:TTTSF) wants to replicate that feat.

The StrainSecure platform incorporates elements of social media. Customers have the chance to verify and critique strains included in the system, offering greater opportunities for brand engagement.

The platform also allows retailers to engage customers and build brand loyalty in new ways through the StrainSecure QR Code.

Right now, this system is in its early stages - but TruTrace has plans for rapid growth.

It works like this: anyone who wants to engage the cannabis community can register on the StrainSecure service, providing information to create a profile.

That participant - be it a seed farmer, a grower, a regulator or a producer - can then take part in the verification and testing process, ensuring that the information contained within StrainSecure is accurate.

The service is specifically geared towards the medical cannabis market - allowing hospitals, doctors, patients and companies access to key information regarding cannabis products.

But this could be just the tip of the iceberg for TruTrace (CSE:TTT; OTC:TTTSF).

#4 Expand, Expand, Expand

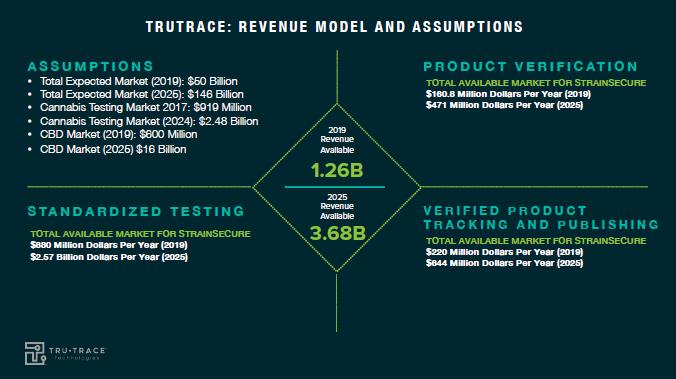

TruTrace’s different applications give it multiple revenue streams - from exposure to the medical cannabis industry to helping companies throughout the cannabis supply chain connect with one another.

The platform comes with a fee, allowing TruTrace to charge every time the StrainSecure service is used.

And once the tracking, verification and publishing side of the business takes off, TruTrace can access revenues from ad sales - something Facebook has been using to fund operations and expansions for years now.

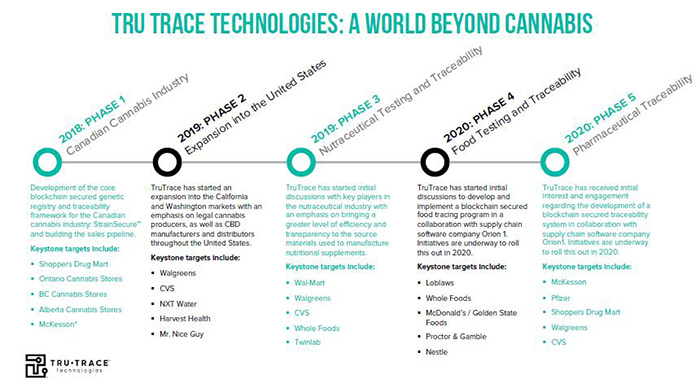

And there’s already an expansion plan in place.

First, TruTrace will cement its place in Canada, where cannabis is fully legal. Through StrainSecure, the company hopes to construct a sales pipeline for cannabis products to major distributors.

From there, it hopes to move onward to the United States, where cannabis is regulated in more than a dozen states. In California and Washington DC, where cannabis is decriminalized, TruTrace will target major distributors of CBD and cannabis products—including Walgreens and CVS, both of which are expanding into the CBD market.

TruTrace (CSE:TTT; OTC:TTTSF) has its sights set on a world beyond cannabis - bringing its StrainSecure tech to markets adjacent to cannabis.

#5 Grow Baby, Grow

Where is TruTrace at right now?

Well, the company is flying way under the radar.

But buzz is starting to build.

StrainSecure has plans for expansion in 2019 and 2020.

And TruTrace stock jumped on the news that it had signed a deal with Shoppers Drug Mart, a major pharmacy chain in Canada.

The stock has been stagnant, but catalysts could be coming - once the company expands access to StrainSecure and continues to grow the revenue stream.

Between the supply chain and product verification elements, TruTrace (CSE:TTT; OTC:TTTSF) is sitting on an idea potentially worth a fortune, for a market that has only just begun its meteoric growth.

Investors can’t afford to let this one sail by.

Other companies primed to take advantage of the next cannabis boom:

Auxly Cannabis Group (TSX.V:XLY)

Auxly is an up-and-comer in the marijuana industry, with a growing presence in Eastern Canada. The company, formerly known as Cannabis Wheaton, the streaming company operates with a unique spin, focusing on its investments and partnerships within the space.

Some investors are bullish on Auxly due to its rapid rate of growth. And its recent strategic partnership with Atlantic Cultivation solidifies that stance.

The $2.5 million deal gives Auxly a 50 percent equity stake in Atlantic, in addition to a right-to-purchase up to 30 percent of dried cannabis and cannabis trim at Atlantic’s Newfoundland and Labrador facilities.

Hugo Alves, President and Director of Auxly commented: “This partnership with Atlantic, coupled with our premium craft producer Robinson’s Cannabis in Nova Scotia and our world class innovation and extraction hub at Dosecann in PEI demonstrates Auxly’s commitment to Atlantic Canada where we are building meaningful cannabis businesses that have a positive impact on the region.”

Emerald Health Therapeutics (TSX.V:EMH)

Emerald Health is another veteran in the cannabis sector which places a lot of emphasis on its strategic partnerships and acquisitions. With a highly experienced team in life sciences and product development, the company is taking the industry by the horns.

In 2018 alone, Emerald Health secured over 500 acres of hemp harvest for the extraction of low-cost cannabidiol, with a commitment to double that number in the coming years.

In addition to its production commitments, however, Emerald Health has also just received the green light from Canadian regulatory officials to sell its award-winning Endo product line of endocannabinoid-supporting nutritional products in the country.

HEXO Corp. (TSX:HEXO)

Hexo, previously Hydropothecary, is making some major moves in the cannabis industry. The company, which is engaged in the production, distribution and marketing of cannabis and cannabis products, has secured a huge deal with international beverage giant Molson Coors.

The joint venture signifies a new era in recreational marijuana, bringing two heavyweight industries together under one roof.

HEXO’s CEO and co-founder Sebastien St-Louis, explained, “As two leading companies who share a track record of excellent practices, as well as respect for law and regulations, HEXO and Molson Coors Canada have established a relationship built on trust, and together we will develop responsible, high-quality cannabis-infused beverages for the consumable cannabis market in Canada.”

The Supreme Cannabis Company, Inc. (TSX: FIRE)

Supreme Cannabis is engaged in production and sale of medical marijuana. The Company is focused on the wholesale sector of the medical cannabis market in Canada and operates an approximately 342,000 square foot greenhouse facility located in Kincardine, Ontario.

Recently, Supreme announced an international partnership with Khalifa Kush, a brand run by rapper Wiz Khalifa. The agreement covers a variety of consulting services, from strain development to product lineup, expected to include pre-rolled marijuana joints, extracts, capsules, and cannabis oils.

Wiz Khalifa noted, “My team and I have spent the past year finding a partner that shares our vision, values and passion for cannabis. The team at Supreme Cannabis understands the importance of high quality cannabis and how to produce high quality cannabis at scale.”

MedMen Enterprises Inc. (CSE: MMEN)

Valued at more than $1.65 billion, with 800 employees and 18 licensed marijuana facilities in California, Nevada and New York, MedMen is a large U.S. marijuana firm and one of the biggest dispensaries around. Its stores are affectionately known as the "Apple Stores of weed," and the company has done well marketing marijuana in the three U.S. states.

The company announced a 50/50 joint venture, MedMen Canada, with Canadian-based Cronos Group, the first ever marijuana firm to be listed on the Nasdaq. Its IPO proved somewhat disappointing, with the stock price falling shortly after the initial wave of enthusiasm dropped off. But the company has still managed to raise over $100 million since 2017.

By. Charles Kennedy

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication should be viewed as a paid advertisement. Leacap Ltd and Safehaven and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher was not specifically paid for this communication. However, a related company was previously compensated by Tru Trace Technologies In May 2018, to produce and disseminate other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Safehaven will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ technology, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://Safehaven/terms-and-conditions If you do not agree to the Terms of Use http://Safehaven/terms-and-conditions, please contact Safehaven to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Safehaven is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.