The advent of cost-competitive, light-weight materials like 'ElectriPlast' is changing how manufacturers comply with regulatory changes, for instance emission standards imposed by the Obama Administration on cars and light trucks. Integral Technologies (ITKG) has developed a highly-conductive plastic hybrid material - ElectriPlast - and entered into partnerships with BASF, Hanwha, Delphi and East Penn to commercialize this product to [potentially] replace steel and copper [and other metal] components. Vehicle manufacturers have to meet a fast-approaching emissions standard and we believe ElectriPlast could be an economical solution in electrical shielding, and increasingly competitive in copper wiring, both large unaddressed market needs. Coupled with an efficient and scalable manufacturing method, flexibility in shape & form, and falling raw input prices, in this note we take a look at how economies of scale have made solar power more competitive with traditional sources of electricity over time, and why ElectriPlast could not only follow this trajectory [versus traditional metals], but actually become an economically viable substitute for copper in electronics/electrical industry.

In parallel, Integral has taken steps to de-risking the Company, notably through 'blue-chip' partnerships, by de-leveraging the balance sheet through buy-back of debt(s), and in taking necessary steps to meeting NASDAQ listing requirements, all the while receiving little to no credit for these value-creating milestones in the marketplace. We see this as an opportunity to own a Company that could ‘power’ a global light-weighting shift estimated at $300 Billion.

ElectriPlast ‘In Play’ On Fast-Approaching Global Fuel Economy Mandates

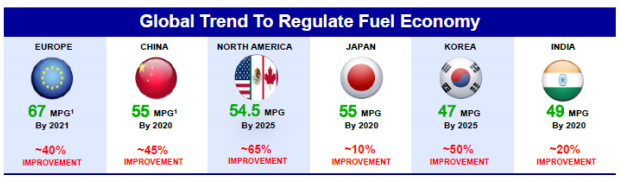

In 2012, Obama issued a mandate to increase fuel economy to 54.5 mpg for cars and light-duty trucks by 2025. The push for improvement in fuel economy has spread to a global scale (figure 1, below) and has driven the demand for eco-friendly technologies.

Figure 1. Global enforcement of fuel economy mandates in the next 10 years will be a driver for eco-friendly solutions.

Source: Honeywell

Specifically within the automotive sector, this has driven a ‘lightweighting’ trend as evidenced by numerous investments made by the Department of Energy (DOE) within the vertical. For instance, in March of 2015 the DOE announced a conditional commitment for a $259M loan to Alcoa to support a manufacturing facility where the company will produce high-strength aluminum for North American automakers looking to lightweight their materials.

80% Weight Savings with ElectriPlast vs. Copper In Cars…and Trains and Planes?

ITKG’s ElectriPlast is a durable, non-corrosive, thermally and electrically conductive hybrid plastic blend that can displace metals/alloys across various applications. This blend provides an 80% weight saving when used in place of copper and a 40% improvement over aluminum, thereby allowing for significant weight reduction without compromise in performance.

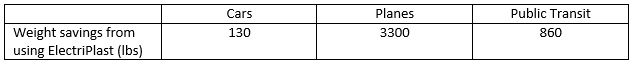

ElectriPlast could potentially serve as a viable replacement for copper wiring within cars. With the average wiring harness weighing 220lbs, this represents the third heaviest component within vehicles, behind the engine and chassis. Assuming that ElectriPlast can replace 75% of the copper material (to account for indispensable core components) car manufacturers can realize a net weight saving of ~130lbs.

ElectriPlast could be used in a similar capacity within the aviation and railway industry. For example, the Boeing 767 uses as much as 135 miles of copper wire, at a weight of more than 4400 lbs. Once again under the assumption that ElectriPlast can replace 75% of the copper, a net weight savings of ~3300lbs is realized. Additionally, ElectriPlast’s superior properties make it preferable to copper wires which are susceptible to oxidation, corrosion, vibration fatigue as well as causing electronic failures due to overheating conditions. This is especially important considering the fatal consequences of system failure while 30,000 feet above the ground.

Another example from the transportation industry, electric subway cars, trolleys and buses can use anywhere from 625lbs to 9200lbs of copper with a weighted average of 2300lbs. Assuming that 50% of the copper is used for wiring and ElectriPlast can replace 75% of it, an average net weight saving of 860lbs can be realized.

Figure 2. Weight Reduction Using ElectriPlast in Different Transportation Modalities

ElectriPlast could also find applications in the satellite market. Despite the market being relatively small and having a small growth rate, ElectriPlast can have a major impact due to the weight dynamics of the satellite. Weighing 15 tons or more satellites derive one-third of its weight from copper wiring. Using the same assumptions as before, this could represent a massive weight saving, an estimated 8400lbs.

Limited Copper Supply Could Adversely Affect Cost…to the Benefit of Substitutes like ElectriPlast

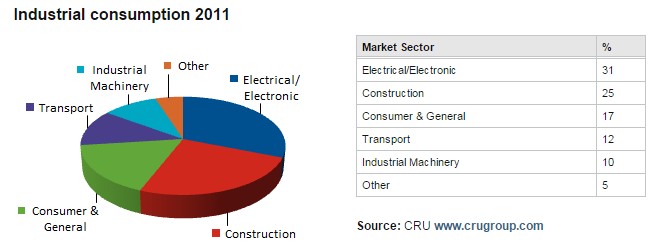

ElectriPlast’s introduction into the market could not come at a better time. According to Japan Oil, Gas and Metals National Corporation’s Copper Demand Trends, it is estimated that the global mineable supply of copper will be exhausted in 40 years - coupled with the fact the world’s biggest supplier of copper, Glencore PLC, says the forecast surplus in 2015 is very small and is subject to downward revisions. Glencore even stated that it would not be surprised to see an actual deficit in 2015. There are recycling initiatives to counteract the rapid depletion of copper reserves, however it is unlikely to be sustainable as copper is ubiquitous in applications. The result will likely be a financially crippling spike in the price of copper unless a viable replacement is found. This is where ElectriPlast comes in. Referring to Figure 3 (below), ElectriPlast could act as a substitute for copper, and be made into a plethora of products used in the ‘electrical/electronic’ industry.

Figure 3. Copper Consumption By Industry

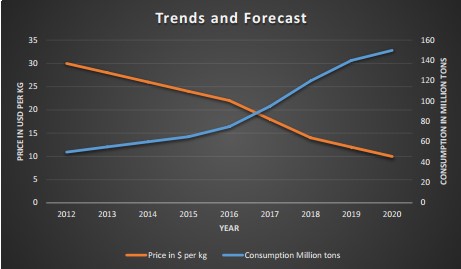

Economies of Scale Have Made Solar Cells Cheaper, Increasing Competitiveness in Energy Mix. As Carbon Fiber Prices Follow Suit, ElectriPlast Could Become a Substitute in New Verticals

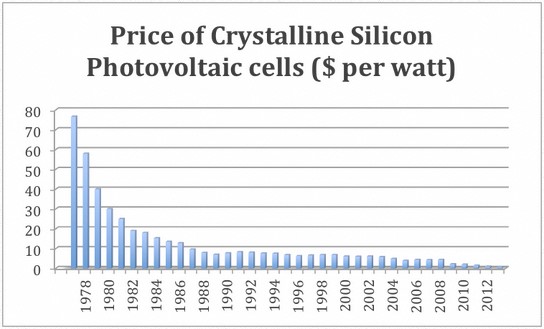

As with most disruptive technology, initial implementation comes at a high cost. However, that cost is generally mitigated by further advancement in technology, manufacturing and supply; to the point where it becomes cost competitive or even cheaper than the existing paradigm. For example, the cost of an average solar panel system is declining at 11% per annum, and has dropped 63% since 2010. This is reflected in Figure 4 (below), which shows how photovoltaic (solar) cells are becoming more cost competitive with traditional sources of electricity, eg. non-renewable fossil fuels. This has created opportunity best captured by companies like NASDAQ:FSLR), (NASDAQ:TSL) and (NASDAQ:VSLR).

Figure 4. Economies of Scale Have Helped Reduce Solar Cells Costs 63% Since 2010 Source: The Greenage.

Drawing a parallel to light-weighting, as carbon fiber use becomes more widespread, its price drops. And as an input in the manufacture of ElectriPlast, this long-term trend favorably affects Integral Technologies and their ability to ‘power’ light-weighting on a global scale. According to MAI Carbon Cluster Management GmbH, a partner of BMW & and Audi, the production costs of carbon fiber could decline by 90%.

Figure 5. Economies of Scale Will Help Drive Down Carbon Fiber Cost.

Source: Infosys

We believe ITKG’s partnership with Delphi will be a key factor in exploiting the benefits of ElectriPlast as a replacement for copper wiring in cars, among other applications. ElectriPlast would complement Delphi’s suite of lightweight wiring solutions, one of which is aluminum-based - which provides a fraction of the weight savings that could be obtained by using ElectriPlast (recall that ElectriPlast is at least 40% lighter than aluminum).

If ElectriPlast were able to penetrate just 1% of the new auto build market for wiring only, revenues could be in excess of $400 million per annum. This figure does not include the electrical shielding market, which Integral is [already] aggressively developing.

BASF Exhibit Shown On Video Suggests ‘Blue Chip’ Partnerships Advancing; 2015 Could Be Pivotal Year for ITKG

In August of 2013, Integral entered into a letter of intent with the world’s largest chemicals company, BASF (who, non-coincidentally has a large plastics division), to jointly explore the use of Electriplast in North American markets:

“[…] BASF and ElectriPlast will jointly explore the potential to utilize ElectriPlast materials as a lightweighting solution for applications requiring electrical shielding, while reducing weight to meet CAFE requirements initially targeting a broad array of automotive applications.”

While ITKG has not explicitly stated that the [BASF] partnership is reaching fruition in the form of a large commercial order, a video of BASF’s global automotive market segment manager, Calvin Nichols, apparently showcasing a hybrid, conductive plastic, suggests ITKG and BASF’s collaboration may have matured further than ITKG has been able to reveal to date (often, non-disclosure agreements restrict what the parties in the agreement can publicly state at a given point in time). The video clearly articulates a product used in shielding application for automotive casings. Click here to view the BASF Video

Our takeaway is that a large commercial order for ElectriPlast-based automotive casing parts could be closer to fruition than the market perceives it to be, and that this creates a potential inflection point and important catalyst for the Company for the remainder of 2015 (since, the exact timing of this event is ambiguous, yet seemingly near).

Notably, Electro Magnetic Interference solutions are a $3.8 Billion market [2] Again, capturing a relatively small piece of this pie would be extremely meaningful to shareholders in ITKG.

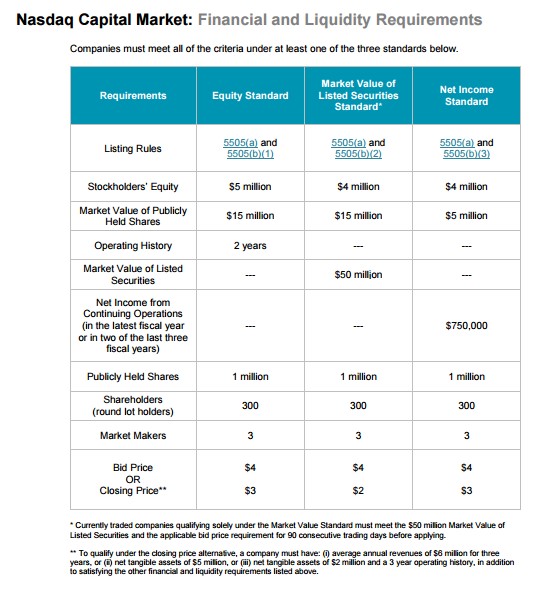

Recent Events Suggest ITKG Taking Prerequisite Steps to NASDAQ Uplisting

Earlier this week, ITKG announced the appointment of Jeffrey A. Babka to its board of directors and as Chairman of their audit committee. Coupled with buying back debt, ITKG CEO Doug Bathauer appears to be taking steps to potentially qualifying for a listing on the NASDAQ in the near future. The criteria for a NASDAQ listing is shown in Figure 5, below.

Figure 5. NASDAQ Listing Requirements

Source: NASDAQ

Babka puts ITKG on the path to satisfying the NASDAQ’s requirement for a majority-independent board of directors and strong corporate governance. The buying back of debt not only deleverages the balance sheet and improves fiscal health, but is also an important step towards meeting the NASDAQ’s ‘shareholder’s equity’ requirement. Furthermore, Babka’s background in building businesses that are later sold to conglomerates or industry leaders, is a testament to the caliber of talent ITKG is able to attract. This strengthens our resolve that meaningful commercial orders for ElectriPlast must be near.

We also view the biggest hurdle to an uplisting as perhaps one of the most exciting potential catalysts in 2015. Logic follows that if ITKG executes on a large commercial order, its share price will perform. As of the most recent quarter, there were approximately 28.7M warrants at a weighted average of $0.35 outstanding. Recent market prices clearly show that the bulk of these warrants are well in-the-money and could be exercised profitably. Should this occur, it accomplishes 3 things:

1) De-risking of future financing event or dilution

2) Potential source of $10M+ in capital from existing shareholders

3) Satisfy NASDAQ shareholder’s equity requirement

At the moment, outstanding warrants create a non-cash liability on ITKG’s balance sheet. If, or when exercised, this liability is wiped out, and shifted to the asset side of the balance sheet to reflect the proceeds from the exercise(s).

A cash infusion from warrant exercises would further allow ITKG to invest in R&D to broaden ElectriPlast’s commercial applications. For instance, after hiring top engineers from Lear Corporation last year, ITKG has reported, among other things, a breakthrough in the use of ElectriPlast in bipolar battery plates. According to the Company’s VP of Engineering, Bob Pavlovic, this is one of few advances seen in the $44.7 Billion lead-acid battery space – with the majority of research seemingly focused elsewhere, eg. lithium-ion batteries. The advantage of ElectriPlast in lead-acid batteries is that it can reduce manufacturing cost by requiring fewer components (similar to electrical component casing), replace metal that corrodes and has a limited lifespan, is 3-4x more gravimetrically efficient than existing lead-acid batteries, and can molded into virtually any shape or size.

ITKG Offers Unique Way To Capture Meaningful Upside from Lightweighting Shift

Perhaps the best way to play macro shifts is to own names that are levered to these changes. For instance, if BASF were to find a large commercial order for ElectriPlast for use in automotive casings, BASF and OEMs, raw product suppliers and perhaps others would be beneficiaries in the supply chain. But not one Company would stand to benefit as much, on a relative basis, as Integral Technologies itself. This is because the Company is not currently valued based on near-term success. Rather, ITKG trades as if success is likely, but further down the road. This creates a dynamic where any one of ITKG’s ‘blue chip’ partnerships culminating in an initial product order would likely catapult shares higher. We drew a parallel with solar stocks that have benefitted from long-term decline in component cost(s) and, resultantly, a higher energy mix for the renewable source. Similarly, if an investor were to play the multi-billion dollar lightweighting shift, they might consider owning ITKG to capture meaningful, potential upside.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research LLC on behalf of a third party as part of research coverage services of Integral Technologies (the “Company”). One Equity Research has received forty nine thousand nine hundred forty dollars from a third party as of the date of this note and expects to receive fifty thousand restricted common shares of the Company as well as additional compensation in the future. This research note is not an offer or solicitation to buy or sell the securities of Integral Technologies. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/