Lightlake Therapeutics (LLTP) just filed a new drug application (NDA) for an estimated $1 Billion opportunity. The Company expects $55 Million in milestone payments and tiered double-digit royalties from its licensee – a specialty pharma company led by former executives from Elan (acquired by Perrigo in 2013 for $8.6 Billion) and founders of Azur Pharma (acquired by Jazz Pharma in 2011 for $500 Million; now worth upwards of $2 Billion).

At a $14 Million market cap, Lightlake Therapeutics is the cheapest biotechnology company with a NDA pending before the FDA for a drug that potentially solves a billion dollar unmet need.

Incredibly, the last $4M+ in capital that LLTP has raised was at an implied valuation of $50 Million, a premium of 257% to recent share prices. Put another way, LLTP shares are currently trading at a 72% discount to where sophisticated investors bought in.

We believe that if LLTP were taken public by a leading healthcare investment bank, they would be valued at a substantial premium to today’s market price. In the last 8 weeks, the median valuation of 16 IPOs in biotech was over $200 Million.

We believe Lightlake is one of the most compelling value plays in healthcare and that a FDA approval of their lead drug – expected before year-end 2015, will lead to an uptick in the Company’s valuation and create enormous upside for investors today.

Lightlake Is the Only Pure-Play That Can Address Growing Healthcare Epidemic

“Currently there is no FDA approved intranasal naloxone and the country is facing a growing epidemic of opioid overdose, both with respect to heroine and prescription drugs.[1]”

As Amphastar’s President, Jason Shandell, correctly stated (above) in May of this year, the FDA has yet to approve naloxone that isn’t administered by injection. Naloxone - which is included in the World Health Organization’s list of essential medicines - was approved under the brand name Narcan in 1971 and is used to reverse opioid overdose. Death from opioid overdose, which includes heroin and prescription painkillers like oxycodone, hydrocodone, morphine et al., is on the rise despite Mylan (MYL), Hospira (HSP) and Amphastar (AMPH), all of whom actively market an injectable naloxone to first responders.

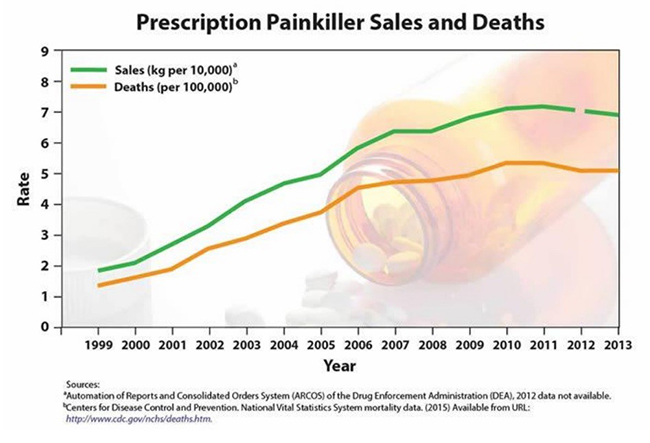

Figure 1. Correlation of Opioid Prescriptions and Death From Overdose

The underlying problem is that only first responders and emergency room operators can use a syringe to administer a subcutaneous injection of naloxone. More than 25,000 Americans die from heroin and opioid overdoses per annum, and that number has consistently risen every year in the last decade.

Now Amphastar is touting an intranasal spray (nasal spray) to remedy this problem. The Company stated on their most recent quarterly call that they would be filing a New Drug Application, or NDA, for an intranasal naloxone ‘this year’. An intranasal delivery of naloxone would be an effective way to put this life-saving medication in the hands of bystanders who can literally save the life of a patient who has overdosed on opioids, without needing any medical training and without risking injury or contamination.

Amphastar says that partnering with a “company that sells a lot of prescription opioids” or marketing “directly to physicians so when they prescribe an opioid they could also suggest that the patient purchase Intranasal naloxone” could be an effective way to get intranasal naloxone out to those who need it most…and of course generate sales for the company.

But this is hardly a novel idea, because in 2014, the Substance Abuse and Mental Health Services Administration (SAMHA) suggested that health care providers include prescribing [naloxone] along with a patient’s initial opioid prescription.

Lightlake, who developed an intranasal naloxone (“nasal naloxone”) in partnership with the National Institute on Drug Abuse (NIDA), filed a rolling submission in June and a complete NDA on July 27. Lightlake is 1 of only 2 companies with an application before the FDA for nasal naloxone, the other being Indivior, a $1.75 Billion company that was spun-off from Reckitt Benckiser.

Meanwhile Lightlake trades at just a ~$14 Million valuation, and is the only pure-play on nasal naloxone for opioid overdose, and other indications.

How Big Is Opioid Overdose In the United States? Big Enough for Indivior, Adapt and…PDL Biopharma.

As with many injected drugs, patient compliance and access to [injected] naloxone for opioid overdose is limited. Data suggest that if access to naloxone was widespread, deaths from prescriptions drugs would not strongly correlate with the number of prescriptions. But since they do (as shown in Figure 1, above) SAMHA suggested in 2014 that a physician prescribing opioid painkillers also prescribe naloxone. According to the CDC, there were 257 million opioid prescriptions written in the United States in 2009. They were written to an estimated 22.9 million patients. If a prescription of naloxone were to cost $50, this would equate to a market worth well over $1 Billion per annum. This explains why a Company called kaleo, which brought an ‘auto-injector’ to market last year, was able to convince PDL Biopharma (PDLI) to extend the company $150 Million in debt to market ‘Evzio’. While Evzio is more ‘convenient’ than a syringe and kaleo is actively working to put it into the hands of laymen, it still makes use of a needle that could include drawbacks such as injury or contamination, among other problems. A nasal spray version of naloxone would obviously trump administration by needle.

Notwithstanding, Evzio has created strong precedent for Lightlake to gain FDA approval for its nasal naloxone potentially in as little as a few months. Evzio received priority review from the FDA and was approved in three and a half months. Indivior, whose NDA for nasal naloxone was accepted by the FDA at the end of July, was also granted priority review.

Evzio has reportedly priced its auto-injector at a sharp premium to naloxone in syringe form. For instance, GoodRx shows most pharmacies carrying Evzio at ~$600. Our assumption on the size of the opioid overdose market relies on physicians co-writing a subscription for naloxone with painkillers (as discussed, above) but at a $50 price point. Consequently, if the market was able to absorb a cost 2x, 3x, or 12x (as in Evzio’s case) the cost of naloxone in a syringe, the market size for naloxone quickly expands to multi-billions. This explains why even $1.75 Billion Indivior made explicit reference to their nasal naloxone filing and need for the product in the marketplace in news releases and filings.

The large market opportunity also helps explain why one of the most successful specialty pharma entrepreneurs decided to personally invest $86 Million of $95 Million in Adapt Pharma to in-license and then commercialize Lightlake’s nasal naloxone. Adapt Pharma committed to paying Lightlake $55 Million in milestones and tiered royalties based on worldwide sales.

Lightlake Lands Best-In-Class Partner to Lead Charge into $1 Billion+ Market

In 2011, Jazz Pharmaceuticals (JAZZ) and Azur Pharma, a Company founded by Seamus Mulligan, Eunan Maguire and David Brabazon, merged in a deal that gave Azur’s private shareholders 20% of the combined entity. At the time the deal was worth ~$500 Million for Azur; today that interest is worth >$2 Billion. Seamus, Eunan and David built a $100M a year specialty pharma business in the U.S. and sold it to Jazz for ~5x sales. Now Seamus, Eunan and David are running Adapt Pharma, where they have personally invested at least $86 Million to get back to doing what they do best – building robust businesses around unmet needs in CNS disorders. Prior to Azur, the team at Adapt cut their teeth as executives at Elan - whom Perrigo acquired in 2013.

Adapt Pharma has only in-licensed one product: Lightlake’s nasal naloxone for opioid overdose and the licensee’s website indicates that this product is their primary focus at the moment. In our view, this is huge validation of not only the opioid overdose product but of Lightlake’s entire platform.

Adapt agreed to pay Lightlake $55 Million in regulatory and sales milestones, but the exact terms were kept private. What we do know from the [Lightlake] filings is that LLTP will be eligible for a milestone payment upon FDA approval of [their] nasal naloxone and first commercial sale of the product. We would suspect that the milestone payment upon regulatory approval would be meaningful – perhaps in the order of $4-5 Million – and put LLTP in a position to not only advance the rest of their pipeline without diluting existing shareholders but also, potentially, qualify for a listing on a senior exchange like the NASDAQ.

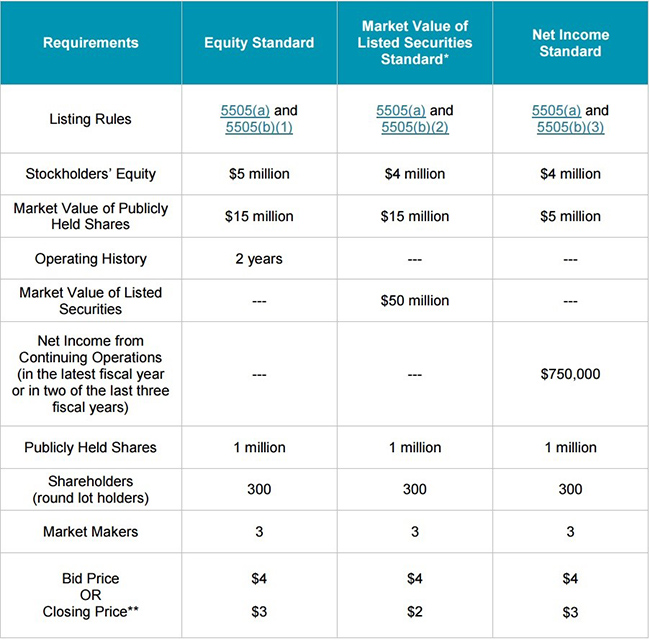

The NASAQ has two ‘standards’ that Lightlake could potentially qualify under: the ‘Equity Standard’ and ‘Net Income Standard’, as shown in Figure 2, below.

Figure 2. NASDAQ Capital Markets Listing Requirements

Lightlake would qualify under the equity standard (see Figure 2, above) if shares traded slightly higher on the anticipated FDA approval of their nasal naloxone or perhaps even commercialization by their partner, Adapt. This would help the company meet the ‘value of publicly held shares’ criteria. Alternatively, LLTP could also qualify under the ‘net income standard’ upon FDA approval/commercialization of their lead product based on the size of Adapt Pharma’s milestone payment.

LLTP has a relatively small overhead expenditure and costs largely shift to Adapt after (assuming) FDA approval of nasal naloxone. If LLTP were to receive $5 Million from Adapt, the Company could potentially record a $750,000 profit for fiscal 2016 and qualify for an up-listing in several months.

We note that in the last 8 weeks alone, investment banks have staged 16 biotech IPOs, raising an average of $84 Million predominately for companies with a lead drug candidate in mid to late stages of development. Figure 3 below shows the most recent biotech IPOs to hit the market.

Figure 3. The Last 16 Biotech IPOs Trade At An Average $422M Market Cap vs $14M for LLTP

The size and quantity of biotech deals in the last year show an ever-increasing appetite among institutional investors for the next big blockbuster drug. In part, interest has been spurred by M&A by large pharmaceutical companies that are seeing their own blockbuster drugs go off-patent quicker than they can replace them with new pipeline candidates and are forced to acquire smaller companies. Another catalyst for the biotech frenzy is the advent of personalized medicine and breakthroughs in difficult to treat diseases like cancer.

LLTP is not a cancer company and hasn’t any drugs in the pipeline related to treating cancer whatsoever. What LLTP has is a proven drug – naloxone – that is in dire need in nasal form by millions of people who run the risk of overdosing and succumbing to death from a common prescription painkiller like oxycodone. If LLTP itself doesn’t sell you on the unmet need for a nasally-administer naloxone, then Amphastar and Indivior and perhaps, above all, Adapt Pharma’s sudden interest in this specialty market certainly should.

The size and valuation of biotech IPOs in the last 8 weeks, not to mention in the last year, bode well for LLTP’s valuation, particularly upon a potential uplisting to NASDAQ. In our view, a national listing would open the door for institutional ownership, and importantly solve the current market inefficiency. If LLTP were valued just based on probability-weighted, risk-adjusted present value of the milestone payments expected from Adapt ALONE, LLTP could still command a valuation 2x north of where its shares are traded today. When you begin to factor in where the Company sold future profit interests in its drug candidates or compute the present value of future royalty cash flows from the opioid overdose product (which Adapt is wholly marketing), the valuation grows to be even more compelling, and seem even more absurd ahead of a potential FDA approval, commercial product launch, and when compared to valuations among [biotech] peers.

Lightlake Sells ‘Profit Interest’ In Pipeline Drug Candidates At Implied Valuation >3X Current Market Price

LLTP’s Chief Financial Officer (CFO), Kevin Pollack, deserves credit for being the only biotech company we’ve ever come across that sold interest in potential profits from the commercialization of a potential drug therapy. Most investors who are risk-averse would not bet on a drug making it past R&D, let alone FDA approval, let alone commercialization and the dreaded word in biotech…profitability. But LLTP’s CFO Kevin Pollack has raised >$5 Million by selling a share of future profit interests in the Company’s pipeline products. For instance, in the nine months ending April 30, LLTP raised $4 Million at an implied valuation of $50 Million. We computed this by taking $3M raised from an investor[2] (see deferred revenue paragraph in 10Q filing with the SEC) in exchange for 6% of [potential] future profits from LLTP’s nasal naloxone drug candidate. If LLTP’s equity were valued at $50 Million, shares would trade at $27, or a 257% premium to recent market prices. This has staved off dilution and is perhaps the most shareholder-friendly financing we’ve ever seen a biotech company complete.

LLTP is the ONLY Company Under $50M with a Filed NDA, With Peers Valued 10X More Or Greater

High-profile NDAs filed or expected to be filed this year include Sarepta’s (SRPT) eteplirsen, BioMarin's (BMRN) drisapersen, Acadia Pharma’s (ACAD) pimavanserin and as well as potential blockbuster drugs from Gilead, ZS Pharma, Merck, Takeda...and the list goes on. Consequently, these companies are valued in the billions by investors.

At the same time, our research into filed (and high-profile NDAs expected to be filed in 2015) reveal that LLTP is the cheapest company in biotech with a drug pending approval for a potential billion dollar plus indication. Companies that come close to LLTP in valuation with a pending NDA address a market or indication a fraction the size of opioid overdose and still trade at 10X LLTP’s market cap, at a minimum (the lowest valued Company we found with a NDA submission this year, excluding LLTP, is Repros (RPRX)).

Why Own LLTP Right Now?

If we could summarize the LLTP opportunity in one paragraph, we would stress that this Company is on the precipice of regulatory and, potentially, commercial success. LLTP has landed the best partner any specialty drug development firm could possibly ask for, and is quickly approaching the first of (hopefully) several cash flow events. We believe that LLTP’s current valuation does not credit the Company with the above-market and non-dilutive financings they’ve accomplished, the partnership they’ve inked, or assign any value to the remaining pipeline whatsoever, even when LLTP’s second most advanced product is another potential billion dollar indication and has reported impressive data from a controlled Phase 2 study. In the base case scenario, LLTP should be trading at 2-3X current prices; in the bull case, the upside is extraordinary like only biotech investors could expect to see from their investments.

References

- http://seekingalpha.com/article/3181116-amphastar-amph-on-q1-2015-results-earnings-call-transcript

- See deferred revenue, paragraph 5, in 10Q filing with the SEC dated Jun 12, 2015

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC on behalf of Lightlake Therapeutics (“Lightlake” or the “Company”) as part of research coverage services. We have received one hundred thousand dollars as of the date of this report and expect to receive an additional twenty thousand dollars for ongoing coverage of the Company. We have also received ten thousand restricted shares of Lightlake and may receive an additional forty thousand restricted shares in the future. This research note is not an offer or solicitation to buy or sell the securities of Lightlake. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/