According to the American Heart Association, an American dies from cardiovascular disease every 39 seconds and more than 83 million Americans have at least one condition affecting the heart or blood vessels. Innovative medicines have helped reduce cardiovascular-related deaths by 30% between 2001 and 2011. Still, this disease category costs American society 700,000 deaths and more than $312B each year.

Keeping the heart beating will be a prevalent focus in medicinal research as obesity becomes a global epidemic. The FDA will be forced to ease their stance on the approval of drugs, imaging agents and medical devices. In turn, this will create lucrative investment opportunities in the space for shrewd investors. In this note we look at 3 way to invest in the space.

Arca Aiming To Keep Pulse Regular With Gencaro

Atrial Fibrillation (AF) is a disorder in which the regular pattern of the heart's two small upper chambers (the atria) becomes irregular, causing blood to pool which increases chances of stroke. Due to a CAGR of 23.5% since 2009, AF is considered an epidemic cardiovascular disease with an estimated market of $9.4B by 2020.

Arca’s (ABIO) lead product Gencaro is a Phase II beta-blocker for the treatment of AF in patients that are diagnosed with systolic heart failure (referred to as reduced ejection fraction- HFREF). This is when the heart muscle does not contract effectively and less oxygen-rich blood is pumped out to the body.

Back in 2009, the FDA rejected Gencaros Phase III trial (BEST study) for AF, which tested 2708 heart failure patients. However, a retrospect analysis of the data showed that an entire cohort of patients in the trial that were treated with Gencaro had a 41% reduction in the risk of new onset AF.

Patients with genotype beta1-389, which is represented in approximately 50% of the general population, experienced a 74% reduction in risk of AF. Thus, if the company can isolate the genotype and target this half of the population, Arca could have a breakthrough AF drug candidate. These results influenced the FDA to grant Arca Fast Track development.

The company’s plan is to initiate a Phase 2B study in approximately 200 patients by year end 2016 and then potentially transition to Phase 3 and enroll an additional 420 patients in the first half of 2017.

Investors Insured With Downside Protection

With a market cap of ~65M and a cash balance of around $40M, markets are valuing Gencaro’s potential at 25M. Arca expects its funds to be sufficient through the end of 2017, by which time the company may have advanced to Phase 3 studies. Markets are discrediting Arca because:

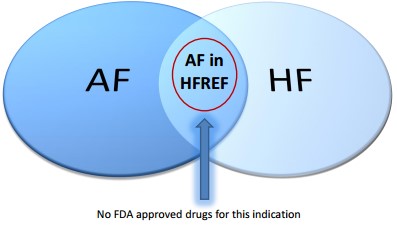

- There is no FDA approved drug for AF in HFREF indication

- Beta-blockers approved for HFREF, but used off-label for AF have demonstrated limited efficacy

- Approved agents for non-HFREF patients are associated with significant side effects

Figure 1: ARCA estimates Gencaro AF in HFREF to be a $450M -$900M opportunity

Prominent healthcare institutional funds like Tekla and RA Capital have taken notice of Arca’s valuation discrepancy and built relatively sizeable positions with each owning around 10%. With the institutional support and promising data to build on, Arca is one of the best drug cardiovascular plays in the market.

FluoroPharma Leveraging Promising Imaging Agents to Power Heart Disease Diagnoses

There are two underlying trends that are impacting the global nuclear diagnostic market to move away from SPECT and towards PET imaging:

- PET image resolution is superior to SPECT

- Global shortage of Tc-99, the radioactive isotope tracer used for SPECT

PET scans are primarily used in oncology because of the better-quality of imaging, a technique that is only starting to catch on cardiology. We believe PET’s diagnostic advantages and the tectonic shifts in the supply market will cause a major shift, eating away at SPECT’s 90% market share of the cardiology market.

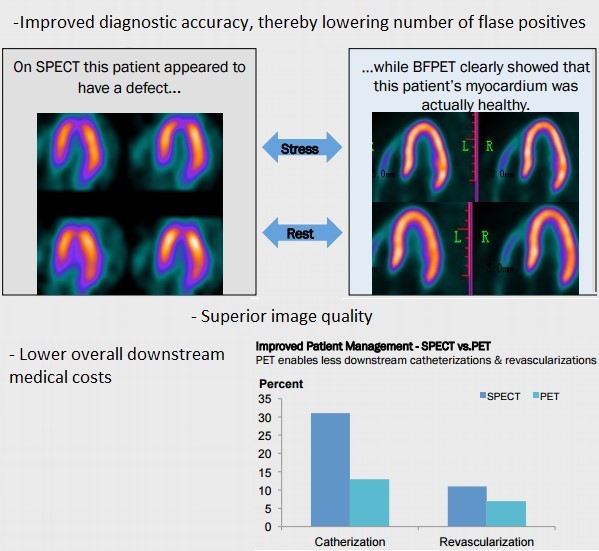

Cardiolite SPECT imaging is the current gold standard scan that helps physicians make diagnostic decisions on coronary artery disease (CAD) by seeing how much blood is reaching different parts of the heart. However, due to the subpar image quality of SPECT imaging agents, about ¼ patients are incorrectly diagnosed, which results in added costs to the healthcare system as these patients would need to be re-evaluated using invasive and costly procedures. Even with a ~75% diagnostic accuracy, Cardiolite had sales of ~400M before losing patent exclusivity in 2008 and demanded an off-patent salvage value of $525M when acquired by Lantheus Medical.

With the interest shifting towards PET, investors should be looking at imaging agents like FluoroPharma’s (FPMI) is BFPET and Cardiopet. BFPET, FPMI’s cardiovascular blood flow stress tester, has distinct advantages over SPECT that include improved diagnostic accuracy, superior image quality and lower costs to the medical system in the long-run (below).

If diagnostic accuracy is improved from the standard 75%, which is likely with BFPET given the higher image quality, billions could potentially be saved by the US healthcare system.

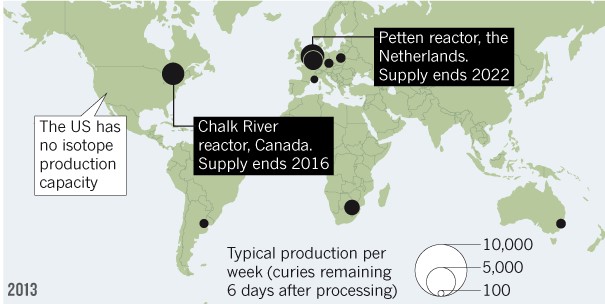

On the supply side, radioactive tracer technetium-99m, which is injected into patients during SPECT scans, is facing a supply shortage. The Chalk River reactor, which produces close to a third of the current global supplies and over half of the US supplies, is ending production of isotopes in 2016.

The lack of availability of technetium-99m will presumably propel the industry to look for alternative diagnostic procedures such as BFPET, which use a substitute isotope with ample supply called fluorine-18.

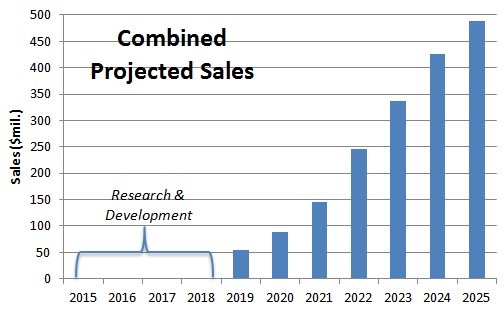

Given the headwinds driving PET adoption, we assume FPMI can penetrate 3% of the combined addressable market that is estimated to be $16.3B by 2025. This in turn results in sales of $489M (above).

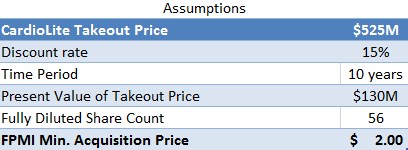

Upon patent expiration in 2025, FPMI should be worth $525M at the very least, which is what Lantheus acquired CardioLite rights for. Discounting for the 10 year time lapse and risk associated with development, if FPMI were only sold for salvage, it would still be worth $2/share.

In our view, the upside in FPMI could be greater than 13X current price by year’s end, as two major de-risking events, particularly BFPET Phase II data, create a catalyst for shares. Read HERE for a detailed analysis.

St. Jude’s Acquisition of Thoratec Validating Late Stage Heart Failure Device Market

In the last month, two large device makers have announced entrance to the late stage heart failure market. St. Jude Medical (STJ) agreed to buy smaller late stage HF device rival Thoratec (THOR) for $3.4B, a 38% premium over the prior week closing price. Additionally, Abiomed (ABMD) outlined their strategy to treat higher risk (Class IV) patients as part of their long-term growth strategy during their annual investor conference.

St. Jude’s CardioMEMS heart failure monitor is used to monitor Class III HF patients, so the company made the acquisition to round out their pipeline in an ability to serve more classes of HF patients. Thoratec’s devices are used for mechanical circulatory support to treat Class IV heart failure. St. Jude ended up paying a hefty 7x projected 2015 revenue of $485M.

With major players taking interest in the area, we believe Sunshine Heart (SSH) has been long overlooked. Through their minimally invasive C-Pulse System, Sunshine Heart (SSH) offers a device for moderate to severe heart failure (Class III/IV) patients that potentially halts the disease progression and in certain cases, reverses heart failure. After their temporary enrollment pause back in March, Sunshine Heart expects to reopen all sites for enrollment by the end of August. Due to this, we believe the opportunity in Sunshine Heart to be one of the most misunderstood in public markets, as explained in our prior note.

With major players looking into the advanced HF space, investors should know that the FDA released a health care warning about the serious adverse events associated with LVADs treating late stage patients.

“These adverse events include an increased rate of pump thrombosis (blood clots inside the pump) with Thoratec’s HeartMate II and a high rate of stroke with the HeartWare HVAD since approval of the devices. FDA is also aware of bleeding complications related to both the Thoratec HeartMate II and HeartWare HVAD.”

Sunshine Heart’s addressable market is a colossal $88B, so for the company to warrant a similar $3.4B valuation and 7x sales multiple to what St. Jude paid, it would only need to penetrate 0.5%. Keep in mind, Sunshine Heart’s device has no contact with blood, so the likelihood of blood clots or strokes is reduced, theoretically making safety profile superior to already approved competitors.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC on behalf of Sunshine Heart, and FluoroPharma Medical, as part of research coverage services. One Equity Research has received ten thousand dollars from Sunshine Heart as of the date of this report and expects to receive ten thousand dollars from FluoroPharma and may receive additional compensation from either company in the future. An affiliate of One Equity Research, LLC holds an ownership interest in Sunshine Heart. This research note is not an offer or solicitation to buy or sell the securities of any issuer. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms