The U.S. government’s recent mercury pollution regulations have created a new multi-billion-dollar energy industry for next-generation, low-cost mercury emissions control tech, with the first beneficiary of this largesse recently closing $2 million in additional financing and consolidating its unique position in this rapidly expanding market.

Midwest Energy Emissions Corp. (MEEC) is riding high on its status as a key provider to the $200 billion+ coal-fired power industry, if not one of its primary saviors in the aftermath of Environmental Protection Agency (EPA) mercury pollution regulations that took effect on 16 April.

When the EPA announced its new regulations, opening the floodgates for savvy new mercury remediation technology companies to save the coal industry, they essentially mandated the creation of a $2 billion business annually, and MEEC has been swift off the starting blocks.

With the knowledge that by mid-2016, the bulk of the remainder of America’s coal-fired plants will also come under strict regulations, MEEC has already secured $110 million in long-term contract revenues with major U.S. power producers.

10 Reasons to Watch Midwest Energy Emissions Corp.

1) Huge Market: To say this is a huge market is an understatement, and when you add in the federal mandate—the potential is that much more significant. In addition to mandated Federal mercury emissions standard compliance by 16 April 2016, 24 U.S. states and Canadian provinces have similar mercury emission control mandates. The total North American expenditure for annual coal-powered mercury compliance equipment and product is estimated to exceed $2 billion. MEEC estimates its U.S. market opportunity alone at 800-850 coal-fired EGUs with an average $2.5 million revenue opportunity per EGU.

2) Rapid Growth: MEEC is experiencing phenomenal growth over a very short period of time. From Q2 to Q3, the company has recorded 164 percent revenue growth. Management reported sales growth from $1,373,293 in Q1 to $3,625,858 Q3 ended Sept 30th. Total 2015 estimated revenue now exceeds $8 million.

3) Impressive 2016 Revenue Estimates of >$30 Million+. MEEC management has already provided guidance to at least $30 million of revenue from existing contracts in 2016. This includes $5,342,400 of Deferred Revenues to be realized as all 15 EGU systems are completed and commissioned. The company is currently bidding and competing on many additional system installations across North America.

4) Proven Market Acceptance and Technology Leadership: With $110 million in contracted revenue for emission control product sales, equipment installations and consulting services, MEEC is riding high. The company’s service level and low cost guarantees indicate the potential here for revenues from coal fired electricity generating units for the life of the EGU—in other words, for decades.

5) Industry-Leading Next Generation Technology

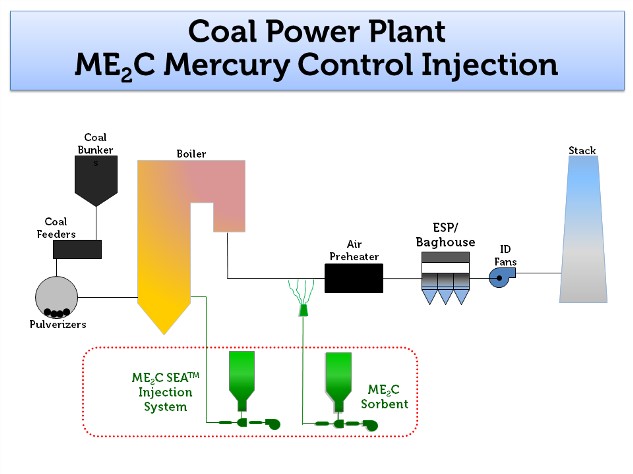

The SEA™ approach to mercury capture is specifically tailored for each application to match a customer’s fuel type and boiler configuration for optimal results. MEEC’s ‘secret sauce” is its high-grade sorbent enhancement additive—injected into the boiler in minimal amounts—that works in tandem with proprietary sorbent products to ensure maximum mercury capture with superior economics compared to typical mercury removal techniques in use today.

6) World Class & Worldwide Patent Protection

From its exclusive technology license with the Energy and Environmental Center (EERC) within the University of North Dakota, MEEC’s technology is covered by 29 Patents (21 issued) in the U.S., Canada, China and Europe. MEEC has the right to acquire the patent portfolio in perpetuity for a nominal price.

7) 5X Equity Appreciation Potential: Keep in mind that high-growth pollution control/specialty chemical stocks are trading at 2.5x sales.

According to Zach’s Small Cap research, at 2.5 times sales of over an estimated $50 million by 2018, MEEC’s market cap should exceed $100 million. Today its market valuation is less than $20 million.

8) Fully Financed & Cash Flow Positive. A private equity fund managed by Alterna Capital Partners has increased its investment in MEEC to allow the company to manage its future growth in meeting the demands of growing client projects. Alterna's recent investment of $600,000, with an additional $1,400,000 investment contemplated on or before 30 June 2016, follows their initial $10 million convertible debt transaction in July 2014.

9) Sky’s the Limit once MEEC Starts Licensing Globally

China, India, Canada and Europe account for 5 times the coal-fired power generation of the U.S. With patents secure in all these areas, MEEC’s longer-term growth will come from exclusive, global licensing agreements.

10) Market Confusion on MATS Regulation Provide Significant Below Market Entry Point. Investors are confused about the EPA’s MATS regulations after the Supreme Court remanded a part of the regulation to a lower court. At issue is a very limited section of MATS regulatory presentation as to the cost vs. value of MATS implementation. The Supreme Court asked for a supplemental cost finding from the EPA. On 30 November, the Environmental Protection Agency (EPA) proposed a supplemental finding that states that “including a consideration of cost does not alter the EPA’s previous determination that it is appropriate to regulate air toxics, including mercury, from power plants.” At the end of the day, the proposed supplemental finding does not change power plants’ compliance obligations, which began in April of this year, or the steps that many plants across the country have already taken and are continuing to take to meet those obligations by installing controls and technologies to reduce toxic air emissions. None of the coal-power plants MEEC has contracted with or with whom they are testing mercury emission reduction technology have changed plans to comply with MATS, according to MacPherson.

MEEC’s best-in-class mercury emissions control technology allows coal-fired power plants to comply with the EPA’s strict Mercury and Air Toxic Standards (MATS) rule mandating all coal-powered plants in the U.S. larger than 25 mega-watts remove roughly 90 percent of mercury from their emissions.

The largest first-generation emission control companies in this industry right now are Federal Signal Corp. (NYSE: FSS), Cabot Corp. (NYSE: CBT), Advanced Emissions Solutions, Calgon Carbon Corporation and CECO Environmental Corp (NASDAQ: CECE). But it is the small-cap players with the leading next generation tech--such as MEEC--who stand to make the most striking gains.

Legal Disclaimer/Disclosure: This article was paid for by a third party advertiser. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.