In 2009, The Tobacco Control Act granted the FDA authority over the regulation of all tobacco products. 22nd Century Group (XXII) and Vapor Corp (VPCOD) became popular investment vehicles for investing in this regulatory change with their promises of low-nicotine alternatives to cigarettes.

The Environment Protection Agency’s (EPA) mandates for more fuel-efficient vehicles have made automakers like Tesla (TSLA), and more recently, Elio Motors (ELIO), darlings with investors. For instance, Elio’s valuation soared past $1 Billion shortly after its IPO, irrespective of the fact that the 3-wheel ‘car’ maker is still pre-commercial.

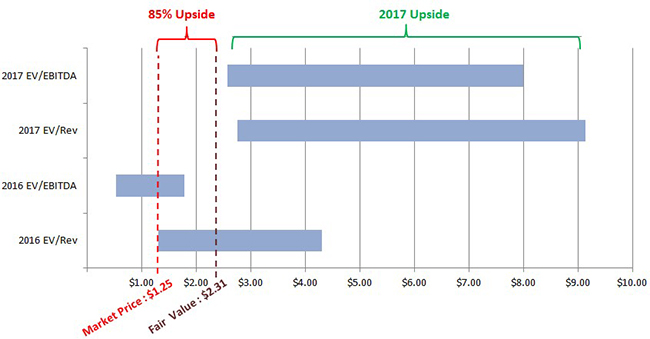

Sports Field Holdings, Inc. (OTCQB: SFHI) could be the runaway winner from the regulatory tailwinds that are rattling the $6 Billion sports facilities market. SFHI’s 2015 sales are expected to be in the $4 Million range. 2016 sales are projected to be $17 Million, with over $14.5 Million in projects contracted year-to-date. As sales double, every comparable company we were able to find suggests shares of SFHI should double too. We believe fair value for SFHI is $2.31 a share. The most recent closing price was $1.25 per share. This implies that the upside of owning SFHI could potentially be 85%+.

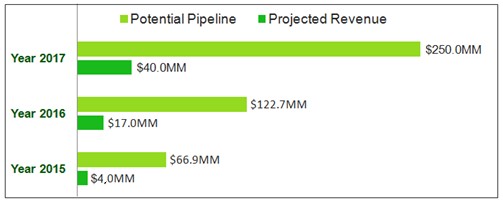

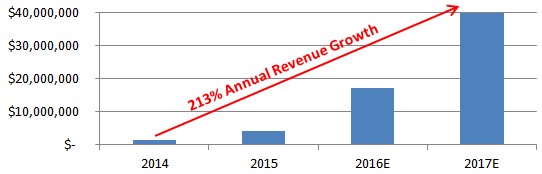

Figure 1: SFHI Revenues are Expected to Double in each of Next Two Years

Potential Regulatory Tailwinds in Sport Field Facilities Could Drive SFHI Revenues

Concerns have been raised about the safety of chemically-filled recycled tire crumb used in fields and playgrounds nationwide. Federal agencies like the EPA and CDC are undergoing a comprehensive 2016 plan that could eliminate the use of harmful chemicals in synthetic turf. SHFI’s turf uses an alternative that is free of chemicals, which could become the new standard. Due to the health advantages, the company is already seeing a spike in demand for their eco-safe turf, as their actual sales show.

Regulatory Changes Created Multi Hundred-Million Dollar Valuations for Smaller Cigarette Companies. 2 Cases Explain Why Sports Field Could Be The Next Beneficiary of A Regulatory Shift In Athletic Fields.

Case 1: Tobacco Control Act For XXII & VPCO

In 2009, The Tobacco Control Act granted FDA authority over the regulation of all tobacco products. While the Act prohibits the FDA from banning cigarettes outright, it allows the FDA to require the reduction of nicotine in cigarettes. Accordingly, large cigarette companies like Philip Morris and British American Tobacco were required to moderate marketing efforts, which further contributed to the downward trend in national smoking rates.

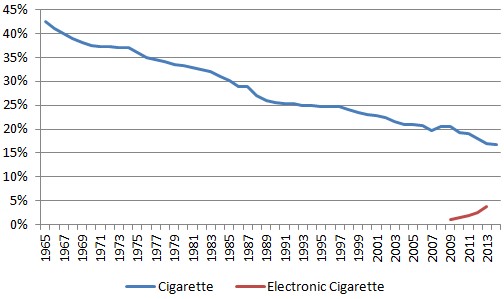

Figure 2: Adult Smoking Rates in U.S. Have Fallen From 42% in 1965 to 17% in 2014; Electronic Cigarette Rates Nearly Quadruple Since 2010

The tobacco regulatory change presented an opportunity for 22nd Century’s (XXII) low nicotine cigarettes, which contain 95% less nicotine than conventional cigarettes according to the company. 22nd Century is running studies, which are being funded by the FDA’s Center for Tobacco Products [1], to show that their low-nicotine cigarettes might reduce dependence on the addicting chemical and, consequently, the number of cigarettes smoked.

22nd Century investors are hopeful that the FDA will grant the company the first Modified Risk Tobacco Product (MRTP) designation, which would allow the company to market their offering as the only ‘very low’ nicotine cigarette. Gaining this marketing edge could draw the attention of the big tobacco players and encourage a licensing deal or acquisition.

Electronic cigarette (“e-cig”) smoking rates have nearly quadrupled since 2010 as users of e-cigs are using the product in place of traditional cigarettes. The market for e-cigs is expected to reach $1.5B in 2015 and grow more than 20% annually because e-cigarettes have lighter regulation versus other tobacco products [2]. Small players like Vapor Corp are using these tailwinds to compete with multinational corporate giants.

Case 2: Fuel Efficient Emission Standards Give Rise to Elio & Tesla

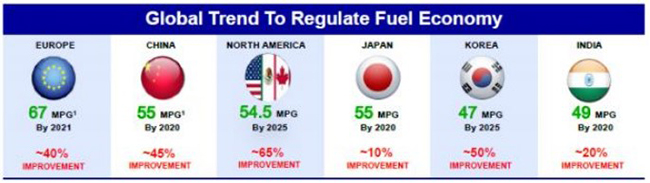

The Environmental Protection Agency (EPA) & National Highway Traffic Safety Administration (NHTSA) have set standards for passenger vehicles models built 2017-2025 to consume roughly half the fuel as vehicles manufactured in 2008 (Figure 3, below, shows a graph from Honeywell explaining government mandates worldwide towards emission improvement). The government has created different tax credits and loan incentives to entice automakers to invest in fuel efficiency. Tesla, for example, has earned more than $534 million from the sale of environmental credits to competitors that don’t sell enough zero emission vehicles [3].

Figure 3: Eco-Friendly Technologies Benefit as Fuel Economy Improvement Reaches a Global Scale

Elio Motors (ELIO), a three-wheeled prototype that is predicted to run 84 miles per gallon, has used environmental mandates to submit an application (however, which has yet to be accepted) for a $185M low interest loan from the Department Of Energy. The company has received over 50,000 pre-ordered vehicle reservations, even though the Company has yet to record a vehicle sale.

Nevertheless, Elio Motors managed to raise $17M at a 1x pre-ordered sales multiple on the back of increasing government and private investment into [more] fuel-efficient vehicles.

Due to being three wheeled, Elio is classified as a motorcycle and does not technically apply for the government’s auto incentive programs. The company has announced that it is working with congress to permit participation in these programs. This has not deterred investors, however, since its current market cap is nearly $1 Billion.

Sport Facilities Could Be on Verge of Regulatory Change; SFHI Could Be The Biggest Beneficiary

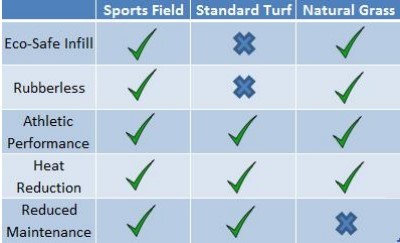

Standard turf systems use sand and ground up discarded automobile tires that are known to contain toxic materials as infill material. A study by a Yale professor [4] showed that many of the chemicals in synthetic turf contained carcinogens and irritants that are hazardous to our health.

The Environmental Protection Agency (EPA), Centers for Disease Control (CDC) and other federal agencies are undergoing a 2016 research action plan to further evaluate the health risks associated with tire crumbs [5]. By the end of 2016, these federal agencies anticipate releasing a draft status report that could cause a shift in the turf industry.

If tire crumbs are confirmed to cause adverse health effects, Sports Field’s (SFHI) product will be the main beneficiary due to their toxic-free material and shock absorbing structure.

Figure 4: When compared to Standard Turf & Natural Grass, Sports Field’s Turf is Superior

Sports Field uses an eco-safe turf infill called ‘Organite’ that is made of zeolite and walnut shell. This lead-free alternative is lightweight and does not fall to the bottom of the infill matrix like the heavier sand in standard turf. SHFI’s turf is free of chemical toxins, enhances the absorption of the field and thus minimizes an athlete’s injury risk.

SHFI’s Rapid Revenue Growth Indicting Increasing Adoption of Eco-Safe Turf

Each year, over 1,000 new synthetic turfs are installed due to their reduced maintenance and lower cost, when compared to natural grass fields. Sports Field is seeing demand for their turf surge because of these associated cost savings and eliminated health risks versus other synthetic turf.

SFHI has been endorsed by future hall of fame linebacker Ray Lewis and has completed turf installation projects for facilities such as ESPN’s Sport Science Studio.

Figure 5: ESPN’s Sport Science Studio Project Completed by Sports Field Holdings (SFHI)

The company is leveraging recent attention to head injuries from the National Football League (NFL) to distinguish itself as one of the top turf field providers, with an aim of lowering concussion risk for football players due to their product’s superior shock-absorbing qualities.

Leveraging the [likely] swiftly-approaching shift in turf regulation and the scrutiny surrounding head injuries among amateur and professional football players, SHFI expects their revenues to grow an average of 213% annually in each of the next two years, as seen in Figure 6, below.

Figure 6: From 2014 to 2017, SHFI Revenues to Grow 213% Annually

SHFI Fair Value $2.31/share; Implying Upside of 85% From Current Market Price

SFHI projected 2016 and 2017 revenues to be $17M and $40M, respectively. We believe the 2016 revenue projection to be a low hurdle as the company has contracted $14.5M of sales in just the first 3 months of 2016, according to their recent press release [6].

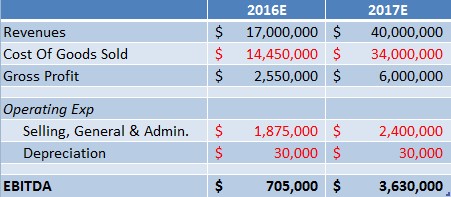

Applying a 15% gross margin (used to calculate COGS in Figure 7, below) and assuming the quarterly SG&A expense is a moderate $600,000 in 2017, Sports Field’s EBITDA margin could be 9%, a conservative figure for the construction industry, which ranges from 10% to 20%.

Figure 7: Projected Consolidated Balance Sheet

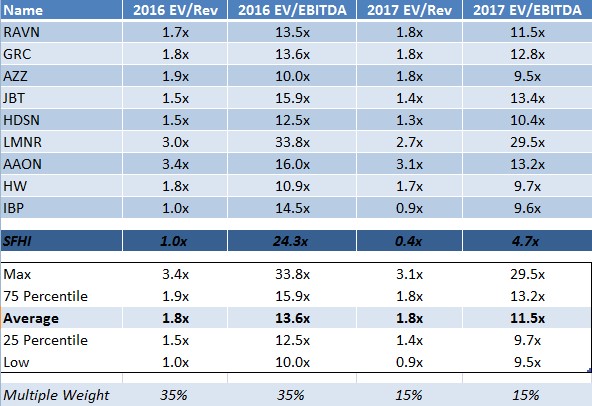

If SHFI were priced in line with the average forward EV/Sales & EV/EBITDA multiples that construction and manufacturing companies such as Head Waters (HW) and Installed Building Product (IBP) have been assigned, as shown in Figure 8, below, SFHI shares would be worth $2.31, or 85% greater than current market price.

Figure 8: SHFI Trades at a Discount to Peers’ Average in 3 of 4 Valuation Metrics

We placed more weighting (70% combined) on the 2016 numbers than the 2017 (30% combined) to demonstrate that even using conservative assumptions, upside in Sports Field is substantial. Under these assumption we think upside could be 85%+

Figure 9: SFHI Valuation Ranges from $0.52 – $9.14 per Share with a Weighted Average Fair Value of $2.31; 85% Higher Than Current Market Price

Key Takeaways:

- EPA, CDC are driving an opportunity for SFHI in a $6 Billion a year U.S. athletic facilities industry with eco-friendly turf in, non-eco-friendly turf out.

- SFHI is executing on its business model, growing tripled digits in 2015 and projecting 2016 sales of $17 Million with $14.5 Million in deals already inked in the first quarter of the year

- Regulatory change drove multi-hundred million dollar/billion dollar valuations for XXII, VPCOD, ELIO despite unclear profit outlook

- SFHI is expecting positive EBITDA in 2016

- Peers show SFHI is conservatively worth $2.31 per share but recently traded at just $1.25

- SFHI upside potential is 85%+ based on our conservative financial models

- Regulatory changes create a catalyst for owning shares in 2016; sales momentum could put spotlight on SFHI.

References & Endnotes

[1] http://www.nejm.org/doi/full/10.1056/NEJMsa1502403

[2] http://www.prnewswire.com/news-releases/global-e-cigarette--vaporizer-market-2015-2025---analysis--forecasts-for-the-50-billion-industry-300124050.html

[3] http://www.latimes.com/business/autos/la-fi-tesla-credits-20150805-story.html

[4] http://www.ehhi.org/turf/findings0815.shtml

[5] http://www.epa.gov/sites/production/files/2016-02/documents/federal_research_action_plan_tirecrumb_final_2.pdf

[6] http://finance.yahoo.com/news/sports-field-holdings-fiscal-2015-173719788.html

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Sports Field Holdings, Inc. ("Company") as part of research coverage services entered into February 2016. We expect to receive twelve thousand dollars per month and sixty-two thousand five hundred restricted shares of the Company on the 90-day, 180-day, 270-day and 360-day anniversary of our agreement. However, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, One Equity invested into Sports Field Holdings through a 12% convertible note to voice our support and belief in the Company's growth outlook. The terms of the convertible note are fully described in an 8-K filing with the SEC at https://www.sec.gov/Archives/edgar/data/1539551/000121390016011285/f8k021916_sportfieldhold.htm We are short shares of Elio Motors Inc. and may reverse or add to our position at any time without prior written notice. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/