On March 22, 2016 the Food & Drug Administration (FDA) said it would require opioid painkillers to carry a black box warning, as part of the U.S. government’s response to curbing the opioid epidemic [1]. Overdose on prescription painkillers like ‘Percocet’, ‘Oxycotin’, ‘Vicodin’ and illicit heroin, combined, led to nearly 26,000 deaths in 2014. Critics, however, say it may be “too little, too late” and point to the failure of the black box warning instituted in 2004 for anti-depressants, suggesting the label change is unlikely to adversely affect major opioid drug makers like Purdue or Endo, or newer entrants like Pernix or Elite Pharmaceuticals.

If Opioid Drug Makers Aren’t The Beneficiaries of Regulatory Change, Who Is?

Titan Pharma (TTNP) shares are up 45% ahead of the May 27 FDA decision on whether to approve the Company’s long-acting buprenorphine – a drug used to treat addiction to opioids. Similarly, Amphastar shares have gained 19% since the start of March. The company makes naloxone in a syringe – a drug used to save people who have overdosed on opioids.

Amphastar’s naloxone sales doubled in 2015 as the Obama administration announced an increase in spending on naloxone and major pharmacy chains CVS and Walgreens agreed to make naloxone available over-the-counter (OTC) in 35 states this year.

Arguably, the biggest beneficiary is Opiant Pharmaceuticals (OPNT), whose shares are flat since the start of the year. Shares recently traded at $9, while we see fair value being at least 97% higher, or roughly $18 per share.

Surprising Beneficiary Is First To Market, With a Convenient Formulation of the Antidote

Opiant owns the only FDA-approved nasal spray naloxone, which is sold under the brand name ‘NARCAN’. Access to naloxone has historically been limited by the need for a first-responder to administer the drug through a needle or syringe form. Nasally-administered NARCAN, launched by Opiant’s proven specialty-pharma licensee on February 25th, is expected to broaden access to the life-saving drug and consequently expand sales of the drug. Indivior projected $100 Million in peak sales for their own nasal-spray naloxone drug candidate. The FDA rejected their application in Q4’15. Sarah Potter, an analyst at Deutsche Bank, valued Indivior’s nasal naloxone at $160 Million if commercialized in 2016.

The market opportunity for a convenient and accessible form of naloxone, eg. nasal spray versus syringe, is significantly larger than the $60 Million reported for 2014 by IMS Health. This helps explain why Adapt Pharma, Opiant’s commercialization partner for NARCAN, agreed to pay $55 Million in milestones and tiered royalties in exchange for the global sales rights. What this doesn’t explain is why Opiant trades at a market capitalization of just $18 Million. We believe fair value is at least 97% higher, which excludes any value attributed to OPNT outside of NARCAN.

U.S. Government Triples Spending On Naloxone, Eyes Increasing Spend in 2017+

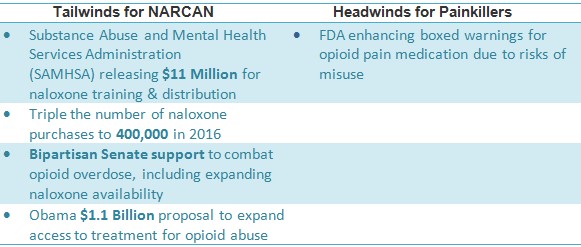

The federal government’s bipartisan efforts are committed to expanding access to naloxone. The budget allocates $400 million to battle opioid abuse this year [2], including tripling the number of naloxone distributions to 400,000. Congress is meeting in early May to vote on outlaying an additional $570 Million over the next five years while Obama has proposed to increase this funding to $1.1 Billion over the next two years [3].

A potential increase in funding will allow Adapt to leverage NARCAN’s position as the only available nasal naloxone and bring the solution one step closer to being a commercial hit.

Figure 1: Regulatory Shifts Allocating Funds That Support NARCAN Commercialization

They Licensed, Commercialized And Eventually Sold it For $500 Million. Now They’re At It Again With NARCAN

Adapt Pharma’s founders – Seamus Mulligan, Eunan Maguire and David Brabazon - built specialty pharma Azur to $100M in revenues. In 2011, Azur was then acquired by Jazz Pharma in a $500 Million deal, now worth roughly $1.9 Billion.

Before being acquired, Azur bought an antipsychotic drug called FazaClo, used to treat schizophrenia. In 3 years, Azur’s FazaClo captured 9% market share. FazaClo made up 40% of Azur’s sales when the company was acquired by Jazz.

Mulligan, Maguire and Brabazon have now taken on full NARCAN commercial responsibilities. Thus, Opiant has completed the shift of risk for reward and is letting Adapt do what they do best: sell specialty pharma products and capture market share.

NARCAN Could be Significant Player in The $60 Million $1.3 Billion Opioid Overdose Market

Doctors wrote 10,331 prescriptions for naloxone in 2014, compared to an estimated 260 million opioid prescriptions. With the high profile opioid death of music legend Prince, and David Siegel - a Florida billionaire who made his fortune in timeshares - driving co-prescription initiatives with his Victoria’s Voice Foundation [5], naloxone scripts could see a material bump this year and beyond.

A study published in the Journal of American Medical Association [4] estimates that roughly 7% of patients prescribed opioids are considered at high risk for abuse. If 7% of dispensed painkillers are co-prescribed with naloxone at NARCAN’s average price of $75/kit, then this potential tailwind suggests that the market for opioid overdose is $1.3 Billion (calculated in a prior note) rather than the IMS estimate of $60 Million.

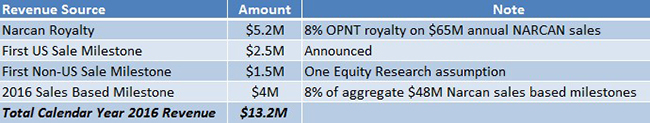

Given its first mover advantage, we assume NARCAN could capture 5% of the estimated $1.3 Billion opioid overdose market and generate $65 Million in 2016 sales. We assumed OPNT’s royalty rate would be 8% based on a sensitivity analysis [6]. Accordingly, Opiant’s 2016 revenues from milestones and royalties could come in at $13.2 Million, as shown in Figure 2, below.

Figure 2: Breakdown of OPNT’s Expected CY 2016 Revenues of $13.2M

Q2 results will be the first sign of [NARCAN’s] potential traction. This could create a catalyst for OPNT and a reason to own the Company now.

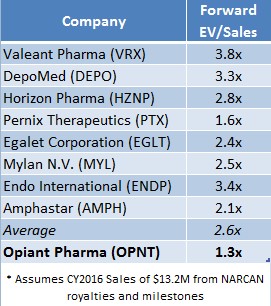

OPNT Fair Value is $17.76/Share, or 97% Higher Than Current Market Price

OPNT currently trades at 1.3x EV/Sales (on a forward basis, assuming 2016 sales of $13.2 Million) compared to other specialty pharma companies like Valeant (VRX) at 3.8x and DepoMed (DEPO) at 2.6x. If OPNT were priced in-line with its peers, OPNT shares would be worth $17.76 or 97% higher than recent market price(s).

Figure 3: Peers Suggests OPNT Shares Could Be Worth Nearly 2X Current Market Price

2016 could be the year Opiant’s mispricing is corrected. Opiant owns the only non-injected form of naloxone approved by the FDA, yet the company trades at a significant discount to our computed fair value. We believe that greater awareness of Opiant’s economic interest in NARCAN and sponsorship from the U.S. government will buoy OPNT stock like it has other existing anti-addiction and overdose antidote companies Titan Pharma and Amphastar. Regulatory tailwinds and increased NARCAN distribution could lead to a successful drug launch. If revenues total $13 Million, OPNT is easily worth >$25 Million, or $17.76 a share, compared to a recent market price of $9.

Key Takeaways:

- FDA ‘black box’ warning shows swift action by government to curb opioid crisis; spending on naloxone is expected to triple

- NARCAN is a nasally-administered naloxone sold by Adapt Pharma (private), in-licensed from publicly-traded Opiant Pharmaceuticals (OPNT)

- Adapt is experienced in commercializing specialty drugs and has first-mover advantage in a burgeoning naloxone environment; the size of the market is underestimated given a convenient and layman-accessible form of naloxone, eg. nasal naloxone

- Titan Pharma, Amphastar have rallied on opioid outlook; OPNT still trading under the radar

- Co-prescription, increasing access to naloxone OTC and awareness spurred by David Siegel and Prince’s recent death could expand awareness for NARCAN and catalyze shares

- OPNT is compelling: shares trade at $9 but are worth close to $18, in our view

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and seventy thousand dollars and twenty six thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional twenty four thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/

References & Endnotes

[1] http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm491739.htm

[2] https://www.whitehouse.gov/blog/2015/12/30/more-funding-opioid-epidemic-bipartisan-budget-agreement

[3] https://www.whitehouse.gov/the-press-office/2016/02/02/president-obama-proposes-11-billion-new-funding-address-prescription

[4] http://archinte.jamanetwork.com/article.aspx?articleid=1840033

[5] http://perspectivemagazine.com/240320164555/david-siegel-shares-vision-for-victorias-voice-foundation-at-gnex-2016

[6] http://ir.baystreet.ca/article.aspx?id=178