If you thought lithium was big last year—you were right. It was. But it’s huge today, and by most accounts, it will continue to get bigger, as spot prices for battery grade lithium in China indicated earlier this year.

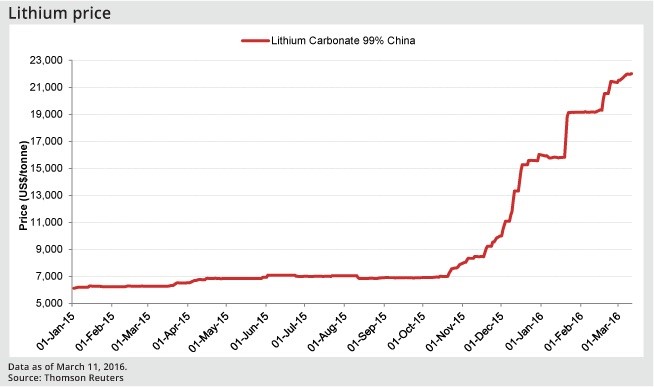

Spiking from $7,000 per ton to over $20,000 per ton, the floodgates were suddenly opened for a new game on a new playing field, with a commodity that isn’t even traded like a commodity—for now.

Welcome to the lithium boom, the spawn of a technology-driven revolution that knows no bounds.

And as this segment undergoes a major overhaul, the lithium oligopoly will come to an end, making room for new entrants who are making their presence felt. And as the game changes, and the evolution takes shape, investors will be looking for new lithium projects on highly prospective land. More to the point, they’ll be looking for projects put out there by companies with lower market caps but strong, intuitive management with the right track records.

Amid the land rush in the lithium space that is unfolding at intense pace in the U.S. state of Nevada, one new entrant stands out as it casts a much wider net over this state’s prospective ‘white petroleum’, figuring that there’s much more under the ground that we ever imagined.

It’s not just about getting in on the lithium ride right now, before it’s too late; it’s about how you get on it without taking too much risk: This just might be how...

8 Reasons to Watch Nevada Energy Metals (TSXV:BFF) (OTC:SSMLF)

1. The lithium boom is already here. According to an article by Goldman Sachs, the lithium market could triple by 2025—EVEN WITHOUT considering the already steadily rising demand for consumer electronics and even without considering our massive power storage needs. With each small 1% jump in electric vehicle market share, lithium demand just for this segment will increase by 70,000 tons. And EVs are about to hit the mainstream irrevocably now that Tesla (NYSE:TSLA) has launched its affordable Model 3.

2. Major land rush intensifying as Tesla’s battery gigafactory nears completion: Demand for lithium—now THE hottest commodity on the planet—is going up. It’s been called the new gasoline—our ‘’white petroleum’’. There is a battle raging right now for lithium market share, and everyone’s on the front line: major tech players, investment gurus, and resource exploration companies. Right now, it’s all about getting hold of prospective lithium-rich acreage, fast-tracking exploration and securing new supply. The land rush is on in full force, and Nevada Energy Metals is one of the most aggressive project generators out there.

3. Bullish prices: The price catalysts don’t get much better than this: This is our new gasoline, and fundamentals here are clear and impressive. While other commodities are plummeting, lithium is defying the market. In 2014, lithium prices grew 20%. And in 2015 battery grade lithium spot prices in China surged from US$7,000 per ton in the middle of the year to a whopping US$20,000 per ton earlier this year.

4. A euphorically tight supply situation for lithium: The surge this year in spot prices in China, the ravaging hunger for lithium batteries and power storage solutions has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants. Supply as it is can’t come close to meeting potential future demand, and that brings us to...

5. Nevada, ground zero for the American lithium boom: This is the only place in the entire United States that has confirmed lithium, and home of the only American venue with lithium already in production. Nevada is now on track to become one of the major lithium hot spots, joining the ranks of Australia, China and the Latin American ‘’Lithium Triangle” of Argentina, Brazil and Chile, where majors like FMC (NYSE:FMC) and Chile’s Sociedad Quimica y Minera de Chile (NYSE:SQM) have traditionally converged.

And Nevada is where Tesla is building its $5-billion battery gigafactory, which will need more lithium than it can presently get its hands on, and where start-up Faraday Future is also putting up a $1-billion electric vehicle plant. Nevada’s lithium customers are already in place. Now it’s about finding more supply.

Nevada Energy Metals is right in the middle of this sweet spot, but it’s also got the bigger picture in mind...

6. Two highly prospective lithium properties in the Nevada epicenter: Nevada Energy Metals’ Clayton Valley BFF-1 Lithium Project abuts the only producing lithium mine in the US—Albermarle’s (NYSE:ALB) Silver Peak Mine. This is where a lot of new entrants to the lithium game are clustering, and it’s ground zero in the land rush. It’s also in Tesla’s gigafactory backyard.

On May 17, Nevada Energy Metals agreed to grant 1074654vNevada Ltd (a private corporation) an option to acquire a 70% interest in the BFF-1 Clayton Valley Property. The move should provide a cash injection to Nevada Energy Metals while also reducing the company’s risk.

Then we’ve got Alkali Lake, which is a 60-40 earn-in agreement with Dajin Resources Corp. (TSX-V:DJI). This prime acreage is only about 12 kilometers from Albermarle’s solar evaporation ponds. Geological findings in Alkali Lake show two deep-seated basins of prime lithium hunting grounds. Surface sampling results at Alkali Lake confirm the presence of near-surface lithium.

7. Not a One-Trick Pony: Nevada Energy Metals has an aggressive acquisition strategy that continues to pick up momentum. The company is positioning itself as a project generator, not a one-off explorer in Nevada’s initial lithium heartland of Clayton Valley. Nevada Energy Metals is changing the way this game is played by making the lithium playing field in Nevada more attractive to potential investors. It’s casting a much wider exploration net around this area, based on geology that mirrors the lithium-producing Clayton Valley, because in all likelihood, given the geothermal footprints at play here, Nevada has a lot more lithium than anyone ever imagined. When it comes to de-risking, this company has figured out what investors want: They want a foothold in lithium where risk is lessened by diversity.

8. Two forward-looking prospective properties that focus on the bigger geological picture in Nevada: What’s particularly unique about Nevada Energy Metals is that it is thinking outside the box and going beyond the obvious Clayton Valley. This brings us to their Teels Marsh West project, which is about 48 miles outside of the Clayton Valley area. Here the company has staked 100 pacer claims covering an impressive 2,000 acres—all of which is highly prospective lithium grounds in tectonically active territory bounded by faults. And for investors who are all about de-risking, this is 100% wholly owned, with no royalties.

Further diversifying this portfolio, the company has the Sam Emidio property, in the desert by the same name. Until recently they had 69 claims here, but as of 26 April, Nevada Energy Metals has expanded to this 155 claims. It’s another very promising lithium hunting ground, with historical data showing lithium value in brine from a depth of 1.5 meters.

The site sits next to a 4.6 megawatt geothermal power plant, where high temperatures of around 155°C provides a “heat source for the circulation of meteoric groundwater believed important in the formation of lithium brine deposits as found at Clayton Valley,” the company says on its website.

Nevada Energy Metals made news on May 13 when it announced that it increased its lithium brine exploration assets by acquiring 128 placer claims (2,560 acres) in the Black Rock Desert, roughly 200 kilometers north of Reno. The 100% acquisition will add a new source of lithium brine, and an exploration program scheduled for this summer will determine the area’s potential.

San Emidio Li and Black Rock Desert are just two of a growing list of projects that Nevada Energy Metals is pioneering beyond the Clayton Valley.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.