ImmuDyne’s (IMMD) acquisition of 78% of Inate Scientific has created a share price anomaly: market price of $0.26 but a fair value at $0.50. As a result of the acquisition, ImmuDyne is expected to:

- Generate 720% year-over-year revenue growth

- Report $0.025 EPS in 2016

- Incentivize Inate to generate $5 million in earnings for IMMD shareholders for a complete payout to Inate’s founders

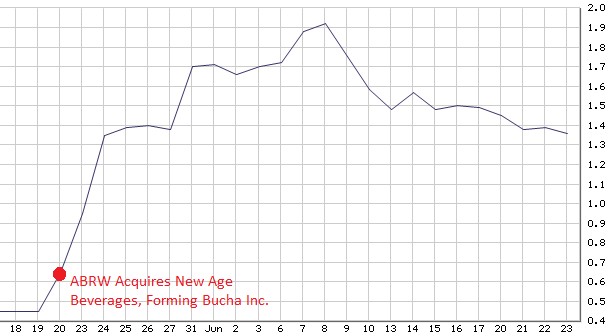

When American Brewing (ABRW) acquired New Age Beverage, an arbitrage formed between [ABRW’s] then market price and its fair value post-acquisition. American Brewing shares jumped 195%.

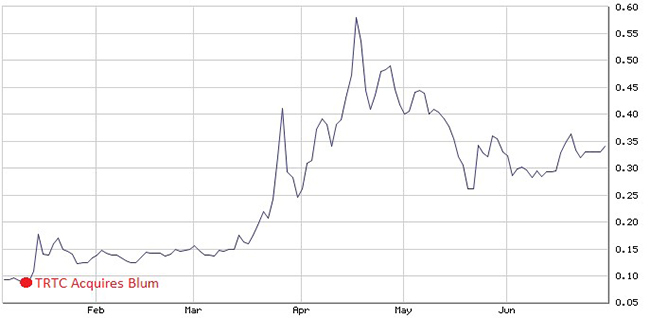

When Terra Tech (TRTC) bought Blum, shares spiked as much as 427% post-acquisition.

When MGT Capital (MGT) announced that it would acquire IP developed by John McAfee, shares soared 700%+.

We think IMMD shares could follow American Brewing Company or Terra Tech or MGT Capital in rising in value post-acquisition of Inate Scientific. In our view, IMMD shares would need to rise 92% to reach fair value. Further supporting our thesis, many of IMMD’s peers trade at 2x ImmuDyne’s forward EV/sales multiple. Put another way, we believe IMMD shares trade at roughly a 50% discount to fair value.

What Caused American Brewing Shares to Jump 195%?

ABRW’s acquisition of New Age Beverage added:

- Wide-ranging portfolio of high growth beverage products, including energy drinks and bottled water;

- Broader infrastructure that will shelve beverages in double the amount of outlets;

- Combined expected revenues of $55 million and free cash flow of $3.5 million for 2016.

Figure 1: ABRW Went From $0.65 to $1.92 After Acquisition of New Age Beverages

Prior to [the] New Age Beverage acquisition, American Brewing was selling kombucha tea at an expected annual run rate of $5 million and losing money. Post-acquisition, American Brewing trades at 0.95x forward EV/sales

Comparatively speaking, IMMD trades at just 0.82x forward EV/sales.

To fund their acquisition, American Brewing assumed ~$15 Million in debt. IMMD funded their Inate Scientific acquisition through equity – although most of it is subject to a ‘clawback’ unless Inate is able to generate certain pre-tax profits in a strict timeframe (more on this below). ImmuDyne has just $0.1M in debt on their balance sheet.

What Caused TRTC to More Than Triple?

With the acquisition of Blum, Terra Tech (TRTC):

- Claims to be the only publicly-traded company that touches every aspect of the cannabis lifecycle from cultivation to extraction to branding and retail sale;

- Expects to double 2016 revenues to $20-$22 million, up from $10 million in 2015;

- Took a step forward in becoming self-sustaining as Blum is a cash flowing business.

Figure 2: Terra Tech Stock Has Tripled In Price Since Acquiring Blum

Terra Tech agreed to pay 1.5x forward sales for Blum, making the deal contingent on Blum’s 2016 revenues. This way, Terra Tech only pays for performance and protects its shareholders.

ImmuDyne, however, is paying Inate Scientific equity based on pre-tax earnings, rather than sales. In other words, Inate’s founder only get paid IF they generate earnings for their parent company, ImmuDyne (IMMD), within a strictly-defined timeframe. The first major milestone calls for at least $0.015 in EPS in 2016. We think 2016 EPS could be $0.025, however, as explained below.

What Did MGT Capital Partners Do To Cause Shares to Soar 700%?

MGT Capital Partners acquired ‘D-Vasive’ and ‘Demonsaw’ which resulted in [the]:

- Appointment of security pioneer John McAfee as Chairman & CEO

- Expansion of its portfolio of IP assets into privacy and security applications

Figure 3: MGT Shares Up 700% Since Acquiring ‘D-Vasive’

The D-Vasive & Demonsaw acquisitions have added roughly $250 million in enterprise value to MGT. Inate Scientific, on the other hand, has only added $5 million in enterprise value to ImmuDyne [1], which supports our thesis that the deal has created an anomaly in the market price for IMMD shares.

IMMD Shares Trade at $0.26, But Inate Deal Puts Fair Value at $0.50 or 92% Higher.

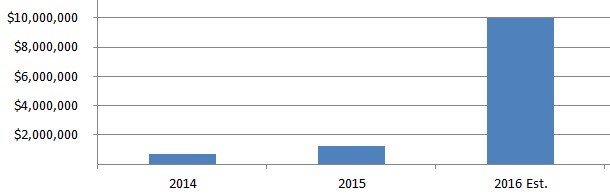

ImmuDyne’s fiscal 2015 sales were $1.22 Million. Fiscal 2016 guidance is for $10 Million in sales, with Inate expected to contribute the lion’s share of the 720% top line growth. Figure 4, below, shows year-over-year sales growth.

Figure 4: Inate to Add Significant Revenue to IMMD total in 2016

ImmuDyne’s Q1’16 sales came in at $1.64 Million, growing 470% compared to the same period a year ago (i.e. pre-Inate). In a shareholder update, Immudyne said that it added 3 new marketing partners at Inate to (i) lower customer acquisition cost and (ii) maintain growth trajectory to $10 million in 2016 revenue.

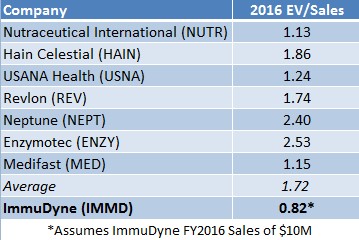

ImmuDyne trades at 0.82x forward EV/sales, compared to peers at 1.72x forward EV/Sales. If IMMD were valued in-line with other similar companies focused on packaged consumer goods, shares would be worth $0.50. Examples include Neptune Technologies (NEPT) at 2.4x forward EV/Sales or USANA Health at 1.24x forward EV/sales, as shown in Figure 5 (below).

Figure 5: IMMD Trades At Just 50% of Peers On Forward EV/Sales Multiple

Implemented Cost Savings Suggest Profitability Imminent

We see earnings at $0.025 per share in 2016 as ImmuDyne’s cost-cutting measures and anticipated ramp in sales in 2H 2016 contribute to a greater-than-expected profit. ImmuDyne said that in the second half of Q1 2016 Inate cut costs 25% with strategic changes like in-sourcing customer service reps. All else being equal, a 25% reduction in costs in Q1 would have led to a profitable quarter for the Company.

In arriving at our fair value for IMMD shares we assumed $10 million in revenues for 2016. This is what ImmuDyne has publicly guided since forming a joint venture with Inate Scientific.

Since, ImmuDyne acquired 78% of Inate and said the shares tendered in the deal were contingent on Inate contributing at least $0.5 million in earnings to IMMD in 2016.

If we run with another ImmuDyne disclosure and assume a 25% cost improvement is possible in 2H 2016, we arrive at $0.86M or $0.025 in EPS for 2016 (as explained in further detail here). At 20X our estimated 2016 earnings, IMMD shares should trade at $0.50, or 92% over current market price. That 20 forward P/E multiple compares to 17.8 forward P/E for the S&P 500 and 18.9 forward P/E for the NASDAQ. To put that into context, ImmuDyne is expected to grow revenues 720% in 2016 versus flat or declining growth for the broader market.

Inate’s Payout is Fully Contingent on Earnings

ImmuDyne took a 78% interest in Inate Scientific in exchange for up to 9.5M common shares predicated on Inate helping ImmuDyne earn $5 Million, or $0.12 per share in pre-tax earnings by 2018.

Inate would be issued a total of 2.3 million IMMD shares if Inate can generate at least $500,000 in pretax earnings for IMMD shares in 2016, giving investors a catalyst to own IMMD shares right now. If Inate expects to get paid, it has to pay IMMD at least $0.5 Million this year. But if ImmuDyne’s cost cutting changes in Q1 pay off, we expect earnings to come in at $0.86 Million this year.

Why Own IMMD Shares Right Now? 2H 2016 Could Have Major Catalysts, Meanwhile Shares Are Undervalued.

We believe visibility of ImmuDyne’s acquisition of Inate Scientific was and remains low. The acquisition, if projections are met, immediately valued shares at 2x then-current price. We still think IMMD shares need to rise 92% to be trading at fair value.

If our analysis of similar post-acquisition inflections (i.e. MGT Capital or Terra Tech or American Bewery) spills over into IMMD at any point, we think IMMD’s potential to turn a profit in Q2 or 2H of 2016 will be the catalyst that ignites shares right now.

We also see the risk to reward trade-off as being compelling: ImmuDyne has a shareholder-centric management team with a large vested interest in the common shares of the Company. They closed the Inate Scientific acquisition without using any cash or burdening the balance sheet with debt. The equity that they issued to Inate’s founders can be clawed back by IMMD if Inate does not give IMMD shareholders $5 Million in earnings in a defined time-frame.

Looked at another way, at current market prices, IMMD is valued as if sales are expected to be $4.8 million this year, but the company has guided for $10+ million in 2016 sales. Therefore, reporting greater-than-expected revenues could surprise the market and potentially cause shares to inflect.

Further, the market has not valued IMMD in anticipation of earnings. Reporting of any actual earnings will create another catalyst in 2016. We think this could happen as soon as Q2 results, which are due mid-August.

Lastly, if IMMD meets projections on 2016 sales and earnings, focus will shift to growth in 2017. Any of ImmuDyne’s peers show the Company’s shares are undervalued; and any of Terra Tech, MGT Capital or American Brewing show how quickly that can all change.

Key Takeaways

- Awareness of ImmuDyne’s acquisition of Inate was and remains low, creating an anomaly between market price and fair value for IMMD shares

- Market price for IMMD shares is $0.26 while fair value is likely $0.50, pointing to potential upside of 92%

- American Brewing, MGT Capital Investments, Terra Tech shows how quickly valuations can change post and accretive acquisition and some awareness of the deal

- We think potential revenue ramp(s) and earnings surprises could create awareness for ImmuDyne’s Inate deal and cause shares to quickly inflect to fair value

- IMMD reports Q2 results mid-August, creating a catalyst for owning share right now

References & Endnotes:

[1] Change in Enterprise Value (“EV”) computed as difference between IMMD EV as of this note’s publishing date and IMMD EV prior to joint venture with Inate Scientific

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received forty thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We expect to receive ten thousand dollars per month and an additional five hundred thousand restricted shares for our services, ending on January 31, 2017, however our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/