ImmuDyne’s (IMMD) marketing platform could add millions in shareholder value after the Company said it was negotiating to in-license a new and disruptive product offering for a $3.5 Billion opportunity. This is in addition to 720% revenue growth expected in 2016.

The potential deal could validate ImmuDyne’s direct-to-consumer marketing engine – a majority-owned subsidiary called ‘Inate Scientific’.

Companies with validated platforms and commercialized products trade at multiples of ImmuDyne’s valuation of just $8.5 Million. Examples include names like Elite Pharma at 30X, Organovo at 35X and Gluu Mobile at 25X, all of whom built shareholder value by validating a platform and onboarding disruptive product offering(s).

ImmuDyne shares would need to rise 100% to trade at fair value, based on valuation among peers. This potential in-licensing deal adds to the value case for owning IMMD shares and provides investors with a catalyst for doing so now.

How Do Elite, Organovo and Gluu Make A Case For ImmuDyne’s Platform?

Elite’s Abuse Deterrent Platform Has Become a $250 Million Business

Elite Pharmaceuticals (OTCQB: ELTP) leveraged its abuse deterrent technology to develop a pipeline of 10 reformulated products and generate fiscal 2016 revenues of $12.5 million, up 140% compared to 2015. Elite shares are up 54% in the last year and now command a $250 million valuation.

Markets Value Organovo’s Bioprinting Platform At $300 Million

Organovo’s commercial launch of a 3D bioprinted Human Liver Tissue validated its bioprinting technology platform and resulted in the company inking research collaborations with Merck (NYSE: MRK), Bristol-Myers Squibb (NYSE: BMY) and Roche Holding (OTCQB: RHHBY). Organovo expects to release a bioprinted Kidney Tissue in Q3’16 and has partnered with L’Oreal (OTCPK: LRLCY) to develop a bioprinted Skin Tissue. The 3D bioprinter has proven to be a scalable platform capable of producing commercial products. In turn, investors have rewarded Organovo with a $300 million valuation.

Glu’s Celebrity Gaming Platform Has Helped Build A $220 Million Valuation

Kim Kardashian: Hollywood proved to be a huge growth driver for Glu, generating $61.4 million and $76.7 million in sales for 2014 and 2015, respectively. This successful celebrity collaboration drove the stock to multi-year highs and validated the endorsement model in mobile gaming. Glu secured follow-on gaming deals with Britney Spears – who released a game in 2015, and an ongoing collaboration with Taylor Swift and Chef Gordon Ramsay.

Inate Scientific Validates Marketing Engine By Repositioning ImmuDyne’s Own Product Offering

Inate Scientific (“Inate”) sells a line of skin care products based on ImmuDyne’s proprietary beta-glucan ingredient. The Company was set up in Q4 2015 to reposition ImmuDyne’s disruptive offering and sell directly to consumers online. Prior to Inate, ImmuDyne had yearly sales ~$1 Million. After forming a joint venture with Inate, sales are expected to total $10 Million in 2016. ImmuDyne quickly acquired a majority interest in Inate for stock – but Inate’s owners only get paid this year if they generate $500,000 in earnings for IMMD shareholders. A complete earn-out in the deal would require Inate to generate $5 Million in earnings for IMMD shareholders (see “ImmuDyne Inks Deal Contingent On Earnings”).

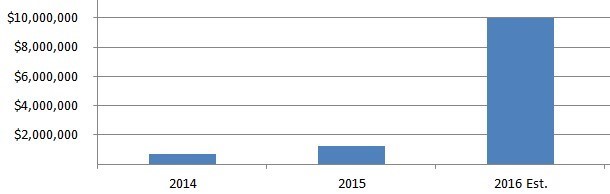

Q1 2015 sales were $1.64 Million, up 470% from a year-ago. Why? Robust revenue generated at Inate. We think this puts ImmuDyne’s projection for $10 Million in sales this year within reach. Figure 1, below, shows ImmuDyne’s actual and projected sales by year.

Figure 1: Marketing Engine to Add Significant Revenue to IMMD total in 2016

If Inate’s ability to reposition ImmuDyne’s longstanding beta-glucan offering and generate $10 Million in sales in 2016 has any takeaway, it’s that underpinning the sales is an undervalued marketing engine.

This engine could be a source of deal-flow, attracting disruptive products with large unaddressed market opportunities. The first product to support this theory is PilarisMax, a dermatologist-backed hair loss solution for a $3.5 Billion market.

IMMD Leverages Inate Platform To Attract Dermatologist-Backed Hair Loss Product For A Wanting $3.5 Billion Opportunity

Proven Marketing Engine Implies Prior Success Could Be Repeated

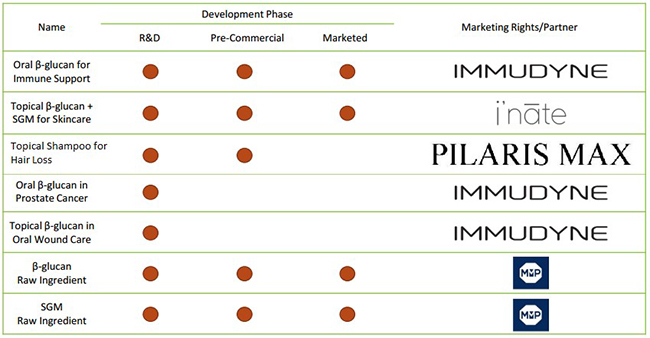

ImmuDyne announced last week that it had signed a non-binding term sheet for an exclusive world-wide license to market and sell PilarisMax, a hair loss shampoo/conditioner backed by two respected and successful dermatologists in Florida. The product itself is all-natural and provides an interesting alternative to regulated drug products that appear to under-deliver on the promise of hair growth for large segments of the ‘hair thinning’ or ‘balding’ population. PilarisMax would offer ImmuDyne a potential new revenue stream (shown in Figure 2, below), adding to $10 Million in anticipated sales this year.

Figure 2: IMMD Building Pipeline That Addresses Broad Unmet Needs

Exposure To $3.5 Billion Fragmented Hair Loss Market

The FDA approved 2 products for treating baldness – Merck’s ‘Propencia’ and ‘Rogaine’ from Johnson & Johnson (NYSE: JNJ). But both products’ patents expired and sales have dwindled. For instance, Merck’s Propecia sales were down from $447 Million in 2011 to $183 Million in 2015. And both products have reported side effects, explaining why the rest of the market goes to ‘alternative’ products.

This means that the market is highly fragmented and potentially a lucrative opportunity for a proven online marketer to capture share of.

PilarisMax Is All Natural

According to the patent filed by PilarisMax’s inventors and practicing dermatologists, Steven Shapiro and Michael Borenstein, the topical hair treatment is composed of a saw palmetto berry derivative and caffeine. Both ingredients are natural and have well understood safety profiles.

Compared to Merck’s Propecia, which has shown to have sexual side effects due to its mechanism of inhibiting testosterone in the prostate, PilarisMax’s profile has no serious side effects.

Inate is uniquely positioned to offer disruptive products a platform for reaching consumers. It helped ImmuDyne generate $1.64 Million in revenue in Q1’16. Now the product could potentially position and market a disruptive offer for millions struggling with hair loss and in need of a solution.

If Implied Upside To Owning IMMD is 100%+, How Much Greater Is It Considering Robust Platform?

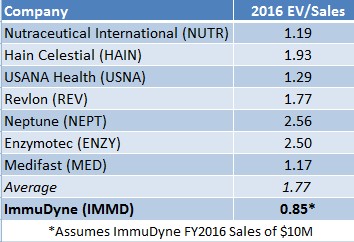

ImmuDyne’s projected $10 Million in sales for 2016 imply a forward 0.85x EV/Sales multiple. A quick analysis of companies similar to ImmuDyne yields an average EV/Sales multiple of 1.77x (Figure 3, below). This means that IMMD shares, based on the existing product offering alone, already trade at a 50% discount to fair value.

Figure 3: IMMD Trades At 50% Of Peers On Forward EV/Sales Multiple

The implied fair value for IMMD shares, based on an analysis of peers is $0.50. But shares trade at just $0.25 in the marketplace. We think that in addition to the potential 100%+ implied upside to owning IMMD shares, Inate Scientific’s ability to attract, develop and commercialize disruptive consumer product offerings like PilarisMax for the $3.5 Billion ‘hair loss’ market will only further drive ImmuDyne’s sales growth and earnings power.

If the Elite Pharma, Organovo or Glu Mobile cases demonstrate tens of millions in value underlying their product platforms, what is ImmuDyne’s platform with Inate worth?

A definitive licensing deal for PilarisMax creates a unique near-term catalyst for owning IMMD shares.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received forty five thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We expect to receive ten thousand dollars per month and an additional five hundred thousand restricted shares for our services, ending on January 31, 2017, however our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/