OPEC’s new output deal makes for good media sound bites, even if it is more desperate than realistic. But as oil volatility breaks new records, one commodity continues to rise to the forefront—lithium. And there’s even talk of a Latin American OPEC-like cartel in its future, while U.S. lithium is already turning pure-play investment into pure-play profit in Nevada.

The future is not about oil, it’s about lithium—the key driver of a massive energy revolution that has already reached the point of no return. The latest indication was a landmark decision by Germany’s Budesrat last week to ban the internal combustion engine by 2030.

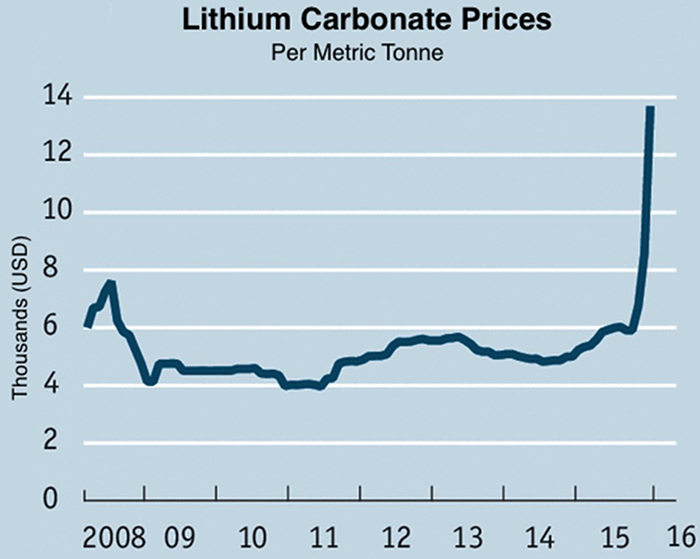

Prices have tripled. Supply is already tight, and demand is poised to make new barons out of today’s lithium explorers.

It’s not about hedging bets anymore on lithium as the driver of our energy future. Now, for those who’ve already invested in the emerging small-cap explorers like Nevada Energy Metals (OTCQB:SSMLF), it’s time to reap the rewards. For those who have been slow to jump on this bandwagon, it’s time to panic about being left out.

Already, there is talk of shortage, with the supercharged electric vehicle industry concerned about readily available lithium supply.

The world has plenty of lithium, but it wasn’t prepared for the global energy revolution and the sheer velocity of the electric vehicle industry or the ambitious surge in energy storage and powerwall demand.

The problem is finding and developing new supply to keep pace with voracious new demand. This is where junior pure-play explorer Nevada Energy Metals comes into play, offering investors a real foothold right in the heart of the lithium playing field, with risk significantly reduced with multiple lithium targets.

It’s right in the heart of the intensifying lithium rush in the U.S. state of Nevada. But it’s also casting its net much wider to position itself as a longer-term developer of new lithium deposits in a state where geography promises endless lithium wealth.

Spiking Prices, Soaring Demand Shine Light on Small-Cap Pure-Play

Spiking from $7,000 per ton to over $20,000 per ton earlier this year, the market indicates the beginning of an energy revolution that knows no bounds.

The surge this year in spot prices in China, and the ravaging hunger for lithium batteries and power storage solutions has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants.

(Source: Economist.com/Citigroup)

Nevada Energy Metals is banking on the fact that the lithium floodgates have been opened—and there is no closing them now. They’re also wisely hedging their bets that the recent tripling in lithium prices is only a modest precursor to what it is to come.

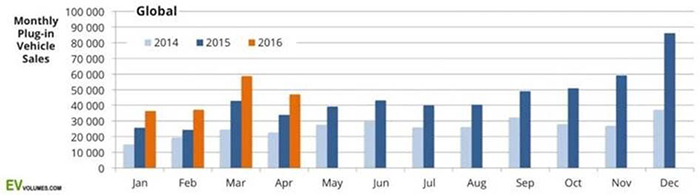

As for the first-quarter of this year, electric vehicle sales had grown 42% year-on-year, worldwide, according to EV-Volumes.

Electric vehicles sales from 2014 through April 2016:

The EV segment is already going mainstream. Tesla has stormed the mainstream US market with its newest model, and even UBER has jumped on board. EVs have already entered the profit stage in Norway, and will soon be followed by the Netherlands, helped out by some EV-market-loving laws that demand that every single car in the country be electric by 2025. In Asia, too, EVs are bursting the traditional car bubble.

And with a mind-boggling 12 battery gigafactories on the books globally, we’re looking at a supply and demand equation that is overwhelmingly in favor of new lithium miners and explorers.

Cornering first new production and simultaneously capturing second phase new production from completely unexplored and untapped Nevada terrain is the key to cashing in on the lithium boom in both the near- and long-term.

This is exactly where Nevada Energy Metals has carved out a significant niche in a market that is moving so fast that investors are having a hard time keeping pace.

The land rush is already on in full force in Nevada’s Clayton Valley, which is ground zero for the American lithium boom.

Nevada’s geology tells a much more lucrative story, and so far we’ve only got the introduction.

Nevada Energy Metals has not only secured an exploration target in Clayton Valley, but it’s also expanding exploration well beyond, and early this year raised over US$1 million, making it fully funded for its exploration plan.

The company is changing the way this game is played, focusing on diverse acquisitions of high-quality lithium acreage. This is the only company on the field right now that is setting itself up as a major lithium project generator.

The Dawn of a New Era—Meet the Next Potential Energy Magnates

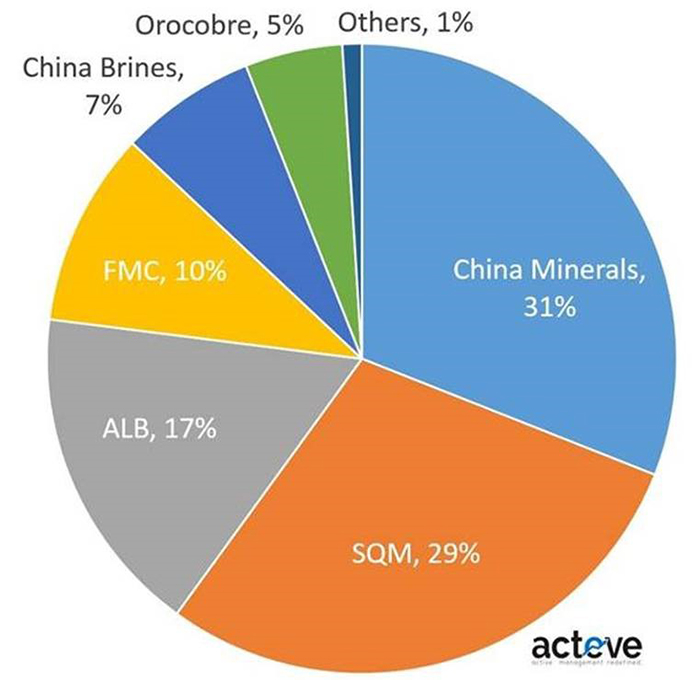

With the Latin American lithium triangle of Argentina, Bolivia and Chile talking about an OPEC-style cartel for the mineral, and with Nevada barely containing the land rush, the pure-play junior miners and explorers are stealing center stage away from the traditional four lithium giants, who have controlled this space for so long.

The big four:

We are now witnessing the end of what has been known as “the lithium oligopoly” and the dawn of the new entrant. New lithium projects on highly prospective land are the new rage. What investors are craving at the tipping point in this lithium boom is a lower market cap combined with strong management and solid near- and long-term strategy.

There is nothing stronger at this critical point in the lithium boom than a company that dives in right at prime time during a land rush and starts acquiring a diverse, forward-thinking portfolio that covers all the potential bases for an investor.

For Nevada Energy Metals, this is all about strategically staking high-potential land while negotiating joint ventures to cover exploration costs, while still maintaining the ability to cherry pick those projects they want to develop 100% in-house.

So far, so good. This strategy has already netted the company US$350,000 in cash (including future payments on current agreements), plus cash equivalents with unlimited growth potential.

Things are moving very fast. The company’s line-up includes an impressive seven projects in Nevada, and exploration is moving at breakneck speed.

Already on 1 September, the company announced that samplings from its Big Smokey Valley project (100% owned) returned high-level Lithium values in 150 out of 170 samples. We’re looking at 3,200 acres here, with 160 place claims—all in an area with three geothermal resources, which means a high potential for commercial quantities of Lithium. Sampling also began in another 100% owned Nevada project in Black Rock Desert in late August.

Nevada Energy Metals’ Clayton Valley BFF-1 Lithium Project abuts the only producing lithium mine in the US—Albermarle’s (NYSE:ALB) Silver Peak Mine. This is where a lot of new entrants to the lithium game are clustering, and it’s ground zero in the land rush. It’s also in Tesla’s gigafactory backyard.

Then we have the Black Rock Desert project, also in Nevada, and also 100% owned by Nevada Energy Metals. This project covers around 2,000 square kilometers and contains 5 of the 30 currently listed Known Geothermal Resources Areas in the state. On 22 September, Nevada Energy Metals saw a surface sampling program here return significant geochemical results. These results are highly promising because they are comparable to those found in Clayton Valley—the center of the land rush—and in Teels Marsh. It’s enough of a result for Nevada Energy Metals to immediately dispatch a crew to expand its land position by staking more claims.

Nevada Energy Metals also has nearly 170 placer claims in two other forward-looking lithium exploration areas: the Teels Marsh West project which is on highly prospective lithium grounds in tectonically active territory, and the San Emidio property.

As Oil Dulls, Lithium Becomes Blindingly Bright

In the energy game, oil is incredibly volatile, and OPEC’s unexpected (but also unexpectedly dull) agreement in late September to cut output by 740,000 bpd, the details of which are to be determined at the end of November, will have little impact on prices. This is where the very clear fundamentals of lithium, combined with the fantastically tight supply situation, is winning over investors.

The electric car market is quickly ramping up production, with Tesla alone eyeing an estimated 500,000 cars by 2018—up from 80,000 this year. And everyone’s building battery gigafactories—we count 12 in the works in total. China is eyeing 5 million electric cars on the road by 2020.

But from the lithium perspective, this is now a junior game, and to de-risk it, it needs to be diverse. As a lithium project generator, Nevada Energy Metals (OTCQB:SSMLF) is uniquely positioned to de-risk entrance into the mineral of our future.

Right now, junior pure plays are the best way to gain exposure to this high-demand precious metal. This market is moving full speed ahead, and it’s not waiting for anyone. Once there’s an OPEC-style cartel, we’ll have missed the critical window.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are subject to change without notice.We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.