As oil flounders--ruled by wild speculation and held hostage by OPEC whispers--lithium explodes to the top of the commodities line-up. The rules of this fundamentally fantastic game are changing, and one explorer has emerged ahead of the junior pack as a major-league project generator.

This is now definitively a junior explorers game, and Nevada Energy Metals (OTCQB:SSMLF)

is a leading the charge for discovery of new production of lithium as supply lags behind phenomenal demand. Nevada Energy Metals has achieved this feat by scooping up a significant portfolio of highly prospective, unexplored terrain in lithium-rich Nevada.

It’s a project-generation niche that no other junior is filling, and it’s in a market that is moving so fast that investors are having a hard time keeping pace.

New Exploration is the Key to this Market

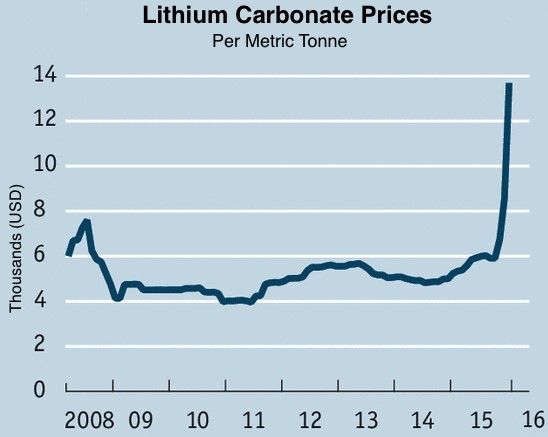

Supply is already tight, and it’s only getting tighter. Electric vehicles are exploding into the mainstream from every corner of the earth. The latest indication was a landmark decision by Germany’s Bundesrat last week to ban the internal combustion engine by 2030. Prices have tripled, and we’re now staring directly at the next commodity barons.

They won’t be those just hovering around the heart of the American lithium boom in Clayton Valley, Nevada—they will be those who cast their nets much wider and get ahead of the lithium development game.

Nevada Energy Metals is among the most forward-thinking lithium explorers out there, and it knows that Nevada’s geology tells a story that is much bigger than Clayton Valley—a story of endless lithium wealth.

Nevada Energy Metals has not only secured an exploration target in Clayton Valley, but it’s also expanding exploration well beyond. Earlier this year, it raised over US$1 million, making it fully funded for its ambitious exploration plans.

The company is changing the way this game is played, focusing on diverse acquisitions of high-quality lithium acreage. This is the only company in the field right now that is setting itself up as a major lithium project generator, offering investors a lucrative foothold while significantly reducing their risk with multiple lithium targets.

The Tipping Point

We already know that lithium is the hottest commodity on the planet and is fueling a massive energy revolution; and we already know that juniors are the key to the lithium boom. We are now at the next stage: the critical point where the best-positioned juniors reveal themselves.

From an investor’s perspective, there’s nothing stronger than Nevada Energy Metal’s fast-moving strategy to secure a diverse, forward-looking portfolio, staking out high-potential land while negotiating joint ventures to cover exploration costs.

In the meantime, the company gets to choose which projects it wants to develop 100% in-house.

It’s a winning strategy that has already netted the company US$350,000 in cash (including future payments on current agreements), plus cash equivalents currently in excess of US$400,000. The growth potential here is unlimited.

The momentum at this point is unstoppable: Nevada Energy Metals’ line-up already includes 7 impressive Nevada projects, and exploration is moving at breakneck speed.

Samplings from the Big Smokey Valley project, which is 100% owned by Nevada Energy Metals, returned high-level lithium values from samples across 3,200 acres and 160 placer claims in very attractive geothermal areas that promise commercial quantities.

Sampling has returned even more impressive results at the company’s Black Rock Desert project, also 100% owned. The Black Rock Desert Project consists of 128 placer claims (2,560 acres/ 1,036 hectares) located in southwest Black Rock Desert, Washoe County, Nevada.

So far, the results are comparable to those at ground zero of the lithium boom—Clayton Valley—where Nevada Energy Metals’ BFF-1 lithium project abuts the only producing lithium mine in the United States, Albermarle’s (NYSE:ALB) Silver Peak Mine.

Nevada Energy Metals also has nearly 170 placer claims in two other forward-looking lithium exploration areas: the Teels Marsh West project, which is on highly prospective lithium grounds in tectonically active territory, and the San Emidio property.

While Clayton Valley is the hottest playground in Tesla’s (NASDAQ:TSLA) gigafactory backyard, the new ground zero is the lithium-bearing geothermal treasures that lie beyond this. This is exactly where Nevada Energy Metals stands out among the juniors, and it’s got the funding both to meet its ambitious exploration strategies and to maintain the momentum for investors.

From Pure-Play Investment to Pure-Play Profit

We are at the turning point here, where pure-play investment into lithium starts to turn into pure-play profit. It’s no longer about hedging bets: The drivers of the lithium boom are clear and present, and electric vehicles are only the beginning. The second wave of the boom will be a major surge in energy storage and powerwall demand.

Even for the first phase, there is already talk of shortage for the supercharged electric vehicle industry, which is concerned about the readily available supply of lithium—and the rush is on for juniors to secure enough supply in time.

- As of the first-quarter of this year, electric vehicle sales had grown 42% year-on-year, worldwide, according to EV-Volumes.

- Everyone’s jumping on this bandwagon—even Uber Technologies Inc.

- In Europe, EVs are already profitable.

- In the US, all by itself, Tesla is eyeing an estimated 500,000 cars by 2018—up from 80,000 this year.

- China is eyeing 5 million electric cars on the road by 2020.

- Everyone’s building battery gigafactories—we count 12 in the works in total.

Lithium will go for a premium, and the market has already spoken, with prices spiking from $7,000 per ton to over $20,000 per ton earlier this year.

(Source: Economist.com/Citigroup)

It’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants. The recent tripling of lithium prices may only be a banal harbinger of what is to come.

Smart Money on a Smart Multiple-Play Explorer

What investors are craving at the tipping point in this lithium boom is a lower market cap combined with strong management and a solid strategy that goes beyond the first phase of new supply development.

And from an investor perspective, it’s not a game best played through the traditional big three lithium miners: Albermarle (NYSE:ALB) in Chile and Nevada; SQM (NYSE:SQM) in Chile; FMC (NYSE:FMC) in Argentina.

New supply is largely a junior game.

It’s hard to beat Nevada Energy Metals in terms of diversity of lithium play. It’s also hard to compete with its dream team strategy that focuses on de-risking for investors. Not only does the company offer a reduced-risk way to gain exposure to the precious metal of our future, but it does so at a small-cap price.

Finding a unique way to minimize risk and leverage capital and expertise while aggressively working toward acquisition—this is a win-win set-up in the lithium game, and its where shareholder value starts looking quite attractive.

The smart money is backing Clayton Valley as the next US lithium supply source. Genius money is looking at a much bigger picture.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are are subject to change without notice. We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.