Consumers continue to vote with their dollars away from sugary drinks and towards those that provide a health benefit.

Actions at large beverage companies reflect this continuing shift: the Coca-Cola Company (NYSE:KO) bought VitaminWater for $4 billion in 2007 and has continued tacking on non-soda alternatives. Like ZICO, a coconut water company, and the cold-pressed juice manufacturer Suja Life.

PepsiCo (NYSE:PEP) rolled up the ubiquitous Naked Brand of juice drinks a decade ago, and more recently completed the acquisition of probiotic drink-maker KeVita.

And still, Coke has seen its revenue drop from $48 billion in 2012 to $44 billion as sugary drinks have come under fire.

Pepsi’s revenue has declined from $66 billion to $61 billion in the same time.

The move from pleasure beverages to healthy beverage is only building momentum, and it’s clear that smaller upstarts are where these larger companies are looking.

Names like ZIVO Bioscience, Inc. (OTC:ZIVO) and New Age Beverages Corp. (OTCQB:NBEV) are benefitting from this move toward healthier products. ZIVO’s stock has already doubled in the last quarter, and NBEV is up 165% since November. ZIVO is already partnered with major animal health player Zoetis (NYSE:ZTS), and the potential for its protein additives in the smoothie and healthy fruit juice category is tremendous.

Sugary Drinks Are Going Away

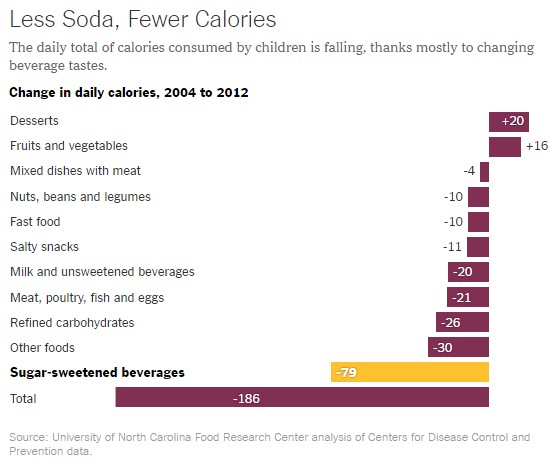

As consumers become more educated on the dangers of excess sugar, they have responded by taking steps to remove certain items from their daily caloric consumption. According to the University of North Carolina Food Research Center, between 2004 through 2012, the change in American children’s daily caloric intake of sugar sweetened beverages has dropped by 79 calories.

In the last several years, beverage companies that had built their portfolios with a concentration on drinks with a high sugar content have been actively trying to diversify into new product categories.

Monster Beverage Corporation (NASDAQ:MNST), while being a huge category innovator with the introduction of energy drinks, is suffering from the perception that its flag-ship product is loaded with sugar -- 27 grams to be precise -- in a can of Monster Energy. Its stock was down -13.8% in Q4 2016.

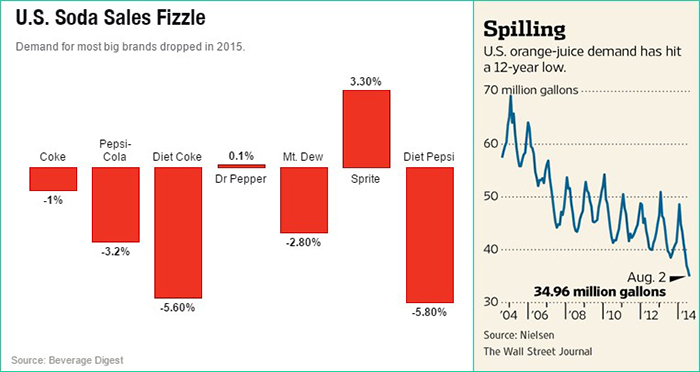

Even natural drinks with high sugar content are doing poorly. US orange juice demand has fallen by 30% in the last ten years. Skypeople Fruit Juice Inc. (NASDAQ:SPU), a Chinese company that produces and sells a wide variety of fruit juices and fruit juice concentrates, was once a big hit with investors. Its stock has been decimated from $20 to $6; annual revenue from 2012 is down 16%, to $86M in 2015. Its stock was down -42.7% in Q4-2016.

Meanwhile, Beverage Companies With a Health Benefit Are Doing Well

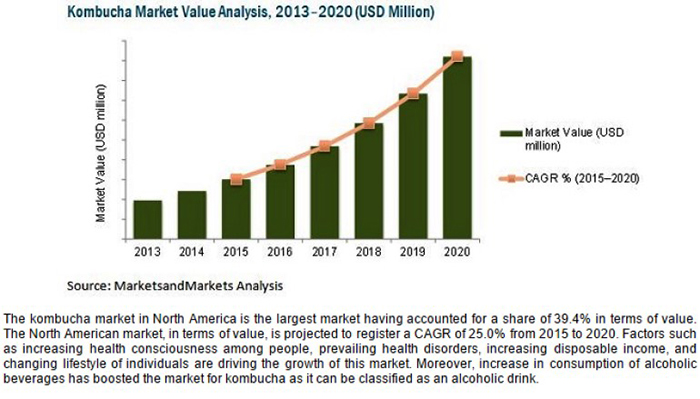

Meanwhile, companies that are building healthy beverage portfolios are being rewarded. New Age Beverages Corp. (OTCQB:NBEV) started out as American Brewing Corp. and was attempting to roll up of the micro-craft brewery space, but switched strategies with the acquisition of a national kombucha distributor called Bucha Live in 2015.

Kombucha is one of the fastest growing product categories in the beverage space, partly because it is perceived as having a real and substantive health benefit. By betting squarely on this new product category, and functional beverages in general, investors have been impressed. NBEV climbed 165% in the last quarter of 2016.

Protein as a Functional Benefit in Beverages Continues To Be a Strong Driver of Growth

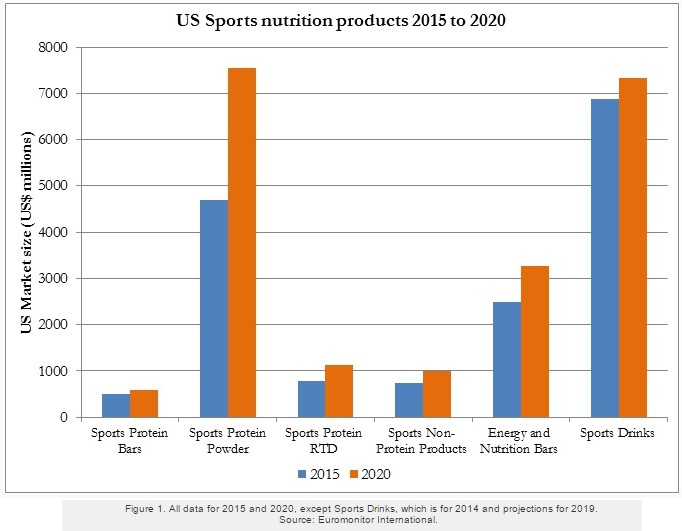

According to Euromonitor International, the US market for sports nutrition plus energy/nutrition bars and sports drinks is set to exceed $20 billion by 2020. While traditionally body builders and elite athletes have made up the bulk of the sales of protein powders for drinks, the category is expanding from more casual exercisers.

The bulk of the protein powders in today’s market are made from Whey protein, which is the liquid remaining after milk has been curdled and strained. It is a byproduct of cheese or casein manufacturing and has several commercial uses. It is by far the most popular protein in the market place, with many suggesting that a daily protein shake or two is a great addition to an otherwise healthy diet – especially for those who strength train on a regular basis.

But more recently, other forms of protein are starting to show growth as the market ponders the safety profile of Whey, which is inaccessible for lactose intolerant individuals; a wide range of reported side-effects are not completely understood.

Proteins made from plant-based forms are becoming increasingly popular, with pea, soy, and algae leading the way.

ZIVO makes a protein additive that has huge potential in the beverage space

ZIVO is a Michigan-based company that develops and commercializes nutritional compounds, created through its proprietary algae strains. Their application is boundless: supplements and nutraceuticals for both humans and animals, as well pharmaceutical uses. The company has signed agreements with impactful collaborators, like Zoetis, and are quickly moving into a commercial stage of development.

Despite being the single largest consumer of CO2 on our planet – and thus the single largest O2 creator – algae are understated organisms.

So is the multi-billion-dollar market for algae-based products.

That’s changing rapidly.

The global market for algae-based products is expected to exceed $44 billion by 2023, according to research from UK-based Credence, growing at a compounded annual rate of 5% from 2016 through 2023. This market encompasses feed & food products, nutraceuticals, colorants and pharmaceuticals. And the US market for algae-based products is one third of this global market, almost evenly split between food/feed and nutraceutical applications.

ZIVO is already up 35% since November when the company announced the creation of a new, high-protein vegan power drink concept containing the company's proprietary algal biomass in fine powder form. This additive contains a significant amount of non-animal, non-dairy, non-GMO vegan protein and dietary fiber – a potentially healthier and safer alternative to whey.

The company has one of the more advanced IP portfolios focused on algae commercialization. Zivo and Zoetis Inc. (NYSE:ZTS), (formerly Pfizer Animal Health), the world’s largest animal health company, are jointly working on bovine mastitis research using Zivo’s proprietary algae proteins. At the end of last year, privately held animal nutrition innovator NutriQuest signed on to develop a poultry feed additive for immune health and growth promotion.

The diversity of these revenue streams is what makes Zivo, and its novel protein sources, so unique: the goal is to out-license multiple products, collecting licensing fees and royalties of 2-10% of product sales.

In the veggie smoothie drink market is expected to reach $7 billion by 2020. A market leader like the PepsiCo Naked Pressed line of smoothies generates almost $700 million in annual sales. As a potential licensed ingredient for a single, similar product line, ZIVO could expect potential annual income of $10 -50 million with little or no cost of goods and minimal operating expenses.

This strategy is successfully employed by Ligand Pharmaceuticals (NASDAQ:LGND); a $2.2 billion company that benefits from a portfolio of 14 royalty streams from small- to mid-sized drug products, for $110 million in 2016 revenue.

It’s all about having the top dollar hit the bottom line. With almost no cost of goods, Ligand expects 2016 adjusted earnings of almost $3.50 per share. That’s based on a 60% adjusted net margin!

It’s no wonder that investors sent the stock up 500%.

Evidenced by recent moves in both the animal health and consumer space, the demand for protein additives is only growing. Large beverage players have already begun tucking in beneficial beverage brands, and it’s ZIVO’s ability to out-license and create multiple revenue streams from its proprietary algae strains that makes the company so interesting.

LGND spent the last 5 years moving from four to fourteen royalty sources, and its stock has more than quadrupled along with it. ZIVO’s goal? Produce similar royalty revenue sources – and similar performance alongside.

About One Equity Stocks

One Equity Stocks is a leading provider of research on publicly traded emerging growth companies. Our team is comprised of sophisticated financial professionals that strive to find the companies and management teams that will outperform the market and deliver investment returns to our subscribers. Usually we are compensated by issuers we cover. In the case of ZIVO, we have been compensated $2,500 for investor relations services. We are not a licensed broker dealer and do not publish investment advice and remind readers that investing involves considerable risk. One Equity Stocks encourages all readers to carefully review the SEC filings of any issuers we cover and consult with an investment professional before making any investment decisions.

Contact:

Joe Ocasio

347.480.1397