PREFACE

It's the secret hidden in plain sight -- there is a way to profit in the option market in Celgene Corporation (NASDAQ:CELG) that actually takes less risk as it outperforms.

Celgene Stock Tendencies

You could make a perfectly sound argument that Celgene Corporation (NASDAQ:CELG) is the strongest large cap biotech in the world, rife with a strong pipeline and multiple blockbuster drugs already driving mega profits.

But the biotech sector in general has been burdened by potential drug pricing regulation that has held the stock prices in check. There is a strategy with options that benefits from a stock price staying relatively stable, or a the very least, not going down a lot.

Getting Smart With Options

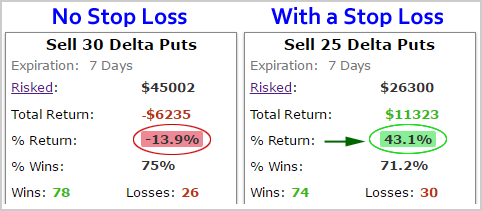

Selling an out of the put spread benefits if the stock rises, but it also profits if the stock simply doesn't drop a lot. It's "semi-bullish," but really, it's just "not very bearish." Here are the results of selling an out of the money put, every week, returned over the last 2-years in Celgene Corporation (NASDAQ:CELG).

This strategy seems like a loser, but there's a detail here that the entire market may be overlooking, which makes it ripe for the picking.

A smart approach to optimizing the reality of Celgene Corporation's stock dynamics is to let the winners run, but cut the losing puts off early. We can do this by putting in a stop loss. While a short put can lose hundreds of percent, it can only profit 100%. We can change that dynamic though:

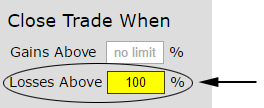

In any week, if the short put loses falls to a 100% loss, let's cut it off, and trade the next week.

We are effectively removing the vast majority of the downside risk.

We can do this with the tap of the mouse:

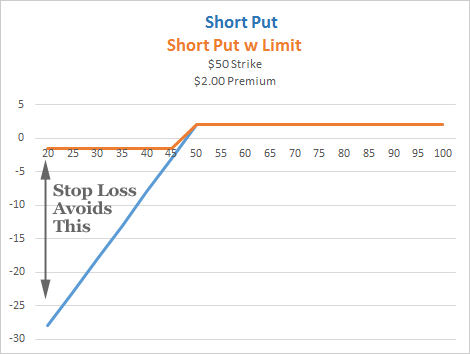

The payoff diagram for the short puts shifts radically:

The blue line is a normal short put, while the orange line is the risk adjusted version with a stop loss. We have removed the vast majority of downside risk.

And here are the results, with the risk reduced strategy on the right and the old version on the left for ease of comparison.

We can see a 55 percentage point increase in return while reducing the risk dramatically. Yes, we have vastly reduced risk and the return is actually higher. This has taken what looked like an obvious losing trade to an obvious winning trade.

IS THIS JUST LUCK?

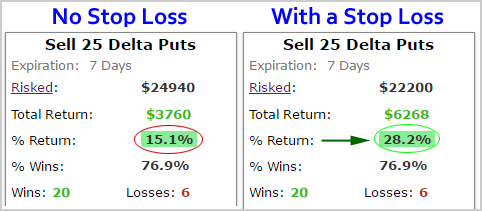

If our analysis is correct, this stop loss implementation of shorting a put should have worked better than the normal strategy of just selling and holding for the near-term as well in CELG.

It turns out that this is exactly what we find. Here are the results, side-by-side, for the last six-months:

We see nearly double the return with less than half the risk. We are focusing on the systematic adjustment to the strategy that took less risk and created more wealth.

What Just Happened

The key to option trading is quite simple -- understanding the dynamics of the stock you're looking at allows you to adjust the option strategy to reflect those dynamics.

This could have been any company -- like Apple or Amazon, or any ETF and any option strategy. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, whether that's a stop loss or avoiding earnings, or both. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author is long shares of Celgene Corporation ( NASDAQ:CELG) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.