Wells Fargo upgraded McDonald’s largely based on the mobile-order-and-pay rollout coming this year

As more and more companies realize the power of FinTech and put Mobile Payments into action, more and more customers shift to mobile-order-and-pay platforms, McDonald’s Corp. is expected to reap rewards when it rolls out the system across its 14,000 U.S. restaurants in the fourth quarter, according to Wells Fargo.

Analysts upgraded McDonald’s (MCD), shares to outperform from market perform in a Monday note, and raised the fast-food giant’s valuation range to $145 to $150 from $125 to $130. McDonald’s shares closed up 0.45% in Monday’s trading session.

READ: Could The Mobile Payment Space Be The Next Sector To Invest In?

“Restaurant consumers are aggressively gravitating toward concepts that offer the greatest level of convenience and control across ordering, payment and distribution,” Wells Fargo wrote. “Among the hamburger players, we believe that McDonald’s is establishing a first-mover advantage with digital that can drive sustainable share gains in late 2017 and beyond.”

McDonald’s had previously announced mobile order and pay as a part of their vision for the “experience of the future,” which will also includes table service, curbside check-in, and many other features. Wells Fargo says Wendy’s Co. (WEN), is slated for similar services, with at least half of their system expected to offer it by the end of this year. Burger King, a Restaurant Brands International Inc. (QSR), chain, and Jack in the Box Inc. (JACK), are also testing the service, analysts said.

McDonald’s upgrade from is also based on the expected second-quarter close of McDonald’s deal in China, after which Wells Fargo expects a “sizeable” margin and return on invested capital expansion inflection point. McDonald’s announced in January that it is selling an 80% stake in its Chinese operations to a group that includes Citic Ltd. and private-equity firm Carlyle Group LP (CG).

Outside of burger chains, mobile order and pay is proving successful at Starbucks Corp. (SBUX), so successful that the number of orders flooding in is causing pick-up congestion at cafes. Starbucks is testing mobile order-only stores as one solution.

See Also: The Co-Founder Of PayByPhone Is At It Again

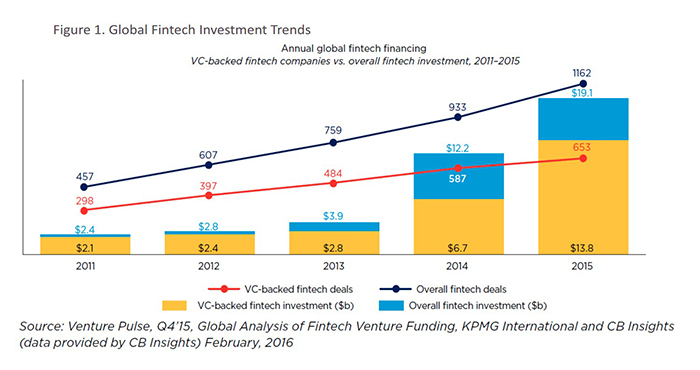

According to KPMG, global investments in fintech has been growing at 51.4% CAGR, from US$100 million in 2008 to $19 billion in 2015, making it the fastest growing sector in Information Technology (IT)

Fast-casual chain Panera Bread Co. (PNRA), is also invested heavily in tech upgrades, with digital sales making up 24% of all sales at company-owned restaurants, according to its most recent earnings report.

According to UBS’ new Burger Competition Monitor, competition among burger chains is high, not just in the quick-service space, but with fast-casual as well

It’s companies like Glance Technologies, Inc. that are even more ahead of the curve than the likes of McDonalds or Burger King in our opinion. At the forefront of everything that is going on here in the Mobile Payment space, Glance Technologies, Inc. is looking to surpass its competition by taking a little piece from everyone. “It’s not just another option for customers, it’s an actual delivery method”.

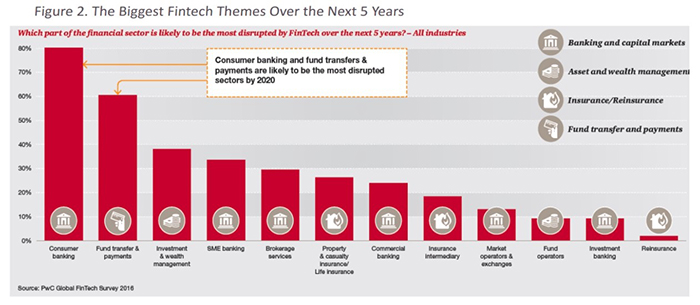

Glance Technologies, Inc. (OTCQB: GLNNF) falls into the highest growth category of all FinTech companies. Over the next 5 years, customer-centric banking and cashless fund transfer & payment represent the biggest investment themes in fintech. In accordance to the biggest top-down investment themes, we will take a close look at an exciting fintech company that offering customer-centric, cashless mobile payment experience in dining, Glance Technologies Inc. (OTCQB: GLNNF)

“For every traditional burger concept there are 16 other traditional units within a 10-minute driving time,” UBS wrote in the April 11 report. Fast-casual, or “better burger” chains, like Shake Shack Inc. (SHAK), however are under-penetrated, and pose a threat to McDonald’s.

“As smaller, fast casual chains continue to generate outsized burger segment growth, they are exerting more pressure on McDonald’s restaurants, and their contribution to competitive intensity continues to grow,” the report said.

These chains might appeal to a different diner, and their footprint doesn’t compare to McDonald’s. “But continued new opens in the same markets highlight increased market penetration in the burger segment,” UBS said.

In addition to digital upgrades, McDonald’s has been focused on changes to the menu, introducing fresh beef in its Quarter Pounder sandwiches, for instance, and testing flavors like sriracha.

UBS rates McDonald’s shares neutral with a $130 price target.

McDonald’s shares are up 8% for the year so far, while the Dow Jones Industrial Average (DJIA), is up 4.5% for the same period.

Source: Westbrook Radio

Nothing in this report should be considered personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. westbrookradio. com is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been compensated twenty-four thousand five hundred dollars from Glance Technologies for GLNNF advertising and promotion. The owner/operator of MIQ has purchased seventeen thousand shares of GLNNF in the open market with no intentions of selling these shares in the next 72 hours There may be other 3rd parties who may have shares in GLNNF, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this newsletter as the basis for any investment decision.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.