There's nothing like raging magma to form the foundation of a multi-billion-dollar business.

When the ashes settled around this millionaire making massive volcano in Argentina thousands of years ago, after expelling its fiery magma, it left behind a vast salt flat that would eventually become a miner's glory and an investor's dream.

This is where Mother Nature pays us back... with an abundance of a metal that is in short supply and will define our energy future—if we can get enough of it.

The metal is lithium.

And the Argentine volcano, one of nature's wonderful gifts, represents the best risk/reward play on lithium we've seen to date.

The best part of this story is that we've already seen it happen once—on the north side of this volcano. Now we're heading to the south side, where Southern Lithium (TSX: SNL.V) is ready to do it all again.

Millionaires are made on risk/reward ratios, and this is potentially the most lucrative lithium punt of the year.

North of the Volcano: Billion-Dollar Lithium Bonanza

On the north side of this volcano, ADY Resources (part of the Enirgi Group) has already proven the massive lithium offerings left behind by Mother Nature, volcanic eruptions and spewing magma over the millennia.

ADY's Salar del Rincon property now boasts exulted status as the ONLY producing lithium operation in Argentina's prized Salta Province.

And it proved everything up when lithium prices were dirt cheap, so investors were hugely rewarded.

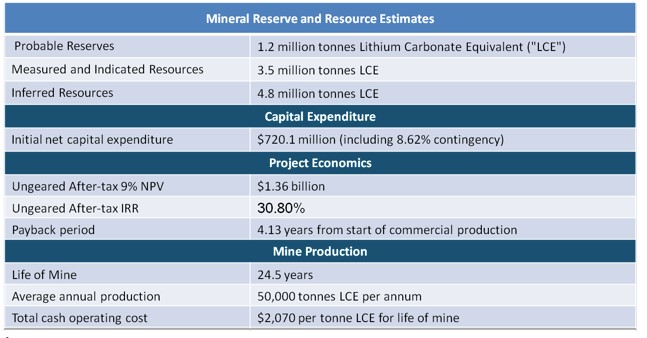

This is what happens when a company parks itself on the side of a massive volcano and then proves up probable reserves of lithium worth over $5 billion.

And it's an even more dramatic bonanza for investors when they discover these resources at a time when lithium is cheap and then watch prices quadruple over the past two years.

Anyone who jumped on that boat before the lithium price surge would be a multi-millionaires today.

After ADY proved up its resources, Chinese lithium spot prices jumped from $7,000 per ton in September 2015 to a high of $20,000 per ton in early 2017, this volcano wasn't spewing out magma anymore; it was spewing out millionaires.

This is what they're sitting on:

Welcome to the South Side of the Volcano

The ADY story is astounding. But that ship has sailed.

What we're interested in now is the other side of the volcano, and a little-known company that is preparing to repeat what ADY has achieved.

The company is Southern Lithium (TSX: SNL.V), and it's already drilling its Cruz property on the south side of the volcano.

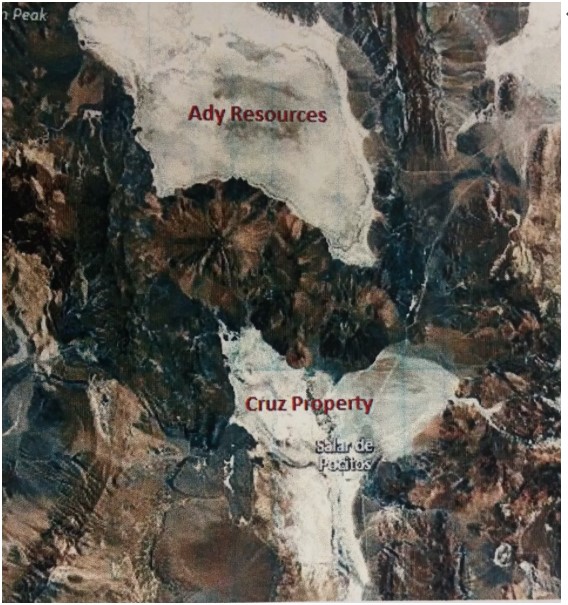

Southern Lithium's Cruz property in the Pocitos Salar basin in Argentina's Salta Province—grand central station for global lithium—encompasses a massive 22,000+ acres. And it's in the same basin and only 11 kilometers to the south of the already proven reserves of ADY Resources' Salar del Rincon property. This is the only lithium operation in Salta Province.

Argentina's salt flats are mesmerizing... along with the potential profits.

And Southern Lithium is not only already drilling, but it's got the cash to prove this up to the end.

The billion-dollar question is, will they prove it up?

Mother Nature says 'yes'. It's the same volcano area that ADY has explored, and it's only 11 kilometers away from ADY's producing play.

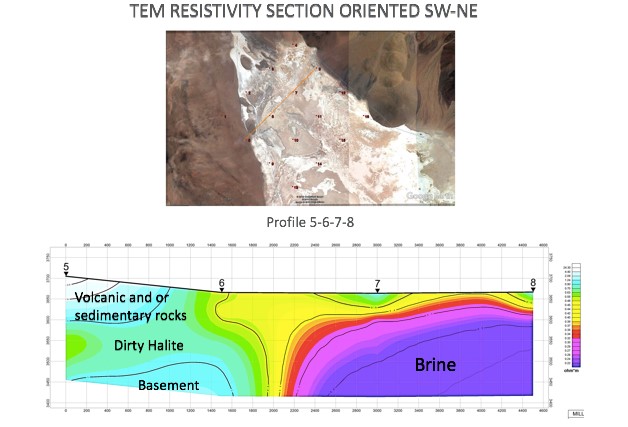

Even better: Geomagnetic work to date indicates the exact same type of geology as ADY's project, and right now, Southern Lithium (TSX: SNL.V) is drilling three holes to prove it all up.

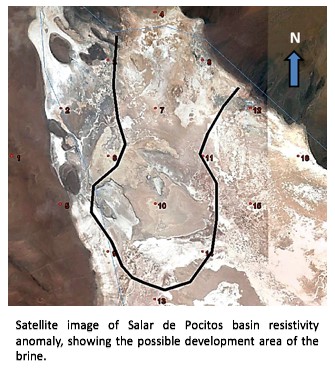

In February, a ground geophysical survey located bodies of subsurface brine over 6 kilometers long and from 30 to 250 meters deep—geological measures that typically have indicated a high content of lithium brine on other Salar basins in the area.

Once they prove this up, it's already too late to get in for the highest risk/reward ratio. And this company moves fast.

They got their permit to drill on the 4th of July, and they launched first-phase drilling just 7 days later.

Down on the ground, with the roads in place, Southern Lithium has already found indications that their side of the volcano could be exactly like ADY's side.

So at this point, it seems to be more a question of not if, but how much lithium they will find.

We expect the news flow to be fast and hot on this one, and once the resource is proven up—then it's going to be the most volcanic play to ever hit this sector.

And keep this in mind, too: Not only is Southern Lithium sitting on the right side of the mother of all lithium volcano... it's also right in the middle of the 'Lithium Triangle' of Argentina, Bolivia and Chile—home to more than half of all known lithium resources on Earth.

Some one-third of all lithium produced comes from Argentina. Think infrastructure in place, political stability and massive brine-based potential. It's made Argentina the darling of the lithium boom for brilliant new entrants like Lithium-X and Millennial—all targeting the Salta Province.

Not a One-Trick Lithium Pony

Southern Lithium (TSX: SNL.V) isn't betting everything on the volcano—regardless of how massive that eruption could be.

Not only are they in the heartland of South American lithium, but they are also positioned right at ground zero of the North American lithium boom.

Several lithium millionaires are in the process of being minted in Nevada alone—even without the biggest volcano in the world, and even without the 'Lithium Triangle'.

Welcome to Clayton Valley, Nevada, the lithium land rush that's right in Tesla's back yard.

The United States Geological Survey (USGS) calls Clayton Valley the best-known lithium deposit in the world, with the only producing lithium mine in all of North America.

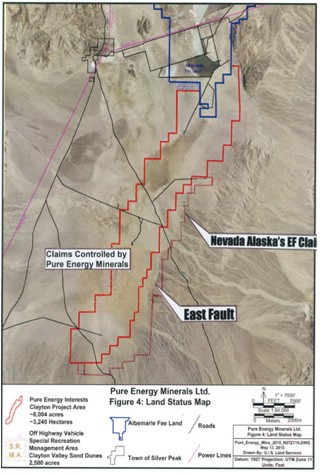

In Clayton Valley, Southern Lithium is right next to Pure Energy, the pioneer of the great Nevada lithium rush.

It's also right next to Albermarle Corp. (NYSE:ALB) lithium mine—the only lithium producing mine in North America.

Southern Lithium's 2,100-acre East Fault project is just on the eastern border of Pure Energy's Clayton Valley claims, and just south of Albermarle's.

Lithium Extractions

We're already on the edge of lithium extractions. Demand is set to outpace supply already this year. And the future holds massive demand that cannot be met without new discoveries and rapid development and production.

Yes, there's new supply coming online, but it's not going to keep pace easily.

According to the most sought-after lithium industry consultant in the world, Joe Lowry, even with the recent wave of new project announcements, a supply shortage can still cause significant issues in the battery supply chain by 2023.

Elon Musk alone is planning on using the entire world's supply of lithium for his $5-billion battery factory in Nevada, which started producing in January.

The top four companies that hold (for now) the oligopoly on lithium supplies can't keep up. Even Albemarle's CEO, Luke Kissam, told investors last year that "from a lithium standpoint, we are pretty much sold out."

The catalysts keep coming, and they are dramatic.

- Tesla opened the doors on its battery giga-factory in January, and expects to be producing so much by next year that it will double the world's battery production single-handedly. And it started producing its Model 3 on 7 July.

- German BMZ has launched the first phase of its German battery factory, and LG Chem is planning one in Poland, which is slated to open next year. Samsung also hopes to start making batteries in Hungary beginning in 2018.

- Mass production of Tesla's Model 3 electric sedan promises to push lithium supply to its bursting point.

- Massive energy storage systems with a voracious appetite for lithium-ion batteries also threaten the supply picture, to the delight of miners.

- Volvo just announced that it will only have electric and hybrid cars by 2025.

This is one metal for which demand is not only visible, it's palpable.

- According to Macquarie Bank (ASX:MQG), the share of lithium demand from electric and hybrid vehicles alone is due to surge from 10 percent in 2015 to 33 percent by 2021.

- Battery manufacturing capacity will triple in the next four years, according to Bloomberg.

- 'Mr. Lithium', Joe Lowry says demand should double between now and 2020, driven by the massive battery market, producers are in no position to keep up with this in the medium or long term.

- Volkswagen says the situation is desperate, and the industry needs 40 gigafactories. The auto giant foresees a huge shortage of batteries by 2025.

Bottom Line?

The ability to extract lucrative lithium from brine is a major coup—and a major opportunity for first-in investors. But the biggest money to be made here is in new discoveries. So, when a small-cap is sitting on the right side of a major volcano of lithium and is gunning full throttle to prove up resources, the risk-reward ratio is high, but also mouthwatering.

Southern Lithium (TSX: SNL.V) could represent the best risk/reward scenario on the lithium scene today.

Once it proves up resources on the untapped side of this Argentine volcano, it will already be too late to take advantage of this scenario. Drilling has already begun, and indications are already there that this play is geologically similar to ADY's.

The company is cashed up, and there's no stopping it now. In numbers, this could end up being a $7-million-market-cap beginning that ends with a $250-$500-million market cap. For investors, it's the chance to make significant gains, if they prove it up.

But what really sweetens this deal is that not only is Southern Lithium (TSX: SNL.V) staked out right next to the only producing lithium play in Argentina's Salta Province, but it's also staked out right next to the only lithium producer in all of North America.

That's prime position on two continents. And this is prime time to watch a volcano erupt again, in a very different and potentially lucrative way.

Honorable Mentions:

Sherritt International Corp. (TSX:S): Sherritt's, one of Canada's biggest Nickel and Cobalt miners is set to profit from the current battery boom. Its two top resources, Nickel and Cobalt are in strong demand by the electric car industry and Sherritt is one of the top players in this sector.

Neo Lithium Corp.(TSXV:NLC): A new player having entered the scene in 2016. Operates the 3Q Lithium brine project, famous for having very low impurities. Production still some way off though.

Orocobre Limited (TSX:ORL): Australian-based pure-play Lithium miner enjoying first-mover advantage in the Salar de Olaroz project in Argentina.

Millennial Lithium Corp. (TSXV:ML): is an emerging exploration and development company, operating in Argentina. Millenial's flagship project is the Pastos Grandes mine in the Salta province which experts consider an 'advanced' project which can be put into production within the next 3 years.

Lithium X Energy Corp. (TSXV: LIX): Lithium X Energy Corp. is a lithium exploration company with the goal of becoming a low-cost supplier for the fast-growing lithium battery industry. Lithium X holds properties in Salta, Argentina and Nevada, close to the Tesla gigafactory.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.