In February 2010, Heartware (NASDAQ: HTWR) completed enrollment of a pivotal study that would support FDA approval for a subset of a subset of late-stage heart failure patients. 12 months earlier, Thoratec (NASDAQ: THOR) offered to pay $282 Million to acquire Heartware1.

Last week, the FDA approved an interim analysis for Sunshine Heart’s (NASDAQ: SSH) own pivotal study for late-stage heart failure2. Sunshine Heart’s investigational device, ‘C-Pulse’, if approved, would address a market 10-20X the size of the one shared by Heartware, Thoratec, and others. The interim analysis suggests Sunshine Heart could complete enrollment needed to support FDA approval in as little as 12 months. Sunshine Heart is currently valued at just $100M. Heartware sports a market cap upwards of $1.45 Billion.

Thoratec’s eagerness to acquire Heartware in 2009 was not in haste; by the Company’s own admission3 the less-invasive ventricular assist device (VAD) Heartware introduced to market has eroded their share [the acquisition was blocked in July 2009 by the FTC to ensure the market for VADs remained competitive].

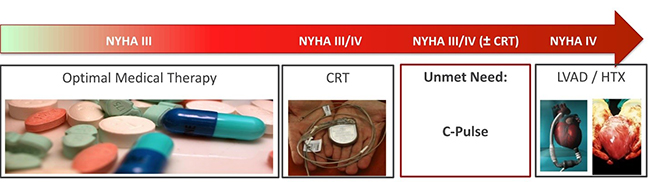

If C-Pulse is successful in halting or reversing heart failure, and is successfully commercialized, this will further marginalize the Class IV-B segment that Heartware and Thoratec aim and/or currently address. This is because C-Pulse would address heart failure upstream of patients progressing to end-stage Class IV heart failure and requiring a VAD (Figure 1, below). Consequently, there is precedent for an acquisition of Sunshine Heart above and beyond the price tag Heartware fetched in 2010.

FIGURE 1 – Heart Failure, A Progressive Disease

Source: Sunshine Heart

The interim analysis approval should mark a return of investors sidelined by a long and unpredictable enrollment period for Sunshine Heart’s pivotal study. That timeline might now stand at just 12 months and coincide with data from a European study being conducted to support commercialization in the EU, where C-Pulse has already gained regulatory approval.

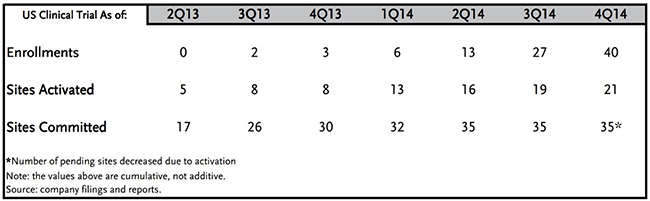

Enrollment in Sunshine Heart’s US pivotal study has always been a function of the number of sites actively screening patients (Figure 2, below), even as management has dealt with typical woes such as reimbursement. The Company has guided that its target remains enrolling 0.5 patients per month per activated trial site. Even at 30 sites (the FDA has approved 35 for this study), this would amount to 45 patients per quarter. This has been roughly in line with actual enrollment figures in the last few quarters.

FIGURE 2 – Sunshine Heart Pivotal U.S. Study Enrollment

Source: Piper Jaffray

As of year-end 2014, Sunshine Heart has enrolled 40 patients in their pivotal study4. We remind readers that the FDA approving an interim analysis means that the Company would reach the finish line at 194. If the company were to enroll an average of 30 patients per quarter over the next 5 quarters, we would reach enrollment required for an interim analysis in Q1 2016. It seems reasonable that enrollment should scale to 20+ patients in Q1 2015, with 21 sites activated. We compute this by 0.5 patients per month * 21 sites * 3 months = 31.5 for the quarter. With additional sites, the Company should comfortably reach 30+ enrollments per quarter, quelling critics who point to slow enrollment in 1H 2014.

Catalyst Looming This Week

Sunshine Heart presents at the Cowen Healthcare Conference on Wednesday March 4 and reports earnings in roughly two weeks. The Company is expected to update investors on enrollment since the start of calendar 2015, which could mark the 3rd consecutive quarter of better-than-expected results. Another reason to think along these lines is that part of the $10 Million loan Sunshine Heart secured on February 18 requires enrollment to be at 100 patients no later than Q3 of this year5.

C-Pulse offers a minimally-invasive device for Class III heart failure, upstream of where Thoratec and Heartware sell their VADs. Thoratec desperately wants in – it screened 2800 patients – and enrolled just 1 in an investigation study. Study recruitment was recently halted6, according to clinicaltrials.gov. Both VAD makers are facing headwinds with the adverse events caused by their devices. Blood clotting, stroke and bleeding events are common, and perhaps acceptable for end-stage heart failure patients, but not the much larger Class III population that Sunshine Heart’s device will potentially address. C-Pulse, by comparison, did not see any of these adverse events in their feasibility study. The only device-related adverse event, lead-site infection, may also soon be a non-factor as Sunshine Heart introduces a fully-implantable version of C-Pulse.

C-Pulse Could Be Hugely Accretive To Potential Acquirer

Even after several years on the market, VADs continue to hold just a few percent of the addressable stage IV heart failure market, a function of the concern of the safety of these devices among patients and physicians. Even if C-Pulse acceptance were 3% of the 1.5M Class III patients in the U.S., it would dwarf the 3% share of the estimated 50,000-100,000 Class IV patients Thoratec holds. To an acquirer, a commercial-ready C-Pulse device would yield several billion at that penetration rate per annum, in the United States alone. On a per share basis, that would be worth upwards of $150 for Sunshine Heart’s shareholders or more than 22x what the market currently values the company at.

C-Pulse would be an accretive and complimentary addition to product portfolios at Abiomed (NASDAQ: ABMD), St. Jude’s (NYSE: STJ), Boston Scientific (NYSE: BSX) and virtually any device company that is seeking a novel product for an untapped, distressed and growing patient population. Importantly, the right company could easily capture considerably more than 3% of the market, in particular if the safety profile of the minimally invasive C-Pulse remains in line with what Sunshine Heart has already demonstrated.

Investors should also look for updates from the Company on a timeline and pathway for regulatory approval of the fully-implantable C-Pulse and an enrollment update in the European OPTIONS HF study as well as reimbursement in the EU.

Even if investors sit stubbornly on the sidelines, an acquirer might not. If Sunshine Heart confirms our suspicions in the next 2 weeks that an interim analysis could occur 1H 2016, this would put the Company on approximately the same trajectory today where Heartware was in 2010 – which is when Thoratec offered $282M to buy them.

References

1) Thoratec to acquire Heartware Feb 13 2009

2) Sunshine Heart Receives FDA Interim Analysis Approval

3) Thoratec 2014 Annual Report

4) Corporate Update Jan 12 2015

5) $10M Loan from Silicon Valley Bank

6) Thoratec REVIVE-IT Study Halted

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC. An affiliate of One Equity Research, LLC holds an ownership interest in Sunshine Heart. The affiliate does not intend to sell any part of their ownership interest in the current fiscal quarter. One Equity Research, LLC may engage the Company in a research coverage agreement in the future. This research note is not an offer or solicitation to buy or sell the securities of Sunshine Heart. The report is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation.