This should be good.

Enterprise Group has experienced almost four years of share price consolidation, following the vicious 2014 resource sector decline. The Company is now stronger and leaner than pre-2014, and management’s aggressive initiatives have seen the stock price rise to new 52-week highs. The Company remained cashflow positive throughout and profitable Q3, Q4 2015 and Q1 2018.

June 2013-May 2018 Enterprise Group (E: TSX)

Background Facts:

- Book Value $1.01

- Current share price $0.55

- No debt

- NCIB of 5% of E stock ongoing.

- $40 million in bank lines available for funding acquisitions

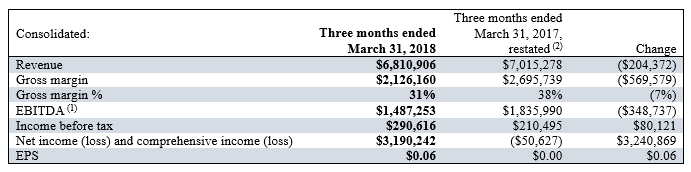

- Q1 2018 eps $0.06 vs. Q1 2017 eps ($0.02)

- Net income Q1 2018 $3.2 million versus Q1 2017 ($50,627)

- Q1 2018 Revenues down 3% from Q1 2017

- Development of proprietary ‘Star’ inventory tracking software system will cut costs and significantly enhance revenues.

One-quarter of profits can be a fluke; two, lucky but three a reasonable trend. For Enterprise, it is the result of planning and execution. From the depths of the resource malaise, the shares are now debt free, cash flow positive and profitable. Not to mention on the acquisition trail with $55 million of cash.

Management has positioned the Company to be the premier resource for industrial equipment rental; initially in the West, ultimately North America and possibly further afield.

Just as the shares received an unfair shellacking as the oil price fell, there seems to be a renaissance afoot that sees oil, currently $70 plus, hitting $100 by 2019. Not that would drive the shares back to their all-time high of $3.50 in 2014, but one has to figure there is excellent potential to regain a good chunk of that decline should oil, and the sector continues to improve.

Given the initiatives put in place and arguably to come, the price may also benefit from proper, old fashion management.

Yes, management is still a thing.

Revenues Down 3%? Should investors Care?

“In the first quarter of 2018 no construction work was completed on a major construction project in Northeastern B.C,” states Desmond O’Kell, SVP of Enterprise. “Otherwise the Company continues to see increased activity. The increased activity experienced by other customers did not fully offset the loss of revenue earned in the first quarter of 2017 associated with that project resulting in a slight decrease in revenues for the quarter. At March 31, 2018, after adjusting for goodwill and deferred taxes, the Company has assets more than total debt of approximately $54,000,000. Enterprise will continue to look for and secure opportunities that improve its financial position and opportunities that will allow the Company to diversify and expand.”

Management owns 21 percent of the outstanding shares.

StarChain

While maximizing revenues and reducing costs is often espoused by the management of most companies, Enterprise has developed StarChain technology, proprietary software, and attendant hardware. Modules will be attached to each piece of rental equipment.

Simply put, Star technology enables its customers to automate and schedule the utilization of the equipment which delivering several benefits that include reduced fuel expenses, lowering onsite maintenance costs and real-time reporting. Several features will be available to the customer in Q3, Q4 2018.

The Company has a history of developing solutions for its customer and has fifteen plus patents in its IP portfolio.

One of the initial cost savings is several thousand dollars a month the technology gains by rendering individual GPS.

ther benefits are utilizing the SaaS tech as a base platform for future applications, improves margins and of course maximizes revenues.

Not to mention the incredible competitive advantage afforded Enterprise as it has no plans to sell or license StarChain at this juncture. There appears to be no competitive software.

So, What Now?

As business continues to build, Enterprise has been able to raise its pricing in line with demand. One of the first things it did when the sector imploded was to reduce costs to remain competitive. It also became a resource to customers and prospects to ensure not just its viability but that of its customers. That practice has served the Company well as the business builds.

Enterprise also recently sold its infrastructure subsidiary Calgary Tunneling (CTHA), to focus on the industrial rental business that brings its subsidiaries’ strength to the fore and provides a stable base for growth. The last four years meet as the culmination of two cycles. First, it heralds that the Company is ready and capable of exceptional growth as it enters this new phase with a clean balance sheet. Second, it proves that the planning, execution as well as pain and suffering since June 2014 has been constructive.

There are many acquisition targets currently being evaluated by the Company. Each will be acquired with not only growth in mind but immediately accretive and strongly complement its existing subsidiaries.

YTD 2018 Enterprise Group (E: TSX)

Disclaimer: Nothing in this article should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is not an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Individuals are strongly encouraged to not use this article as the basis for any investment decision. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in this article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.