The billion-dollar beverage giants have set their eyes on an entirely new industry, an industry that they fear will soon swallow them up if they don’t get ahead of it.

So, if you think you missed the cannabis boom…. Now may be the time for you to get in.

In a matter of days, Canada will legalize recreational marijuana—and it will be the staging ground for other parts of the world.

The highest estimates have global legal cannabis sales reaching nearly $146 billion by 2025. With recreational pot in Canada, the legal recreational sales bonanza is beginning.

As the hype around this up and coming sector grows, the beverage industry is now scrambling to get on board with a string of mega-deals. Cannabis has finally won over the grizzliest of bears and the most skeptical short-sellers, and it is all looking up from here.

Three deals in particular are creating the perfect environment for investors.

And with that in mind, here are 5 stocks that cover pretty much anyone’s investment strategy, whether you want to try to make big bucks on this rampage, or play it safe with a fundamentally strong beverage company that’s getting in on this game …

#1 Coca-Cola (NYSE:KO)

Coke just validated cannabis.

If even Coca-Cola thinks the cannabis market has “incredible potential”—then it does. While Coke’s September 18th announcement that it was “closely watching” the cannabis market and considering marijuana-infused wellness drinks doesn’t compare to the $4 billion another beverage-maker pumped into a grower, it is still a very big deal. More than any other big beverage company scrambling to get into cannabis right now, Coke lends credibility and legitimacy. This was a major, carbonated nod.

If Coke moves forward with this, it would likely consider CBD—a non-psychoactive component in marijuana for an infused drink that could ease symptoms of inflammation, pain and nausea.

For Canada’s Aurora Cannabis (OTCMKTS: ACBFF), it was yet another nice boost, because rumor has it that Coca-Cola is in talks with this company.

And it’s lost on no-one that if Coke starts dabbling in pot, it will be an easier ride—plus, they’ve got the entire Canadian market to experiment on, with recreational legalization just days away. Canada would be the staging ground for the rest of North America.

Wells Fargo is convinced. Its analysts see Coke positioning itself for the long-term here. It also estimates that cannabis-infused drinks are going to be a massive market. They’re eyeing $50 billion in sales annually in the U.S. That would give cannabis-infused drinks nearly half of the entire U.S. beer market sales annually.

This is a great time to get in on Coke—before any official decision is made. When you consider the potential size of this market, Coke’s brand new direction could get a major pot bump. It will also have a domino effect: Watch other non-alcoholic beverage makers follow Coke down this path.

#2 Scythian Biosciences (CSE:SCYB, OTCMKTS:SCCYF)

The playbook is simple: Scythian Biosciences identifies, acquires and flips key businesses - netting a huge profit along the way.

It just cut the best cannabis arbitrage deal in history, and somehow it is still under the radar—but not for long.

Scythian Biosciences, a little-known cannabis incubator, just closed a deal with Aphria, one of the few cannabis majors in the world.

Aphria gave Scythian 15.7 million shares of stock to incubate cannabis assets, right before the first pot rampage exploded. That’s a 6.3 percent share in arguably the strongest cannabis producer in the world—and it also makes Scythian the largest single Aphria shareholder.

When the deal was agreed upon, those shares were trading at CAD $12, worth $193 million.

At the time the deal was closed, Aphria shares were trading at CAD $17.78, making Scythian’s position worth over CAD $278 million.

That’s a massive payoff, all in a day’s work. And that’s what Scythian is brilliant at—it’s a world class incubator and this is its third win-win deal in a row.

Forbes is all over it, and everyone else will be soon. Forbes is right, too. From a ground-floor investment perspective, this isn’t just a big deal—it’s possibly the most mouth-watering arbitrage event in this rapidly transforming sector.

Right now, the market is paying attention to Aphria because the deal gave it “access to world-class assets” in the “most advanced regulatory jurisdictions across LATAM and Caribbean markets”, according to Forbes. It gave them first-mover advantage in Argentina. It gave them market leadership in Jamaica, and gave them Colombia—the prime agro setting with export channels to the rest of Latin America.

And while the market is busy looking at Aphria, Scythian —a very smart and sophisticated incubator of cannabis assets—is stuffing its war chest full of Aphria shares soon convertible to cash.

The market is starting to find out that the incubator is where it’s at. And when they do, more good things could happen.

This deal should put little-known Scythian Biosciences on the cannabis map—in a very dramatic way. It may be the best kept secret in the cannabis sector.

But there’s another big potential catalyst coming, too—in a matter of days or weeks, Scythian is looking to acquire an exclusive medical cannabis license in Florida.

Ahead of that licensing, Scythian took a controlling interest in 3 Boys Farms LLC—an established Florida medical cannabis company and primary care medical organization.

The U.S. legal cannabis market size was estimated at over $7 billion in 2016. And it’s expected to grow at a CAGR of 24.9 percent from 2017 to 2025.

North Americans spent $53 billion on marijuana (most of it illegal) in 2016, according to ArcView Market Research. When the U.S. side of the legal market opens up, Scythian will be there too.

These are floodgates, and they could unleash serious market attention for Scythian Biosciences —which has a valuation more than 70 percent higher just on the Aphria deal.

What most people don't understand about this market is that incubator funding isn't coming from Silicon Valley …

or Wall Street...

It’s coming from publicly traded companies acting as incubators, like Scythian Biosciences.

Scythian looks for the huge upside potential of these early stage investments...

But, because this space is so new, many investors don’t yet understand the profit potential of this new breed of company...And that's opened up a huge opportunity for investors that do.

Scythian is a credible international incubator. It’s also the world's first global cannabis incubator, and they've already made some game-changing deals.

#3 Diageo Plc (NYSE:DEO)

Diageo was the third major alcoholic beverage company to focus on pot. It’s the maker of Guinness beer, Smirnoff vodka and Johnny Walker, and it’s already been in talks with at least three Canadian marijuana growers. It wants a piece of the action quite desperately. Now the speculation is about which grower it’s going to choose, so everyone’s watching those stocks as well.

The speculation so far centers on Aphria (again), Tilray (NASDAQ:TLRY) and Aurora Cannabis (NASDAQOTH:ACBFF).

Aphria seems to have the advantage because it’s market cap is lower than that other two—considerably. Aphria’s market cap is around $2.7 billion, while Tilray’s is about $14.4 billion and Aurora’s is over $8 billion. It also offers a better price per kilo of capacity than its peers. Perhaps more suggestive still, Aphria already has ties to Diageo through a former Diageo exec who now serves as Aphria’s chief commercial officer.

For the UK beverages giant, getting into cannabis seems to be a must.

The Trefis price estimate for Diageo in the last week of August was $157—that’s about a $20 upside from the current price of $138.50.

And Trefis’ price estimate is based on this positive outlook:

#4 Canopy Growth (NYSE:CGC)

Canopy Growth has been the biggest cannabis stock on the market for some time, though in terms of market cap, it was just overtaken by Tilray, which has seen an 800 percent gain since its July IPO.

General market rampage aside, the biggest new catalyst here is the approval Canopy just won for its remaining greenhouse space at Tweed Farms, which expands its licensed footprint to around 3.2 million square feet.

For growers right now, it’s all about expanding capacity. Canopy’s Canadian platform is now 57 percent licenses “with the balance under aggressive development towards the previously announced 5.6l million sq. ft. target production footprint”, the company said in a statement on September 17th. They need this much capacity in order to meet expected demand come October 17th, when Canada fully legalizes recreational pot.

All in all, Canopy’s stock has gained 98.5 percent this year.

Canopy Growth (NYSE: CGC) PT is being raised at Garnier to CAD$95.00 (from CAD$51.00).

But that’s not the only catalyst—it’s just the newest. Beverage giant Constellation Brands, Inc. (see below) announced recently that it will inject some $11 billion into Canopy over the next three years. That’s got investors drooling over the expansion prospects. And in August, Constellation pumped $4 billion into Canopy, raising its shares to 38 percent from 9.9 percent.

All this activity has even earned Canopy the moniker, “the Google of pot”.

Which brings us to #5 …

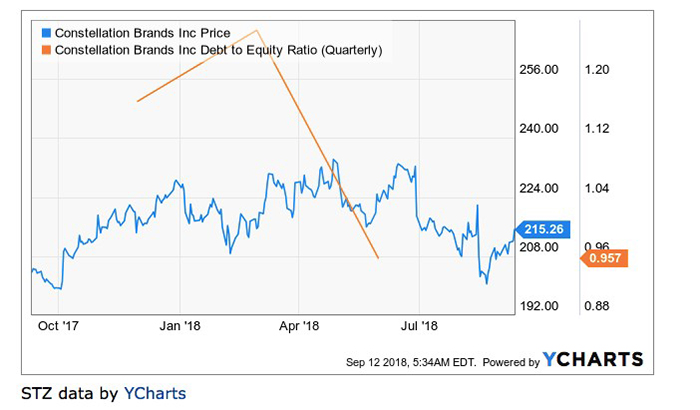

#5 Constellation Brands, Inc. (NYSE:STZ)

Constellation Brands, the maker of Corona beer, upped the ante in the cannabis sector by betting big on Canopy. Stock is up over 9.4 percent for the past month since the announcement of the deal.

Some analysts will argue that if you want to make money on Canopy, you should buy into Constellation as the less risky play in an emerging industry. After all, this gives you an in when pot is legalized, and if anything goes wrong, well, you’ve still got stock in a really solid beverage company. This is for the risk-averse investor who isn’t looking to make big money on cannabis—just a bit of a bump.

And, indeed, the fundamentals for Constellation look pretty good.

The 12-month potential price target for Constellation Brands, Inc. is set at $247.53—a target price that suggests an upside potential to increase by 14.6 percent from the current price.

Other companies making waves in the cannabis sector:

Village Farms International (TSX:VFF) is a broad agriculture company that specializes in greenhouse cultivation of various products, from tomatoes to cucumbers and peppers. It is also one of the first greenhouse growers to join the U.S. Hemp Roundtable.

In Village Farms’ move to diversify, it is looking at hemp as a possible sustainable alternative for many other products. Stephen C. Ruffini , CFO of the company noted, "Village Farms has been at the leading edge of new agricultural opportunities that can more profitably leverage our decades of experience as a vertically integrated greenhouse grower coupled with the scale and excellence of our North America greenhouse operations.”

iAnthus Capital Holdings (CSE:IAN) is a U.S. based cannabis company listed in Canada. The company has recently taken an interest in cannabis-based businesses in four U.S. states. This interest saw its stock price jump at the end of 2017 from below $2 up to its current price of over $5. It recently completed its acquisition of Pilgrim Rock Management, LLC, a management and services company that provides intellectual property licensing, professional and management services, real estate and equipment leasing, and certain other services to Mayflower Medicinals, Inc.

In iAnthus’ recent earnings report, the company highlighted significant growth in its Florida-based GrowHealthy branch and it’s Massachusetts-based Mayflower Medicinals branch.

Cronos Group Inc (CSE:MJN) is another Toronto-based cannabis company with a lot of ambition. The company has prioritized its production acquisitions in order to provide geographically diverse products. Loaded with values, this company is comprised of passionate and focused employees.

One of the primary objectives of Cronos Group is to destigmatize the medical use of marijuana and bring medicine to those who need it. Cronos Group has made it their priority to lead as an example for the industry and provide the best care possible to the community.

Since it’s February listing on the NasdaqGM exchange, Cronos has seen its share prices nearly double, and its moves in the medical field, including September’s insomnia study with Aleafia have secured its upward momentum.

Harvest One Cannabis (TSX.V:HVT): Harvest One Cannabis Inc, formerly Harvest One Capital Inc, is a Canadian company focused on servicing both recreational and medicinal markets.

Harvest One recently raised $25 million in equity financing and $9 million will be used to finance Phase 1 production capacity expansion at United Greeneries’ Duncan Facility.

Harvest One has seen its share price increase in September and we think the company is well-positioned to take advantage of Canada’s looming legalization of recreational marijuana.

Namaste Technologies (TSX.V:N) is an international e-commerce cannabis company operating in 20 countries. Currently, the company’s primary market is in Canada, though as laws evolve around the world, Namaste is well positioned for expansion.

Recently, Namaste received Canada’s first-ever “sales-only” license for medical cannabis distribution. The license represents a huge milestone for the company.

Sean Dollinger, President and CEO noted: "Today marks a monumental achievement for the entire Namaste team and our shareholders. Receiving our Sales License not only validates the vision which we set forth to achieve over two years ago, but it sets the stage for Namaste to become the first fully-integrated platform of its kind. We plan to soft-launch Cannmart's website next week and look forward to feedback from our shareholders.”

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Notice for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Such forward-looking information includes that investor interest in the cannabis sector will continue to grow to October 17, 2018 and beyond; that cannabis use and sales will grow as currently predicted; Scythian’s intended acquisition of various foreign companies and expansion into the US market; that the Aphria stock owned by Scythian will retain its current value and that Scythian can realize a profit on its sale; Scythian’s plans to incubate projects in various locations throughout the world; that it could be granted licensable patents; that Scythian will get an exclusive cannabis distribution license in Florida; that Scythian will create a range of cannabis consumer brands, to be distributed through their own digital platforms, retail units and via partners, that Scythian can develop a proprietary cannabinoid-based combination drug therapy for the treatment of concussions and traumatic brain injury; and that it will be able to carry out its business plans.

Readers are cautioned to not place undue reliance on forward-looking information. Forward looking information is subject to a number of risks and uncertainties that may cause actual results or events to differ materially from those contemplated in the forward-looking information, and even if such actual results or events are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on Scythian. Such risks and uncertainties include, among other things: that a regulatory approval that may be required for the intended acquisitions and subsequent sales are not obtained or are obtained subject to conditions that are not anticipated; growing competition for intended acquisitions in the cannabis industry; potential future competition in the markets Scythian operates for sales; competitors may quickly enter the industry; general economic conditions in the US, Canada and globally; the inability to secure financing necessary to carry out its business plans; competition for, among other things, capital and skilled personnel; the possibility that government policies or laws may not permit legal cannabis sales or growth or that favorable laws in place may change; Scythian not adequately protecting its intellectual property; interruption or failure of information technology systems; the cannabis market may not grow as expected; Scythian’s technology may not achieve the expected results and its accomplishments may be limited; Florida may not grant to Scythian an exclusive cannabis medical license; even if it is granted the Florida license, Scythian may not be able to profitably use it; Scythian may not successfully develop a cannabis consumer brand; and it may not be successful in developing a cannabis based treatment for concussions and brain therapy; even if it develops a successful treatment, it may not be able to protect its intellectual property; its patent applications may be rejected or successfully challenged; Scythian’s business plan also carries risk, including its ability to comply with all applicable governmental regulations in a highly regulated business; incubator risk investing in target companies or projects which have limited or no operating history and are engaged in activities currently considered illegal under US federal laws; and regulatory risks relating to Scythian’s business, financings and strategic acquisitions.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Scythian seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Scythian to conduct investor awareness advertising and marketing for Scythian. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public and non-public sources but is not researched or verified in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Safehaven.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities.