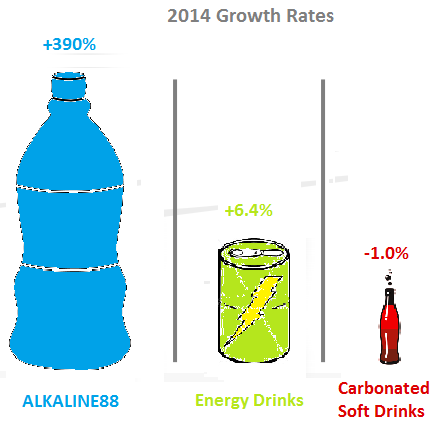

Alkaline water is one of the fastest growing segments in the bottled water category, outperforming premium beverages such as energy drinks. For investors, there’s one clear beneficiary to this trend: The Alkaline Water Company (OTCQB: WTER). The company’s involvement with a rapidly growing trend and nationwide expansion prospects make WTER a compelling value play.

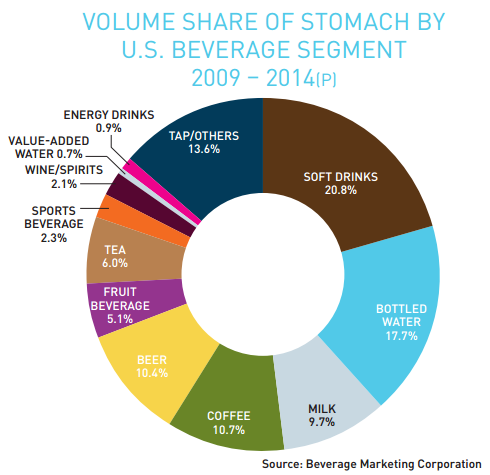

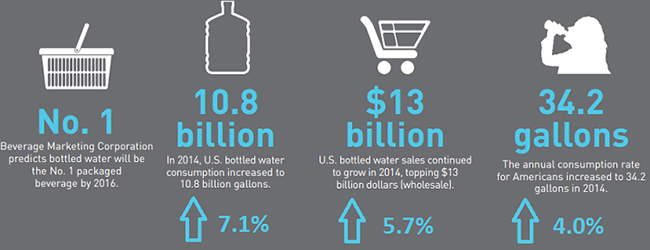

In 2014, sales and consumption of bottled water, the number 2 packaged beverage in the US market, were up - and making strong gains - on the number 1 category, carbonated soft drinks, according to reports from Beverage Marketing Corporation (BMC). Bottled water has increased its “share of stomach” of the overall beverage market from 14.4% in 2009 to 17.8% in 2014 (below).

With the rise of the ‘healthy living’, BMC predicts that bottled water will overtake soft drinks, which currently leads the US market with 20.8%, by 2016. In 2014, bottled water achieved unprecedented highs in volume, sales and consumption while also growing sequentially over 2013.

Increasing Health Consciousness Affecting Dominant Beverage Companies

The world's largest beverage companies are ill prepared for this generational shift, as they have concentrated their product portfolios on carbonated soft drinks. However, consumers have become increasingly concerned about health and wellness, focusing on the caloric intake associated with carbonated soft drinks and the use of artificial sweeteners in “diet” products. As such, the demand for these products has decreased with consumers shifting towards non-carbonated beverages, such as water, teas and sport drinks.

Coca-Cola’s (KO) North American volume was flat in 2014, reflecting 1% growth in “still beverages”, which offset the 1% decline in “sparkling beverages” segment. Still beverages are noncarbonated waters, energy drinks, juices, teas and sports drinks whereas sparkling beverages are carbonated (ex. Coca-Cola, Sprite etc). The growth in still beverages was led by an 8% growth in packaged waters, comprised of Dasani, Vitamin Water and Glaceau Smart Water brands.

Similarly, Dr Pepper Snapple Group’s (DPS) branded carbonated soft drinks, such as Dr. Pepper and 7Up, saw volume increase by only 1% in 2014. The company’s top line was supported by mineral water brands (ie. Penafiel) and carbonated mineral water (ie. Schweppes).

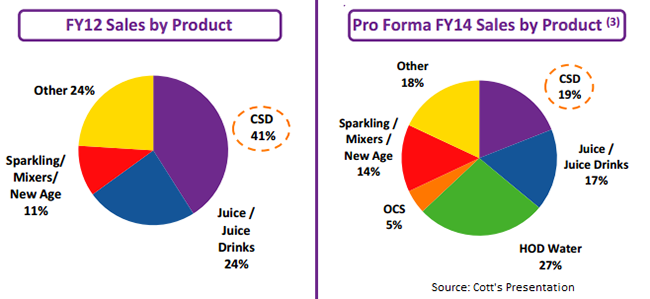

An example of a company that was prepared for this generational shift is Cott Corporation (COT).

As a result of integrating water into the company’s product mix, Cott has shown annual top line growth of 8.5%, easily outperforming the struggling beverage industry.

Alkaline Water Benefits From Increasing Health Consciousness

Bottled water is a commoditized business, so products must have a “value-add” in order to see sales traction. Alkaline water balances the pH levels in the body, which as Dr.Oz’s diet proclaims: “is how one can win the war on heartburn and acid reflux”.

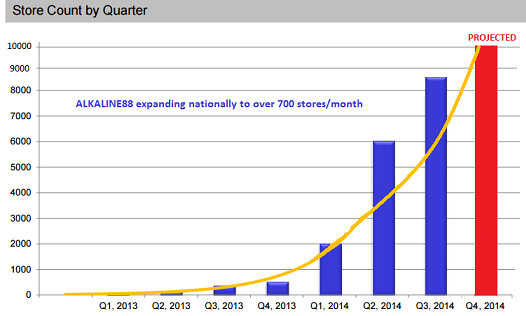

The Alkaline Water Company’s (WTER) brand, ALKALINE88, is seeing rapid adoption from health conscious consumers.

By the end of 2013, Alkaline88 was in 5 states and only 500 stores. Fast forward a year and the product is available in all 50 states at over 10,000 retail location. Company management expects the growth trajectory to continue with the product being placed in 20,000 stores by year end.

Adoption Leading to Explosive Revenue Growth for WTER

Drinking alkaline water is part of an ongoing "healthy living" trend, which is validated by the retail demand of Alkaline88. As a result, WTER has seen revenues explode.

The Alkaline Water Company’s latest quarterly revenues were greater than $850,000, a rise of 390% from the prior year. The company reported that revenues in the first 50 days of Q4 FY2015 were more than for the entire Q3 FY2015, indicating that the triple digit growth rate isn’t slowing down. For the upcoming year, WTER reported annual sales order would come in at $10M, equating to a top-line growth rate greater than 100%.

Triple Digit Growth Company Trading at Discount Valuation

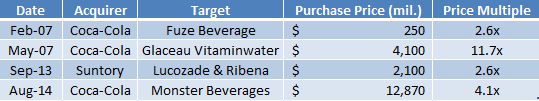

WTER offers investors an investment opportunity that shows no signs of slowing down. The company trades at 1.2x 2015 sales, which is bizarre given past M&A transactions in the beverage industry have closed at multiples as high as 11.7x sales (see above). As the company scales Alkaline88 nationwide, the market should adjust valuation for one of the fastest growing beverage companies and give WTER investors considerable upside in the process.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research, LLC on behalf of The Alkaline Water Company as part of research coverage services. One Equity Research has received 1.5 million restricted shares of common stock as consideration. In addition, One Equity has received ten thousand dollar from a third party for coverage of Alkaline Water Company. This research note is not an offer or solicitation to buy or sell the securities of Integral Technologies. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation.