2019 is set to be the year of an epic gold rebound that dwarfs the 2016 rally.

The global economy is throwing up red flags on all sides.

Just as Goldman Sachs is saying that ‘peak gold’ may be less than two decades away.

Over-valued and over-hyped tech stocks are beginning to lose favor among investors who are looking for safe haven assets.

We may be about to witness a ‘perfect storm’ for gold… and one group in particular is set to benefit.

Gold miners.

More specifically: miners who use cutting-edge tech such as drones, 3D geomapping and shale innovations to boost efficiency.

New technology isn’t just unlocking new gold veins… it’s also rediscovering legendary gold hotspots such as the Klondike or Julius Caesar’s gold in Romania.

With gold prices set to rise, gold miners are gearing up for what could become an unforgettable 2019.

Here are 5 stocks to keep an eye on as you get into the gold game:

#1 Pretium Resources (TSX:PVG):

Canadian Pretium Resources is one of the top growth stories in the gold space.

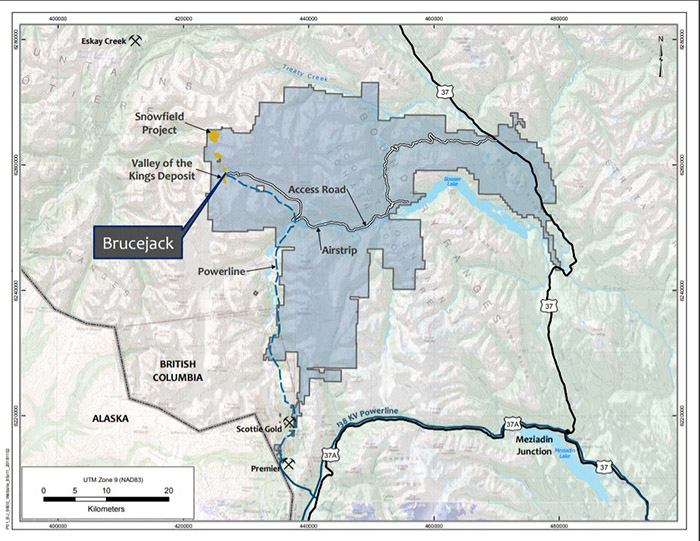

Pretium holds a diverse portfolio of precious metal resource properties throughout the Americas. The jewel in the crown here is the Brucjeack mine in B.C., which is fully owned by the company. A 2016 reserve estimate pegged the total gold reserves of this very mine at 8.7 million ounces. At today’s gold prices that’s no less than $11.3 billion worth of the precious metal.

This 2,700 ton-per-day high-grade gold mine produced an impressive 154,484 ounces of gold in its first six months. At present, Brucejack is averaging nearly 13 grams of gold per ton of rock mined, a very reasonable output that is allowing Pretium to keep their all-in sustaining costs comfortably below the global gold mining average.

In terms of exploration, the company has conducted extensive geological sampling in the vicinity (15-30km) of the mine and has found deposits with grades as high as 19.25 grams of gold per ton.

Long term, investors are being drawn toward the 100 percent company-owned snowfield property. Besides porphyry-style gold and gold-copper deposits, the property also benefits from molybdenum and rhenium mineralization.

#2 Euro Sun (TSE:ESM, OTCMKTS:CPNFF)

Perhaps the biggest surprise story in gold this spring comes from Romania, where a little-known company just became the first non-state-owned entity to receive a ratified mining license for what could become one of the biggest gold discoveries of the century.

Their secret lies in an ancient Roman gold mine buried deep in the Romanian forest, where Euro Sun has claim to 400 million tons of ore - with $13.3 billion worth of gold and copper waiting to be extracted.

The scale of Euro Sun’s discovery cannot be overstated. Once their Rovina mine is fully operational it will likely be the second biggest gold mine on the entire European continent, with a staggering yield of 10.1 million ounces of gold equivalent.

The Rovina mine is certainly not the only Roman mine lying in wait with accessible ore in Europe, but Euro Sun managed to do what big companies like Barrick Gold have thus far been unable to do and obtained a license from the Romanian government to start mining.

This is the first time that a non-state-owned company received a ratified mining license in Romania.

Despite owning 100% of a world-class gold deposit, Euro Sun is undervalued by almost any metric.

Even if the company would never find an additional ounce of gold, the Rovina mine could produce about 150,000 ounces of gold and 50 million pounds of copper a year over several decades.

Industry experts like GMP and Cantor Fitzgerald agree that Euro Sun is significantly undervalued. Cantor Fitzgerald has deemed Euro Sun’s short-term target to be $2.10 - a huge increase from its current price. If this sounds too good to be true, just wait: GMP estimates Euro Sun’s value could be $3.00, an increase of a whopping 355%.

Right now, in large part thanks to the sorry state of the small mining stock market, Euro Sun is a penny stock. But that could change at any moment. With tons of buzz around M&A in the gold sector, there has been no shortage of rumors about a potential Euro Sun take-over, possibly by one of the many Chinese firms investing heavily in the region.

Savvy investors will see an opportunity to get in on the ground floor of something special.

#3 Alamos Gold Inc. (TSX:AGI)

The third of our gold stock recommendations is Toronto-based Alamos Gold Inc., a mid-tier gold producer that owns four fully operational gold mines spanning North America - more specifically, in Northern Ontario, Canada and Sonora, Mexico.

Apart from their gold mines in Canada and Mexico, Alamos owns additional development projects at home in Manitoba, Canada with its Lynn Lake project, in Mexico with La Yaqui and Cerro Pelon, an extension of the Mulatos Mine, and even as far-flung as Turkey, where it owns the Kirazli, Agi Dagi, and Camyurt development projects.

Its Kirazli project is especially noteworthy as the company recently received an operating permit from the Turkish Department of Energy and Natural Resources…

This key development will allow Alamos to ramp up construction, with the goal of kicking off initial production at the mine by the end of 2020. This is exciting news because Kirazli’s probable reserves sit at 10,078,000 ounces, or approximately $13 billion in revenue for the company.

Additionally, Alamos Gold also closed a major deal with Metalla Royalty and Streaming, securing $8 million in Metalla shares in a sale of 18 royalties on assets not owned by Alamos. The deal means that Alamos will now own 6.26% of Metalla.

Alamos’ growing portfolio and key partnerships make it an interesting stock to watch for goldbugs and stock market investors alike.

#4 Osisko Gold Royalties Ltd. (TSX:OR)

This Canadian company boasts an impressive catalog of assets spread across the globe, with plenty more royalties and exploration in development.

Osisko Gold Royalties is currently being watched very closely by investors who have zeroed in on a telling anomaly amongst the vast swaths of data available on all publicly traded companies - you see, the key to successful trading is not having access to the information, but knowing what to look for and what to make of it.

In this case, the movement that has caught the market’s eye is that the firm’s Mesa Adaptive Moving Average (MAMA) has moved above the Fractional Adaptive Moving Average (FAMA). In layman’s terms: there is potentially some major upward mobility in Osisko’s near future.

With its investors feeling bullish about Osisko’s prospects, the company’s stock has climbed at a healthy clip over the last year. To get into the nitty gritty, “shares have moved 6.53% over the past 4-weeks, 58.50% over the past half year and 25.48% over the past full year.”

Osisko is a smart, low-risk investment thanks to its steady growth and significantly reduced debt. Investors who were lucky enough to get their hands on Osisko stock in the last quarter of 2018 will be the first to tell you what a rewarding buy it is.

#5 IAMGOLD (TSX:IMG )

Our last recommendation of the group, but most certainly not the least, is Toronto-based IAMGOLD. The ambitious young company is a fast-growing mid-tier gold miner that looks to us to be on track to become a major player in the gold mining industry.

Sure, the company has faced some recent setbacks, first by postponing its Cote Gold project and now by announcing a plan to lay off 32% of the workers at its Westwood mine. These moves, however, have kept stock prices stable and set the company up for a major rebound.

Many traders are bullish on IAMGOLD, expecting continued appreciation as well as steady growth from the ambitious company.

The company initially garnered a fair bit of buzz when it produced some 214,000 ounces in Q1 2017 thanks to its successful operations in South America and Africa. Now, this past June, IAMGOLD closed a new and highly significant deal with Japanese commodity giant Sumimoto, which will result in the development of a new Ontario gold project.

Right now is the perfect time for investors to get involved with IAMGOLD as the buzz wears off but the projections are rock solid for this quickly-growing commodity.

Other companies to watch as traders turn bullish on gold…

Kinross Gold Corporation (TSX:K)

Kinross Gold Corporation is relatively new on the scene, founded in the early 90s, but it certainly isn’t lacking drive or experience. In 2015, the company received the highest ranking for of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies.

While Kinross posted a significant loss in the fourth quarter of 2018, the company is making strong moves to turn around its earnings, including the hiring of a new CFO, Andrea S. Freeborough.

“Andrea’s successful track record at Kinross and throughout her career, including accounting, international finance, M&A, and deep management experience, will be an excellent addition to our leadership team,” said Mr. Rollinson. “We have great talent at Kinross and succession planning is a key aspect of retaining that talent for the future success of our Company.”

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Euro Sun Mining Inc. to conduct public awareness advertising and marketing for Euro Sun Mining. Euro Sun Mining paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ drilling excursions and mining operations, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.