The beverage industry is concentrated with nearly 90% market share held by Coca-Cola (KO), PepsiCo (PEP) and Dr. Pepper Snapple (DPS). This means that whenever a small company gains traction with a product, one of the ‘Big 3’ – Coke, Pepsi or Dr. Pepper - usually ends up acquiring it. The Alkaline Water Company (WTER) has seen its flagship product, Alkaline88, fly off shelves nationwide, with sales growing triple digits in the last year. This is the kind of growth that is sure to catch a potential acquirer’s attention, but has slipped past investors - at least for now. Acquirers have paid multiples of WTER’s current valuation, and perhaps more tellingly, Coca-Cola has historically invested in high-growth beverage names at a 500%+ premium to where WTER currently trades. Whichever way you cut it, WTER trades at an 80%+ discount to what acquirers have been proven to pay for fast-growing beverage names. This creates potential upside for investors as we approach WTER’s earnings release for fiscal Q4 2015 at the end of June.

Past Acquisitions Prove That Growth Pays – 3 Case Studies Explain Why Acquirers Could Show Interest in WTER

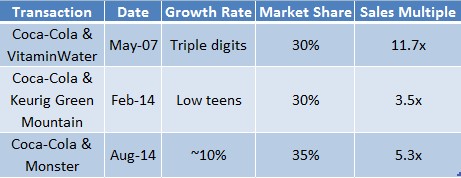

Figure 1. Coca-Cola’s M&A interest has been focused on fast growers with substantial market share

Case 1: Coca-Cola paid $4.1B in 2007 to acquire Energy Brands, the maker of VitaminWater. Before the acquisition, Coca-Cola was seeing soft drink sales decline, while the value-added water brand was growing at triple digits (sound familiar?). Energy Brands sold 77 million cases (or $350M) in 2006, doubling figures from the prior year. Energy Brands controlled about 30% of the US market for value-added water in 2006, second only to Propel. Coca-Cola paid 11.7x sales for the acquisition.

Case 2: In 2014, Coca-Cola and Green Mountain Coffee entered into a 10-year agreement to develop Coke brand products at home using Keurig’s drinkmaker. In addition, Coca-Cola made a $2.55 billion equity investment for a 16% stake in Green Mountain Coffee (GMCR). With Keurig’s coffee makers represented in more than 1 in 5 US households, Green Mountain accounted for 30% of retail coffee sales in 2014. With Coca-Cola’s partnership, Green Mountain expects its long term top line to grow in the low-teens. Coca-Cola paid 3.5x sales for their investment.

Case 3: To recover some of the decline in soda sales growth, Coca-Cola announced a 17% stake in Monster Beverage (MNST) in exchange for $2.15 billion. Energy drink sales have been the fastest growing sector in the beverage market showing year-over-year growth of 20%, 11% and 6.8% in 2011, 2012 and 2013, respectively. Monster had a 35% share of the $9B US energy-drink market in 2013, second only to Red Bull’s 43%. As a result of being a top player in their category, Monster saw top-line growth of 10% annually. Coca-Cola paid 5.3x sales for their share of the Company.

If Coca-Cola were to invest in WTER at the median price paid for the 3 cases (discussed, above), Coca-Cola would value WTER at roughly $50M - a 500% premium to current prices for WTER shares.

If Alkaline Water is The Next Big Thing, WTER is the Best Way to Own the Space

The latest water fad has concentrated on ionized water; bottled water is predicted to overtake market share of carbonated soft drinks by 2016. The projected alkaline water market in the US is $100M and growing. Sales of Alkaline88, WTER’s lead product, has seen rapid adoption on the west coast and is spreading east at a rate of 700 stores/month. Existing purchase orders across all markets indicate a projected run rate of over $10,000,000 annually.

In the last 9 months, WTER grew sales at more than 600% year over year. This trend is continuing into calendar 2015 as purchase orders for the first 50 days of Q4 2015 (ending March 31,2015) have already exceeded the reported third quarter fiscal year sales (ending December 31, 2014) of $857k.This means that WTER’s Q4 top line figure could exceed $1.5M.

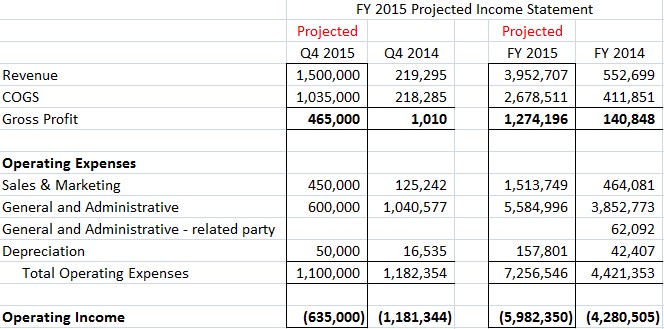

Figure 2. Fiscal year 2015 (ending March 31, 2015) revenues could surprise markets, being the first time company reports quarterly revenue greater than $1M

*WTER fiscal year runs from April 1 – March 31, making company’s Q4 2015 fiscal year end on March 31, 2015

Assuming quarterly revenues of $1.5M, WTER would show year-over-year growth of 580%. The majority of this growth is coming from expanded distribution outside Southern California; however the company is also showing strong same store growth year-over-year of 250%. Alkaline88’s success in Southern California increases the likelihood that the company’s geographical expansion plans will be successful as sales spread east. Additionally, the same store growth indicates that the product is being well received and frequently used by returning consumers.

Q4 and full 2015 fiscal year results will be reported towards the end of June. Not only could WTER continue showing tremendous revenue growth, but it will be the first time the company reports quarterly revenue greater than $1M. At an approximate market cap of $10M, the market is severly discounting WTER’s current and future growth. In our view, the upcoming earnings results could be a major positive catalyst for WTER stock.

Sales Growth Could Trigger Other Catalysts, Help WTER Shares Trend towards Takeout Value

Reporting quarterly sales of at least $1.5M will catch the market by surprise and could cause WTER’s share price to rally. If WTER stock trades higher than $0.13, investors should be mindful of the company’s approximate 17.2M warrants outstanding at an exercise price of $0.125. If exercised, these will yield $2.15M in cash without additionally diluting investors. More importantly, WTER could utilize proceeds from warrant exercises to fund expansion plans and accelerate growth even further.

Figure 3. Past acquisitions in the beverage space showing the lengths acquirers will go to drive revenues

WTER plans to add 2-3 new facilities to their existing 4 manufacturing facilities by the end of 2015. This, along with Alkaline88’s initial traction, will secure a run rate $10M+ for fiscal 2016 (effectively calendar 2015).

The Company trades at ~1.1x 2015 sales, which is bizarre given past M&A transactions in the beverage industry have closed at multiples as high as 11.7x sales (see above). If WTER were acquired at the average price to sales multiple of the beverage transactions listed in Figure 3 (above), shares would be worth $0.47 or 400% greater than recent market prices. We see this gap in potential take-out value and market value narrowing as the Company continues scaling Alkaline88 nationwide, and investors assign a sales multiple befitting one of the fastest growing beverage companies in the U.S. This suggests possibility of considerable upside for WTER investors today. At the very least, Coca-Cola’s investments & acquisitions over the years seem to suggest that The Alkaline Water Company is trading at a discount – and being one of the ‘big 3’ beverage companies that might be all that really matters.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research LLC on behalf of The Alkaline Water Company (the "Company") as part of research coverage services. One Equity Research has received 1.5 million restricted shares of common stock from the Company as consideration. In addition, One Equity has received ten thousand dollar from a third party for coverage of The Alkaline Water Company as of the date of this note and expects to receive additional compensation in the future. This research note is not an offer or solicitation to buy or sell the securities of The Alkaline Water Company. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/