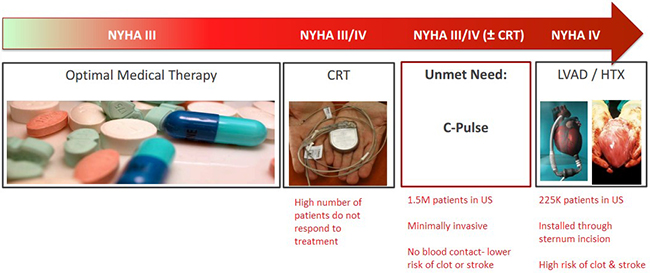

1.5 million Americans are affected by Class III progressive heart failure, a disease with few treatment options. In the US, only ~2,000 transplants are performed annually due to the lack of donor hearts. Advanced stage patients are currently presented with two alternative heart pumps by companies Thoratec (THOR) and Heartware (HTWR), both of which sport valuations greater than a billion dollars. These heart failure patients, however, sacrifice any chance at a regular life due to the device’s side effects.

Through their minimally invasive C-Pulse System, Sunshine Heart (SSH) is hoping to provide these same distressed patients with a device that will improve their quality of life. Companies in the past that commercialized a first-in-class drug have received valuation premiums due to the exclusivity in their respective markets. Sunshine Heart is comparable to these pharmaceuticals since their device could be the breakthrough that 1.5 million have been looking for.

In the last four months, Sunshine Heart has announced several de-risking events that have actually advanced the company’s overall operations. Fundamentally, the stock should have followed suit, but instead has declined around 40%. We view this as a unique opportunity to take advantage of the $88B addressable market that Sunshine Heart is exposed to.

Sunshine Heart’s Similarities to ‘Miracle Drugs’

Since the Class III progressive heart failure market has few treatment options, it would make sense to compare the C-Pulse System to a first-in-class drug aimed at treating a disease. Such circumstances desperately need market products in their respective categories. Due to the pricing power of the developer, this generally results in companies having a monopoly if/when the said product is commercialized.

A perfect example is Bristol-Myers Squibb’s (BMY) YERVOY for metastatic melanoma, a form of skin cancer. This was the first advanced melanoma therapy in more than a decade, so BMY was able to charge $30,000/injection. Each round of treatment required 4 injections, totaling $120,000 in treatment costs. In 2014, YERVOY generated sales of $1.3B, a 36% increase year over year. Similarly, Sovaldi, Gildead’s (GILD) drug which treats chronic hepatitis C, costs $84,000 for a 12-week treatment, or exactly $1,000 a pill. Gilead generated $10.3 billion of Sovaldi in 2014 as a result of the pharma’s pricing power.

Stage III heart failure patients face a difficult situation. Many at this stage will see progressive symptoms indicating that they are nearing a potentially inventible death. Options are to essentially continue medical therapy until surgery is needed when the heart failure advances to stage IV. This results in having a device tethered to the patient for remainder of life which also increases the risk of blood clots and stroke.

Figure 1: Minimally Invasive C-Pulse Procedure Satisfies an Unmet Need for Heart Failure Patients

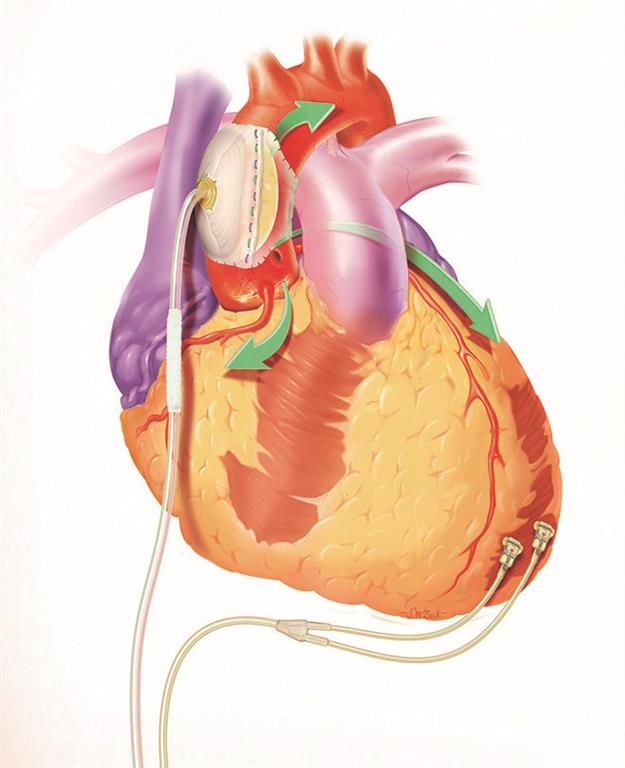

Sunshine Heart offers a minimally invasive therapy for moderate to severe heart failure that halts the disease progression and in certain cases, reverses heart failure. The C-Pulse System uses a balloon that is wrapped around the outside of the aorta to add a secondary pulse to every heartbeat. The C-Pulse System inflates and deflates the balloon in rhythm with the natural heartbeat, thereby applying a “secondary pulse” which strengthens the heart’s function.

Figure 2: C-Pulse’s Minimally Invasive Balloon has no Contact with Blood

The C-Pulse can be implanted using minimally invasive surgical techniques and is typically performed in 90 minutes with no need for heart stoppage. The device is not life sustaining, meaning it can be disconnect for short periods of time, allowing patients to perform regular activities. Because the device has no contact with blood, the likelihood of blood clots or strokes are reduced.

Lower Valuation after De-Risking Events, Unjustified

To understand just how unjustified Sunshine Heart’s valuation is, compare the events that have occurred in the last four months. The company has furthered operations, yet received an enterprise value half what it was before.

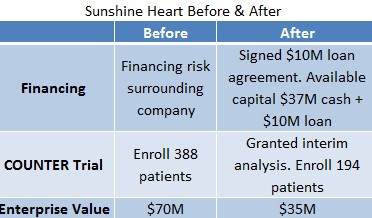

Figure 3: Sunshine Heart Reporting Operational Advancements yet Receiving Lower Valuation

- Feb 19, 2015: Financing

Sunshine Heart announces loan agreement with Silicon Valley Bank to receive up to $10.0 million in capital. This funding essentially eliminates the imminent financing risk around Sunshine Heart as the company has access to as much as $47M, including ~$37M cash balance and $10M loan. The available capital will be sufficient for the company through 2016

- Feb 25, 2015: Interim analysis

FDA grants Sunshine Heart interim analysis which reduces the total length of the COUNTER study. Instead of the original 388 patients needed to enroll, the FDA is requiring only half the data (194 patients). This potentially cuts two years off the development curve for the company.

- March 6, 2015: Temporary Enrollment Pause

Sunshine Heart was required to take a temporary pause from enrollment of its COUNTER heart failure trial as per FDA protocol. If at least three of first 20 patients pass away, for any reason, the trial must be paused and evaluated. 4 patient deaths were reported, all of which were non-device related. C-Pulse safety profile remained unchanged since all deaths were non-device related.

- May 26, 2015: FDA Approval To Resume Enrollment Resume

Sunshine Heart got the go ahead from FDA to resume enrollment in their study. The company is working on providing study centers with information required to approve continuation of study enrollment at each center. This is expected to be complete within 4 weeks. Therefore, by the start of August, company’s COUNTER trial should be back up.

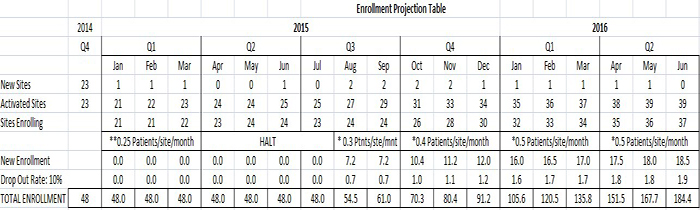

Before the halt, the company was seeing its largest enrollment numbers, so a similar pace is expected to continue.

Figure 4: Enrollment Projections Indicate REVIVE-IT Could Be Fully Enrolled By Early Q3 2016

Source: One Equity Research Estimates

By the end of 2015, Sunshine Heart expects to be somewhere between 32-35 activated sites. Projections above call for 34 sites, of which only 30 are enrolling as the other sites are in a 2 month training period. In prior conference calls, Sunshine Heart has forecasted that pace for enrollment is expected at roughly 0.5 patient/site/month. At this rate, expect the company to complete enrollment by Q3 2016.

Vast Valuation Discrepancy if Sunshine Heart Valued Based on Its Target Market

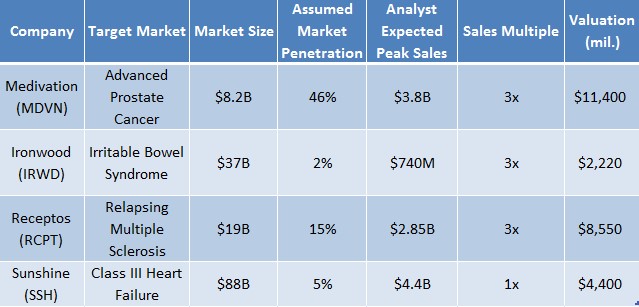

Figure 5: Sunshine Heart Should Be Valued at $4.4B When Compared to Other Treatments Targeting Unaddressed Markets

Valuing a product that targets an unaddressed market requires that investors assume the forecasted peak sales upon commercialization. To determine this, investors must calculate the market size which the product will penetrate and apply a sales multiple to the projected figure. We ran with estimates provided by analysts covering these names. For instance, Medivation’s treatment for prostate cancer, Xtandi, targets an $8.2B market. Analysts forecast that sales of Xtandi will grow to $3.8 billion by 2023, at a CAGR of 24%, accounting for an impressive 46% of total branded drug sales in the prostate cancer space. Applying a sales multiple of 3x would value Medivation at $11.4B.

Sunshine Heart’s addressable market for C-Pulse is 1.5M patients in the US at a cost of $59,000/device. Therefore, the market is worth upwards of $88 Billion. Assuming commercialization and penetration of 5% of the addressable market, C-Pulse could achieve peak sales of $4.4 Billion. Even if Sunshine Heart were valued at 1x peak sales, this would imply the market is currently valuing Sunshine Heart at 1/50th its potential value.

Back in mid-February, SSH stock was trading in the $5.20 range, or approximately a $70M enterprise value. Currently, Sunshine Heart stock trades in the $3.20 range, or 40% lower.

However, in recent months Sunshine Heart inked a deal with Silicon Valley Bank for capital that will suffice through 2016, thereby eliminating financing risk, and by which time the Company’s pivotal COUNTER-HF study should be fully-enrolled.

Additionally, being granted interim analysis cut the trial time in HALF, which equates to two years, the time value of which was not credited to SSH in the market. Net, Sunshine Heart is still 20 months ahead (24 month gain from interim analysis approval, less a 4 month delay from halt) in the development process compared to mid-February, but trading 40% lower.

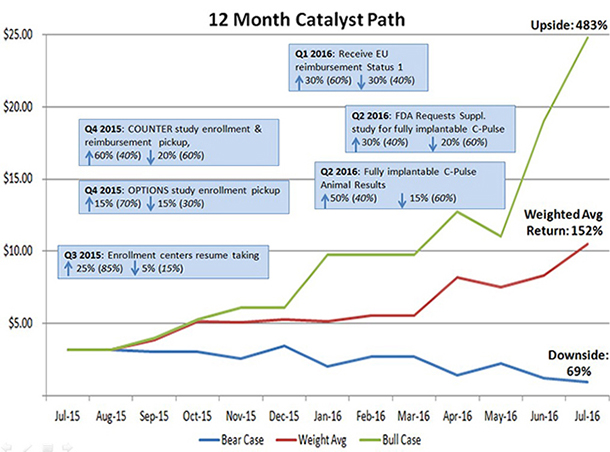

To illustrate why we think SSH is a compelling name to own right now, we put together a probability-weighted outcomes chart (below) showing where shares could trade, based on the outcome of known and anticipated events over the next 12 months.

Given the above catalysts (and the respective probabilities), Sunshine Heart should be trading above $10, or 210%+ higher, on a weighted average basis in 2016.

Immune-oncology drugs have been the focus of headlines lately due to their advance in difficult-to-treat diseases, with high morbidity outcomes. These companies have received roaring valuation because their drug [candidates] could fill large unmet needs in healthcare. Class III heart failure is by and large completely unaddressed. We believe this favorably positions Sunshine Heart’s C-Pulse device to capture a significant share of the market, if or when commercialized. In our view, the Company has been unfairly punished in the markets, and shares will revert back to levels seen but a few months ago and then some. We view this as an extraordinary opportunity to own a great Company at an ever better price and see 50%+ in near term upside; 200%+ should the gap between current market price and fair value ($10+) narrow.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC on behalf of Sunshine Heart, as part of research coverage services. One Equity Research has received ten thousand dollars as of the date of this report and may receive up to twenty thousand dollars per month for ongoing coverage of Sunshine Heart. An affiliate of One Equity Research LLC holds an ownership interest in Sunshine Heart. This research note is not an offer or solicitation to buy or sell the securities of Sunshine Heart. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms