They say you can lead a horse to water but you can’t make it drink. Consumers are growing increasingly health conscious and beverage makers who don’t adapt their product offering to fit this tectonic shift stand to lose out. We think the Alkaline Water Company (WTER) is the one of the best ways for investors to capture 300%+ in near-term upside from this consumer lifestyle shift, as we explain further in this note.

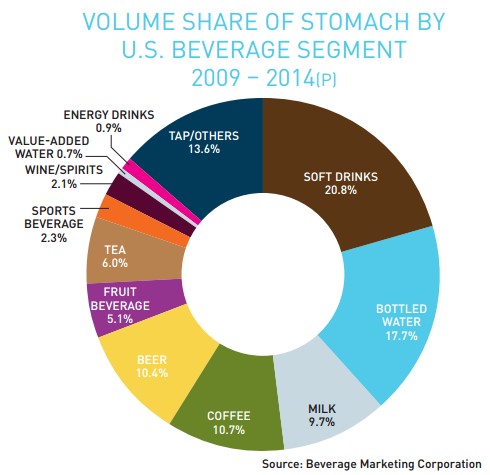

Bottled water, the #2 beverage category in the U.S., is quickly making gains on the #1 category – carbonated soft drinks, according to the Beverage Marketing Corporation (BMC), as shown in Figure 1 (below). Its ‘share of stomach’ of the overall beverage market has grown from 14.4% in 2009 to 17.8% in 2014 (below). BMC says the ‘health living’ trend will help bottled water overtake soft drinks by 2016.

Figure 1: Water on the Verge of Overtaking Soft Drinks as #1 Beverage

The benefactors of this shift could include names like SodaStream (SODA), whose launch of several new value-added water products is expected in July. Keurig Green Mountain (GMCR) has failed to adapt and has been adversely affected and its shareholders punished.

In this note we look at 3 key beverage names – SODA, COT, GMCR – that are reporting earnings over the next few weeks, and review WTER’s recently-reported results for fiscal 2015, including guidance for profitability in fiscal 2016.

Keurig Green Mountain Stock Going KOLD

When Coca-Cola said it was partnering with Keurig to bring Coke & Sprite-like beverages to soda making machines, GMCR shares spiked. Green Mountain’s financial performance, however, has not met expectations. Market share for GMCR-owned brands dropped to 28%, down from 35% one year ago, with a 5% sales decline and 12% volume decline in the most recent four-week period, according to Nielsen.

Q2 revenues grew only 3% as GMCR missed on both top and bottom lines. Guidance was also cut due to weak brewer demand in 2015. The company’s shares have tumbled 50%, with the company guiding for flat top line results in Q3 and the balance of fiscal 2015.

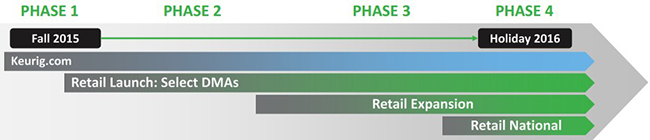

Green Mountain is expecting KOLD, the cold drink machine that Coca-Cola & GMCR partnered on, to be the next big product in the company’s product pipeline, but it would seems counterintuitive with consumer preferences moving in the opposite direction. To make matters worse, KOLD’s full launch is still over a year away (Figure 2, below) and the appliance is priced more than double that of competitors at $299.

Figure 2: KOLD Launch At Least 18 Months Away

Consumers are becoming more health conscious, yet Keurig is offering what appears to be an overpriced soda-maker machine. Fighting the consumer trend has hurt GMCR’s largest investor, Coca-Cola (KO), whose average purchase price is at least $75 per share.

SODA’s Rebranding – “Water Made Exciting” – Could Bear Fruit 2H 2015

SodaStream (SODA) is reinventing itself as a health-conscious provider of sparkling-water machines - rather than a soda-maker. The company’s initial efforts to brand itself as an alternative to Coca-Cola and PepsiCo (PEP) didn’t align with shifting consumer preferences for healthier options. Q1 2015 sales were down 11% on a constant currency basis, compared to the same period in 2014.

To kick start their transition, SODA will be launching a completely new portfolio of 50 sparkling water flavors that include fruits, zero-calorie, vitamin-infused plus line, flavored essence, and sparkling gourmet. The new positioning and flavor range could bear fruit on the back half of 2015 as shipment to US stores is scheduled for late July.

Cott Spends $1.25B on Acquisition to Broaden Consumer Reach

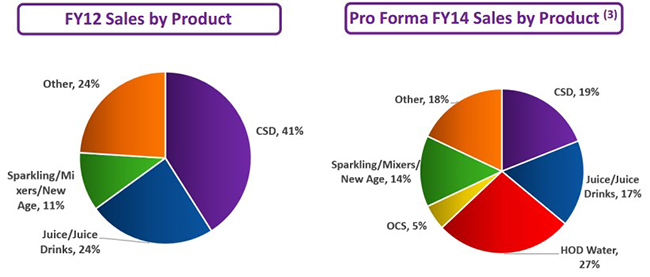

In November 2014, Cott Corporation acquired direct-to-consumer bottled water and coffee distributor DS Services to expand beyond private-label soft drinks and juices and widen its client base from retailers and distributors to consumers' offices and homes.

Prior to the $1.25B acquisition, Cott had posted falling sales for 11 straight quarters. With the acquisition of DS Services, the company expects to turn revenue growth around by 2-3 percent per year and minimize share of carbonated soft drinks from 41% to 19% of their portfolio, as shown in Figure 3, below.

Figure 3: Cott Acquiring DS Services to ‘Get With The Times’

Cott reports earnings before U.S. markets open on Thursday, July 30, 2015. It seems likely that with shares up 50% year-to-date, results from Q2 2015 could carry momentum over into the fall and perhaps the rest of 2015.

WTER Replicating Success in Southern California with Store Expansion Nationwide

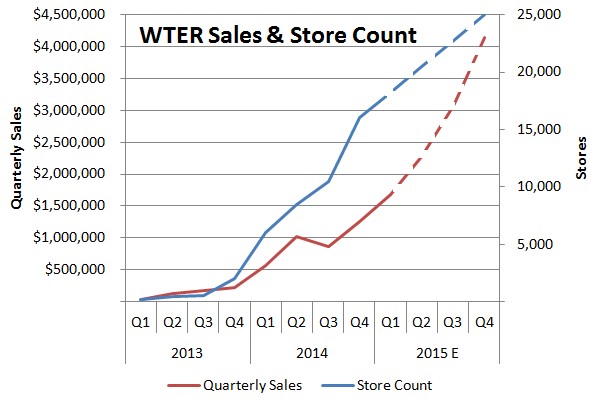

The Alkaline Water Company reported fiscal 2015 sales of $3.7M, representing year-over-year growth of 570%. In large part, the growth was driven by a successful campaign to expand the number of stores carrying Alkaline88, the Company’s flagship product, to retailers nationwide, after clinching the title of top-selling alkaline water in Southern California. Demand for Alkaline88 is spurred by increasing consumer health awareness and a general shift towards value-added waters. As of March 31, 2015, WTER’s fiscal 2015 year-end, Alkaline88 was available in over 16,000 stores, according to the Company. Alkaline88 expanded to about 6,000 retail locations in Q1 2015 and over 14,000 locations in the last year.

Figure 4: WTER Trajectory Accelerating As Company Ups Guidance

WTER expects continued store expansion to continue into fiscal 2016 and projects to be in over 25,000 stores by fiscal year end. This store count is accelerating as the company originally expected to be in 20,000 stores by the end of calendar year 2015 (or Q3 FY2016, since the Company counts fiscal year as Apr 1 to March 31 of any given year). If the new guidance is prorated, WTER should have nearly 23,000 stores by year-end, compared to original guidance of 20,000 stores. An accelerating store count should translate to a pickup in sales.

WTER’s Alkaline88 is carried by 34 of the top 75 retailers, according to the Company. For instance, WTER stated in their annual report that they had completed a successful road with Costco in Northern California. Logic follows that as the top-selling alkaline water brand in southern California, Costco took an interest in the product offering. Our thinking goes that successful sell-through at a handful of Costco locations will translate to this national retail chain (and others) eventually filling orders for all of their stores. This is relevant because WTER gains a national presence with high-volume stores like Costco without any added sales or marketing.

Further indication that Alkaline88 is performing well on retail shelves is inherent in WTER announcing the addition of 500ml, 700ml and 1L bottle product offerings. To sell these new product offerings, WTER needs shelf space. And to get shelf space, retailers need to be placing orders. The addition of these product lines is suggestive of the fact that retails are interested in selling Alkaline88 in multiple sizes. This bodes well, considering WTER has been successful selling 3L and 1 gallon sized bottles. We view this as a potential catalyst for accelerated sales growth in fiscal 2016.

WTER Shares Trading at 70% Discount to What Acquirer Would Potentially Pay

To meet growing demand for Alkaline88, WTER has increased production capacity threefold over the past year by adding co-packing plants and machinery throughout the country. For fiscal 2016, WTER expects to add up to two new co-packer facilities, strategically located to reduce freight costs and meet future growth objectives. The company will have the capacity to sell up to $2M of water wholesale per month, a figure that will increase with additional co-packer facilities expected to be added towards the end of the fiscal year. This increased capacity will give WTER the ability to grow sales to $24M per year, before any additional investment in capital equipment is necessary.

WTER expects revenues in excess of $10M for fiscal 2016, which implies growth of at least 170% compared to fiscal 2015. While the Company has guided and now reiterated sales for fiscal 2016 to be at or above $10M, we believe that it’s likely that the company will exceed this figure thanks to strong demand for Alkaline88, increased production capacity and continued retail store expansion.

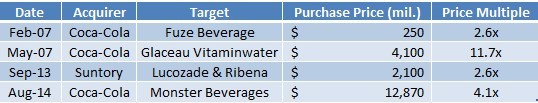

Historically, fast-growing companies in the beverage industry have been acquired at an average of 5X sales (see our discussion of why Coca-Cola would pay more than 3X WTER’s current market price), as shown in Figure 5, below.

Figure 5: Companies on the Cutting Edge of Fast Growing Consumers Trends Fetch High Price Tags

If WTER were acquired at the average of four notable acquisitions in the beverage space, shares would have a take-out value of $0.47, or be worth roughly 3.3X recent market prices. This relies on the Company’s forward guidance of $10M in sales for fiscal 2016 (which ends on March 31, 2016 or Q1 of calendar 2016).

As we’ve previously noted, we believe sales could top the Company’s own estimate for fiscal 2016. Should this occur, even 3X recent market prices would make WTER look cheap to a potential acquirer.

WTER Says Profitability Only Months Away

The most surprising announcement in WTER’s fiscal 2015 report is that the Company expects to be cash-flow breakeven for the third fiscal quarter (ending December 31, 2015) and profitable in fiscal Q4 (ending March 31, 2016). We view focus on managing costs as a shareholder-friendly move by upper management, even whilst triple-digit top-line growth ultimately courts a potential acquirer or strategic partner like Coca-Cola.

Consumers are slow to change preferences. Movement towards healthier diets directly benefits companies like Alkaline Water Co. (WTER) and adversely affects soft-drink makers like Coca-Cola, PepsiCo et al. Historically, small beverage companies that show consistent sales growth for several consecutive years are acquired for rich multiples. If alkaline water is here to stay, the Alkaline Water Company – WTER – is the best way to capture the upside. If WTER can meet guidance of $10M in sales for fiscal 2016, shares – which currently trade for just $0.14 – should be trading closer to $0.47. If sales exceed $10M, we believe upside is greater than 300%.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research LLC on behalf of The Alkaline Water Company (the "Company") as part of research coverage services. One Equity Research has received 1.5 million restricted shares of common stock from the Company as consideration. In addition, One Equity has received twenty thousand dollar from a third party for coverage of The Alkaline Water Company as of the date of this note and expects to receive additional compensation in the future. This research note is not an offer or solicitation to buy or sell the securities of The Alkaline Water Company. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/