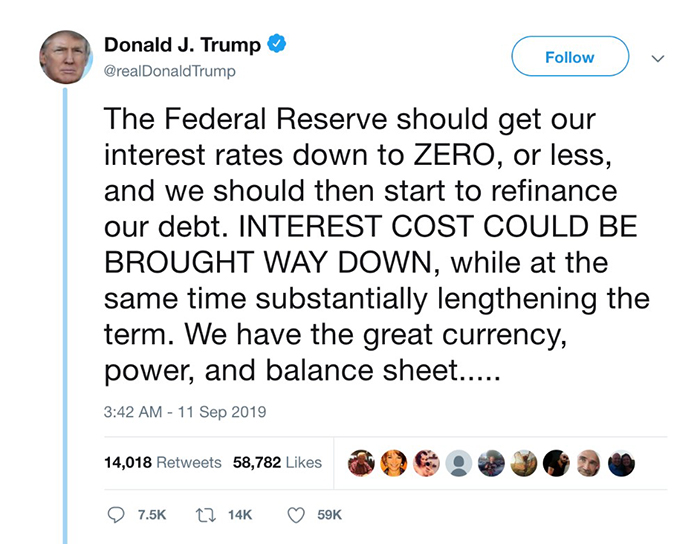

Trump knows the economy is the key to re-election in 2020...

And he's done something no other president in recent history has done...

He attacked the Fed…

Over and over again in a series of supercharged tweets.

In fact, he’s put so much pressure on the Fed that they’re beginning to cave.

Though rates haven’t hit zero just yet…

The Fed has announced two cuts despite a previously hawkish stance.

But that’s only the tip of Trump’s Twitter influence.

From his trade war talks to his political tirades…markets listen.

And gold markets are no different.

Actually, it may be even more likely to move as a result of Trump’s influence.

Gold has soared this year…

And some experts believe it is likely to go even higher as trade tensions mount and worries of a global slowdown continue to fester.

But one small company is prepared not just to weather the storm…but to ride the wave of the looming gold boom.

That’s because it has everything going for it.

Europe’s second largest gold mine…

A team that always overperforms…

And a history of success.

The company’s stock, according to Cantor Fitzgerald, “is inexpensive by any and all metrics.”

That’s right. It’s a steal because few people -- yet -- have heard the story of Euro Sun Mining Inc. (TSX: ESM, OTCPK:CPNFF).

Based at their mine in Rovina, Romania, Euro Sun has an estimated 400 million tons of ore, with billions of dollars worth of gold and copper locked inside.

Cantor Fitz thinks they are undervalued by 500% and GMP Research predicts a 671% gain.

With such a huge find ready for the taking, this could be the gold story of 2019.

Plus, any small move on the gold market could accelerate the company’s rise… from 5x to 10x to even 30x its current market cap.

Here are five reasons investors should not miss out on the biggest gold story of 2019:

#1 Re-Discovered $13 Billion Romanian Treasure

Euro Sun has captured an asset of immense value: a Romanian gold mine that was first proven one hundred years ago.

The Ancient Romans excavated $16.8 billion in gold at today’s prices from this area of Romania, minting coins that were scattered across an empire 11 million square miles in size.

Modern research indicates that Europe still has billions in gold locked away, with hundreds of mines sitting around just waiting for re-activation.

The problem? Acquiring permits can be labor-intensive and sometimes impossible, thanks to EU regulation.

Back when permits were available, Barrick Gold (NYSE:ABX), the world’s most valuable gold miner, got in on the action: the company pumped in $20 million to develop Rovina.

Now Rovina is owned by Euro Sun… and Euro Sun has done the impossible... it just got its hands on a mining permit.

The Rovina mine has been classified as a “highly scalable” asset, with an immense growth potential, according to Cantor Fitzgerald.

Mines like Rovina are hard to come by, even though the area is rich in ore.

And Euro Sun (TSX: ESM, OTCPK:CPNFF) has gotten around its toughest problem – acquiring the licenses it needs to start developing Rovina’s full potential.

The mining license from the Romanian government was approved in November 2018 – the first license to have been given out since 2003.

A resource statement from 2019 offers a view of the potential riches: 400 million tons of ore in three bodies, roughly 7.1 million ounces of gold and a billion and a half pounds of copper, or 10.1 million ounces of gold equivalent.

In February 2019, Euro Sun completed its Preliminary Economic Assessment (PEA) for Rovina. The mine looks ready to produce an average gold equivalent of 139,000 ounces over twelve years.

All told, the company is looking at $9.3 billion in gold and $4 billion in copper… a total haul of $13.3 billion.

Better yet, the mine is perfectly situated near a Romanian mining town, with a population of 13,000. Road and rail transportation is close at hand, ready to carry the mine’s product to market.

Based on the company’s current market cap, the upside potential here is incredible.

Any small move in gold will soon bring this story to the front page.

#2 When Gold Moves a Little, Little Miners Move Hundreds of Percent

NOW is the time to buy gold.

Analysts are optimistic that prices should continue to climb, potentially exceeding $1400/ounce, due to declining gold stores.

Right now, gold stocks are trading cheap, as they have been since January.

But one thing that investors and speculators often forget, is how explosive gold-stock upside is when gold moves higher.

And, when gold goes up, gold companies tend to do very, very well.

Every 1% move in gold can send a small miner up 10% or more... And a 10% move can send a small miner up 100% or more.

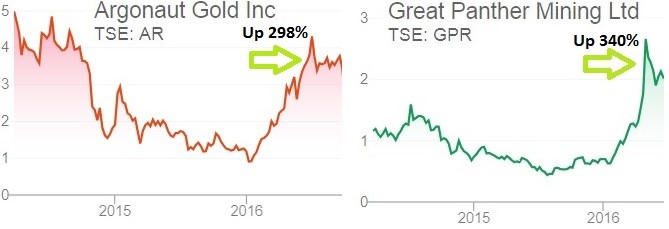

Back in 2016, gold prices jumped 26% in 6 months… and gold miner returns were stellar:

Mid cap miners such as Endeavour Mining Corp gained 196% in 6 months, while its Ontario based competitor IAMGold gained 256% in that same timeframe.

…but some of the real winners were the shareholders of small cap miners.

Argonaut Gold’s share price jumped 298% in 6 months, and its peer Great Panther Mining saw its share price even jump by a whopping 340% in no more than 4 months after it reported a 19% in gold production.

Companies like Euro Sun (TSX: ESM, OTCPK:CPNFF) could start selling at a premium…for investors who don’t snatch them up now.

And when gold goes up, little companies like Euro Sun often go up multiples higher.

But this story gets even better. There’s a bigger -- nearby -- catalyst.

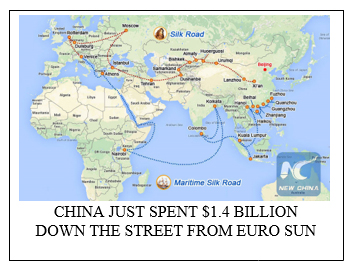

#3 Speculation: Euro Sun to be Acquired by Chinese Soon? China Just Spent $1.4 Billion Down the Street

Could the company be snatched up soon, delivering a huge windfall to early investors?

It’s certainly a strong possibility.

And we think China might have a part to play because they just spent $1.4 billion to acquire a mine right down the street from Euro Sun.

China is making a big global investment push, as part of its $900 billion “Belt and Silk Road” initiative.

Chinese investment along the road is surging, covering 68 countries.

China wants to acquire assets along the Silk Road route—gold, silver, copper, you name it—and that route runs right through Romania.

And the Chinese have just paid $1.4 billion to acquire another mining asset…which sits right down the street from Euro Sun...

China’s nearby acquisition could also take years to fully license.

And Euro Sun (TSX: ESM, OTCPK:CPNFF), on a site with ZERO ancient ruins is even better positioned for a multi-billion dollar payday.

The Rovina mine is fully licensed. It’s poised to become one of the biggest gold and copper mine in Europe.

It’s right next to a major Romanian mining town of Brad, which has already excavated $17 billion in gold at today’s prices in the last 100 years.

In fact, Brad’s coat of arms prominently features a mining cart. There’s ample access to talent, transportation and infrastructure... as well as a nearby sea port.

Soon, this story will hit the shores of America.

#4 “Undervalued by 218%” -- Cantor Fitzgerald “355% Gain” -- GMP Research

In 2016, GMP declared Euro Sun the “new old kid on the block,” declaring the company had 10 MILLION OUNCES in gold equivalent waiting to be dug up.

And the numbers look even better now than they did two years ago.

At current prices, Euro Sun could realize $550 in profit per ounce… resulting in total revenue of $5.5 billion from Rovina alone.

It’s no wonder that GMP noted Rovina has “robust economics and upside…If another ounce is never found, Euro Sun already owns a potentially extremely robust project.”

Cantor Fitzgerald agrees with GMP’s estimate. Cantor Fitzgerald completed its own estimate in early 2019.

The deposit at Rovina “carries strong economics on a standalone basis.” The only thing holding Euro Sun back is the fact this is happening in a small company... far away from the lights of Wall Street.

But as we already explained, that could change in a flash…once this story gets out.

The management at Euro Sun (TSX: ESM, OTCPK:CPNFF) knows what it’s doing. The company is led by CEO and President G. Scott Moore, a business executive with twenty-five years’ experience in the resource sector, and the former EVP of Sulliden Gold and Director of Avion Gold.

Moore and his team have cultivated excellent political conditions in Romania, evidenced by their successful acquisition of a license for the Rovina mine.

And now all they need is the capital to take Rovina to the next level…and turn it into one of the largest gold mines in Europe.

At the time of writing, Cantor Fitz thinks they are undervalued by 218% and GMP Research predicts a 355% gain

#5 The 2nd Biggest Gold Mine in Europe Could Soon 30X

And it could go much higher...

When gold moves a little, miners like Euro Sun can move A LOT.

And the company has already received positive attention.

Barrick, the world’s largest gold miner, once invested $20 million into the Rovina mine. The asset has been developed and has fallen into Euro Sun’s lap. Now all it needs to do is exploit it.

Cantor Fitzgerald puts Euro Sun’s short-term target at $2.10. That’s a 218% increase from its current price.

And GMP goes even further: they reckon Euro Sun is worth $3.00, an increase of 355%.

This is a company with a phenomenal upside.

It’s got a fully-licensed gold mine in Romania, the only one of its kind, that could be the biggest gold mine in Europe… an asset potentially worth $10.1 billion.

And that’s if prices stay where they are! If gold edges above $1400/ounce, profits from Rovina could be even higher.

If China comes calling, Euro Sun (TSX: ESM, OTCPK:CPNFF) stock could be worth 5x or 6x what it is now...

As it becomes the #1 gold mine in Europe.

And if its billions in profits are one day realized, that 5x could turn into 30x… A company to rival Barrick in size and value.

But the time to get in on, Euro Sun (TSX: ESM, OTCPK:CPNFF) is now...

Before it begins a potential run to $3.00 or more.

Other companies looking to capitalize on the coming precious metals boom…

Eldorado Gold Corp. (NYSE:EGO, TSX:ELD)

This Canadian mid-cap miner has assets in Europe and Brazil and has managed to cut cost per ounce significantly in recent years. Though its share price isn’t as high as it once was, Eldorado is well positioned to make significant advancements in the near-term.

In 2018, Eldorado produced over 349,000 ounces of gold, well above its previous expectations, and is set to boost production even further in 2019. Additionally, Eldorado is planning increased cash flow and revenue growth this year.

Eldorado’s President and CEO, George Burns, stated: “As a result of the team’s hard work in 2018, we are well positioned to grow annual gold production to over 500,000 ounces in 2020. We expect this will allow us to generate significant free cash flow and provide us with the opportunity to consider debt retirement later this year. “

Kinross Gold Corporation (NYSE:KGC, TSX:K)

Kinross Gold Corporation is relatively new on the scene, founded in the early 90s, but it certainly isn’t lacking drive or experience. In 2015, the company received the highest ranking for of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies.

While Kinross posted a significant loss in the fourth quarter of 2018, the company is making strong moves to turn around its earnings, including the hiring of a new CFO, Andrea S. Freeborough.

“Andrea’s successful track record at Kinross and throughout her career, including accounting, international finance, M&A, and deep management experience, will be an excellent addition to our leadership team,” said Mr. Rollinson, CEO of Kinross. “We have great talent at Kinross and succession planning is a key aspect of retaining that talent for the future success of our Company.”

Yamana Gold (NYSE:AUY, TSX:YRI)

Yamana, has recently completed its Cerro Moro project in Argentina, giving its investors something major to look out for. The company plans to ramp up its gold production by 20% through 2019 and its silver production by a whopping 200%. Investors can expect a serious increase in free cash flow if precious metal prices remain stable.

Recently, Yamana signed an agreement with Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

The agreement is a major step forward for the Agua Rica region, and all of the miners working on it.

Pan American Silver (NASDAQ:PAAS, TSX:PAAS)

Pan American is a world-class mining operation with active projects in Mexico, Peru, Canada, Bolivia and Argentina. Though silver has seen better days, it is still a favorite among investors stocking up on safe haven assets.

Recently, Pan American made a major acquisition of Tahoe Resources, absorbing the company’s issued and outstanding shares.

Michael Steinmann, President and Chief Executive Officer of Pan American Silver, said: "The completion of the Arrangement establishes the world's premier silver mining company with an industry-leading portfolio of assets, a robust growth profile and attractive operating margins. We are also now the largest publicly traded silver mining company by free float, offering silver mining investors enhanced scale and liquidity."

First Majestic Silver (NYSE:AG, TSX:FR)

Though First Majestic recently took a significant blow, as a strong dollar weighed on precious metals resulting in a poor quarterly earnings report, there’s still a lot of bullishness surrounding the stock. Adding to the negative numbers, however, was a string of highly valuable acquisitions which are likely to turn around for the metals giant in the mid-to-long-term.

While it’s primary focus remains on silver mining, it does hold a number of gold assets, as well. Additionally, silver tends to follow gold’s lead when wider markets begin to look shaky. And with analysts sounding the alarms of a global economic slowdown, both metals are likely to regain popularity among investors.

Further boosting its portfolio, the company also entered a share-repurchase program, as it feels that its stock is. at the moment, undervalued, and will benefit all shareholders by increasing the value of the stock.

By. Alexander Stebbing

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Euro Sun Mining, Inc. to conduct investor awareness advertising and marketing. Euro Sun Mining paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. Euro Sun Mining also paid the Publisher additional sums as compensation for other marketing services earlier this year. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, the success of the company’s exploration operations, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.