Last week Allergan paid $560 Million cash to acquire Naurex, a company developing a next-generation anti-depressant that mimics the promising activity ketamine has shown in treating depression. Naurex has completed two Phase 2 studies that have proven the mechanism, robustness, and quick onset of drug-candidate GLYX-13 versus the slow-acting SSRIs and SNRIs that carry black-box warning and don’t ‘work’ in majority of depression patients. But the acquisition points to an even bigger opportunity that NO ONE noticed – the only remaining company developing an anti-depressant for SSRI/SNRI resistant depression patients using the promising NMDA receptor target is VistaGen Therapeutics (VSTA) - which trades at less than 1/4th of the purchase price of Naurex.

VSTA is initiating a Phase 2 study of their NMDA receptor drug candidate in September, which we believe will create visibility for this undervalued company. As notable arbitrage opportunities in biotech have shown, the gap between what Allergan paid for Naurex - $560 Million - and VistaGen’s fully diluted valuation - $130M – may not last long.

The potential upside to the arbitrage trade, in our view, is 330%. With critical Phase 2 data expected from VSTA in 2016, we believe the results will command investor attention as major depressive disorder (herein referred to as ‘depression’) remains a multi-billion dollar unmet need.

Glaxo’s Development of Next-Generation Migraine Drug Explains Upside Opportunity for a Next-Generation Depression Drug.

Triptans, a class of anti-migraine drugs commercialized in the 1990s, created a multi-billion dollar revenue stream for AstraZeneca (AZN), Merck (MRK), Pfizer (PFE) et al. after GlaxoSmithKline (GSK) developed and launched 'Imitrex'. Glaxo relied on studies that showed promise in treating migraines with a serotonin (5-HT) agonist. However, 5-HT carried side-effects that would limit its real world use. Glaxo developed Imitrex as a 'safe' alternative to 5-HT with the same mechanism of action. This spurred development of dozens of derivatives and copy-cat Imitrex drugs for the treatment of migraines, producing billions in sales for large pharma and generic drug makers.

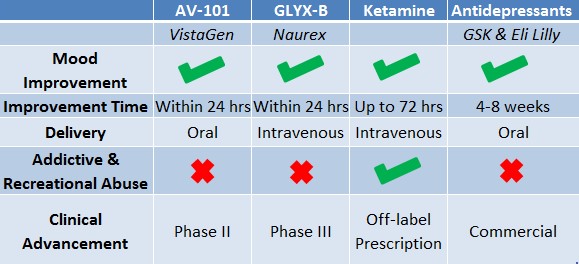

VistaGen's AV-101 and Naurex's GLYX-13 are drugs that aim to mimic the mechanism of ketamine in treating depression while forgoing its side-effects, including addiction and psychosis. Dr. Carlos Zarate's studies at the National Institute of Mental Health showed that ketamine, a N-methyl-D-aspartate ("NMDA") receptor antagonist, produced rapid and robust antidepressant effects.

Robust Activity, Favorable Safety Profile

AV-101 and GLYX-13 are NMDA modulators, which supports an impressive safety profile distinct from ketamine - a channel blocker. As with the studies that demonstrated promise in targeting the 5-HT receptor for the treatment of migraines, researchers' understanding of the role of ketamine as an anti-depressant has spurred development of a new-generation of drugs for depression. This is important because most patients do not respond to the current standard of care for treating depression - a class of drugs known as selective serotonin reuptake inhibitors (“SSRIs”) and serotonin-norepinephrine reuptake inhibitors (“SNRIs”) - and those that do respond suffer from drawbacks such as lengthy time for the anti-depressant drugs to work and an increase in suicidal thoughts while waiting for the drugs to have the desired anti-depressant effect. This explains why SSRIs carry a black-box warnings from the FDA.

By contrast, AV-101 and GLYX-13 produce a fast-acting anti-depressant effect versus the several days, weeks or even months it takes for SSRIs/SNRIs to ‘work’.

In the 1990s, Glaxo knew that Imitrex could be a blockbuster product because migraines affected millions of people in the US, Europe and rest of world. An estimated 1-in-10 Americans take anti-depressants, with the World Health Organization estimating that depression affects 350M people worldwide.

Why VSTA Should Command a Premium to Allergan’s $560 Million Acquisition of Naurex

VistaGen is the only publicly-traded company developing a depression drug - AV-101 - based on NMDA receptor activity.

More importantly, GLYX-13, or Naurex's lead candidate, while more advanced clinically vs. AV-101, is an IV-administered drug. AV-101 is an oral drug. When Glaxo introduced Imitrex, it was limited to intravenous (IV) delivery and sales were in the hundreds of millions. When Glaxo introduced a tablet and nasal-spray version of Imitrex, sales grew to over a billion per year. The advantages of an oral drug versus one that requires a patient to attend a clinic to be administered the same drug by IV is clear - convenience and [typically] better compliance. There are countless examples where drugs that had robust activity in oral form easily trumped sales of earlier forms of the same drug administered by needle or through IV.

Figure 1: VistaGen’s AV-101 is orally-available like existing Anti-Depressants, But with Potentially Superior Activity

Allergan's acquisition of Naurex for $560 Million clearly articulates the acquirer’s view that a Phase 2 IV-drug targeting the NMDA receptor for the treatment of depression is worth >$560M. This supports our view that if AV-101, VistaGen's oral NMDA receptor, can mirror GLYX-13 in activity in their upcoming Phase 2 study, an acquirer would likely pay a substantial premium to $560M own VSTA outright.

Companies developing drugs to treat large unmet needs, eg. depression, with novel mechanisms, eg. targeting NMDA receptor, are fetching increasingly lucrative takeout offers. Below we look at several paired trades where an IPO or involvement of a sophisticated investor created an arbitrage opportunity between what an existing publicly-traded company was valued at in the market and the valuation a closely-related competitor or company with a comparable technology would fetch in an IPO. The examples we use in Aduro/Advaxis and NantKwest/Sorrento are by no means exhaustive; we could have just as easily proven that companies developing CAR-T immunotherapies to treat cancer or gene therapy companies have validated one another and created huge market capitalizations and attracted enormous capital from both institutional and corporate investors. In either event, these paired trade examples which created triple-digit returns for shrewd investors explain exactly why VSTA should see triple-digit upside itself, on the tailwind created by Allergen’s $560 Million acquisition of Naurex.

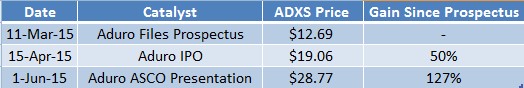

Case 1: Aduro’s $1B+ Rumored IPO Helped Spur Shares Of Closely-Related Advaxis 127% In 4 Months.

Aduro (ADRO) and Advaxis (ADXS) are the only two companies developing cancer immunotherapies that use genetically modified listeria to stimulate an anti-tumor response. In April, Aduro’s rumored IPO and an investment from Novartis was a catalyst that made listeria-based cancer vaccines exciting. When Aduro filed its prospectus in March, Advaxis was valued at about $400M, or at a 60% discount to the rumored $1B valuation that Aduro was expecting in their IPO.

Sophisticated investors viewed this discrepancy as an opportunity to buy Advaxis to own a comparable technology at a substantial discount to Aduro. In the prospectus risk section, Aduro acknowledged that there were third parties using “listeria-based vaccines to treat certain cancers”, thereby confirming the science between the two companies had fundamental similarities. Yet, one company was valued more than double the other.

By the time Aduro filed its IPO on April 15th, the bullish sentiment surrounding the newest addition to the public immunotherapy realm had spilled over to Advaxis - the only other company with listeria-based cancer vaccines in clinical trials. Advaxis stock had rallied 50% in a month. The momentum continued into ASCO 2015 when Aduro presented encouraging Phase 1b data for treatment of Mesothelioma. By then, Advaxis stock was up 127%, as shown in Figure 1 (below).

Figure 2: Advaxis Rallying on Aduro’s rumored and actual IPO valuation.

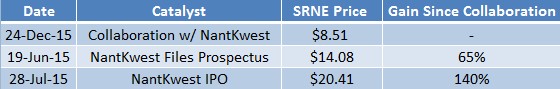

Case 2: NantKwest IPO Puts Spotlight On Sorrento; Shares Climb 140%.

Last week, NantKwest (NK) offered 8.3M shares at $25 apiece, raising $207 million in its IPO. NantKwest opened at $37 and now trades around $30. At its offering price, NantKwest reached a fully diluted market capitalization of $2.6 billion, the largest valuation given to a biotech IPO.

Sorrento shared the spotlight with NantKwest as the company owns about 3.03M shares (~3.5%) of NantKwest stock through their announced collaboration on NantKwest’s CAR-TNK platform. In December 2014, the two companies entered into a partnership to develop CAR-TNK immunotherapies for treatment of cancer and infectious diseases. This technology platform combines NantKwest’s Natural Killer (NK) cell-line therapy with Sorrento’s G-MAB antibody library to further enhance the body’s first line of defense against diseased cells.

NantKwest’s billionaire Chairman & CEO Patrick Soon-Shiong owns 19.9% of Sorrento and a 57% interest in NantKwest. Sorrento’s CEO Henry Ji also sits on NantKwest’s board. Shiong’s large bet on Sorrento and the valuation underwriters assigned NantKwest created an arbitrage opportunity that led to a rise in the share price and valuation of Sorrento, as shown in Figure 2 (below). For instance, shares of Sorrento are up 45% since NantKwest filed their prospectus in June.

Figure 3: Sorrento Shares Up 140% Since On The Heels of NantKwest Collaboration, IPO

Owning VSTA Could Mean Triple Digit Upside, With Arbitrage Opportunity Representing 330%+

On a fully-diluted basis, VistaGen trades at roughly 1/4th of what Allergan paid to acquire Naurex and their lead drug candidate, GLYX-13, an IV-administered NMDA receptor with a favorable safety profile to the ketamine activity that has shown promise in treating depression. Put another way, VSTA trades at a 77% discount to what Naurex was acquired for in Allergen’s all cash-deal.

Since the Naurex acquisition was announced last week, we believe the market has had ample opportunity to evaluate the news. The arbitrage opportunity between what VSTA currently trades at ($130M), and what Naurex was acquired for ($560M), is not for lack of awareness of the NMDA receptor as a promising target for treating depression or Naurex – and certainly not for lack of ‘awareness’ of the $130B company Allergan. We believe the arbitrage opportunity in owning VSTA stems from (i) a lack of awareness of VSTA and (ii) a lack of awareness that VSTA is the only remaining player targeting the NMDA receptor for treatment-resistant depression.

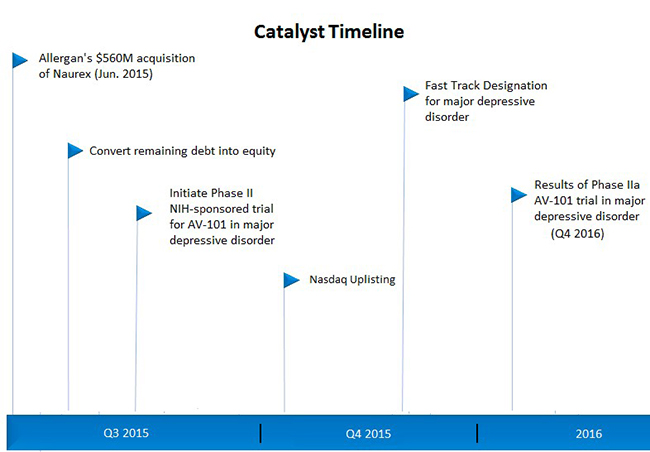

Further, as with Aduro/Advaxis, or Sorrento/NantKwest, we think visibility of VSTA among investors will improve substantially over the near-term. For instance, VSTA has been validated by one of the top thought-leaders in the depression space, Dr. Zarate, who is Chief of Experimental Therapeutics & Pathophysiology at the National Institute of Mental Health (NIMH) – the largest scientific organization in the world dedicated to mental health research. The NIMH has funded all of VSTA’s clinical studies to-date and committed to funding their first Phase 2 trial slated to start in September. To-date, NIMH funding for development of VSTA’s AV-101 is $11.3 Million.

We believe the initiation of a proof-of-concept Phase 2 study in September will create visibility that VSTA has thus far lacked. Results of this Phase 2 study, expected in 2016, would put VSTA on a similar footing with Naurex today, as Naurex’s impressive activity in GLYX-13 has significantly de-risked VSTA’s lead drug candidate and is partially predictive of what investors may see from VSTA’s Phase 2 study results. If VSTA returns results in-line with Naurex’s Phase 2 data, we believe the arbitrage opportunity will cease to exist given the clear preference an acquirer would give to an oral drug (VSTA’s AV-101) over an IV drug (Naurex’s GLYX-13). Should this transpire, and barring uncertainties and risks inherent in drug development, VSTA shares could see upside of 330%+.

Figure 4 (below) shows a timeline of catalysts that could make the current arbitrage opportunity in VSTA shares non-existent by 2016.

Figure 4: Series of Events That Could Spark VSTA Rally

Here’s What VSTA Needs To Do To Score a $560 Million+ Exit, Like Naurex.

If ever the phrase ‘when in Rome, do as the Romans’ had application in explaining valuation arbitrage between two companies, it’s best used to explain that if VistaGen’s AV-101 can do what Naurex proved in its Phase 2 evaluation of GLYX-13, then VSTA should be able to score an exit like Naurex at $560M+.

In September, VSTA starts a Phase 2a study of AV-101 at the NIMH. Here’s what Naurex reported from their Phase 2a study:

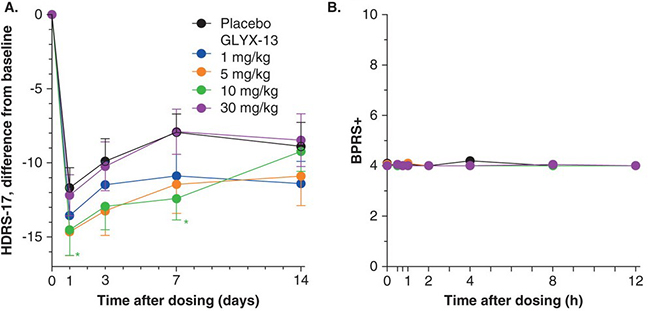

A single dose of GLYX-13 reduced depression scores (measured by HDRS-17- as shown in Figure 5, below) in subjects who had failed at least one prior antidepressant treatment. The reductions were evident within 24 hours and lasted for an average of 7 days. No serious adverse events were reported (measured by BPRS+- above right), but 10% of subjects did report dizziness versus none on placebo.

Figure 5. Phase 2a Study Results of Naurex in Depression

VistaGen’s Phase 1 data showed statistically significant improvements in patient mood within 24 hours and no serious adverse events in two studies evaluating the orally available AV-101. If these results are repeated in the Phase 2a study in September, this would put AV-101 on an equal footing with Naurex’s Phase 2a study results and further suggest that AV-101 could successfully advance to a registration or Phase 3 study. And, as we’ve articulated in sections prior, we believe positive Phase 2a data would command a valuation of $560M+ for VSTA on the tailwind that Allergan’s acquisition of Naurex just created – but NO ONE has yet noticed.

On a fully diluted basis, VSTA shares would be worth $51 if valued at Naurex’s acquisition price. VSTA currently trades at ~ $12/share. We view this is a compelling arbitrage opportunity and see upside in owning the name.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC. One Equity Research LLC has not been compensated for this note but may engage Vistagen Therapeutics (the "Company") or any issuer mentioned in this note in a research coverage agreement in the future. This research note is not an offer or solicitation to buy or sell the securities of any issuer mentioned. The report is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. An affiliate of One Equity Research LLC is long shares of Advaxis as of the date of this note and may sell at any time. Please read our full disclaimer at http://www.oneequityresearch.com/term