Global demand for batteries is forecasted to rise 7.7% per year to $120B by 2019, driven by the rapidly expanding production of hybrid/electric vehicles and investment in energy storage systems to provide backup power. With battery technologies on the cusp of breakthrough innovation, icons Elon Musk and Warren Buffett have taken notice and gotten involved. Following “smart money” (in the most literal sense) would lead investors to pervasive trends in the battery space.

Lithium-Ion’s Sudden Explosion Proves Change Is Slow

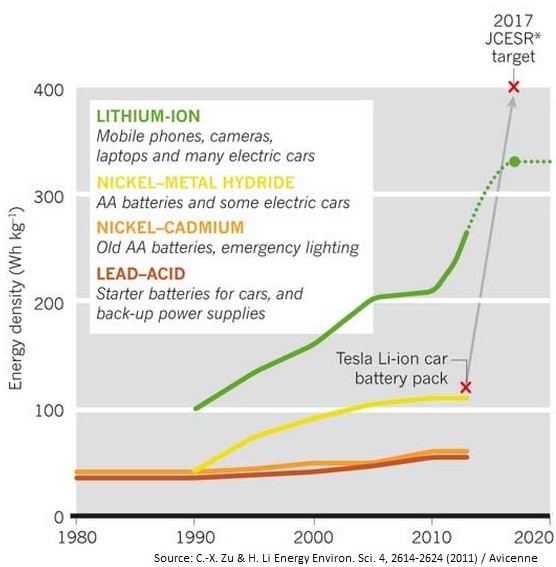

The first commercial versions of lithium-ion batteries were sold by Sony back in 1991, holding less than half the energy by weight and costing 10x more than today. Though this battery technology has been around for nearly a quarter century, li-ion batteries became prevalent with the increased popularity of Tesla’s (TLSA) electric vehicle. Nowadays, lithium-ion batteries are the predominant choice for most personal electronics and electric cars because they have a higher energy density than alternatives.

Figure 1: Li-ion Batteries Have Nearly Triple Energy Density of Other Batteries

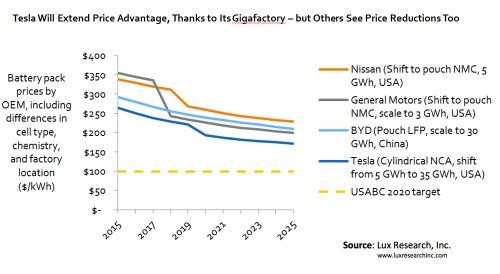

Some researchers think that improvements to li-ion cells have hit a peak and any further advancements would only squeeze in at most 30% more energy by weight. On the cost front though, industry leaders, including Panasonic-Tesla, can expect to see costs for battery packs fall by up to 35% by 2025, to $172/kWh, according to Lux Research.

Buffett backed BYD Company (BYDDY) which claims to be the largest supplier of rechargeable batteries in the world, is challenging Tesla/Panasonic for top spot in battery capacity. The Chinese company is ramping production from 10 GWh capacity at the end of this year to about 34 GWh of batteries by 2020. This would put it about even with Tesla's planned $5 billion Nevada gigafactory that is expected to produce 35GWh of batteries annually by 2020.

Figure 2: EV to Become Cheaper as Li-ion Costs Expected To Fall to $172/kWh

A peer-reviewed analysis found that lithium-ion battery prices have come down about 14% per year since 2007 on the strength of volume production and technology. With the Gigafactory production facility, in partnership with Panasonic, Tesla is planning to continue this cost cutting through scale, location proximity and further innovation.

Energy Storage Blasting Past Li-Ion

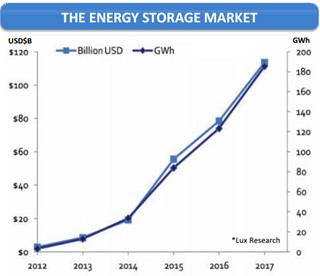

Figure 3: Energy Storage Market Could Grow Faster Than Innovation in Lithium Ion

Lux Research is expecting an explosion in the energy storage market due to demand from China and Western European nations. In 2012 lithium-ion batteries made up nearly 80% of the energy storage market, but it is expected that by 2017 they will only capture about 13% due to advancements in cheaper alternative batteries. Due to added costs, such as power conditioning systems, land, construction and integration associated with the storage market, prices will range between $498- $655/kWh. Lithium-ion battery producers must further reduce costs, or they risk losing a lot of market share.

Roof-top solar energy provider Solar City (SCTY) partnered with Tesla on the new Tesla Powerwall home batteries to act as the backup power supply. Though this technology has massive disruptive potential, the cost of lithium-ion batteries is a current concern (as explained above). As a result, SolarCity will only offer the larger 10kWh sized battery, which is only intended to be used as occasional backup when electricity goes out. The 7kWh version made for daily use doesn’t make financial sense, indicating that only way for this partnership to realize potential is if the cost of lithium-ion batteries continues its downward trend.

ZBB Energy Corp (ZBB) is a pure play for investors looking to take advantage of the explosive energy storage market. ZBB serves the utility and commercial segments of the energy storage market with their EnerStore flow battery. EnerStore is built in 50kWh batteries and expandable to 500kwH in one singular enclosure by linking 10 batteries. With multiple enclosures, EneStore can provide up to 2mWh. Unlike most batteries, EnerStore’s electrodes don't take part in the chemical reactions; they are simply substrates for the reactions. That means no loss of performance from repeated cycling that typically causes electrode material deterioration. ZBB EnerStore technology is based on the reaction between zinc and bromide, a cheaper alternative to lithium-ion that can potentially eat into the energy storage market share.

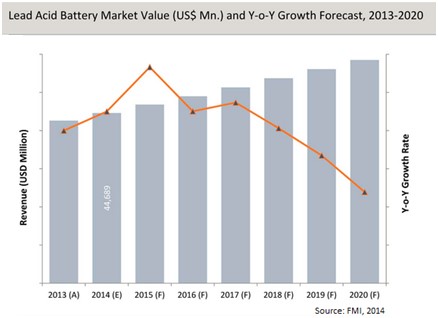

Integral’s Breakthrough Could Help Keep Lead-Acid Batteries at the Top

The global lead acid battery market is projected to reach US$58.5B by 2020 at an estimated CAGR of 4.6%. Though growth rates of lead-acid batteries are slowing, it is the most common rechargeable battery system in the world, with a market share of as much as 40%.

Figure 4: Lead-Acid Battery Growth Slowing Amid Competitive Pressures

While every other battery is out to disrupt the conventional technology, lead-acid batteries have proven to be reliable, durable and offer relatively low maintenance cost than other alternatives. The slowing growth, however, is due to the technical limitations of lead-acid batteries which include low energy density and heavy weight.

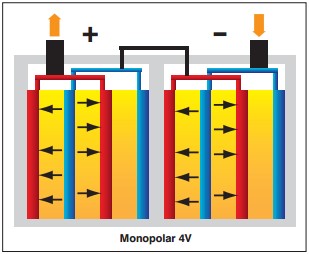

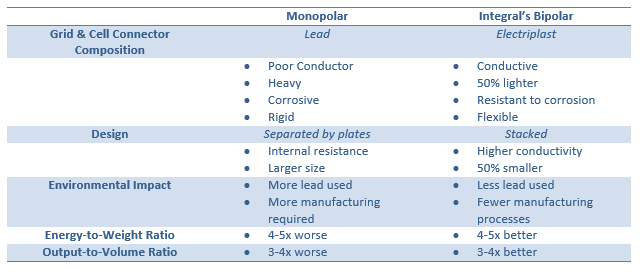

For years most batteries have been made with conventional ‘monopolar’ technology which uses two plates per cell and connects these cells in a series of metallic connectors outside of the cell or through a wall (see below).

Figure 5: Monopolar Design Inefficiently Places Lead Plates

This design results in ohmic losses (power dissipation due to internal resistance) within the plates. Additionally, because the grid and cell connectors are made of lead (a poor conductor of electricity), the total weight of the battery is increased as lead accounts for about 65% of weight while current delivery isn’t positively amplified in any way.

Integral Technologies (ITKG) is developing a bipolar plate to enhance lead-acid batteries.

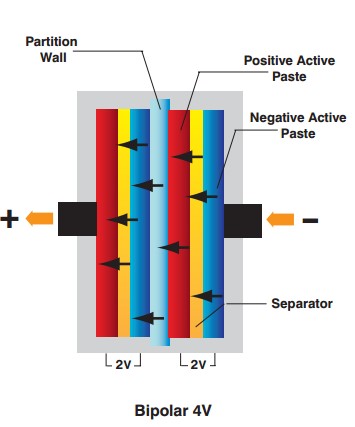

Figure 6: Bipolar Design has More Energy Capacity and Is Lighter

A bipolar designed battery has cells stacked in a sandwich construction so that the negative plate of one cell becomes the positive plate of the next cell (above). These cells are separated from each other by ITKG’s bipolar plate which allows each cell to operate in isolation, thereby leading to higher conductivity. By eliminating the top lead with Integral’s Electriplast, a conductive carbon fiber reinforced material that can displace heavier metallic components, batteries are at least 50% lighter in weight and at least 50% smaller.

The main problem limiting the commercialization of bipolar lead-acid batteries has been the availability of a lightweight, inexpensive and corrosion resistant material for the bipolar plate, and the technology to properly seal each cell against electrolyte leakage. Integral’s bipolar plate is made using polymers and metals resistant to sulphuric acid so there is corrosion resistance.

Integral expects the energy-to-weight ratio to be 4-5x better than current lead-acid batteries while its power output-to-volume ratio is expected to be 3-4x greater as well. In other words, the new lead-acid battery technology will be able to package the same energy and power into three to four times lighter and three to four times smaller battery packages, making lead acid battery competitive with lithium ion technology.

Figure 7: Integral’s Bipolar Plate is a Breakthrough for Lead-Acid Battery Technology

Bipolar Lead Acid Batteries Are All Substance No Glamour

Integral’s breakthrough in lead-acid batteries does not share the same appeal as lithium-ion’s headline grabbing progress. Due to this, markets have overlooked this wave of innovation. Investors realizing the advantages of Integral’s biopolar lead-acid batteries will understand that this innovation eliminates the need for multiple components within the battery and the use of expensive material. At the end of the day this results in a lighter and cheaper battery that is highly conductive and perhaps comparable to lithium-ion.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

This research note has been prepared by One Equity Research LLC on behalf of LPF Communications (“LPF”) as part of research coverage services of Integral Technologies (the “Company”). One Equity Research has received forty nine thousand nine hundred forty dollars from LPF, a shareholder and adviser to the Company, as of the date of this note and expects to receive fifty thousand restricted common shares of the Company as well as additional compensation in the future. This research note is not an offer or solicitation to buy or sell the securities of Integral Technologies. The note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/