The economy is reopening, stock markets are already bouncing back in a hedge on the future, and we’re about to see the biggest shift in capital in years.

It’s a big money shift away from tradition and towards a future in which retail investors--and major hedge funds--demand that their investments go into companies that are sustainable.

It’s not politics or ideology. It’s not right or left. It’s pure free-market sentiment dictating what happens after the lesson the market has learned before and during a global pandemic:

Welcome to the $30-trillon-plus mega trend of sustainable investing, otherwise known as ESG (environmental, social and governance) Investing.

And welcome to one of the new companies positioned to give big capital exactly what it’s looking for: Canada’s Facedrive ( TSXV:FD,OTC:FDVRF), the competitor to Uber that’s working to turn ride-sharing into a sustainable, more carbon-neutral industry.

Even better, while Uber has been burning cash like crazy for a decade and still isn’t profitable, Facedrive has an entire ecosystem of revenue generation setups that treat ride-sharing as much more than a ride: It’s a high-tech business segment that has many ways to generate revenue while the wheels are rolling.

Where Big Money Will Go To Multiply

Even before COVID-19, Big Money was shrugging off tradition, increasingly in favor of ESG investing, which hit $30 trillion even before the pandemic.

What the pandemic did was bring the enormous potential threat of climate change into clearer focus. The new investment thesis rationale is this: If we weren’t 100% sold on the threat of climate change, we also weren’t 100% sold on a global pandemic after so many previous scares that turned out to be overblown.

The new investment thesis ties into risk mitigation and reputation. Companies that can’t withstand a crisis aren’t good investments. Likewise, companies that will be continually called out in social media for contributing to crises are also taking on too much risk in relation to future returns.

Gone may be the days when everyone across the board will throw endless amounts of cash at a company like Uber that contributes to pollution, constantly spars with authorities and its own drivers, and burns cash without making a profit.

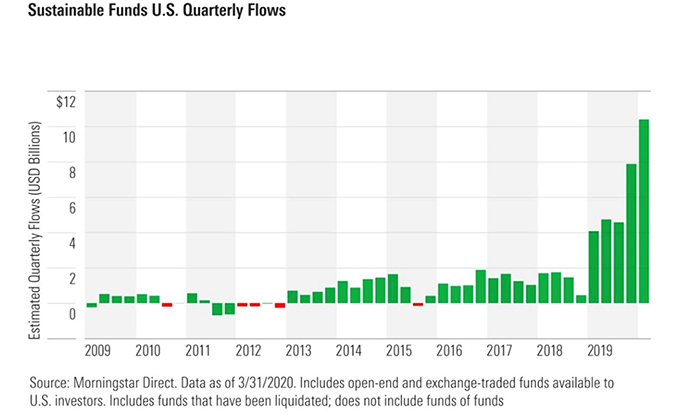

Tradition has been in the throes of a slow death since 2009:

And then came the pandemic, which has so far seen sustainable investments wildly outperformed conventional in Q1 2020.

Instead, big capital will start looking at ride-sharing 2.0, ushered in by Facedrive in 2019.

Facedrive knows sustainability. Its business model is about “people and planet first”. It also knows risk mitigation, views its drivers as integral stakeholders, and views ride-sharing in general as far more than a way to get from Point A to Point B. It’s targeting multiple revenue streams.

The Risk Mitigation Ride

Facedrive is transforming the ride-share space into something that everyone can get on board with.

It’s the first platform to offer a carbon-neutral solution by giving riders a choice of EVs or hybrids, and by planting trees along the way to offset emissions for any conventional rides.

That means a lot when you consider that the average U.S. ride-hailing trip results in 69% more pollution than whatever transportation options it displaced.

A highly strategic acquisition in March also saw Facedrive expand far beyond the first-and-last mile that is usually associated with ride-sharing. Facedrive acquired HiRide, an innovative new Canadian startup that emerged from Ontario’s “Technology Triangle” to rewrite the rules of long-distance car-pooling and bring it into the high-tech mobility fold.

Now, Facedrive covers every mile, and it’s about to expand into the United States and Europe.

Along the way, it’s unleashing plans for revenue stream after revenue stream because it doesn’t view ride-sharing as a simple “ride”. It views ride-sharing as part of a much larger ecosystem--and a much more profitable one than Uber pursued as it prepares, a decade later, to lose more than $1 billion this year. So much for Uber’s $100 billion valuation wishes.

Facedrive is already on the front lines of the COVID-19 battle, providing discounted rides for healthcare workers, developing the new TraceSCAN app to help keep communities and families safe by detecting instances of infection, and organizing a medical delivery service that keeps high-risk groups from unnecessary exposure.

Once the pandemic subsides, Facedrive will have an already proven and established healthcare initiative that includes specialized vehicles for anyone with additional needs to contactless delivery of essential over-the-counter medicines and medical supplies with high-tech management of automatic refills.

Facedrive’s entire ecosystem is about earning revenue from the rider relationship, keeping in mind that millennials want an all-inclusive experience.

The innovative high-tech mobility company has also rolled out Facedrive Foods, focused on sustaining relations between local food suppliers and restaurants and the communities they serve. And in line with the sustainability and impacting investing theme, they aim to provide riders with healthy choice deliveries.

Facedrive Foods, which is now piloting in six cities in Ontario and will expand to other regions soon.

But last week, Facedrive Foods provided a glimpse as to how serious the company is in targeting the Canadian food delivery industry. To kick-off its aggressive expansion drive in the segment, Facedrive Foods entered into a binding term sheet to acquire assets of Foodora Canada. This move is especially significant because Foodora Canada is a subsidiary of Delivery Hero, a $20 Billion European multi-national food delivery service that operates in over 40 countries internationally and services more than 500,000 restaurants.

Facedrive Foods acquisition of Foodora Canada’s assets would give Facedrive a billion dollar boost and huge jump on its major Canadian food delivery competitors such as Uber Eats and Skip The Dishes. Facedrive would obtain instant access to hundreds of thousands of Foodora Canada’scustomers, and 5,500 new restaurant partners. With this move, Facedrive Foods would overnight position itself into the top echelon of Canadian food delivery services and turn up the heat on major incumbents in the space.

Nor does the ecosystem end here: No successful millennial-driven platform is anything without their own “merch” to go along with it. That means celebrity tie-ins for big branding.

Will Smith’s Bel Air Athletics clothing brand is betting that Facedrive is the ride of the future. That’s why he’s co-branding an entire line of merch with Facedrive.

It’s also why WestBrook Inc., the company Smith shares with his wife Jada Pinkett Smith, is partnering with this environmentally conscious startup that is now expanding globally to challenge Uber in more countries.

Some 1,000 new products co-branded by Bel Air and Facedrive are ready to launch, with pre-orders coming soon on the Facedrive website. And it’s all sustainable, made in North America.

Uber was a taxi replacement. Facedrive is a lifestyle.

It’s a lifestyle that is not only positioned to survive the coronavirus culling but to thrive in the new environment that has big money moving away from tradition and whole-heartedly towards companies who understand the risk we all face.

COVID-19 has shown us exactly how deeply interconnected our basic systems of survival are, whether it’s to battle a virus or fight climate change. Facedrive figured this out back in 2016. Now it’s ready to launch globally, and the timing is indeed evolutionary.

Canadian companies looking to capitalize on the $30 trillion sustainability push:

Let’s start with some Canada’s renewable energy push. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Polaris Infrastructure (TSX:PIF) Is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:WPRT) is a renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

Take telecom giant Shaw Communications Inc (TSX:SJR.B), for example. Shaw is taking a leadership role among Canadian telecom providers through its use of renewable energy, In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

BCE Inc (TSX:BCE) is another Canadian telecom giant going to great lengths to reduce its carbon footprint. For the past 25 years, BCE has been at the forefront of the environmental movement. Their environmental management system (EMS) has been certified to be ISO 14001-compliant since 2009.

By. Paul Cantle

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that the demand for environmentally conscientious ride sharing services companies in particular will grow and take a larger share of the market; that Facedrive’s marketplace will offer many more sustainable goods and services, and grow revenues outside of ride-sharing; that new products co-branded by Bel Air and Facedrive are ready to launch, with pre-orders coming soon on the Facedrive website; that Facedrive can achieve its environmental goals without sacrificing profit; that Facedrive Foods will expand to other regions outside southern Ontario soon; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plan. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract a sufficient number of drivers to meet the demands of customer riders; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; that the products co-branded by Facedrive may not be as merchantable as expected; the ability of the company to keep operating costs and customer charges competitive with other ride-hailing companies; and the company’s ability to continue agreements on affordable terms with existing or new tree planting enterprises in order to retain profits. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. An affiliated company of Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has signed an agreement to be paid in shares to provide services to provide marketing and promotional activities to expand ridership and attract drivers. In addition, the owner of Oilprice.com has acquired additional shares of Facedrive (TSX:FD.V) for personal investment. This compensation and share acquisition resulting in the beneficial owner of the Company having a major share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.