At $8 per share, Lightlake Therapeutics (LLTP) is the cheapest biotech company with an approved therapy for a >$1 Billion unmet need. The November 19 FDA approval of Lightlake’s NARCAN nasal spray is expected to trigger an initial $3.75 Million milestone payment to LLTP, which trades at just $15 Million.

We believe that improved visibility expected with an uplisting to NASDAQ will be transformational for LLTP and mirror what investors have seen with Anavex (AVXL). We believe LLTP's partner, Adapt Pharma, which is backed by $95 Million and led by the group that founded & sold Azur to Jazz Pharma for $500M in 2011 (a deal now worth $2 Billion), validates LLTP the same way Dr. Patrick Soon-Shiong has Sorrento (SRNE) or Martin Shkreli has KaloBios (KBIO).

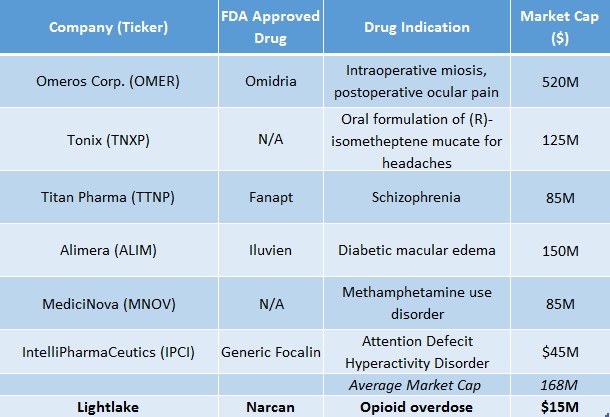

In the last 12 months, LLTP has (i) taken a drug from R&D to commercialization while preserving the integrity of its capital structure with $6.35M in non-dilutive capital at an implied valuation 4X greater than current market price; (ii) struck a licensing deal for $55 Million in milestone payments plus royalties and completely shifted risk over to a commercial partner with a proven track-record in specialty pharma sales; and (iii) is still valued at an estimated enterprise value of $11M, while it's FDA approved drug addresses a billion dollar pandemic.

LLTP Disrupts Billion Dollar Market - To The Chagrin of Indivior, Amphastar, PDL BioPharma

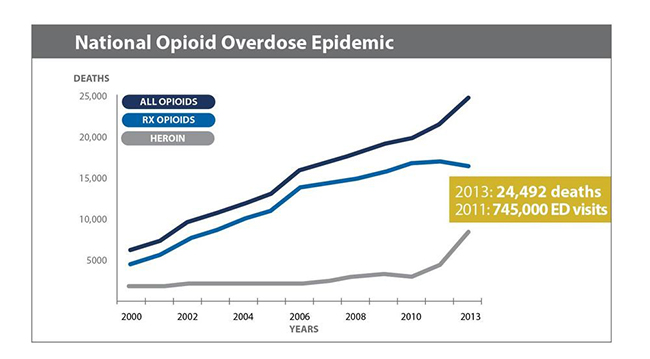

On November 19, 2015 the FDA approved Lightlake’s lead product-candidate, NARCAN nasal spray. NARCAN is the branded name for naloxone, an opioid antagonist used to reverse opioid overdose. If you haven’t heard, overdose caused by opioids has reached epidemic proportions in the United States, as shown in Figure 1, below.

Figure 1: Overdose Deaths Have Quadrupled Since 2000

Lightlake’s commercial partner, Adapt Pharma, bought the rights to the NARCAN name earlier this year[4]. Turns out, ‘NARCAN’ is almost as widely, if not more widely, searched for as ‘naloxone’, its generic name. For purposes of commercialization, this gives Adapt Pharma a quick path to ramp sales in an estimated $1 Billion market.

Lightlake’s innovation is a device that administers naloxone intra-nasal, or through the nose. LLTP’s intranasal spray was approved by the FDA in less than 4 months after submission. Comparably speaking, Indivior’s intranasal naloxone is still pending a decision from the FDA despite having been submitted 3 months before LLTP[2]. Likewise, Amphastar (AMPH) - who markets a syringe naloxone - is scrambling to submit an application to the FDA for an intranasal naloxone, but is well behind both Indivior and notably, LLTP.

In 2014, privately-held kaleo borrowed $150 Million from PDL BioPharma (PDLI) to market EVZIO, a naloxone ‘auto-injector’. Compared to the generic drug in a syringe, which costs $30+ per dose[3], EVZIO was priced at upwards of $500 per dose[1]. Private and government payers have stepped up to reimburse for EVZIO. Even private foundations, like the Clinton Foundation, have stepped up to finance EVZIO in order to get it in the hands of laymen and, potentially, save lives. What kaleo/PDL BioPharma have effectively done is spent millions creating awareness for [better] alternative forms of naloxone that the average person can administer, compared to naloxone in a syringe, which requires a medical professional. They’ve also created enormous pricing power for companies like LLTP, which now has a FDA-approved naloxone in a disruptive non-needle form.

Figure 2: Nasal spray (on the right) carries none of the infection risk prevalent with needles (on the left).

Azur’s FAZACLO Took 9% Market Share, Before $500M Acquisition by Jazz Pharma. Azur Founder Now Commercializing LLTP’s Opioid OD Drug.

In December 2014, Lightlake partnered with Adapt Pharma to commercialize nasal naloxone. LLTP is entitled to $55 Million in regulatory and sales milestone payments from Adapt, which raised $95 Million in 2014 to in-license and market specialty pharma products. Adapt co-founders Seamus Mulligan, Eunan Maguire and David Brabazon personally invested at least $86 of the $95 Million raised.

Interestingly, LLTP’s nasal naloxone appears to be the primary focus of Adapt Pharma’s activities. This is validating because Adapt Pharma’s founders built their previous start-up, a company called Azur Pharma, to $100M in revenues. They were then acquired by Jazz Pharma in a $500 Million stock-swap in 2011. The acquisition was worth upwards of $2 Billion this year.

But before Azur was acquired, Seamus and his partners bought an antipsychotic drug called FazaClo, which is used to treat schizophrenia. In 3 years Azur’s FazaClo captured 9% market share. FazaClo made up 40% of Azur’s sales when Jazz bought them.

This background proves two things: Adapt Pharma is led by a group of entrepreneurs with a proven-track record in specialty pharma product commercialization and shareholder value-creation. Both bode well for LLTP, which trades at a valuation that completely ignores the fact that if Adapt were to capture 9% of the opioid overdose market with NARCAN nasal spray, the royalty to LLTP would likely be $8-9 Million.

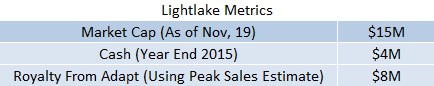

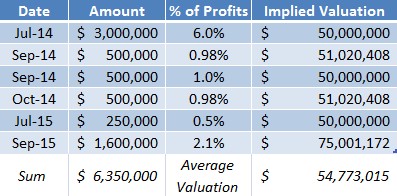

Figure 3: Market Inefficiency Evident In LLTP’s Current Valuation

FDA Approval. Top Commercialization Partner For An Unmet Need In Billion Dollar Market. Yet LLTP Trading At 1/10th Value Of Peers.

Lightlake has a $15M market cap. Assuming $4M in cash by year-end, enterprise value is just $11M. As a benchmark, we took a random sample of 6 small companies with a FDA approved product for a large unaddressed need. On average, valuations were upwards of $100M. We use this sample to point to the thesis that trading on the OTCQX has created an enormous inefficiency for fair value of LLTP shares.

Figure 4: LLTP Looks Attractive As Companies with FDA Approved Products Valued Several-Fold LLTP’s Current Market Cap.

Why LLTP Trades At Deep Discount to Fair Value & Why That Could Soon Change.

1. Validation Just Happened. Not Everyone Knows.

Prior to the licensing deal with Adapt Pharma, Lightlake was a completely different story. In our view, Adapt Pharma partnering with Lightlake is validating of the Company’s technology, management, and future. We think that most investors in the biotech space simply passed on LLTP due to its miniscule size. On the flipside, this makes it attractive. The milestones from the Adapt licensing deal for NARCAN nasal spray dwarf the Company’s market cap 3.6X. We believe that sooner, rather than later, the market will catch on to this inefficiency.

2. LLTP Trades OTC. However, NASDAQ Listing Could Be Right Around The Corner.

Most investors don’t buy over-the-counter listed issuers. However, LLTP could qualify for a listing on the NASDAQ Capital Market under the income standard. A close look at the Company’s SEC filings will show that the profit interests LLTP sold to investors in exchange for cash are accounted for as revenue. Depending on the size of the milestone received from Adapt Pharma for winning FDA approval, LLTP could qualify for an uplisting to NASDAQ as early as Q1 2016. This could open the door for future institutional financings, and an end to the inefficient [under]valuation.

3. Biotech Investors Are Used To Buying Biotech Companies That Destroy Capital Structure. LLTP Has Preserved Itself.

One year ago, LLTP had 1.79M shares outstanding. Today, LLTP has 1.87 Million shares outstanding. Excluding options issued to management for performance, LLTP has only diluted its share count ~4% in over 12 months. At the same time, CFO Kevin Pollack raised upwards of $6 Million. The last $1.6M was raised in exchange for 2.1% of the future profit interests in one of the Company’s products; an implied $75 Million valuation (versus LLTP’s market value of $15 Million).

Figure 5: Lightlake has Raised Capital at 265% Premium to Recent Market Prices

Perhaps biotech investors are used to substantial dilution and have therefore avoided one of the few - if not the only – biotech names to actually preserve its capital structure in the last 12 months.

4. Little To No Institutional Ownership. Although, In Our View, This Isn’t The ‘End All’.

For most biotech companies, lack of institutional ownership is akin to the kiss of death. Why wouldn’t institutions want to own a promising technology? We believe they will come. For now, Adapt Pharma’s licensing deal is a proxy to what institutional investors are likely to think. If LLTP is good enough for Adapt to partner with, it’s good enough for the best funds in the sector to invest in when the time is right. We think that could happen (ironically) as the valuation expands and/or upon a NASDAQ listing.

5. Commercialization of NARCAN Nasal Spray in Q1 2016 Completely Changes How Investors Perceive LLTP.

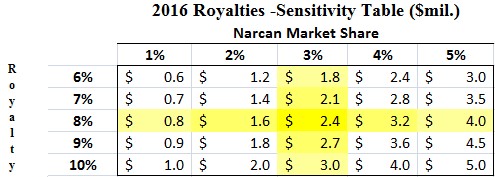

With Adapt expected to commercialize NARCAN Nasal Spray in early 2016, LLTP has completed the shift of risk for reward. LLTP is no longer responsible for commercialization or development of the product. Rather, LLTP is the receipt of up to $55 Million in milestone payments and tiered double-digit royalties. We put together a sensitivity analysis, as shown in Figure 5 (below), to show how even under the most conservative of estimates, LLTP still derives several million in royalty revenue in 2016 from sale of NARCAN nasal spray.

Figure 6: Under Conservative Assumptions, LLTP Could Receive $2.4M in 2016 Royalties

Our estimate of $2.4 Million in royalty revenue (Figure 5, above), assuming a 75% net profit margin, is roughly equivalent to $1 per share in earnings. LLTP traded at $8 most recently. Even if 8x earnings was a fair value, where is the value for the rest of LLTP’s pipeline reflected? We believe it’s not reflected at all.

Own LLTP Now To Capture Upside From 2 Catalysts In 2015

Adapt Pharma is contractually obligated to pay Lightlake a milestone for FDA approval of NARCAN nasal spray. The size of the milestone is redacted, however, an amendment to the agreement filed with the SEC on November 19 shows total regulatory milestone payments will total $7.5 Million. Based on a review of similar licensing transactions - for instance Endo & BioDelivery Sciences' deal for Belbuca or Tesaro and Opko agreement on Rolapitant - we believe LLTP could receive as much as 50% of the $7.5M from Adapt before year-end 2015. This will help bolster LLTP's cash balance and support R&D of the Company's pipeline candidates.

Additionally, we believe that with a meaningful milestone payment and reasonable share performance, LLTP will qualify for listing on the NASDAQ by Q1 2016. As investors have seen with Anavex Life Sciences (AVXL), visibility and liquidity greatly improved with [their] uplisting from the OTCQX to NASDAQ. We believe LLTP is greatly undervalued and NASDAQ visibility will correct the inefficiency.

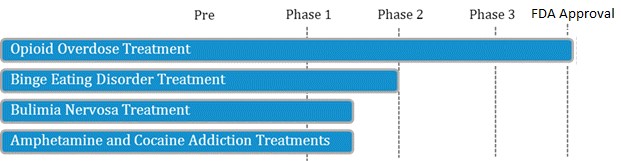

We would also point to LLTP's pipeline, including the lead R&D asset for binge eating disorder (BED), which addresses a potential $2.7B market. Shire's 'Vyvance' was recently approved for BED and is expected to generate substantial growth for the billion dollar drug.

Figure 7: LLTP’s Valuation Completely Discounts Value of Company’s Drug Pipeline

Sorrento Therapeutics (SRNE) jumped from $4 to $26+ after the company announced a collaboration with Dr. Patrick Soon-Shiong. Martin Shkreli recently bought a controlling interest in KaloBios (KBIO), whose shares spiked from $2 to $14+ overnight.

We believe that if no one else, Adapt Pharma may end up acquiring LLTP. At its current valuation, LLTP is likely valued less than the actual milestone and royalty payments Adapt Pharma would pay the Company over the next two years. Plus, you’d get a well-supported Phase 2 Binge Eating Disorder drug and other pipeline candidates, free of charge.

If you’re not in the market for acquiring a $15 Million biotech company outright, the easiest way to own [the] potentially enormous upside would be to own LLTP shares. Remember, the last $6.25 Million in capital invested in an implied valuation almost 4X current market price.

References

[1] http://www.fiercemedicaldevices.com/story/kal-o-cuts-price-auto-injector-opioid-overdose-partnership-clinton-foundati/2015-01-27

[2] http://indivior.com/investor-news/indivior-plc-announces-fda-acceptance-of-naloxone-nasal-spray-new-drug-application-with-priority-review

[3] http://www.bloomberg.com/news/articles/2015-09-08/as-overdose-deaths-climb-so-does-demand-for-their-antidote

[4] http://www.businesswire.com/news/home/20150702005127/en/Adapt-Pharma-Acquires-Narcan-NDA-Obtains-License

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC ("One Equity") on behalf of Lightlake Therapeutics (“Lightlake” or the “Company”) as part of research coverage services. We have received one hundred thousand dollars as of the date of this report and expect to receive an additional twenty thousand dollars for ongoing coverage of the Company. We have also received ten thousand restricted shares of Lightlake and may receive an additional forty thousand restricted shares in the future. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. This research note is not an offer or solicitation to buy or sell the securities of Lightlake. This note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as a basis to make any investment decisions. Investing involves considerable risk. One Equity urges all readers to carefully review the Company’s SEC filings and consult with an investment professional before making any investment decisions. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/