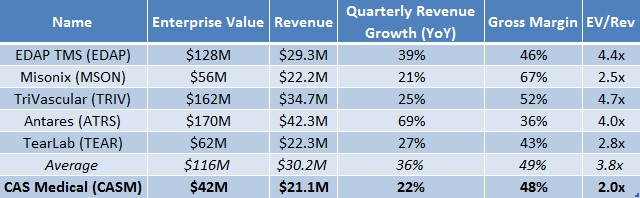

CAS Medical (CASM) is a fast-growing razor & blades device business, trading at half the valuation of its peers (see Figure 3, below). The Company’s ‘razor’ component is crowding out competitor Medtronic, while creating predictable cash flows through its recurring ‘blades’ sales. This Company is exactly what Warren Buffett looks for: (i) predictable growth – CASM’s razor & blades business reported 22 consecutive quarters of double-digit growth – (ii) at a discount to fair value – peers trade at ~4X EV/Sales while CASM trades at just 2X. If CASM were valued in line with peers, this $1.60 stock would be trading at upwards of $3 per share.

CASM Is Taking Market Share From Medtronic

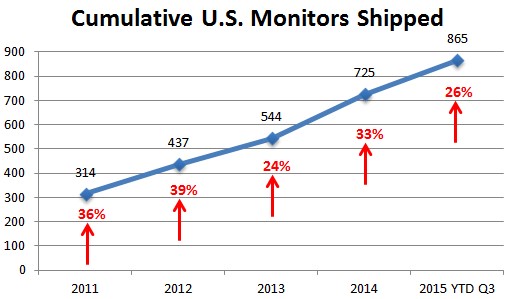

CAS Medical sells a ‘cerebral oximetry’ device called ‘FORE-SIGHT’, which measures blood oxygen levels in the brain during surgical procedures. Hospitals that purchase FORE-SIGHT – the ‘razor’ component – must purchase sensors – the ‘disposables’ or ‘blades’ – for every procedure performed. CASM estimates U.S. market share is 15-20% with 865 devices sold to-date, with an additional 35 unit sales expected by year-end [1]. However, in Q3 2015, CASM shipped 53 units [2], exceeding expectations. Figure 1, below, shows the rapid adoption of the FORE-SIGHT device by U.S. hospitals.

Figure 1: FORE-SIGHT Adoption by U.S. Hospitals Growing Double-Digits Each Year, Creating Barrier To Entry For Competitors

The global brain monitoring devices market is estimated to be growing at an 8.6% CAGR [3]; CASM has grown FORE-SIGHT at a CAGR of 32% for the last 3 years by taking market share from ‘INVOS’, a competing oximetry device by Medtronic (NYSE: MDT).

INVOS measures blood oxygen levels on a relative basis, which can be affected by factors such as a patient’s anesthesia or cardiovascular disease. This means that when a patient’s blood oxygen level falls outside the baseline range, adverse outcomes may arise during surgery. FORE-SIGHT provides an absolute blood oxygen level reading and is less susceptible to deviations (eg. the device measures the actual blood oxygen level and therefore provides an absolute reading).

The market’s preference for FORE-SIGHT over INVOS is reflected in a disclosure by CASM that half of the Company’s new U.S. accounts previously used a competing [oximetry] device before switching to FORE-SIGHT in the last 12 months.

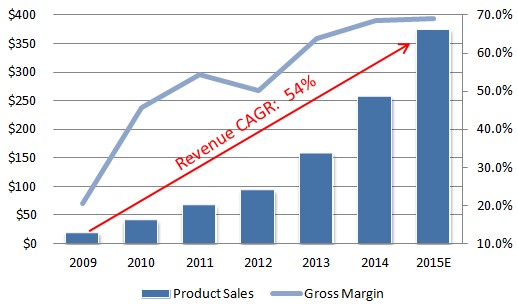

DexCom Took Share From Medtronic; Shareholders Were Rewarded With 1400% In Upside

In 2009, DexCom launched ‘SEVEN PLUS’ – a device that provides constant blood sugar measurement (also called continuous glucose monitoring) without having to perform finger prick tests. Medtronic’s ‘MiniMed’ device was the market leader for continuous glucose monitoring at the time. SEVEN PLUS differentiated itself through more accurate readings and grew sales at a CAGR of 54% over 6 years (as shown in Figure 2, below) to win DexCom 70% market share[4].

Figure 2: DexCom Took Share From Medtronic, Grew Sales At CAGR of 54% With Product Differentiation

Sales of SEVEN PLUS disposable ‘sensors’ – the blades to DexCom’s continuous glucose monitoring device – helped spur margin expansion from ~20% in 2009 to roughly 70% today. During this period shares of the company rallied over 1400% and now help support an EV/Sales multiple of 19 for the company. For context, CASM’s peers trade at an EV/Sales multiple of ~4; CASM trades at just 2x (as shown in Figure 3, below).

Figure 3: If CASM Were Valued In Line With EV/Sales Multiple Assigned To Peers, Shares Would Be Worth $3.02

High-Margin, Growth Business In Focus, Suggesting CASM Should Now Trade In Line With Peers

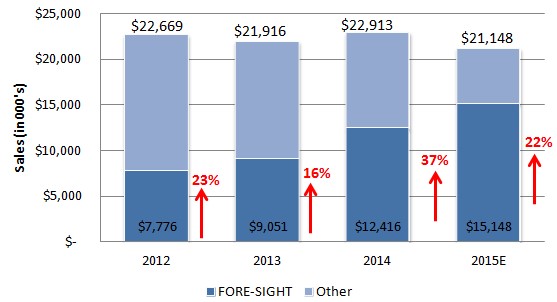

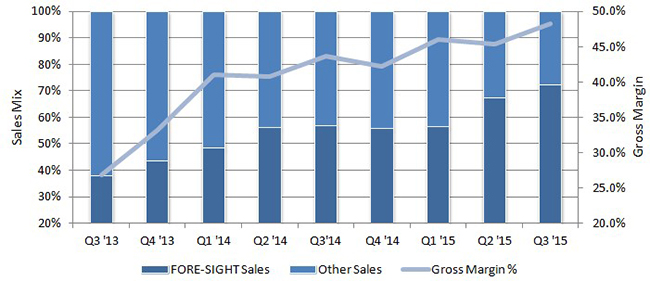

CAS Medical’s legacy businesses have masked growth from FORE-SIGHT, which explains the lag in valuation compared to peers in the past. However, as Figure 4 (below) shows, legacy sales have become increasingly less important to the Company as sales of CASM’s oximetry device represent 72% of the overall mix in 2015 (based on FY2015 estimates).

Figure 4: Although net sales have been flat, FORE-SIGHT is growing double digits and becoming dominant portion of CASM’s revenues

Growth of FORE-SIGHT in CASM’s revenue mix has helped margins expand from 27% to 48% in 2 years [5] (as shown in Figure 5, below), roughly in line with DexCom’s margin expansion in the same time frame.

Figure 5: Disposable sensors driving margin expansion from 27% to 48%; 21% improvement in 2 years

As CASM sells more FORE-SIGHT units to more hospitals, sensor sales – which command a 60%+ margin – begin to set CASM apart even from its peers (shown in Figure 3, above) and instead mirror sensor sales from DexCom, which commands a 19X EV/Sales valuation based on similar cost of goods structure, double digit growth and the barrier to entry created by its dominant market share.

A good proxy for CASM’s low-margin legacy equipment business is Netflix’s (NFLX) DVD business, which masked growth in the company’s subscription sales in prior years. Netflix detached from the DVD business to focus on high-margin subscription sales, which now support one of the largest price-to-earnings multiples (329x) in the technology sector. If CASM were to divest of its low-margin legacy businesses, proceeds from the sale could help support growth of FORE-SIGHT by investing in a quickly expanding salesforce and support team. More importantly, legacy sales would no longer cloud the high margin, high growth oximetry business that is taking market share from Medtronic.

To make use of one other recent example of an innovative company taking share from a company enjoying a monopoly, last week Pacific Biosciences (PACB) shares jumped from $4 to $10 after the company announced a new sequencing platform that investors believe could wrestle meaningful market share from Illumina (ILMN).

CASM has captured a substantial piece of the oximetry market by offering a device with absolute blood oxygen level measure. If adoption continues at the rate seen in the last two years, CASM could quickly become what DexCom was a few years ago – one of the hottest growth stories in healthcare.

CASM Worth $3.35 Per Share to an Acquirer, Compared To Recent Quote of $1.60

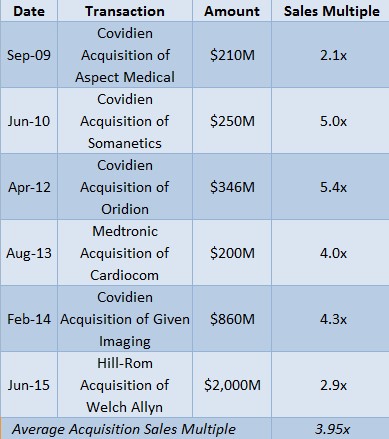

The reason high-margin, high-growth device companies with a unique or differentiated product trade at 4X EV/Sales is because acquirers are willing to pay roughly the same multiple on sales to outright own them. Figure 6, below, shows acquisitions in the device space and the multiple paid for each target.

Figure 6: Past acquisitions in patient monitoring space indicate CASM would fetch $3.35/share from acquirer

CASM’s placement of FORE-SIGHT devices in medical centers is directly correlated with growth in sales of their disposable, high-margin sensors. These sensors create recurring revenues that are potentially attractive to larger device companies, particularly those that have lost sales to FORE-SIGHT.

If we were to assume fiscal 2016 sales of $23 Million, based on an estimated 20% growth rate, CASM would be worth $90 Million, or $3.35 per share, to an acquirer based on past transactions in the industry. This is compared to recent market prices of roughly $43 Million, or $1.60 per share; an implied upside of 109%.

References

[1] http://seekingalpha.com/article/3141496-cas-medical-systems-casm-ceo-thomas-patton-on-q1-2015-results-earnings-call-transcript

[2] http://seekingalpha.com/article/3659876-cas-medical-systems-casm-ceo-tom-patton-on-q3-2015-results-earnings-call-transcript?part=single

[3] http://www.marketsandmarkets.com/Market-Reports/brain-monitoring-devices-market-909.html

[4] http://files.shareholder.com/downloads/DXCM/960334164x0x829930/B3155CE9-B5FD-4A56-A98F-3619634581B5/Investor_Presentation_5-15-15.pdf

[5] http://www.sec.gov/Archives/edgar/data/764579/000107261315000447/form10-q_17865.htm

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: One Equity Research, LLC ("One Equity") provides coverage of undervalued issuers who typically pay for this coverage. Issuers compensate One Equity because of our unique ability to reach thousands of investors interested in learning about fast-growing but mis-priced companies run by talented and ethical management teams. We have not been compensated by any issuers mentioned in this note at the time of publication, but may receive compensation from CAS Medical (the "Company") in the future. This note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as a basis to make any investment decisions. Investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/