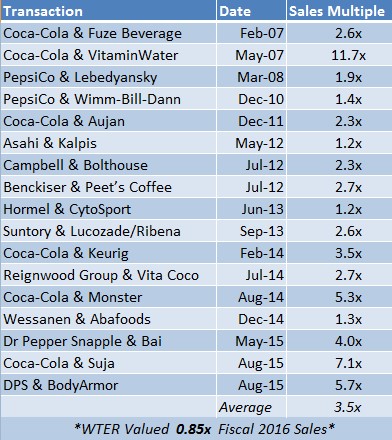

The average exit in the beverage industry is 3.5x sales. One of America's fastest growing beverage companies - The Alkaline Water Company (WTER) - trades publicly at 0.85x projected sales for fiscal 2016. WTER makes alkaline water, one of the fastest growing beverage products alongside organic teas and juices. In August Coca-Cola paid 7.1x sales for a stake in Suja, an organic juice maker; Dr. Pepper paid 5.7x sales for BodyArmor, a sport-drink maker. If WTER were valued at the average exit multiple in their industry, shares would be worth $0.23. WTER trades at just $0.06.

Figure 1: Notable Beverage Acquisitions Receive Average Sales Multiple of 3.5; WTER Trades at 0.85x.

Coca-Cola Valued Monster Beverage At 5.3x Sales in 2014. Here's How WTER Could Create 480% In Upside For Investors, By Following In Monster's Footsteps.

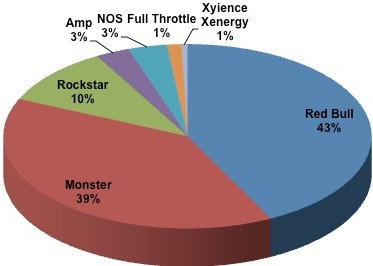

Coca-Cola valued Monster Beverage (MNST) at 5.3x sales when it acquired a minority stake in the company in August 2014 [1]. Shares of Monster have more than doubled since.

Monster created product stickiness with consumers by differentiating their product through branding. This means that the perceived value of a Monster energy drink, as an example, is greater than that of a competing energy drink. The perception of product superiority has given Monster pricing power, leading to higher margins and, in turn, a lucrative business.

Figure 2: Monster Took 39% Share of Energy Drinks Market in 2014

The Alkaline Water Company, or WTER, makes bottled alkaline water. Bottled water is a commoditized business, so products must have a perceived “value-add” in order to command pricing power. WTER does just that.

WTER’s alkaline brand is called Alkaline88 and offers perceived health benefits above and beyond ordinary water: balancing of your body’s pH levels which helps support the immune system and a healthy lifestyle [2]. Lifestyle consumers place actual value on these perceived benefits and are willing to pay more for Alkaline88 than they would for natural spring or purified water. WTER has targeted consumers who are health conscious and built a following among early adopters. These early adopters have helped the Company grow sales triple-digits for 3 consecutive years and erect barriers to entry for competitors to Alkaline88.

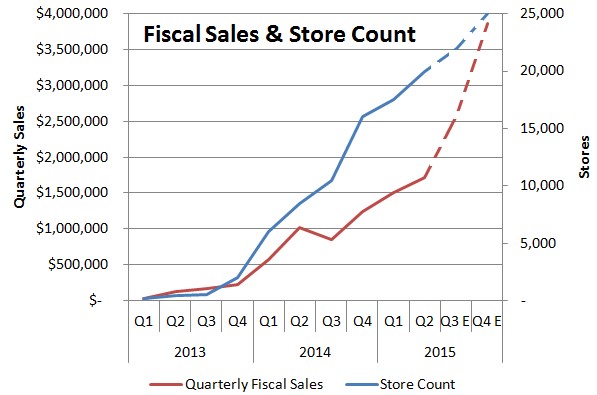

In 2013, WTER’s Alkaline88 was in 5 states and sold in 500 stores [3]. 24 months later, Alkaline88 is available in all 50 states and 20,000 retail locations. WTER’s product sales have directly correlated with the number of stores carrying Alkaline88. We used this data to project sales by quarter (as shown in Figure 3, below), based on management’s guidance of $10 Million in revenue by the end of fiscal 2016.

Figure 3: Forecast Suggest WTER Sales At $3.9 Million in Fiscal Q4; Implying Company Will Have Sales Multiple of Just 0.85 versus Monster’s 5.3x

If WTER can successfully scale growth of Alkaline88 by continuing to resonate with the growing consumer wellness trend [4], the Company could warrant a valuation like Monster Beverage at 5.3x sales or higher. The average price-to-sales multiple in beverage industry exits (3.5x sales, as shown in Figure 1, above) suggests WTER shares could have upside of 280%; if WTER were valued at 5.3x sales like Monster, the upside to owning shares could be as much as 480%.

FitBit, Lululemon Demonstrate How ‘Brand’ Translates To Tangible Value For Common Shares. Monster Is Not The Exception; WTER Brand Could Support Valuation ~6X Current Price.

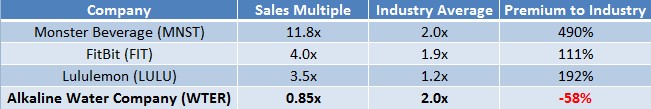

Fitbit (FIT) sells fitness tracking bands, a rather commoditized wearable technology. Fitbit, however, has managed to charge as much as $249.95 for their bands by building a strong bond with consumers who associate the Fitbit brand with a wellness lifestyle that goes beyond the company’s basic technology. Similarly, Lululemon has been able to charge premium prices for yoga apparel, even though the difference in the article of clothing is marginal. A consumer can buy similar apparel at Gap, for example, 40% cheaper than at Lululemon; yet Lululemon expects to sell over $2.2B of yoga apparel in 2015 [5]. Both Fitbit and Lululemon have pricing power thanks to consumer loyalty to their brand. This brand value is directly reflected in their tangible market value – both companies trade at least twice the price-to-sales (P/S) multiple when compared to their industry average, as shown in Figure 4, below.

Figure 4: Monster, Fitbit, Lululemon Command P/S Multiple More Than Double Industry Average; Despite Traction, WTER Trades At A 50% Discount To Its Industry

Brand value is the reason that Coca-Cola paid 5.3x Monster’s sales for a minority interest in the Company back in 2014, compared to industry average exit multiple of 3.5x. Today, Monster stock trades at an 11.8x sales multiple.

Brand value has clearly differentiated Fitbit and Lululemon from its peers and this is reflected in their valuation.

WTER trades at a 58% discount to its industry average P/S multiple, despite being one of the hottest growth companies in the beverage industry. We view this as an inefficiency and an opportunity to own a growth name at a discount to industry benchmark. If early sales traction is any indication, the market has placed no value on WTER’s brand to-date. If value were placed on the brand affinity consumers have already shown for Alkaline88, we believe the Company could trade closer in line with exits in their industry at 3.5x sales. The Company’s track-record in generating a return on marketing spend should further narrow the gap between market and potential fair value for WTER.

WTER Off To Strong Start With Early Hints At Brand Affinity For Alkaline88; Momentum Could Translate To Tangible Market Value

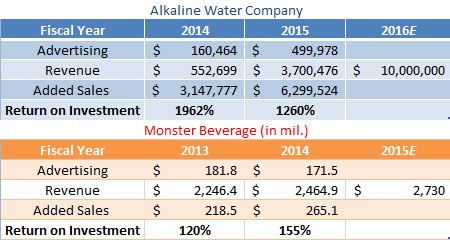

WTER’s early success with Alkaline88 suggests the Company is building a vibrant brand and that their product has stickiness with early adopters. For instance, WTER’s return-on-investment (ROI) in marketing spend appears to be $12.60 for every $1 in advertising. Comparably speaking, Monster saw $1.55 in sales for every $1 spent. Figure 5, below, shows the breakdown of advertising spend versus actual and projected sales the following year, for WTER and Monster Beverage, respectively.

Figure 5: For Every Advertising Dollar Invested, WTER Returns $12.60 in Sales

As a caveat, Figure 5, above, clearly shows that Alkaline88 is in the early stages as a consumer product. WTER estimates sales in fiscal 2016 to be $10 Million, compared to $2.7 Billion for Monster Beverage. It’s therefore to be expected that WTER will have a substantially larger ROI for every dollar spent on advertising. The early evidence is encouraging, however, and suggests the Alkaline Water Company has momentum behind its brand building exercise. As Fitbit and Lululemon clearly demonstrate, if you build it, the market will attribute tangible market value to it – and in some cases reward you with an industry leading multiple.

For The Risk Tolerant Investor, WTER Could Be An Attractive Opportunity To Own A Growth Name At A Discount To Fair Value

Every investment is a trade-off between risk and reward. The Alkaline Water Company is an early-stage innovator in one of the fastest growing segment of the beverage industry. The Company recently reported that they are now the fastest growing alkaline water company in the United States. And growing pains often accompany high growth companies. The Alkaline Water Company will need an additional $3-5 Million in growth capital, according to filings with the SEC. This capital might not be available at attractive terms, however, management’s large equity interest in WTER suggests their interests are aligned with shareholders’ best interests: attaining capital at the best terms available. More importantly, the Company’s track-record of generating $12.60 in sales for every $1 spent on marketing (as shown in Figure 4, above) should resonant with investors. WTER has clearly demonstrated an understanding of how to build and support sales.

For investors willing to entertain the risks inherent in WTER, the upside could be very attractive. If we assume WTER’s projected sales of $10 Million in fiscal 2016 (which ends in Q1 of calendar 2016), the Company trades at 0.85x sales. The industry average is 2x sales. This implies upside of 135%.

If we compare WTER’s projected 0.85x sales multiple to the average exit sales multiple of 3.5x, upside of 312% is implied.

If we compare WTER’s projected 0.85x sales multiple to the 5.3x multiple Monster Beverage received from Coca-Cola, the implied upside is 523%.

We believe this $0.06 stock – WTER - could trade for $0.23 per share, or higher, with continued triple-digit sales growth and product stickiness that comes with a vibrant brand.

References

[1] http://www.bloomberg.com/news/articles/2014-08-14/coca-cola-to-acquire-stake-in-monster-beverage-for-2-15-billion

[2] http://www.thealkalinewaterco.com/why-alkaline88/alkaline88-overview

[3]http://www.thealkalinewaterco.com/uploads/default/files/watercorp-corporate-pp-presentation-june14-revised.pdf

[4] http://ir.baystreet.ca/article.aspx?id=134

[5] http://seekingalpha.com/article/3504616-lululemon-athleticas-lulu-laurent-potdevin-on-q2-2015-results-earnings-call-transcript

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC on behalf of The Alkaline Water Company ("WTER" or the "Company") as part of research coverage services. One Equity Research has received three million restricted shares of WTER from the Company for its services and intends to sell its shares as soon as it is legally permissible to do so. In addition, One Equity received twenty nine thousand nine hundred fifty five dollars from LP Funding LLC, a shareholder and consultant to the Company, as of the date of this report. As of 10/4/2015 LP Funding has sold 722,500 shares of WTER and may continue to sell shares without notifying One Equity Research. This research note is not an offer or solicitation to buy or sell the securities of The Alkaline Water Company. Information in this report is believed to be accurate as of the date of publication. This note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as a basis to make any investment decisions. Investing involves considerable risk. One Equity urges all readers to carefully review the Company’s SEC filings and consult with an investment professional before making any investment decisions. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/