While Oxis (OTCQB: OXISD) trades at just 1/7th the value of its peers, the Company is developing the next generation of cancer immunotherapies, validated by Amgen’s bispecific ADCC, Blinctyo, and Seattle Genetic’s Adcetris, a first-in-class FDA approved antibody-drug conjugate (ADC).

Healthcare funds like venBio, Perceptive Advisors and Broadfin have seen triple digit returns (Figure 1, below) and collectively poured $100M+ into Lion Bio (LBIO) to bet on a drug technology that Anthony Cataldo licensed back in 2011. Cataldo is now repeating the same process with Oxis International, which trades under the symbol OXISD.

Figure 1: Early LBIO Investors Sitting on 215% Return Today; Peak of 600% Return in March 2015

CEO Who Prompted Lion Bio Reform is in Process of Turning Around OXISD

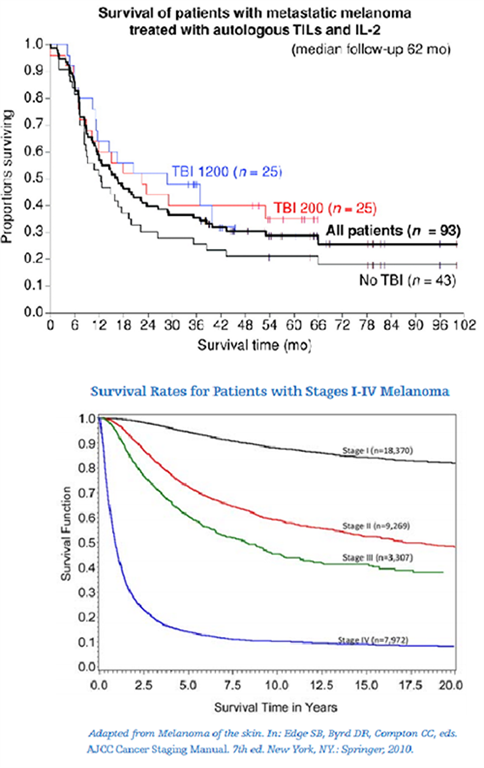

Anthony Cataldo lay the foundation that supports Lion Biotechnologies’ current adoptive cell therapy. While President & CEO of Genesis Biopharma, which then merged with Lion Bio and changed its name, Cataldo licensed the rights to a metastatic melanoma therapy and entered into an R&D agreement with the National Cancer Institute to advance the treatment. In a phase 2 trial, 35% of patients (n=101) were without disease progression at 4 years, compared to historical survival rates in the mid-teens, as seen in Figure 2, below.

Figure 2: Stage IV Metastatic Melanoma Patients Seeing Meaningful Survival Benefit With LBIO Therapy

Lion Bio has utilized Cataldo’s early efforts to raise over $100M, receiving backing from prominent healthcare funds such as venBio, Perceptive Advisors and Broadfin Capital. These funds, and other early investors, saw returns on their 2013 investment peak at 600% in March of 2015.

Cataldo, now the Chairman & CEO of OXISD, is emulating the same process he commenced with Lion Bio four years ago, as shown in Figure 3, below.

Figure 3: OXISD Early Changes Reminiscent of Lion Bio’s Reform in 2013

Oxis has built a robust pipeline of clinical and preclinical candidates by licensing intellectual property from MultiCell Immunotherapeutics (MCIT), University of Minnesota and University of Pittsburgh. The company has cleaned up their cap structure through a financial restructuring and carried out a reverse stock split, effective December 15th, 2016 [3].

These steps were done as a prelude to an institutional financing round and an up-listing to the NASDAQ, similar to Lion Bio in 2013. These events will drive value for OXISD, acting as upcoming catalysts in 2016 that will help validate the company’s next generation technology.

OXISD is Developing the Next Generation of Immuno-Oncology Combination Therapy

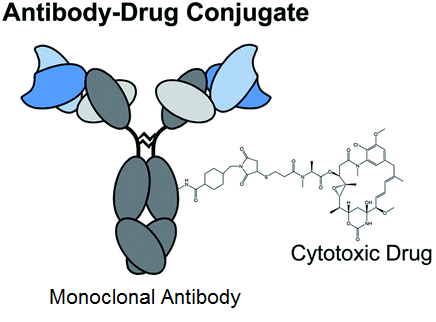

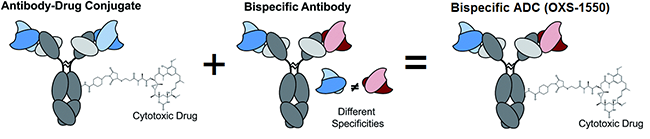

Monoclonal antibodies- engineered proteins that attach to cancer cells to make the cancer visible to the body’s immune system- have become common in immunotherapy. An anti-body drug conjugate (ADC) is a monoclonal antibody linked to a cytotoxic drug (such as a chemotherapy drug). The antibody is used as a homing device to take the cancer killing drug directly to the cancer cell, shown in Figure 4, below.

Figure 4: ADC’s combine targeting capabilities of monoclonal antibodies with the cancer-killing ability of cytotoxic drugs

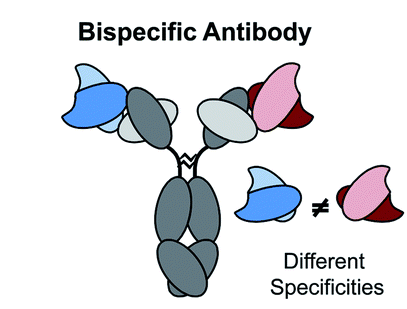

Bispecific antibodies possess the ability to bind two distinct antigens that are on the surface of a cancer cell. This offers the potential to create highly specific therapeutics with greater potency.

Figure 5: Bispecific antibodies have two different arms, each one capable of binding a different antigen on a cancer cell

OXISD’s lead product candidate, OXS-1550, is a combination of the above therapies: bispecific antibody and ADC. Oxis’ bispecific ADC therapy binds to the CD19 & CD22 antigens present in lymphoma and leukemia cancer cells. The cancer cells then internalize OXS-1550 and are killed due to the action of drug's cytotoxic diphtheria toxin payload. This combination leverages the precision of bispecific antibodies to distinguish cancer cells and the potency of a cytotoxic drug.

Figure 6: Oxis’ lead drug candidate is a combination of a bispecific antibody and an ADC

OXS-1550 demonstrated clinical activity in a Phase I trial in patients with relapsed/refractory B-cell lymphoma or leukemia. After one cycle of therapy, durable objective responses occurred in 2/10 patients; one was in complete remission after a 2nd cycle. This shows promise in multiple cycles of drug therapy since a maximum tolerated dose was not determined in the Phase I study.

OXISD Would Be a $15 Stock If It Traded In Line With Immunotherapy Peers

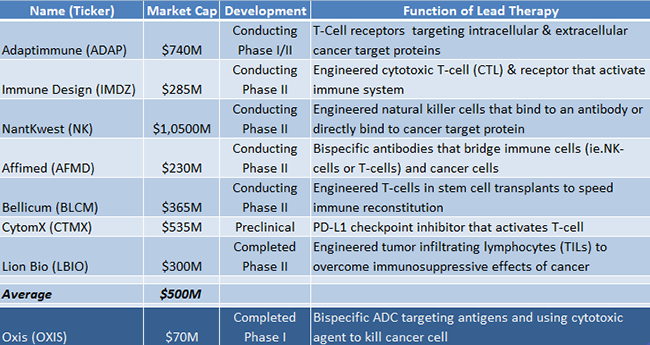

Next generation oncology therapies such as bispecific antibodies, CAR-T treatments and advanced cell therapies have garnered a lot of excitement from early stage data. As seen in Figure 7, below, biotechs developing these exciting therapies have been rewarded with multi –hundred million dollar valuations even though they are (at best) years away from commercialization.

Figure 7: OXISD Trades 1/7th Value of Immunotherapy Companies With Early Stage Data + Promising Pipeline

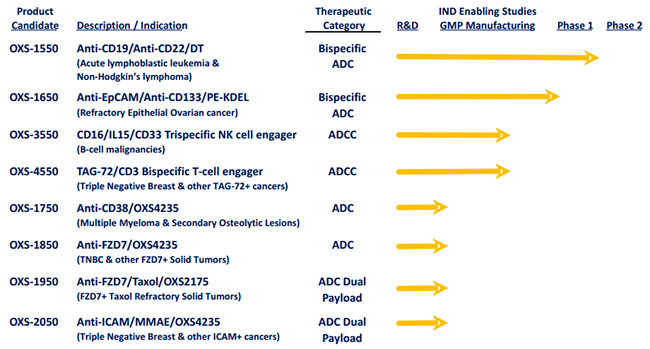

Oxis, however, trades at 1/7th the value of other immuno-oncology companies. The company’s robust pipeline includes a new class of therapy, bispecific ADCs which showed promise in Phase I trials and next generation candidates such as trispecific NK cell engagers. Oxis should be able to utilize these novel therapies to drive its valuation, much like NantKwest did with their genetically engineered natural killer (NK) cells. Even with just support from Phase I data, NK’s breakthrough and the company’s promising preclinical pipeline was enough to warrant a $2.6B IPO, the largest ever for a biotech company [4].

Figure 8: Oxis Pipeline Full Of New Categories of Therapeutics

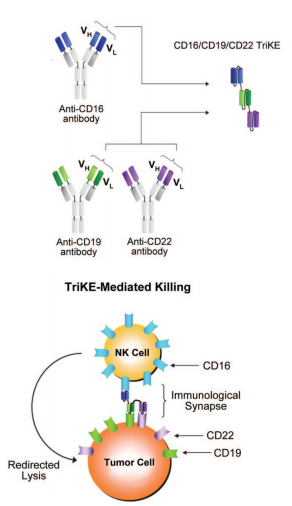

Oxis’ pipeline includes preclinical candidates that have shown therapeutic potential for enhancing immune responses. Their trispecific NK cell engager (OXS-3550) triggers natural killer cell activation through the CD16 Fc receptor, significantly increasing NK cell activity against tumor targets (shown in Figure 9, below).

Figure 9: Trispecific Killer Cell Engagers (TriKEs) bind to different antigens while also presenting a receptor that signals NK cells to the tumor

Trispecific NK cell engagers are generated from monoclonal antibodies containing components that recognizing specific antigens (such as CD19/CD22) on a tumor cell. These antibodies are combined with a CD16 receptor that NK cells express. The CD16 component of a trispecific antibody recognizes NK cells and sends a signal to engage the immune defense to attack the cancer. These preclinical results [6] and OXS-1550 give good reason for OXISD to receive a “new therapy premium” much like Seattle Genetics received for having one of two ADC drugs on the market.

Own OXISD Now To Capture Upside in Catalyst-Filled 2016

Oxis reached an agreement last week to convert all outstanding debt, warrants and preferred shares into common shares upon a $6 Million financing [7]. Upon conversion, Oxis will have no debt and approximately 31M shares outstanding on a fully diluted basis.

Anthony Cataldo lay the groundwork for Lion Bio at $2 before it went to $14; he’s now doing the same thing with OXISD, but within one of the most exciting new verticals in cancer.

Kite Pharma (KITE) completed a $632M IPO on a promising approach to treating cancer with T-cells; Juno Therapeutics (JUNO) followed suit with a $1.7B IPO in late 2014. But the next generation of cancer immunotherapy might actually involve Natural Killer (NK) cells, which explains why NantKwest’s (NK) early success in the space helped secure the largest biotech IPO ever at $2.4 Billion.

It just so happens, OXISD is developing a tri-specific antibody that engages the NK cell to attack cancer.

References

[1] http://lbio.com/press_releases/lion-biotechnologies-announces-positive-updated-data-from-ncis-phase-2-study-of-til-therapy-in-the-treatment-of-metastatic-melanoma/

[2] http://www2.mdanderson.org/depts/oncolog/articles/11/1-jan/1-11-compass.html

[3] http://otce.finra.org/DLDividendsDistributionsSplit

[4] http://www.renaissancecapital.com/news/nantkwest-prices-upsized-ipo-at-$25-well-above-the-range%3B-largest-biotech-i-34674.html

[5] http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2697811/

[6] http://mct.aacrjournals.org/content/11/12/2674.long

[7] http://www.sec.gov/Archives/edgar/data/109657/000135448816005863/oxis_8k.htm

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Oxis International (“Oxis” or “Company”) as part of research coverage services. We have received thirty one thousand restricted shares of Oxis for our services as of the date of this report and expect to receive additional compensation in the form of cash and restricted shares of Oxis in the future. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. This research note is not an offer or solicitation to buy or sell the securities of Oxis. Information contained in this note is believed to be accurate as of the date of publication. This note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as a basis to make any investment decisions. Investing involves considerable risk. One Equity urges all readers to carefully review the Company’s SEC filings and consult with an investment professional before making any investment decisions. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/