Rite-Aid & CVS recently stated they will sell naloxone over-the-counter, creating a tailwind for Lightlake Therapeutics (LLTP) as its commercial partner launches their [recently] FDA-approved naloxone nasal-spray. Obama is allocating $133 million in 2016 towards tackling the overdose epidemic by tripling government purchases of [naloxone] to 400,000 units. Lightlake Therapeutics (LLTP) is the only FDA-approved nasal naloxone, but trades at an estimated 1.5x EV/sales compared to peers in the specialty drug space at 4.6x.

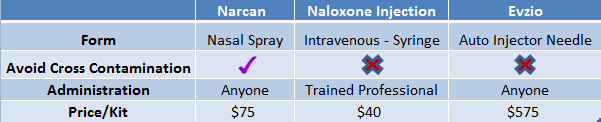

Nasal Naloxone Priced In Line With Alternatives Even Though It Offers Greater Benefits

At $70/kit, Narcan - the branded name for LLTP’s nasal naloxone- has been competitively priced to alternatives already on the market, Figure 1, below. This pricing strategy came at a time when other specialty pharma companies Valeant, DepoMed et al. have been scrutinized for aggressively raising drug prices. Competing ‘auto-injector’ naloxone, Evzio, was priced at a significant premium ($575/kit) to alternatives.

Figure 1: LLTP’s Narcan Is Competitively Priced While Offering a More Convenient Form of Naloxone

Lightlake’s nasal naloxone is designed for the average person to use compared to naloxone in a syringe, which requires a trained medical professional to administer. Presumably, this will drive sales, particularly on shelves in CVS and Rite Aid.

We would also suggest that CVS and Rite Aid set precedent for other national pharmacies (Wal-Mart, Walgreens, Kroger et al.) to follow suit in offering naloxone over-the-counter (OTC), which could create further momentum for LLTP in 2016.

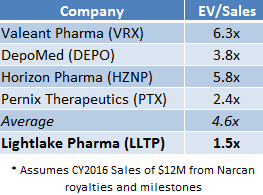

If Valued In-Line with Specialty Pharma, LLTP Shares Worth $30; 200% Above Current Price

If LLTP were priced in line with the average EV/Sales multiple that specialty pharma companies have been assigned, as shown in Figure 3, LLTP shares would be worth $30 today [1].

Figure 2: LLTP Currently Trades at 1.5x EV/Sales; Peers Command 4.6x EV/Sales.

Adapt Pharma Needs 5% of Opioid OD Market to Justify LLTP at $30/Share

Indivior, a specialty pharma company with deep pockets and experience, was competing with Lightlake in 2015 on being the first company to get a nasal naloxone to market. Indivior’s nasal naloxone was ultimately rejected by the FDA one week after the FDA approved LLTP’s Narcan. This solidified Narcan as the market leader in the billion dollar opioid overdose market. Indivior had guided for peak sales of $50 - $100 million for their nasal naloxone product.

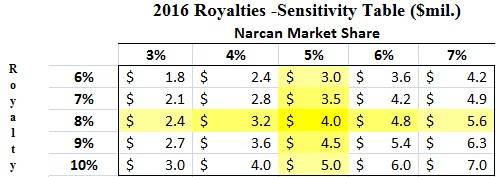

We conservatively assume that Lightlake’s Narcan will generate $50 million in 2016 (or ~5% of the $1 billion opioid overdose market), the low end of Indivior’s peak guidance. Adapt agreed to license Narcan from LLTP in exchange for up to double-digit royalties; which we assume to be 8%.

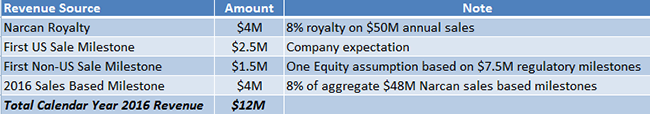

Figure 3: LLTP Could Receive $4.0M in 2016 Royalties

Under our assumptions, Lightlake would receive $4 million in royalty revenue in 2016. In addition, the company expects [2] to receive a $2.5 million milestone payment from Adapt after the first commercial sale of Narcan in the US and an estimated $1.5 million from first sale of Narcan outside US markets. We also project that Adapt Pharma pays a $4 million milestone based on the $50 million 2016 Narcan threshold the company hits during first year of commercialization. If our projections hold true, Lightlake should see 2016 revenue of $12 million.

Figure 4: Breakdown of LLTP’s Expected CY 2016 Revenues of $12M

Why You Should Be Paying Attention To LLTP Right Now

1) Political Funding Allocated to Overdose Pandemic Should Support Narcan’s Commercial Roll-out

The President’s Fiscal Year 2016 budget includes $133 million in new investments aimed at addressing the opioid epidemic (read more here), including expanding access to naloxone. In his plan, Obama will more than triple the number of naloxone doses provided, from 130,000 in 2013 to 400,000 in 2016[3].

Hillary Clinton’s presidential campaign announced a $10 billion plan [4] to combat America’s drug and alcohol addiction. The plan looks to boost treatment and ensure first responders have the necessary drugs to stop opioid overdoses from becoming fatal. Similarly, candidate Bernie Sanders pushed [5] to make naloxone more widely available and provide rebates that would lower the cost of the lifesaving drug.

2) CVS & Rite Aid Broadening Naloxone Distribution, Making it Easier for Patients to Buy Narcan

Each year, health care providers write nearly 300 million prescriptions for painkillers, enough for every American adult to have a bottle of pills. A first mover opportunity, and [likely] political influence has pushed pharmacies to make naloxone OTC. Certain CVS and Rite Aid locations are giving patients access to the essential medicine by consulting an in-house pharmacist rather than requiring a prescription from a physician.

In late 2015, CVS announced that it was making naloxone available without prescription in 14 states. Similarly, naloxone is available at Rite Aid in 6 states and the cities of New York and Baltimore [6]. Both pharmacies are reviewing further opportunities to make the overdose drug OTC in other states.

This move sets a precedent for other nationwide pharmacies like Walgreens and Wal-Mart to follow suit and make naloxone available OTC.

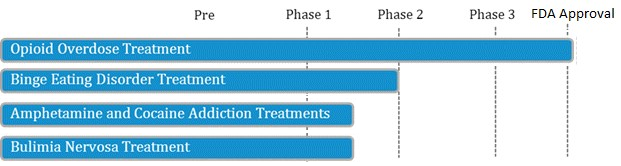

3) LLTP’s Valuation Completely Discounts Value of Company’s Drug Pipeline

Figure 5: At Current Valuations, Investors in LLTP Get Complementary Access to Company’s Pipeline

LLTP recently announced [7] that they will be testing their opioid antagonist drug in patients with Cocaine Use Disorder, a study that will be funded by National Institute on Drug Abuse (NIDA), part of the National Institutes of Health (NIH). With 1.5 million current cocaine users and no FDA-approved treatments, Lightlake’s candidate is targeting a $1.8 billion dollar unmet medical need [8].

Own LLTP to Capture Upside from Narcan’s 2016 Commercialization

The Clinton Foundation funded EVZIO’s distribution, despite the accompanying high price tag, because of the added benefits the auto-injector offered the average individual. This means that government funding will indeed be a tailwind for LLTP’s product, which is not only more convenient, but also much cheaper.

Any distribution deals, such as Walgreens and Walmart following suit with making naloxone available OTC in their pharmacies, will act as a catalyst for Narcan’s commercial rollout. Whatever the case, CVS and Rite Aid just gave the states with the biggest OD problem access to naloxone. Now the question is if consumers will choose nasal spray (LLTP) over syringe or automated needle?

Since Narcan is FDA approved and out-licensed to Adapt Pharma, a group led by entrepreneurs that founded & sold Azur to Jazz Pharma for $500M in 2011 (a deal now worth $2 Billion), LLTP can move their focus to developing candidates in their pipeline. The company’s development strategy has been de-risked moving forward as its foundation revolves around a well-understood drug compound (naloxone).

Even if you place no value on LLTP’s pipeline, the NARCAN milestone/royalties in 2016 alone value the Company at $30 a share, or roughly 3X recent market prices.

References & Endnotes

[1] Computation does not include Lightlake’s ~4.6 million cashless options. Using a net share settlement feature would allow the company to only deliver the difference between the market price and strike price in issued shares when the options are exercised. At $10, for example, a total of ~580,000 shares would be issued from exercised options, bringing the diluted shares outstanding figure to approximately 2.38 million. The dilutive effect will vary depending on market price at time of exercise.

[2] http://finance.yahoo.com/news/lightlake-therapeutics-inc-receives-milestone-140000544.html

[3] https://www.whitehouse.gov/the-press-office/2015/10/21/fact-sheet-obama-administration-announces-public-and-private-sector

[4] http://edition.cnn.com/2015/09/02/politics/hillary-clinton-10-billion-drug-addiction-fight/

[5] http://www.sanders.senate.gov/newsroom/press-releases/sanders-cummings-urge-mayors-and-county-officials-to-combat-overcharging-for-critical-drug

[6] http://www.unionleader.com/States-standing-order-makes-it-easy-to-buy-Narcans-generic-equivalent&template=mobileart

[7] http://finance.yahoo.com/news/lightlake-therapeutics-inc-announces-collaboration-140000063.html

[8] http://www.oneequityresearch.com/wp-content/uploads/2015/09/Nasal-Naloxone-Could-Make-2015-a-Hallmark-Year-for-Lightlake-04-17-2015.pdf

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC ("One Equity") on behalf of Lightlake Therapeutics (“Lightlake” or the “Company”) as part of research coverage services. We have received one hundred thirty thousand dollars and seventeen thousand restricted shares of Lightlake for our services as of the date of this report. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. We expect to receive additional compensation in the future. This research note is not an offer or solicitation to buy or sell the securities of Lightlake. Information contained in this note is believed to be accurate as of the date of publication. This note is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as a basis to make any investment decisions. Investing involves considerable risk. One Equity urges all readers to carefully review the Company’s SEC filings and consult with an investment professional before making any investment decisions. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation. Please read our full disclaimer at http://www.oneequityresearch.com/terms/