Meet ImmuDyne (IMMD) - a biotech company that benefits from the FDA's Generally Regarded as Safe (GRAS) status, which exempts their proprietary immune-modulator from undergoing long and expensive clinical studies before product commercialization.

Biotech stocks are down 20% year-to-date in 2016. ImmuDyne is up 35% year-to-date after reporting product sales growth of 70% year-over-year and guiding for profitability.

ImmuDyne anticipates 2016 sales could total $12M, which would mean a fair value of 3X current market price for IMMD shares. Their [first] target market is worth $18 Billion a year and ripe for disruption.

Safety In Numbers

Biotech stocks are in a rout after a 5 year bull market. Companies with the most exciting technologies, like bluebird bio’s (BLUE) gene-editing technology or Kite Pharma’s (KITE) eACT, have lost half of their market value from peak prices in mid-2015. But there’s some safety in cash, which certain biotech companies were able to raise in the last 12 months. For instance, while bluebird has a $1.6B valuation, it also has $700M in cash, which is equivalent to its burn rate over the next 5 years.

Companies like MannKind (MNKD) or Unilife (UNIS), however, are sinking under the weight of their debt and losses. MannKind spent billions developing an inhalable insulin for the burgeoning diabetes market. But commercialization has been challenging and Sanofi – their once upon a time commercial partner – pulled out of their joint venture. MannKind shares are down close to 90% since the start of 2015. Unilife, who markets injectable drug delivery systems, hasn’t performed much better, down more than 70% due to their high burn rate and dwindling cash balance.

By comparison, up until late last year ImmuDyne generated most of its sales by manufacturing yeast-derived beta-glucan based on know-how and trade secrets, and selling the raw ingredient to global beauty companies like Avon or L’Oreal [1]. They generated a modest $1.2M in sales, according to the Company’s corporate presentation.

But the big change no one has paid any attention to happened in Q4’15. In October, IMMD formed a Joint Venture (JV) with Inate Scientific, a privately-held marketing company that created and launched a ‘skin cream’ product line based on ImmuDyne’s proprietary yeast beta-glucan ingredient.

IMMD owns 51% of the Inate Scientific JV, which reported $0.175M in sales in a one-month beta launch this past December. Inate sells its products online, direct to consumers using a time-tested ‘free trial’ model.

The global market for skin care is nothing to laugh at – it’s worth an estimated $121 Billion in 2016 [2] and IMMD has projected 2016 sales of $10M stemming from their JV with Inate Scientific. Additionally, they’ve hinted that ingredient sales to “2 of the top 5 global cosmetic companies” are expected to nearly double to $2M.

ImmuDyne is not MannKind nor Unilife and even further from R&D stage companies like bluebird bio or Kite Pharma. But there is safety in betting on companies that can grow their top line, manage costs, generate cash flow and maintain the integrity of their balance sheet and capital structure. In our view, IMMD is on track to meet all of these desirable attributes in 2016.

GRAS Status Will Help IMMD Quickly Introduce Effective New Products For Large Unmet Needs

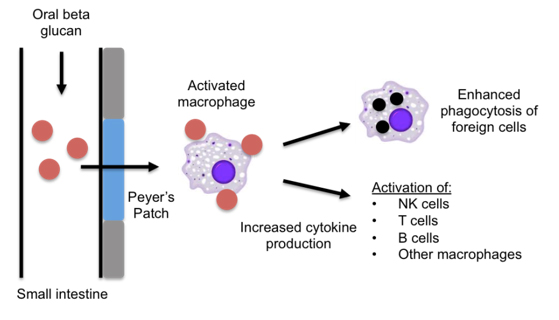

According to Nutritional Journal [3]over 6000 papers have been published on the immune-modulating effects of beta-glucan (β-glucan). The mechanism of action behind β-glucan is, therefore, very well understood. In general β-glucan binds to receptors of immune cells such as macrophages, dendritic cells, neutrophils, eosinophils, and natural killer cells that “induces […] innate and adaptive immune response”, as shown in Figure 1, below.

Figure 1: β-glucans Mechanism of Action

Importantly, beta-glucan is exempt as a ‘drug’ by the FDA under a classification known as ‘Generally Regarded As Safe’ (GRAS) [4].

While β-glucan clearly induces a biochemical response by ‘regulating’ the immune system, it is not considered a drug. This allows IMMD to sell its β-glucan direct to consumers, and achieve ‘efficacy’ or tangible results usually reserved for actual drugs.

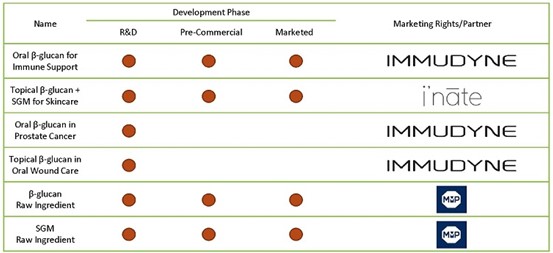

IMMD’s target market is every consumer that has ever bought an OTC medication, supplement or additive only to be disappointed with the value-add of the product. β-glucan’s broad spectrum of activity and ‘natural’ mechanism make it an attractive candidate for common problems like bacterial infections, immune support, overall health & wellness, and wound care, as shown in Company’s product pipline in Figure 2, below.

Figure 2: β-glucan’s Broad Activity Gives IMMD Opportunity To Address Broad Set Of Unmet Needs

Source: Corporate Presentation

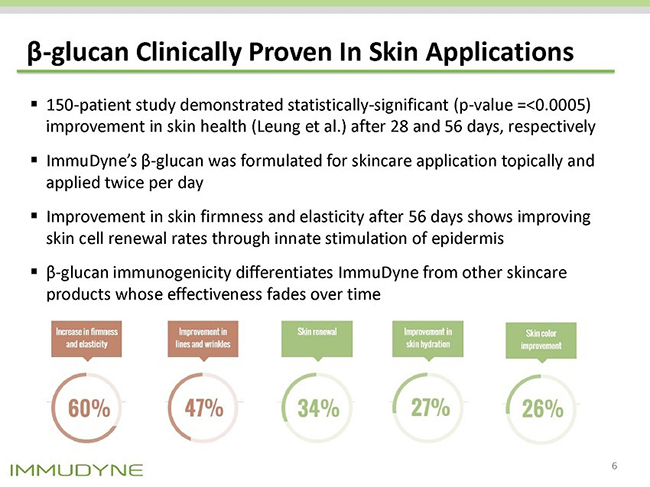

IMMD’s JV partner, Inate Scientific, has leveraged a study from ImmuDyne’s predecessor company, who had evaluated the β-glucan-based skin cream in a 150 patient study. Inate has used the data from this study to market the Inate product line as superior to competitors like [Procter & Gamble’s] Olay Regenerist.

Figure 3: Inate Leverages Clinical Data To Compete With Legacy Skin Creams From Estee Lauder et al.

Source: Corporate Presentation

IMMD Shares Worth 250% More Than Current Price, Based On Average Peer Valuation Multiples

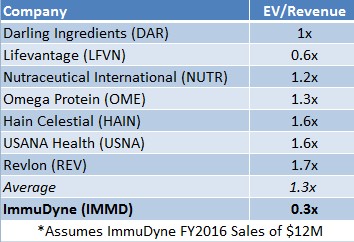

If IMMD were priced in line with the average EV/Revenue multiple that ingredient and beauty care companies such as Hain Celestial (HAIN) and Revol (REV) have been assigned, as shown in Figure 4, IMMD shares would be worth $0.50, or 250% more than current market price, right now.

Figure 4: IMMD Currently Trades at 0.3x EV/Revenue; Peers Command 4X as much at 1.3x EV/Revenue

Importantly, IMMD’s CEO, Mark McLaughlin, who is a 30% shareholder in the Company, has done an impeccable job preserving the capital structure. This is easily explained: Mark’s interest is in maximizing shareholder value as he is, himself, the largest shareholder in the Company. The integrity of ImmuDyne’s capital structure is important – it means growth will accrete to each share and buoy the fair value of that share.

Tectonic Shift In How Consumers Looks At Skin Creams Couldn’t Have Come At A Better Time For IMMD

Recently, consumer trends and marketing efforts have started to shift as the millennial generation is growing their disposable income [5]. Compared to prior generations, millennials are more educated, spending a lot more money online and interested in overall health. ImmuDyne is aligned with this underlying shift by selling their clinically-proven skin cream product through carefully-selected online platforms.

ImmuDyne is a science-driven company that has built commercial infrastructure by leveraging 3rd party expertise in marketing products directly to consumers. With an expected ramp in sales growth and profitability, 2016 is setting up to be an inflection point.

At 0.3x forward EV/Revenue IMMD has potential to jump 250% before it even trades in line with peers at 1.3x EV/Revenue. If expectations translate to actual audited sales, we expect this gap to quickly narrow and create large upside for today’s investors.

References & Endnotes

[1] ImmuDyne has not disclosed which global cosmetic companies they sell ingredients to. Avon and L’Oreal are hypothetical for illustrative purposes, both being ‘Top 5 Cosmetic’ names.

[2] http://www.statista.com/statistics/254612/global-skin-care-market-size

[3] http://www.ncbi.nlm.nih.gov/pmc/articles/PMC4012169/

[4] http://www.fda.gov/Food/IngredientsPackagingLabeling/GRAS/

[5] https://www.shopify.com/blog/16582168-how-to-identify-and-cash-in-on-consumer-trends-and-3-products-trending-right-now

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received ten thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We may receive up to ten thousand dollars per month and five hundred thousand restricted shares over the course of our agreement, ending on November 30, 2016. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we believe that we hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We believe our assessment of issuers prior to entering into a coverage agreement allows us to determine whether an issuer is truly undervalued and deserves greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/