The medical marijuana market is expected to double in size by 2020 as clinical studies provide evidence that cannabis can safely be used as an alternative medicine. GW Pharma (GWPH) and PharmaCyte (PMCB), for example, are driving development of new cannabinoid drug candidates for serious diseases, including epilepsy and cancer, as potential alternatives to chemotherapy and other standards of care that are known to cause serious adverse events.

ImmuDyne (IMMD) is leveraging its proprietary beta-glucan (“β-glucan”), a natural immune-modulator derived from baker’s yeast, to develop and market products that safely enhance the body’s immune system and potentially combat disease. Beta-glucan is exempt as a drug by the FDA under a classification known as ‘Generally Regarded As Safe’ (GRAS). This allows IMMD to sell its β-glucan derived products directly to consumers and bypass the FDA’s expensive drug development process. Beta-glucan is considered a nutraceutical not a drug.

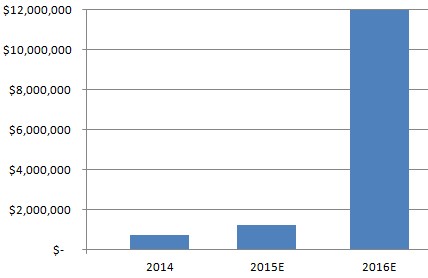

Like medical marijuana companies that have found demand from people seeking natural alternatives to the traditional cocktail of drug from Big Pharma, ImmuDyne has positioned its product pipeline to address several large unmet consumer needs. It already supplies 2 of the Top 5 Global Beauty companies with its beta-glucan and more recently began offering skin care line directly to consumers. While revenues for fiscal 2015 are expected at $1.2 Million, IMMD has guided that fiscal 2016 sales are to approach $12 Million.

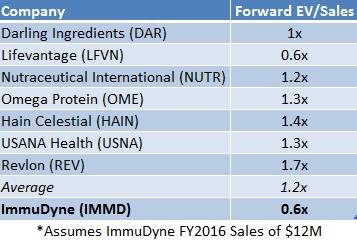

If 2016 sales of $12 Million are met, peers show IMMD is worth $0.47 per share, compared to a market price of $0.25 per share. The difference between fair value and current market price implies potential upside of 88% for ImmuDyne’s investors today.

Adoption of Cannabis Validates Medical Marijuana as Alternative Medicine

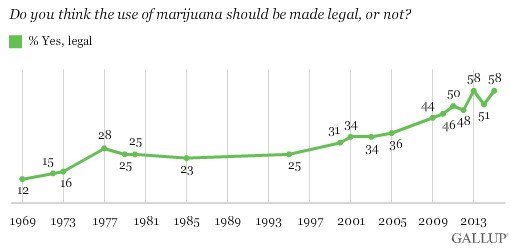

58% of Americans are for legalizing marijuana, tying the high point in the 46-year public survey, as shown in Figure 1 (below).

Figure 1: Marijuana, The ‘New-Age’ Medicine, Gaining Approval Over the Years

As a result of the shift in perception, the medical marijuana market is expected to grow at a CAGR of 20% for the next 5 years, more than doubling in size from $4.4 billion in 2015 to $10.8 billion by 2020 [1].

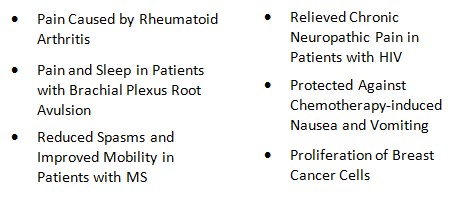

Peer reviewed studies [2] have supported the widespread adoption of medical marijuana and removed the stigma around cannabis. The new age medicine has shown benefits on conditions such as muscle spasms caused by multiple sclerosis, pain from chronic illness and seizure disorders (Figure 2, below).

Figure 2: Peer-Reviewed Studies on Medical Marijuana Show Benefits In Numerous Disease Settings:

The FDA, however, has yet to approve any drug product containing cannabidiol (CBD), the active ingredient in cannabis that is thought to trigger health benefits.

GW Pharma is spearheading the initiative to bring cannabinoid therapeutics into the US. The company has multiple Phase III trials underway for epilepsy and cancer pain. With pivotal data announcements in the first half of 2016, GWPH could offer a breakthrough in treating epilepsy with medical marijuana by having the first FDA approved cannabinoid therapeutic by 2017. Likewise, PharmaCyte successfully obtained a Schedule 1 license from the US DEA, allowing the company to obtain legal supplies of cannabinoid compounds to study a treatment for pancreatic cancer.

Medical Marijuana Inc (MJNA) sells several brands that promote the health benefits of cannabidiol (CBD) hemp oil, including its effects as an antibacterial, anti-inflammatory and pain relief. The ‘green rush’ has increased awareness of CBD’s benefits and resulted in MJNA eyeing international markets such as Mexico for expansion.

β-glucan’s Immune-Enhancing Effects Make IMMD Products Attractive ‘New-Age’ Medicines

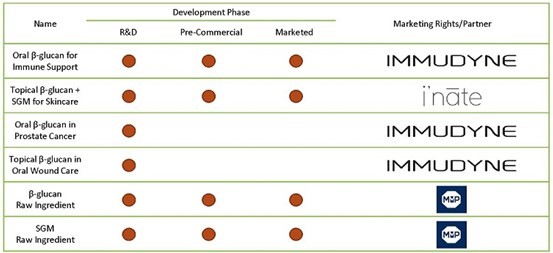

ImmuDyne is leveraging the health benefits of yeast beta-glucan to develop a pipeline of different products (as shown in Figure 3, below), including capsules for immune support and a rejuvenating skin cream.

Figure 3: β-glucan’s Broad Activity Gives IMMD Opportunity To Address Broad Unmet Needs

Beta-glucan (β-glucan), derived from yeast, can be used as a stimulant due to its immunological and pharmacological effects. According to The Nutritional Journal [3] over 6000 papers have been published on the immune-modulating effects of β-glucan. The mechanism of action behind β-glucan is, therefore, very well understood and considered safe.

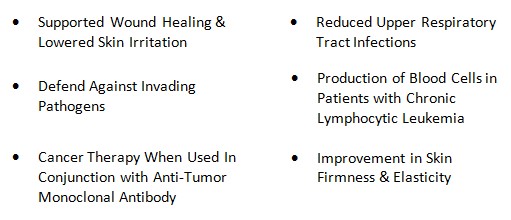

β-glucan binds to receptors of immune cells (ie. NK Cells, T Cells, B Cells) that protect the body and activates their defense mechanisms (Figure 4, below).

Figure 4: Scientific Studies Have Shown Broad Medical Benefits Beta-Glucan

Why 2016 Could Be An Inflection Point for ImmuDyne (IMMD)

1) A Big Change Happened in Q4 2015 and No One Noticed

In 2015, ImmuDyne generated most of its sales by manufacturing yeast-derived beta-glucan and selling the raw ingredient to Global Beauty companies like Avon or L’Oreal [4]. The company is expected to report $1.2M in sales predominately from this activity. However, in 2016, ImmuDyne projects that these ingredient sales to “2 of the top 5 global cosmetic companies” could grow to $2M.

In October, IMMD formed a Joint Venture (JV) with Inate Scientific, a direct to consumer marketing company that sells products online using a ‘free trial’ model. Together, the two companies launched a skin cream product line based on ImmuDyne’s proprietary yeast beta-glucan ingredient. The global market for skin care is worth an estimated $121 billion in 2016 [5] and IMMD has projected 2016 sales of $10M stemming from their JV with Inate Scientific.

2) Rapid Revenue Growth and Profitability

Figure 5: Forecasted 2016 Revenues of $12M Are 10x Higher Than 2015 Revenues

ImmuDyne expects to report 2016 revenues in the neighborhood of $12 million, a 10x increase from the 2015 sales figure [6]. The bulk of sales ($10 million) will be generated from the joint venture with Inate Scientific, showing the potential of follow-on products on ImmuDyne’s top line. In addition to the top line ramp, the company expects to be profitable in 2016, in stark contrast to many medical marijuana companies who have prioritized top-line growth over cost management and capital structure.

3) GRAS Status Allows Fast & Inexpensive Commercialization of New Products

Beta-glucan is exempt as a ‘drug’ by the FDA under the ‘Generally Regarded As Safe’ (GRAS) classification. So although a biochemical response is induced, β-glucan is not considered a drug. Therefore, ImmuDyne does not need to undergo the FDA’s expensive and time consuming drug development process to commercialize a product.

IMMD’s JV partner, Inate Scientific, announced their deal with ImmuDyne in October 2015 and by December 2015, the companies launched their first skin cream product. Given β-glucan’s proven health benefits, ImmuDyne could reasonably be expected to announce similar product launches for common problems like bacterial infections or wound care that would further broaden the company’s product pipeline and revenue channels.

4) IMMD Fair Value $0.47/share; Implying Upside of 100% From Market Price

If IMMD were priced in line with the average forward EV/Sales multiple that ingredient and beauty care companies such as Hain Celestial (HAIN) and Revlon (REV) have been assigned, as shown in Figure 6 below, IMMD shares would be worth $0.47, or 88% greater than current market price.

Figure 6: IMMD Currently Trades at 0.6x Forward EV/Sales; Peers Command 2X, or Twice Their Valuation

Importantly, ImmuDyne’s (IMMD) CEO, Mark McLaughlin, who is a 30% shareholder, has preserved the company’s capital structure. This means that the top line growth and new bottom line in 2016 will trickle down to each shareholder and buoy the fair value of each share of IMMD. McLaughlin’s large ownership interest suggests capital preservation will be prioritized alongside cost management and top-line growth, benefitting all shareholders of the Company.

Key Takeaways:

- ImmuDyne (IMMD) is developing a pipeline of ‘new-age’ nutraceuticals by leveraging the proven health benefits of beta-glucan

- Marijuana companies have utilized adoption of cannabis as an alternative medicine to go into clinical testing for serious diseases, including epilepsy and cancer to clinically-prove health benefits

- Commercialization for marijuana companies remains a challenge in most states where cannabis is illegal, limiting their growth

- FDA GRAS-Status for beta-glucan enables ImmuDyne to commercialize new products quickly & avoid the expensive drug approval process

- IMMD 2016 sales are expected to jump 10x to $12M in 2016; company valued at just 0.6x forward sales versus peers at 1.2x

- If IMMD traded in-line with peers, shares would be worth $0.47, or 88% above recent market prices

- If IMMD traded at the price-to-sales multiple awarded companies like Medical Marijuana (6x sales) or Terra Tech (TRTC) shares would be worth well over $0.47

References & Endnotes

[1] http://www.arcviewmarketresearch.com/s/Executive-Summary-State-of-Legal-Marijuana-Markets-4th-Edition-jvar.pdf

[2] http://jnnp.bmj.com/content/83/11/1125.full.pdf+html

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2997305/

http://onlinelibrary.wiley.com/doi/10.1046/j.1365-2044.2003.03408_3.x/full

[3] http://www.ncbi.nlm.nih.gov/pmc/articles/PMC4012169/

[4] ImmuDyne has not disclosed which global cosmetic companies they sell ingredients to. Avon and L’Oreal are hypothetical for illustrative purposes, both being ‘Top 5 Cosmetic’ names

[5] http://www.statista.com/statistics/254612/global-skin-care-market-size

[6] http://www.otcmarkets.com/edgar/GetFilingPdf?FilingID=11113772

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received twenty thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We expect to receive ten thousand dollars per month and an additional five hundred thousand restricted shares for our services, ending on November 30, 2016, however our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/