Quest Resource Holdings (QRHC) is a vastly undervalued waste management technology Company. QRHC trades at $0.55 per share but is worth at least $2. Goldman Sachs and KKR Co-Founder Henry Kravis suggest QRHC is worth upwards of $6.

QRHC is misunderstood; the Company uses a network of third-party haulers to manage waste for Wal-Mart, Kroger, AT&T and thousands of other businesses without requiring significant capital expenditure by leveraging its intellectual assets.

QRHC is focusing on improving fiscal performance through higher-margin services. Cloud computing companies that transitioned to higher-margin offerings beginning in 2013 tripled the S&P 500 return at their peak.

In February 2016, QRHC appointed Ray Hatch as CEO. Prior to Quest Resource, Hatch helped build Oakleaf, a commoditized waste management broker, into the largest third-party waste network in North America [1], before its acquisition by Waste Management in 2011 for $425M and ran a multi-hundred million dollar food distributor that distinguished itself through its reliability and service.

QRHC Chairman Mitch Saltz was formerly CEO of Smith & Wesson (SWHC) and made his investors a fortune when he acquired the gun-maker for $45 Million in 2001. Saltz brought in an experienced CEO to lead SWHC in 2003, which is valued at over $1.5 Billion today. Saltz is QRHC’s largest shareholder and betting Hatch can grow the Company’s business.

March 31, 2016 is a potential catalyst for QRHC shares as the Company reports full-year 2015 sales and new CEO Ray Hatch comments on his vision for the Company.

QRHC is a Technology Company That is Misunderstood as a Capital Intensive Waste Hauler

Quest’s technology platform connects a network of third party trash haulers who handle recyclable materials with customers who need their services.

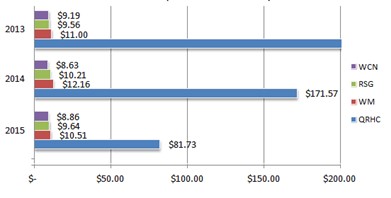

By leveraging their intellectual assets, QRHC is able to generate $81 in revenue for every dollar invested in capital expenditures, compared to $10 in revenue for every dollar invested for Waste Connections, Republic Services and Waste Management (as shown in Figure 1, below) – all of whom rely on capital-intensive business models.

Figure 1: Quest’s Asset Light Model Generates roughly 8x More Revenue Per Dollar Invested Than Peers

Waste Management, Republic Services are giants that operate expensive facilities and large fleets for collecting and disposing of waste in their landfills. Quest Resource leverages its relationships with haulers who own and operate their own equipment to fulfill service contracts with [QRHC] customers. Quest Resource operates a platform that relies on thousands of service providers that compete for their business and utilize otherwise under-utilized capital equipment. QRHC is the ‘Uber’ of Waste Management.

Capital-intensive waste management companies – that generate roughly $10 for every $1 invested in capital equipment - are valued at 1.3x enterprise value (EV) to sales (shown in Figure 2, below). If QRHC were valued at 1.3x EV/Sales, QRHC shares would trade at $2.00.

Figure 2: If Valued in Line With Waste Management Peers, QRHC Shares Would Be Trading 3.5x Higher

But QRHC operates a technology business that generates $81 for every $1 invested in capital equipment and relies on intellectual assets for scale and growth. Therefore, shouldn’t QRHC trade above its peers – or above $2 per share? This suggests a disconnect in the market, where QRHC recently traded for $0.55 a share.

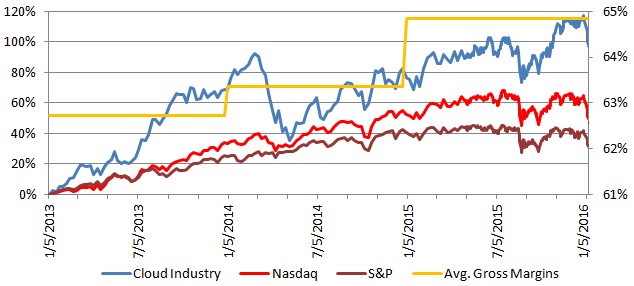

Asset Light Model Allows Cloud Companies to Increase Margins and Boost Share Prices

By moving to a virtual centralized network, cloud companies were able to adopt asset light models that provided enhanced service at higher margins. NQ Mobile (NQ), for example, uses the cloud as a platform for content delivery, enabling higher download speeds and lower server costs. InterCloud (ICLD), a company that helps enterprise clients migrate to the cloud, has offered a new “cloud” revenue vertical that the company expects will lift margins by 17% in the next 2 years [2]. Similarly, Internap (INAP), a provider of internet infrastructure, is delivering margin expansion by selling existing clients new, 70%+ margin hosting and cloud services. INAP is expected to see 2015 margins north of 60%, up from 52% in 2012 [3].

Overall, cloud companies have been reporting an increase in margins since 2013, as seen by the yellow line in Figure 3, below. This surge in operational efficiency has been ensued by higher share price performance across the industry [4].

Figure 3: With Margins Trending Upwards, The Cloud Industry Has Outperformed Nasdaq 2-Fold and S&P 3-Fold Since 2013

QRHC’s Increased Margins Will Take Company One Step Closer to Profitability and Buoy Share Price

Quest has formed a nationwide footprint of over 40,000 customer locations and more than 3,500 third party haulers [5]. The company will leverage this national presence and existing long standing relationships with blue chip clients like Wal-Mart, Kroger and AT&T to cross sell into higher margin service lines.

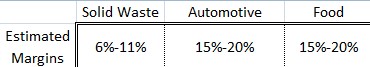

Quest can bundle more profitable service lines such as automotive and food (Figure 4, below) to existing clients who are looking for an economic system of managing their waste. As a result, Quest will be able to generate a favorable revenue mix and improve margins.

Figure 4: Estimated Gross Margin Profile for Waste Streams

A 1% incremental margin improvement would result in roughly $1.7 million trickling down to the bottom line (0.01*170m in estimated 2015 revenues). In 2014, Quest reported EBITDAS of $1.4 million. Reporting a $3.1million EBITDAS as a result of a 1% margin improvement would, all else being equal, imply QRHC is worth more than double today’s price.

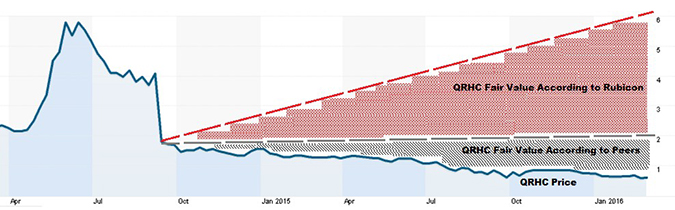

Therefore, as more business shifts towards higher margined service lines, we expect the company’s profitability to improve and QRHC stock to trade in line with or above peers (Figure 5, below).

Figure 5: QRHC Fair Value Is $2.00 if Valued like Capital Intensive Peers and $6.30 if Valued Like Rubicon

The graph above shows that QRHC could present upside of 264% if valued in line with other waste management peers. The clearest indicator that QRHC is grossly undervalued, however, is privately held Rubicon. Rubicon received a $500 million dollar valuation from investors Goldman Sachs, Henry Kravis and Leonardo DiCaprio, who paid 4.17x sales.

Since Rubicon also leverages a technology-driven approach to waste management, it is the most relevant measuring stick for Quest Resource. If QRHC is valued at the same 4.17x sales, it would trade at $6.30 per share, or 10x market price. Rubicon’s planned IPO will buoy QRHC shares by shedding light on this disconnect. In the meantime, QRHC is expected to report fiscal 2015 results on March 31, in which the company’s new CEO Ray Hatch is expected to outline growth plans for 2016 – which could catalyze a move in share price.

Key Takeaways:

- New QRHC CEO, Ray Hatch, appointed in February 2016 expected to focus on cost management and margin expansion, which cloud computing companies have proven is correlated with stock-price performance

- Ray Hatch, who helped build Oakleaf, acquired by Waste Management in 2011 for $425 Million, and managed a multi-hundred million dollar food distributor, joins Smith & Wesson directors Barry Monheit, Michael Golden and Mitch Saltz on QRHC board.

- QRHC lags waste management industry in valuation despite its disruptive technology-driven business model

- Industry implies QRHC fair value is $2.00 per share

- Rubicon, a technology-driven competitor, implies QRHC fair value is $6.30 per share

- Peers imply QRHC has potential upside of 263% - 1060% based on recent market price of $0.55 per share

- QRHC reports full-year 2015 results on March 31, 2016; could catalyze share price movement

References

[1] http://waste360.com/node/19971

[2]http://content.stockpr.com/intercloudsystems/db/184/316/pdf/InterCloud+Investor+Presentation+v23.pdf

[3] http://www.slideshare.net/internap/4-q15-earnings-presentation?ref=http://ir.internap.com/

[4] https://www.bvp.com/strategy/cloud-computing/index

[5] http://s2.q4cdn.com/726070179/files/doc_presentations/2016/Quest-IR-Presentation-V7.pdf

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Quest Resource Holding Corporation ("Quest" or the "Company”) as part of a twelve month research coverage services agreement starting February 1, 2016. In exchange for our services, we expect to receive seven thousand five hundred dollars and seventeen thousand five hundred dollars for the first and second month, respectively, and twelve thousand five hundred dollars per month thereafter. We expect to receive one hundred thousand restricted shares of the Company per quarter, however, our agreement is subject to termination at the discretion of Quest. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/