The joint venture that ImmuDyne (IMMD) said would ramp total revenues 720% in 2016 is expected to deliver impressive earnings, according to a deal inked on Thursday. In an 8-K filing [1] with the SEC, ImmuDyne said it would take a 78% interest in Inate Scientific in exchange for up to 9.5M shares predicated on Inate helping ImmuDyne earn $5 Million, or $0.12 per share in pre-tax income. IMMD shares recently traded for $0.30.

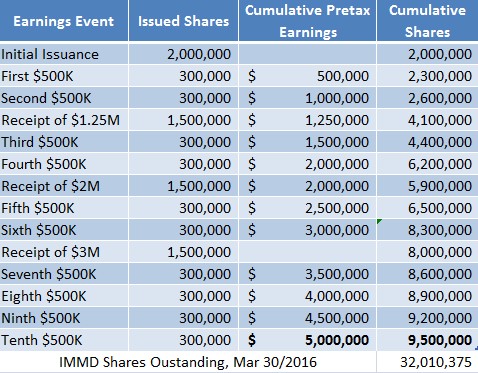

Rarely are M&A deals predicated on earnings, as shown in Figure 1 (below).

Figure 1: ImmuDyne’s Deal With Inate Is An All-Contingency Deal

Companies like Opko (OPK) and 3D Systems (DDD) have used their equity as a form of currency to fund growth through acquisitions. These companies’ targets, however, have never agreed to an all-contingency deal, such as the one that Inate signed with ImmuDyne this week.

The most comparable deal to ImmuDyne’s is Terra Tech’s (TRTC) purchase of ‘Blum’, a medical cannabis dispensary. Terra Tech agreed to pay 1.5x forward revenue for Blum, making the deal contingent on Blum’s 2016 revenues. This way, Terra Tech only pays for performance and protects shareholder interests.

ImmuDyne, however, is paying Inate based on pre-tax earnings that the company receives from the direct marketing of the skin care product line. Therefore, the only way Inate is compensated is if it adds bottom line value to IMMD shareholders.

ImmuDyne’s acquisition of a 78% stake in Inate clearly shows the Company’s interest in acquiring a rapidly-growing brand that anticipates earnings in 2016. All consideration provided to Inate’s managing members, is predicated on earnings, not revenue or sales.

Figure 2, below, shows the contingent consideration ImmuDyne is paying for a 78% interest in Inate.

Figure 2: ImmuDyne Could Receive $5M in Pretax Earnings In Exchange for 9.5M Shares

The managing members of Inate Scientific, a direct-to-consumer marketing company that relies on ImmuDyne’s proprietary beta-glucan for their SKUs, are incentivized to grow sales but also manage costs to ensure a complete earn-out of ImmuDyne shares in the deal. Inate would receive a combined 2.3M IMMD shares if it can generate $500,000 in pretax earnings for this year, which suggests its managing members are confident this can be accomplished.

Provided Inate can generate earnings, their members become large shareholders in IMMD. In this event, maximizing the value of their IMMD shares benefits all current and future ImmuDyne shareholders. Therefore, the deal whereby ImmuDyne acquires 78% of Inate is accretive to the Company’s shareholders today and in the future. The agreement expires in 2 years, therefore by 2018, ImmuDyne could generate $0.12 (pretax) in basic EPS. For reference, IMMD currently trades at $0.30/share.

What Was ImmuDyne Worth Prior To The Inate Deal?

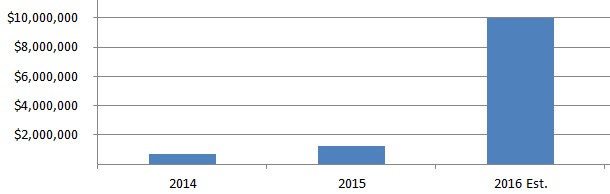

ImmuDyne reported full-year 2015 revenues of $1.22 Million [2]. The Company guided for $10 Million in revenue for 2016, driven by their Joint Venture partnership with Inate Scientific [3].

Figure 3: IMMD Expects Full Year 2016 Revenues To Grow 720%

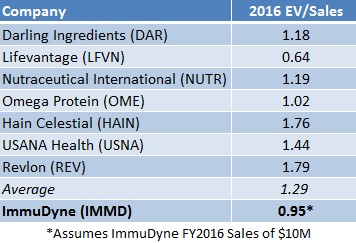

In March, ImmuDyne said sales for the first 2 months of 2016 were $1.2 Million, as much as revenues for all of 2015. If investors use ingredient suppliers like Darling Ingredients (DAR) or Omega Protein (OME) to value ImmuDyne, each share is worth $0.39, based on the Company’s full-year 2016 guidance (see our prior note for a more detailed explanation).

Figure 4: ImmuDyne Trades at a Discount to Peers, Even With Their Announced Business Pivot

What Is ImmuDyne Worth Following The Inate Deal?

If investors look at issuers whose focus is on consumer brands and involvement in the entire supply chain, companies like Neptune (NEPT) and Medifast (MED) serve as strong benchmarks for ImmuDyne to be valued at $0.49 per share.

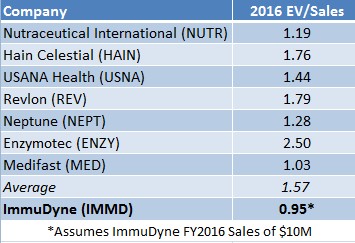

Figure 5: ImmuDyne Trades at a 0.95x Forward EV/Sales Multiple, While Peers Receive 1.57x

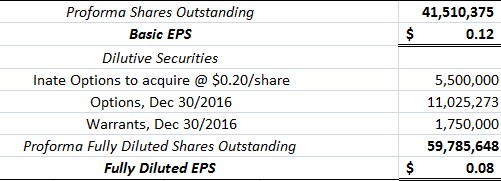

How Do Earnings Change Fair Value For IMMD Shares?

The contingent consideration ImmuDyne offered Inate’s members suggests both parties believe profitability is expected in 2016. Moreover, a complete earn-out is contingent on earnings to ImmuDyne of $5 Million. When factoring in the dilutive effect of stock issuance to Inate’s members in exchange for these earnings, basic EPS (pre-tax) works out to $0.12. If we assume ImmuDyne’s rapid growth warrants a 20x earnings multiple, fair value is $2.40 per share. Again, this compares to a market price of $0.30.

If we reserve valuing ImmuDyne based on earnings, reporting of actual earnings creates a powerful catalyst for the price of IMMD shares to inflect, perhaps as early as this year.

Key Takeaways:

- ImmuDyne (IMMD) inked a deal with Inate Scientific to trade up to 9.5 Million shares for $5 Million in pre-tax earnings by 2018

- Inate Scientific is the direct-to-consumer Joint Venture (JV) that is spawning 720% revenue growth for IMMD in 2016

- Inate must deliver earnings to receive ANY stock consideration in the deal

- IMMD shares are worth at least $0.49 based on a peer analysis, compared to $0.30 market price

- Upside to owning IMMD is 63% based on current fair value;

- Earnings in 2016 create a powerful catalyst and potential upwards re-valuation of IMMD stock

References & Footnotes

[1] https://www.sec.gov/Archives/edgar/data/948320/000121390016012306/f8k0416_immudyneinc.htm

[2] https://www.sec.gov/Archives/edgar/data/948320/000121390016011978/f10k2015_immudyneinc.htm

[3] http://finance.yahoo.com/news/immudyne-pre-announces-full-2015-140602665.html

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received forty thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We expect to receive ten thousand dollars per month and an additional five hundred thousand restricted shares for our services, ending on November 30, 2016, however our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/