A run on gold has propelled it to an all-time high in August 2020 when it nearly doubled from its 5-year nadir, fueled by an overheating stock market, a raging pandemic and massive stimulus packages from governments around the world.

But you still might not have missed the mega-rally.

Gold Rush 2.0 could just be getting started, with junior miners, in particular, gearing up for an encore thanks to their unique ability to act as highly leveraged plays capable of multiplying the gains of gold by margins because of the relative significance of a gold discovery for a junior.

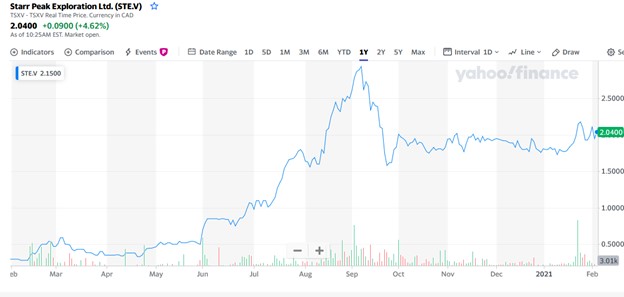

Canada’s junior miners Amex Exploration (TSX-V:AMX) and Starr Peak Exploration (TSX.V:STE; OTC:STRPF) have been particularly outstanding, shooting the lights out during the first gold rush after racking up sizzling gains of 120% and 300%, respectively, over the past 52 weeks.

Both stocks have been incredibly popular with value investors thanks to the companies’ enormous gold potential relative to their market valuations - meaning they have a lot to gain if things go right.

Yes, overall, there has been renewed interest in gold mining stocks after Berkshire Hathaway made a sizable investment in Barrick Gold (NYSE:GOLD)(TSX: ABX) last year.

But there’s much more to it than that, including a Biden Administration that’s about to let loose a $1.9-trillion stimulus package that is trying to make its way through the bureaucratic channels as we speak.

The gold moguls are now stockpiling gold assets because they understand that the rally has legs and a growth runway long enough for multi-year gains. So they’re busy now looking for the next big discovery by a junior with major upside.

And Canadian miners have been thriving. EY’s latest Canadian Mining Eye index shows that TSX mid-tier and junior mining companies jumped 9% in Q4 2020, and 2021 is expected to see them outperform even more.

Canadian resource mogul Robert Friedland has been taking a larger share of his Ivanhoe Mines Ltd (OTCQX:IVPAF) (TSX: IVN) while billionaire Eric Sprott has been actively investing in companies like Amex Exploration (OTCQX: AMXEF) (TSXV: AMX), Vizsla Resources Corp. (TSXV: VZLA) (OTCQB:VIZSF) and Orefinders Resources Inc. (TSXV: ORX).

But the biggest upside could end up being Starr Peak. A couple directors and early Amex investors have jumped into their neighbor Starr Peak as shareholders themselves, and this drill bit is spinning rapidly: The company has cash in the bank and launched drilling in January.

Although gold is sitting at multi-year highs - implying higher entry costs for investors - the global macro-environment setup remains highly supportive of the yellow metal thanks to a plethora of catalysts including projections for a weaker U.S. dollar, more stimulus, negative real yields, dovish monetary policies, and rising inflation expectations.

And, investors don’t have to worry about Wall Street or some other fiendish actors conspiring to keep a lid on gold prices.

Unlike silver, which has sometimes fallen victim to massive pump-and-dump schemes such as the Hunt Brothers fiasco of the 1970s or, more recently, a Reddit-backed short squeeze, the gold market is much bigger and more complex making it a Herculean task even for LBMA (London Bullion Market Association) market makers like Goldman Sachs to manipulate.

Luckily, investors can still take advantage of momentum trades since the long-term gold trajectory is according to many analysts pointing in only one direction - UP.

Here are 3 Big Reasons why Canadian junior gold miner Starr Peak Exploration (TSX.V:STE; OTC:STRPF) could be poised to become the most exciting gold play of 2021.

Source: Yahoo Finance

#1 Peak Gold Supply

A recent SNL Metals & Mining report via Money Week revealed that only 167,000 tonnes of all the gold that has ever been mined remain in existence today. That’s not much at all when you consider that global central banks hold ~ 30,000 tonnes of gold in their reserves.

The report essentially arrived at one conclusion - we have hit ‘peak’ gold.

It’s simple: We have been pulling gold from the ground faster than we can replace it through new discoveries.

Over the last 24 years, we have mined 1.84 billion ounces of gold but only discovered 1.66 billion ounces from 217 deposits creating an obvious deficit. Meanwhile, our known gold reserves have declined to just 674 million ounces from 93 deposits since 2000 compared to 1.1 billion ounces from 124 deposits in the 1990s.

The irony about gold is that our modern technologies have not been able to improve much on the supply side of the equation. In fact, most gold-mining technologies were developed in the 18th century with much of the gold in use today deriving from that period.

You see, peak gold is all about how much gold is reasonably and economically recoverable. Peak gold refers to the point where gold production reaches a zenith and then starts tail spinning, with production declining faster than ever.

Peak gold represents a great watershed for the precious metal - but a great opportunity not only for gold bulls but also for gold investors who aim to realize profits by buying junior gold explorers like Starr Peak, currently valued at below $30 for every ounce of gold it owns.

#2. The Starr Peak-Amex Connection

It’s junior miners like Amex Exploration (TSX-V:AMX) and Starr Peak Exploration (TSX.V:STE; OTC:STRPF) that probably hold the key to new supply.

Only last year, Starr Peak was regarded merely as a good speculative play. However, that may have changed this year after the company kickstarted a drilling campaign that could prove to be the best exposure out there.

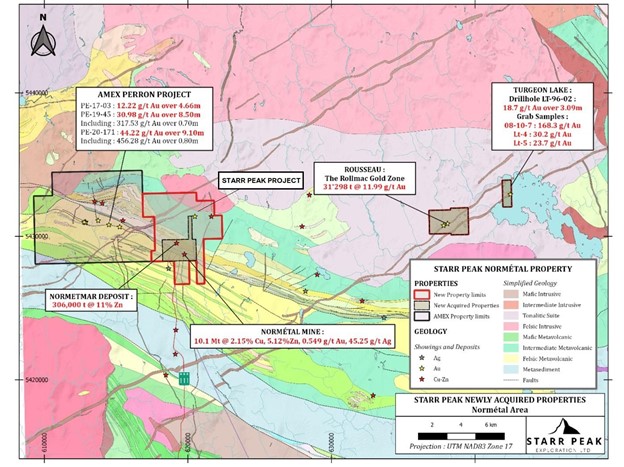

They commenced drilling on the Main bloc of their NewMétal property, covering the past-producing Normétal Mine, from which ~10.1M tonnes of 2.15% Cu, 5.12% Zn, 0.549 g/t Au, and 45.25 g/t Ag were produced. This likely minimizes the risk of disappointing investors with its plans, given that Starr Peak has confirmed grades and favorable historic results for the area about to be drilled.

They have identified a number of drill targets, based on a release issued late last year. Investors can likely expect announcements for these drilled holes to be released in the coming months.

The most exciting part: Starr Peak’s neighbor, Amex Exploration, has just announced a gigantic gold find.

In January, Amex announced the discovery of a new high-grade gold structure by drilling an intersection returning 31.87 g/t Au over 5.10 meters on a new target area on its flagship Perron property. The drill intersection is located approximately 650 metres north-west of the High Grade Zone (HGZ) and 500 metres north-east of the Grey Cat Zone that represents a new gold-bearing area on the property.

Jacques Trottier, Executive Chairman of Amex, said:

"This new high-grade gold area is a game changer for the Perron project. This discovery demonstrates the tremendous upside of the Perron Property as it lies in an area that we had interpreted as being highly prospective but till now had remained untested. There are many more such targets on the Perron property."

Starr Peak is now fully primed to take advantage of its close-ology to that of neighboring Amex Exploration, right on time after Amex announced the discovery of high-grade ore in its adjacent Perron property.

And Amex just keeps drilling closer and closer to Starr Peak’s boundary line. Last report has it, the drill is less than 1km away from the boundary line with Starr Peak and getting closer.

#3 Attractive Macro and Micro Setup

First, these are macro trends that are hard to beat.

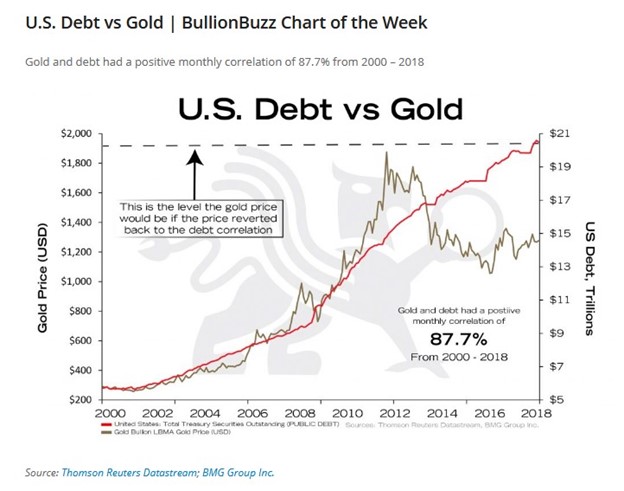

The trajectory of the United States federal budget has been truly worrying - and great for gold. The debt burden is swelling by trillions of dollars and the Treasury is forced to refinance the ballooning debt at ever-growing rates.

For fiscal 2020 (ended in September), federal borrowings totaled $20.3 trillion, a $3.5 trillion increase, good for 20% growth from the previous year’s $16.8 trillion. Meanwhile, the CBO has projected that Trump's $900 billion stimulus package will swell the budget deficit from $1.810 trillion to $2.710 trillion, or a 50% increase.

That scenario will bring total public debt to a staggering $38 trillion by 2030, well over twice the burden in 2019 and an absurd 123% of GDP.

The good news for gold bulls: Debt levels have been showing a strong positive correlation with gold prices.

In fact, gold and debt have displayed an impressive 88% correlation in the period 2000-2019. That includes the divergence period starting in 2012 when gold prices hit a previous all-time high of $1,920/oz.

Source: BMG Group

The strong correlation between debt and gold prices means that gold prices are likely to find a floor around $1,900 per ounce and many think could be trading in the $2,200-$2,300 range over the next two years.

At the same time, the micro trend for a company like Starr Peak is excellent.

From the beginning, Starr Peak has moved aggressively, enough to scoop up the land around Amex right before their big discovery. Since then, it’s continued to expand its position to include 74 miners claims over 2,280 hectares in what is becoming the world’s hottest gold venue of Quebec.

And now it’s drilling. It’s fully funded to see this campaign through to the end.

Momentum keeps building at a fast clip. We expect first results soon, with the January 21st launch of the NewMetal drilling campaign targeting historically drilled and known mineralization.

There’s nothing better in the junior game than drilling right between a major new discovery and a massive past-producing mine. Right when gold could be geared for a long-term rally setup.

Last summer, Legendary investor Warren Buffett finally changed his long-held negative stance on gold when Berkshire Hathaway announced that it would be taking a massive stake in Canadian Barrick Gold (NYSE:GOLD, TSX:ABX ) at a time when gold was soaring. Berkshire Hathaway bought more than $560 million in Barrick Gold shares. Buffett often referred to gold as useless for the most part. But with COVID-19 pandemic market-wide downturn and economic impact, even if the dollar makes a few temporary comebacks, gold is still a very attractive asset for many investors.

Barrick Gold, for its part, has had a particularly tough start to the year, seeing its share price fall from August highs of $29 to its current price of $20.18. That doesn’t mean the company is down for the count, however. Barrick Gold still has a healthy balance sheet, with debt down and enough cash on hand to remain well positioned and relatively risk-adverse.

Despite its excellent and higher-than-expected earnings, Barrick’s stock price has closely followed gold’s trajectory, with the price of the precious metal falling due to more positive economic news and a flourishing tech sector. But according to many analysts, this may not last much longer, and it is likely investors will pile back into gold again.

Newmont (NYSE:NEM, TSX:NGT ) is the largest gold company on the planet, but that doesn’t mean it doesn’t still have upside potential. Founded in 1916, and based in Greenwood Village, Colorado, Newmont is a veteran miner with one of the top executive teams in the business, and its operations span 11 countries, including gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

The big news for the company in 2019 was its acquisition of Goldcorp. Though it was controversial at the time, the $10 billion acquisition has paid off in a big way. As gold climbed to record highs thanks to investors piling into gold due to the COVID pandemic, Newmont has seen a boom in its share price. Last year, gold soared from $1282 to over $2000 at one point, and Newmont’s stock rose with it, earning investors as much as 90% returns on their original purchase.

Like Barrick, Newmont has struggled in 2021, however, seeing its share price fall from its November highs of $68 to its current price of $57. This path has been very closely related to the price of gold which has also tumbled in the same amount of time.

Yamana Gold (NYSE:AUY, TSX:YRI) is another giant that has seen its share price hit especially hard since January. Yamana has fallen by as much as 25% since January alone, and without some short term support it may even head lower. But that doesn’t mean it isn’t a great company worth keeping an eye on.

Recently, Yamana signed an agreement with Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation. The agreement is a major step forward for the Agua Rica region, and all of the miners working on it.

In its fourth-quarter earnings call, President and CEO of Yamana provided investors with a glimpse of what’s to come, “In 2022, we are forecasting 870,000 ounces of gold and 9.4 million ounces of silver and in 2023, 889,000 ounces of gold and 8 million ounces of silver.”

Kinross Gold Corp. (NYSE:KGC; TSE:K) may not be as established as some of its century-old peers, but it’s quickly becoming a major player in the industry. With operations across the globe, its big picture approach is paying off. The $11 billion gold giant has mines in Brazil, Ghana, Mauritania, Russia and the United States, and it’s looking to expand even further.

Since 2015, Kinross has seen its share price rise by as much as 400%. In fact, this year alone, it’s already up by as much as 85%. And Kinross is showing no signs of slowing. With a healthy balance sheet, favorable earnings reports, and governments, banks, and retail investors piling into safe haven assets, it’s likely to continue climbing.

Like its peers, Kinross posted positive fourth-quarter earnings but has been weighed down by the price of gold. The company’s share price has fallen from $7.98 on the first trading day of the year to its current price of $6.80, but not all is lost. Because smaller miners benefit big on even the smallest moves in gold prices, if the price of the precious metal does see an uptick in the coming months, Kinross will likely be one of the biggest benefactors.

Kirkland Lake Gold (NYSE:KL; TSX:KL) is another one of Canada’s tried and true gold miners. Though not quite as large as Barrick or Newmont, Kirkland is no stranger to striking headline grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry.

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

According to a joint press release, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

By. Paula Jennings

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for gold will retain value in future as currently expected, or could rise based on political considerations; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can achieve drilling and mining success for gold; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; and that Starr Peak will be able to carry out its business plans, including timing for drilling. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold prices as expected; the Company may not complete all the property purchases for various reasons; it may not be able to finance its intended drilling programs; Starr Peak may not raise sufficient funds to carry out its plans; geological interpretations and technological results based on current data that may change with more detailed information or testing; and despite promise, there may be no commercially viable minerals or ore on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The writer of this article is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.