If ReneSola’s (SOL) Q1’16 results and subsequent rise in share price are any indication, ImmuDyne (IMMD) has a hidden catalyst forming this quarter.

ImmuDyne sales grew 470% year-over-year, in the first full quarter of operations for subsidiary Inate Scientific [1]. The Company shifted emphasis from its raw material supply business to Inate, its rapidly-expanding direct-to-consumer business. Similarly, ReneSola’s unexpected profit was driven by a sales mix trending away from OEM business and towards downstream project development [2].

ReneSola’s improved margins contributed to its first quarter profit. ImmuDyne lost $0.1 Million in Q1’16 but said that strategic changes implemented in April, such as in-sourcing customer service reps, had cut costs by 25%. We view this as a prelude to higher margins and potential profitability in Q2.

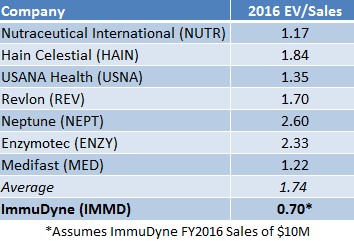

ImmuDyne trades at 0.7x forward EV/Sales, compared to its peer group at 1.74x forward EV/Sales. We see Q2 results as a potential catalyst for narrowing this valuation gap and potentially creating 132% in upside for IMMD shares.

Figure 1: If IMMD were valued in-line with peers, share would be worth $0.51, on a forward sales multiple

After forming a joint-venture with Inate Scientific to market beta-glucan based skincare products direct-to-consumers, ImmuDyne has guided for impressive growth. In fiscal 2014 the Company had sales of $0.714 Million. Fiscal 2015 sales were $1.22 Million. Fiscal 2016 guidance is for $10 Million in sales, with Inate expected to contribute the lion’s share. Q1’16 sales came in at $1.64 Million, with Inate contributing $1.375 Million, or 84%. With a loss of just $0.1 Million in Q1, ImmuDyne would need a single-digit improvement in margins to post a Q2 profit, all else being equal.

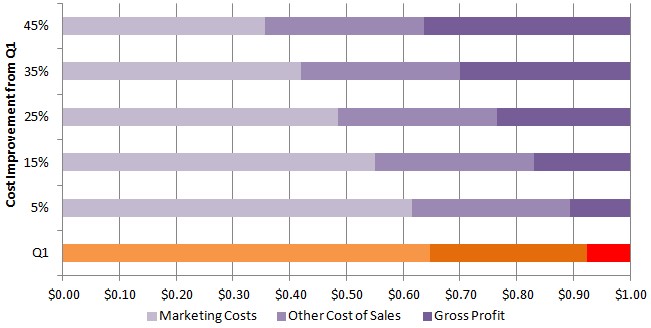

ImmuDyne highlighted in-sourcing of its customer service reps in April as a critical component of lowering costs. The Company added 3 new marketing partners to lower customer acquisition cost, which is a measure of the cost to acquire one customer. We modeled how a decrease in customer acquisition cost would impact gross margin in Figure 2, below.

Figure 2: With a 25% cost improvement, ImmuDyne would spend $0.49 compared to $0.65, to generate $1 of sales

In Q1’16 Inate spent $0.65 (light-color section of the orange bar) to acquire $1 in sales. Each subsequent bar (in purple) represents an incremental reduction in cost of acquiring each $1 in sales. If we assume Inate’s customer acquisition cost drops 25% in Q2’16, gross profit rises from $0.35 to $0.51, or 46%, for every dollar in sales.

Even if sales were to remain flat from Q1’16, this reduction in customer acquisition cost would contribute $0.216M to gross profit and result in a net profit, all else being equal. However, a sales ramp would further buoy this estimate.

If ImmuDyne were to remain on-track with its projected sales growth to $10 Million in fiscal 2016, we see this as a strong catalyst for shares to trade in-line with nutraceutical peers like Neptune Technologies (NEPT), Enzymotech (ENZY) and others at 1.74x forward enterprise value-to-sales (EV/Sales). ImmuDyne trades at just 0.7x forward EV/Sales. A profitable second quarter would create a significant arbitrage opportunity if the gap in valuation between IMMD and peers continued as the status quo.

With Profitability IMMD Shares Are Worth $0.50, 127% Above Current Market Price

As ImmuDyne’s Inate business matures, up-front and one time setup costs will diminish and overall expenses as a percentage of sales should decrease. Through the first six weeks of Q2 2016, IMMD reported that their return on marketing investment increased substantially due to implemented strategic changes, notably expansion in the number of marketing partners bidding for their business and in-sourcing of customer service reps.

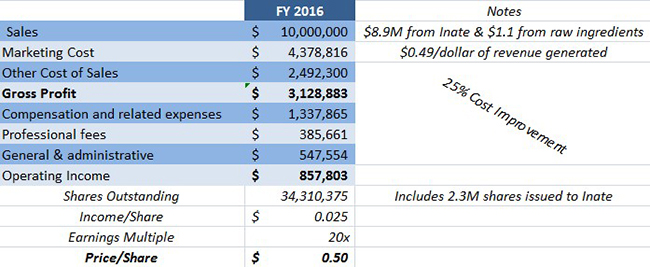

If investors were to value ImmuDyne based on future earnings, and not necessarily sales or sales growth alone, shares would be worth $0.50, compared to a recent market price of $0.22.

ImmuDyne has guided for fiscal 2016 revenue of $10 Million – shown in the sales line in Figure 3, below.

Next we computed marketing cost – which is our iteration of total customer acquisition cost. We computed marketing cost as growing in line with revenue ($4.38M) and then adjusted for a 25% improvement in this expenditure (recall our assumption on customer acquisition cost, above, in Figure 2). The result was a marketing cost line of $4.378M, as shown below.

Then other costs were computed as growing in-line with revenue and adjusted by 25% to account for cost reductions as a result of ImmuDyne’s ‘strategic changes’. Our end result was ‘other costs’ of $2.49M.

Figure 3: Estimated 2016 Profit Pegs IMMD fair value at $0.50/share

Net, we estimate 2016 operating income of $0.86M or $0.025 in EPS for fiscal 2016. If we were to apply a 20 P/E multiple on projected income, IMMD shares would be fairly valued at $0.50. That compares to a recent market price of $0.22.

We note that relative to many of its peers and, in general, many emerging growth companies, ImmuDyne’s capital structure has remained largely intact over the last few years. Dilution in the aggregate has been kept to low single digits. Growth in the last 2 years had been funded by low-cost capital and/or capital contributed by its Joint Venture partners. Importantly, this has resulted in a capital structure where every shareholder continues to fully participate in the future earnings potential of the Company. This is unsurprising, considering that ImmuDyne’s largest shareholder is its CEO & President, Mark McLaughlin, who owns approximately 30% of the Company and has, on several occasions, advanced the Company interest-free loans.

What Are The Risks?

As the upside to owning shares - should ImmuDyne report an unexpected or better-than-expected profit - is substantial this is balanced by extraordinary risk. For instance, there is a risk that sales do not rise as expected or that profitability is not achieved and shares deflate as a result. We view Q1 results and an honest admission that improvements are being implemented as reasons to give ImmuDyne’s management the benefit of the doubt that fiscal results are headed in a positive direction and shares have a good shot at out-performing peers.

ImmuDyne Could Lead Peer Group If Q2 Results Surprise

ReneSola leads its peers – Ascent Solar (ASTI), SolarCity (SCTY), First Solar et al. - in share price performance year-to-date after reporting a surprise profit in Q1’16.

Figure 4: ReneSola Leads Solar Companies In YTD Share-Performance

We see ReneSola’s inflection in valuation and share price on the heels of better-than-expected quarterly results as a proxy for where ImmuDyne may be headed. Importantly, the event sets precedent for ImmuDyne to lead its peers in price, and perhaps valuation, should the Company execute on its targeted 719% sales growth and profitability in fiscal 2016. Should IMMD hit its projections, we think owning shares at current market prices give investors 132% in potential upside.

Key Takeaways:

- IMMD trails peers on an EV/Sales basis; adjustment in price to trade in-line with peers would create 132% in upside

- ImmuDyne’s Q1’16 results show impressive growth and swift action by management to implement changes to drive profitability in 2016

- Strategic changes implemented in April are already reported to have had a positive impact on IMMD’s fiscal performance

- Our estimates show ImmuDyne could report a profit as early as Q2’16 and surprise the street

- Valuing IMMD based on potential profitability in 2016 still demonstrates large arbitrage (127%) compared to recent market price

- Q2 results create a potential catalyst; reason to own IMMD shares now.

References & Footnotes

[1] ImmuDyne Q1 Earnings Release http://ir.immudyne.com/press-releases/detail/47/immudyne-announces-q1-2016-net-sales-up-470-q2-changes-to

[2] ReneSola Q1 Earnings Release http://ir.renesola.com/phoenix.zhtml?c=210622&p=irol-newsArticle&ID=2171346

[3] ImmuDyne Full-Year Revenue Guidance Release http://ir.immudyne.com/press-releases/detail/45/immudyne-pre-announces-full-year-2015-revenues-up-73

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of ImmuDyne ("Company") as part of research coverage services. As of the date of this report we have received forty thousand dollars and five hundred thousand restricted shares of ImmuDyne for our services beginning in November 2015. We expect to receive ten thousand dollars per month and an additional five hundred thousand restricted shares for our services, ending on January 31, 2017, however our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, we loaned ImmuDyne $100,000 USD in an unsecured note that bears interest at 11% per annum for general working capital and to voice our support and belief in the Company's growth outlook. We are long shares of ImmuDyne. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/