The Gym, Health and Fitness Clubs industry has seen a rich revival as a result of recent marketing campaigns targeting different things like fighting obesity, as well as consumer trends toward improved health. In the years to come, analysts predict that many baby boomers are expected to sign up for health club memberships, as they increase their focus on more health-conscious due to their age. And the new generation of millennials has also been driving memberships.

The number of fitness center memberships in the US has steadily climbed during the last 10 years. By 2014, over 54 million people were members of one of the nearly 35 thousand health clubs in the United States. Considering the relative number of gym members in the U.S., it comes as no surprise that North America has one of the largest membership bases for fitness centers in the world. The total fitness center industry revenue in the U.S. amounted to 24 billion U.S. dollars in 2014, which was nearly 90% of the total revenue for the region. By The end of 2015, data from Statista shows that there are over 50million people who have a gym membership.

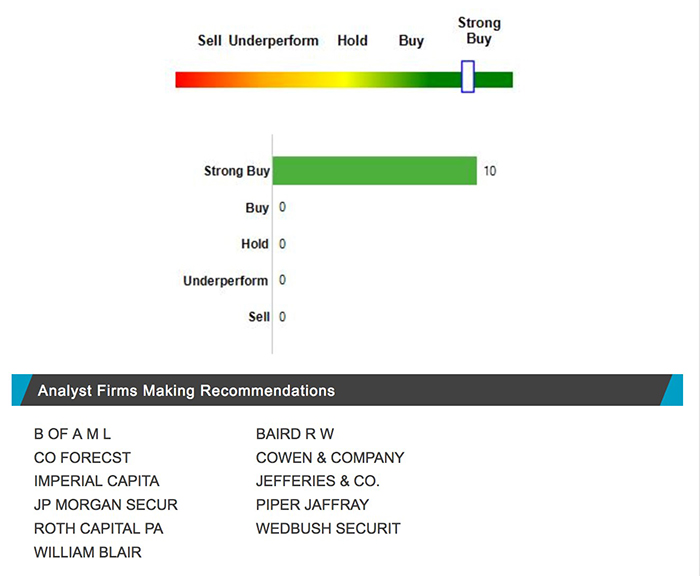

And with companies like Planet Fitness (NYSE:PLNT) continuing to beat street estimates, it should come as no surprise that there continues to be growing demand for fitness centers. For the past 4 quarters, Planet Fitness has outperformed EPS estimates by as much as 15%. Of the 10 analyst firms covering this stock all 10 have ranked the stock as a Strong Buy with a general consensus of a $24, 12-month price target.

Citing earnings grown of over 20% as compared to an industry bench mark of 10.3% as well as a 29.67 PE as compared to an industry 16.10, the low cost model has worked well for this franchise and continues to emphasize the overall growth in the fitness industry.

As a reference point for this growth, athletic apparel and fitness equipment companies like Nike (NYSE:NKE) have seen increasing margins. In its most recent earnings reported in September for the Period ending in August, The footwear and apparel giant recorded earnings per share of 0.73, which demolished analyst expectations of 0.56. This was the largest beat in the last 3 quarters for the company with the Feb quarter showing a 14.6% beat and the November 2015 quarter showing just a 4.65% beat of Wall Street estimates. At a current price of roughly $53 per share, the 12-month target range tops out at $70/share and a consensus of a healthy $63/share.

Currently Vanguard Group, FMR LLC and State Street Corp hold the 3 highest institutional stakes in the company. Analysts forecast a compound annual growth rate for Nike of over 12% for the 5 years, according to a survey by Thomson Reuters.

And this trend hasn’t stopped at just apparel either. Take a look at accessories companies focused on alternative fitness trends like power lifting. Companies in a highly crowded space have needed to find the niche to differentiate themselves from the larger players in the industry. Take for instance a newer company focused specifically on competitive lifting & CrossFit, Exolifestyle, Inc. (OTCMKTS:EXOL). The company’s brand of knew wraps and sleeves are dedicated to workout enhancement instead of workout recovery. The special compression fabrics and unique designs have attracted the likes of popular CrossFit and weight lifting athletes such as Elijah Muhammed, Noah Ohlsen, and U.S. Olympian Sarah Robles. The company also has a signed a non-binding memorandum of understanding with NFL Falcons’ Safety Keanu Neal to become a brand-ambassador, which could expand the brand well beyond a weight-training-only awareness initiative.

In the company’s most recent announcement CEO Vaughan Dugan expressed the company’s focus beyond a single product line, “ We strategically planned and have grown EXO's sales from a single-line company to a multi-line apparel brand offering wrist wraps, weight belts, apparel and active wear… We've established key business-to-business customers and will be rolling out a planned growth strategy to capture a portion of the international fitness market, both inside and outside of CrossFit.”

To this end, the latest surge in health club growth has expanded far beyond apparel and accessories manufacturers. Retail stores have also found increased revenue growth over the more recent quarters as new gym-goers spend money on branded products. And believe it or not, brands remain the big draw. Despite the impact that online sales have had on brick and mortar retail stores, apparel, footwear and accessories brands have continued to create strong demand. It has become evident especially if you are one of these gym-goers, with seemingly everyone wearing “Under Armour (NYSE:UA) this” or “Lululemon Athletica (NASDAQ:LULU) that”.

"The customer still wants to identify with an athletic brand...The logo and branding certainly says, 'I care about my health and well-being," says BB&T Capital Markets analyst Corinna Freedman.

And since May sporting goods retailers continue to flourish. Dicks’s Sporting Goods Inc. (NYSE:DKS) has seen an increase of more than 60% over the month following May’s lows in the high $30 per share range. With the demise of Sports Authority making way for the retail sporting industry to do an about face, Dick’s could have a perfect stage set for new growth. In fact the most recent estimates posted last quarter shows the company beating street estimates by more than 20% based on EPS.

Sixteen out of 25 analysts covering the stock gave DKS a “Strong Buy Rating,” one rated it a “Buy” and the rest came in with “Hold” recommendations. Dick’s also has been able to outpace industry earnings growth by about half of a percent.

Foot Locker, Inc. (NYSE:FL) has also seen a jump in stock price since the summer. Shares have steeply climbed by as much as 36.5% since lows in June. The company also has a few handfuls of analysts covering it and more than 70% have given it a rating of “Strong Buy”. The company reported the earnings of $0.94/Share in the last quarter where the estimated EPS by analysts was $0.9/share. The difference between the expected and actual EPS was $0.04/share, which represents an Earnings surprise of 4.4%.

Meanwhile the growing desire for branded fitness apparel by gym-goers has helped propel revenue expectations over the next few years. Analysts growth projections for the current quarter appear to be somewhere in the ballpark of 10%. They are projecting next quarter growth of 14.7% and for the next 5 years, Foot Locker, Inc. is expecting growth to come in just under 10% (9.15%) per annum.

Considering the growing numbers of new gym memberships in the US alone, the increased demand for more specialized facilities to host classes for CrossFit and weight training, and the rise in overall awareness for healthier lifestyles by both baby boomers and millennials alike, apparel manufacturers and retailers could be slated to benefit.

Legal Disclaimer/Disclosure: A fee has been paid for the distribution of this document. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this document should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are subject to change without notice. We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.