When a drug stock ends years of 50% Y/Y earnings per share growth in the last five years, the stock will naturally drop. For Gilead Sciences (GILD), the downtrend is severe: the stock is down around 35% in the last year.

Quarterly results

Gilead’s quarterly results do not give investors any confidence. Not only did executives give themselves a bonus, but they did so as hepatitis C (“HCV”) revenue continued falling. Management also forecast HCV sales falling, which is bad news for the long-term. No wonder the market wants GILD making an acquisition to re-boot growth.

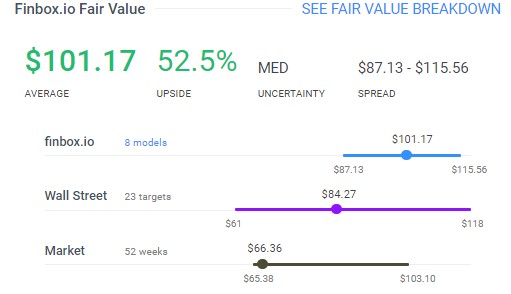

The average price target for Gilead is still high at $84 a share. Finbox.io suggests a $101 valuation:

Management boosted shareholder value by raising its dividend rate. This may stabilize the share price because it reminds investors the company generates solid profits and ROI. The stock action says otherwise: GILD is making new lows every week.

The low P/E of around 6x (present and forward P/E) suggests the market has no expectations for growth this year. Raising prices or boosting sales volumes may attract unwanted attention from the government. Express Scripts, which dropped GILD 2 years ago, will welcome the combo pill Harvoni in 2017. Deals like this may reverse the revenue decline for the company.