Written by Ophir Gottlieb

PREFACE

Alphabet Inc (NASDAQ:GOOGL) stock has enormous upside that may well make it the most promising of the mega cap tech stocks that include Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Facebook Inc (NASDAQ:FB) and Microsoft Corporation (NASDAQ:MSFT).

STORY

Alphabet Inc has seen its revenue and earnings grow essentially unabated. Here is a chart of both metrics:

The bars represent revenue (TTM) and the orange line traces net income (TTM), which in English is after tax profit. But, just as Apple Inc (NASDAQ:AAPL) has faced concerns over a diversification of its revenue stream with respect to the iPhone, and as Facebook Inc (NASDAQ:FB) has faced concerns of slowing revenue and earnings growth due to a lack of diversification, so too has Alphabet Inc faced those concerns.

That mountain of revenue is about 80% from advertising. Most of that advertising comes from Google's Search, and there has been a concern that as search has moved to mobile, Google has less control over the ecosystem which could give way to Apple Inc's (NASDAQ:AAPL) iPhone, if the company so chose, to move away from Google, and it also means Google now faces advertising competition from Facebook's enormous user base, and even, oddly, Amazon.com Inc (NASDAQ:AMZN).

But, Google has a secret weapon -- in fact, it has four secret weapons, and each has the potential to make up a large cap tech company in and of themselves. We can start with the simple, and move to the breaking news at the end.

I. SMARTPHONES - DUH

First, there is this absurd narrative circling that smartphones are doomed to be the next PCs - a dying technology replaced with newer looks, designs and specs. Here is the PC market via our friends at Statista:

The PC market is in decline and will continue to be. But, friends, that is not at all emblematic of the smartphone market. Check out this chart from Statista.

I don't know what else to say other than, the smartphone market is growing, not shrinking.

We wrote a dedicated dossier to Google's new Pixel smartphone Google Has a Huge New Upside Weapon. In that dossier we note the obvious, but somehow wildly misunderstood reality that Wall Street is missing:

While the smartphone numbers we looked at above are interesting, it's all really just conversation for Google.

The company has essentially zero footprint in the smartphone market with respect to actual hardware, so even if smartphones were shrinking, the opportunity for Google is to go from "zero" to some number greater than zero, and that opportunity is big.

We must understand that simply launching a smartphone does not mean it will work. Just ask Microsoft. But, as we discuss in that dossier above, Google has done more than just "launch a phone."

Let's call it an even split at the high end for smartphones, meaning between Apple Inc (NASDAQ:AAPL) and Samsung, about 450 million high end phones have been sold in the last year by the two dominant players.

Alphabet Inc's Google Pixel has been given the imprimatur of the tech critic crowd, placing it directly in competition with the Android Samsung flagships and the Apple Inc (NASDAQ:AAPL) iPhones. In English, the Google Pixel is a legitimate substitution threat.

We'll stop here so not wax rhapsodic (and not to repeat ourselves), but the smartphone market has made Apple Inc (NASDAQ:AAPL) the largest company in the world, even a little piece of that market for Alphabet Inc could mean fully a 25% rise in revenue from this opportunity alone. The Pixel 2 was just announced and will be here in 2017.

After all of that, you could make an argument that this opportunity is small, compared to the rest.

II. SELF-DRIVING CARS

We wrote a dossier It's Time to Focus on Google's Cars. In that piece we uncover the magnificence that is Waymo.

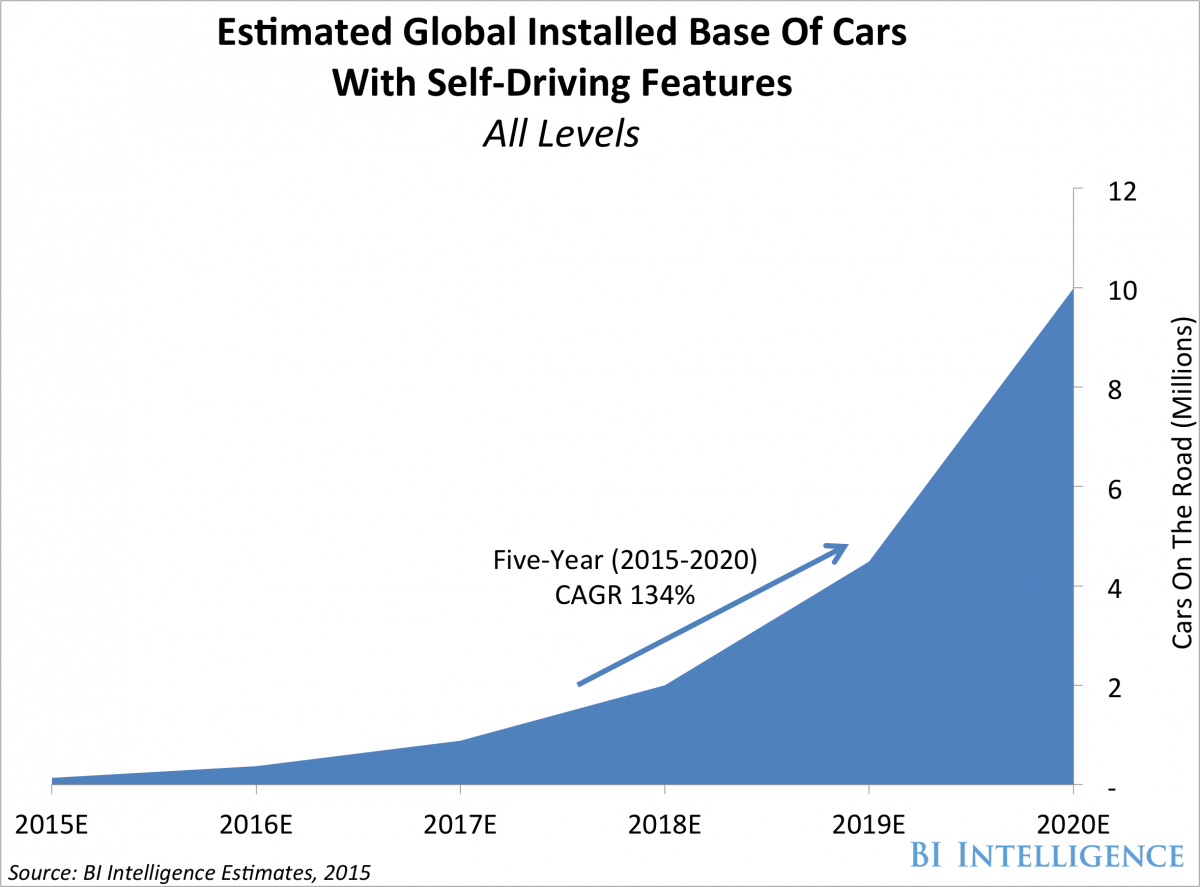

In the last couple of months Alphabet Inc (NASDAQ:GOOGL) has spun out its self-driving car segment into a stand-alone company, still under the Alphabet Inc (NASDAQ:GOOGL) umbrella, called Waymo. Before we dig into the details, a quick step back. This is the expected growth in the market for self-driving featured cars:

For the longest time this project felt like one of the many moonshots that would never really see the light of day - that's what Wall Street would have had us think, at least. But it isn't a moonshot, it's a business - and a rather large one.

It was lost in the wind of headlines, but Alphabet inc has already started talks with General Motors and Ford as well as Honda and Chrysler-Fiat. As we note from that dossier:

Let Tesla sell its 500,000 cars by 2018 if they can. Alphabet Inc is looking to sell tens of millions within five years, with no cost of production, no assembly line, no radical new business - just the best technology in the world licensed to the largest auto makers in the world.

Now, this isn't done but it's definitely starting and Wall Street is miles behind (no pun intended).

THE CLOUD

In our recent dossier Google is Gunning for the Cloud, we discuss at length the moves Alphabet Inc is putting on Amazon.com Inc (NASDAQ:AMZN) and Microsoft to snap that market into its own hands.

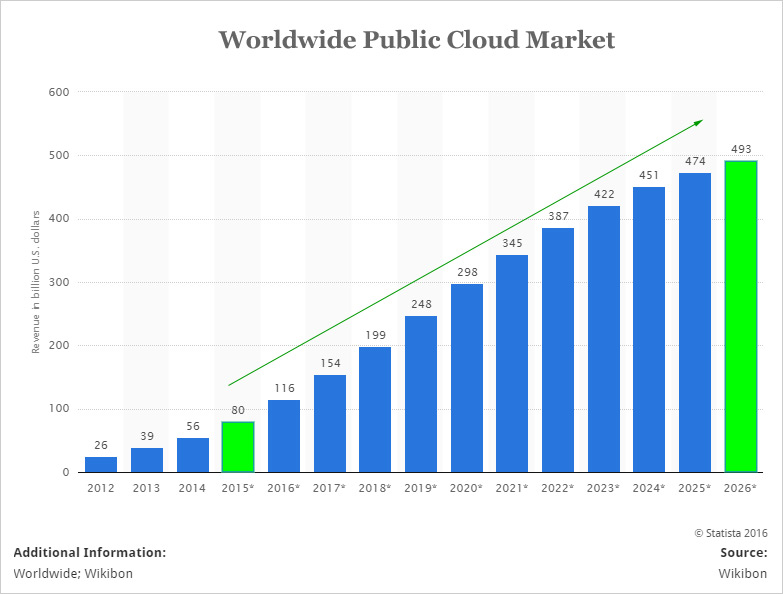

While the cloud has become more like a colloquialism than a name for a technology, the tailwinds to this technological shift are simply unstoppable at this point. There is too much data and too many connected devices even today, not to speak of the absurdity that is to come, to not have a machine learning driven technology to balance the needs of every website, every app, all the data in complete harmony. Enter the cloud.

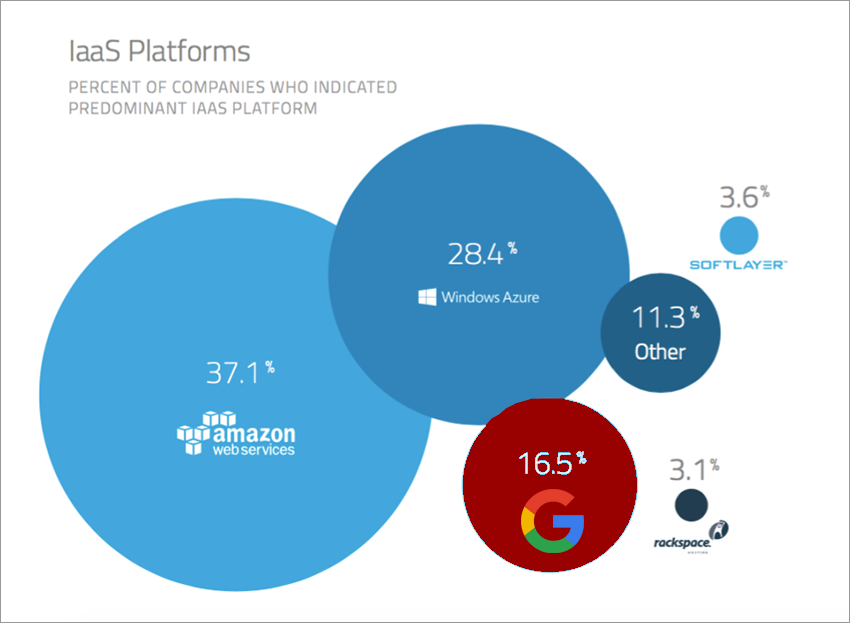

The worldwide public cloud market is forecast to rise from $154 billion this year to nearly half a trillion dollars by 2026. Right now, there are two distinct leaders. Amazon.com Inc (NASDAQ:AMZN) is the undisputed leader and right behind the e-commerce giant is Microsoft Corporation (NASDAQ:MSFT). Here is a market share chart:

While the mainstream media will talk about the battle between Amazon.com Inc (NASDAQ:AMZN) and Microsoft Corporation, the third place company is none other than Alphabet Inc (NASDAQ:GOOGL).

We won't belabor the point here since it is written nice and neat in the dossier noted above, but the point is that the cloud computing market is going to be enormous, and Google has an advantage over both of the incumbents -- there simply is no company that has made more progress in the world of end-to-end machine learning and artificial intelligence than Google.

The demands of the cloud will very soon go well past "having a bunch of servers in a room," and well into the realm of advanced analytics, artificial intelligence and machine learning. With over 25 billion devices soon to be connected in the Internet of Things, don't be surprised to see Google as the new leader in the cloud -- with an advantage that goes well beyond a well formed API structure and cost savings.

Now, that was three of the four secret weapons for Google -- but friends, number four may be larger than all of them.

IV. ONLINE VIDEO

It's just a matter of fact that cord-cutting is coming. In fact, here is a nice visual we put together with data from Statista:

Everything from cord-cutters, to people never having cable, to the number of cable subscribers is pointing in the obvious direction of a need for a new way to deliver TV. And Google is the company with an undisputed lead that it may never relinquish.

YouTube has more viewers aged 18-49, now listen carefully, on mobile alone than any other network or cable broadcast channel in the United States. Here's what new data just showed:

YouTube's average video length may be quite constrained, but in aggregate, viewers are watching a billion hours of its clips per day. That's around 8.4 minutes per day per human, according to some very napkin calculations.

Source: TechCrunch

That reality led to one of the biggest stories in technology of the last five years that somehow has received very little notice. On February 28th we learned that Google has partnered to create "YouTubeTV." And what is this new "YouTube TV?" It's a live and on-demand streaming TV service that will up end cable.

The subscription, which will cost $35 a month for a family plan of up to six accounts, is expected to launch in the next few months in the U.S. Currently there are no plans for international service.

Subscribers will have access to up to 40 networks, as well as YouTube creator content like original content from subscription service YouTube Red.

Channels include all broadcast channels and cable channels like USA, FX, Freeform, ESPN, Fox Sports and NBC Sports. Users can add Showtime and soccer programming for an additional fee.

Then CNBC added some more flavor:

"People will be able to stream to their TVs using Chromecast when the service launches, with additional devices to be added in the future. In addition, Google Home and Google Cast will allow people to speak to their TVs to control their TV experience in the near future."

The most recent data puts cable TV subscriptions at just under 50 million, and subscribers to cable broadband now at 55 million. If we use 50 million as our base, that puts the total addressable market (TAM) for Google at 50 million * $40 /month = $2 billion a month, or $24 billion a year, on top of YouTube's current $12 billion guess-timate in ad revenue.

RISK

Let's keep our eyes on the ball, here. Alphabet Inc is still an advertising first company, and there is risk to that business as mobile becomes a bigger part, if not the central part, and the ad blocking phenomenon also grows.

Further, all of these opportunities, taken as one business at a time, are yet to be proven as winners for Alphabet Inc, although the cloud and YouTube are doing quite well already.

WHY THIS MATTERS

If this is the kind of research you seek, beyond all the click bait that clutters the world of "news," then what we offer may be up your alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley, Barclays, JP Morgan, and the rest on professional terminals as a part of the famed Thomson First Call group. We aim to find the companies that will be the "next Apple," or the "next Google" by diving deep into the trends that will shape the future and finding the lesser known companies that will power them.

Each company in our 'Top Picks' portfolio is the winner in an exploding thematic shift like self-driving cars, mobile data and connectivity, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro for $19/mo. with a lifetime guaranteed rate and you cancel at anytime with no notice. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.