PREFACE

While the tech stocks like Netflix Inc (NASDAQ:NFLX) have been getting all the trading headlines, it turns out that specialty beauty retailer Ulta Beauty Inc (NASDAQ:ULTA) has been a monster trading winner in this bull market. Here are the two stock returns, with Ulta Beauty Inc in red and Netflix Inc in yellow.

But, with the right information, a risk conscious option trading strategy has been the real news and one of the best performers over the last two-years, one-year and even six-months.

Ulta Beauty Inc (NASDAQ:ULTA)

When trading options we need to answer a few questions like -- what to trade, when to trade and when to close the trade. Here's how knowing the answer to those questions has meant nearly 200% returns in Ulta, a return that beats even the mighty Netflix Inc (NASDAQ:NFLX).

What to trade: Lets examine selling out of the money puts in ULTA.

When to trade: Lets also examine weekly options (weekly trading) versus trading every two-weeks.

It might have felt like a trivial difference -- but it isn't trivial at all.

Option trading every two-weeks has turned a 69% return into a 141% return. And even further, it has seen a profitable trade 73.2% of the time, versus 69% of the time, while accruing less commissions.

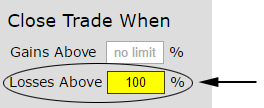

We have answered the what to trade and the when to trade, but we still need to know when to close.

When to Close

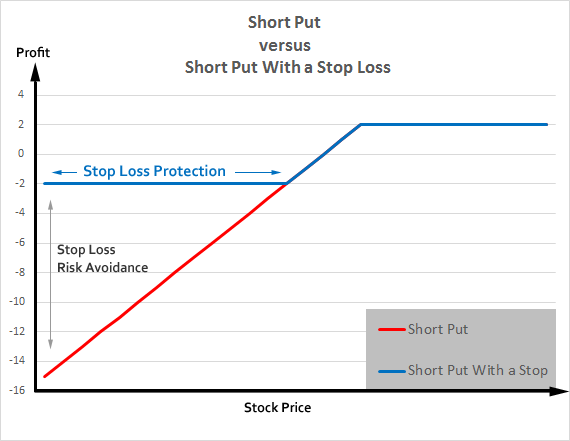

A short put actually has tremendous downside -- so we need to make a risk adjustment to this strategy. While a short put can see a several hundred percent loss in any given trade, we can put a stop loss on each trade to limit that black swan risk.

This move has totally changed the risk:return profile our the option strategy from the red line to the blue line:

And here are the results of using a safety valve in our short put compared to the unprotected one:

We have taken a 141% return, limited risk, and turned it into a 194% return. We have now fully answered the what to trade, when to trade it, and when to close it specifics of our option trades. The final question we need to answer is if this is just luck.

Is This Really Analysis, or Just Luck

Skepticism is natural -- trading isn't a game and that means we have to prove to ourselves that this isn't luck or happen stance.

What we need to do now is look at this short put over various time periods. We see that it has worked over the last two-years, now let's look at the last year:

A 66% return, when we chop the risk down, has turned into a 118% return over the last year. Recall, Netflix Inc (NASDAQ:NFLX) stock, the tech phenomenon, is up less than 45% in the last year and Ulta Beauty Inc (NASDAQ:ULTA) stock is up 53%. We are seeing outperformance.

It's not a magic bullet -- it's just easy access to objective data.

Finally, we look at this short put over the last six-months, these are the results:

Yet again, when we have access to objective data, our what to trade, when to trade, and when to close rules have worked.

What Just Happened

This is how people profit from the option market - it's preparation, not luck. We had a hunch -- we were methodical in our plan, and it worked.

To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.