If you're an investor in Pernix (PTX), Durect (DRRX) or any one of the dozen plus companies developing tamper-resistant technology for opioid drugs, you might want to check out Lightlake Therapeutics (LLTP) - a $16 Million company that signed a $55M licensing deal in December 2014 and, as of November 2015, has the only FDA-approved nasal naloxone.

There are at least a dozen companies competing for the $20+ billion opioid market, which explains why they're cumulatively valued at upwards of $15 billion.

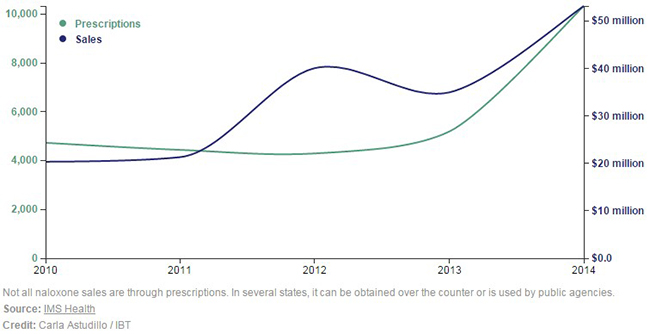

Lightlake is the only FDA-approved nasal naloxone and competes with 2 companies that offer naloxone in a syringe and an auto-injector, respectively. Sales of naloxone were ~$50 million in 2014, according to IMS data. We think this number will rise to $1 billion for 3 reasons:

- Obama is allocating $133 million towards the opioid crisis for 2016

- CVS and Rite Aid have made naloxone available on store shelves as an OTC product

- Guidelines from Dept. of Health suggesting naloxone could become a standard script accompanying 240+ million opioid scripts written every year in the U.S. [1]

In 2014 only 10,331 naloxone scripts were written - compared to 240M opioid scripts - which fits in nicely with the ‘enormous opportunity’ IB Times sees for companies like LLTP.

LLTP most recently traded at $8.75 per share. We think fair value is $30 per share, implying potential upside of 240% [2].

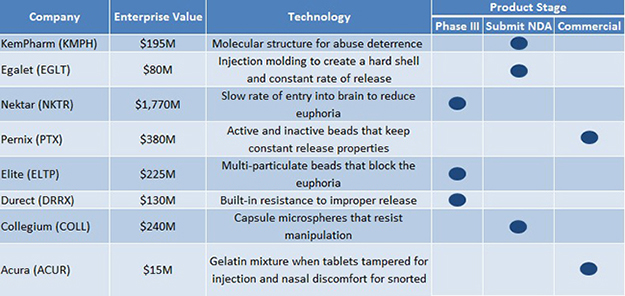

Abuse-Deterrent Space is Large & Well Established, But Crowded

In 2014, sales of opioids in the US were $20+ billion. With more than 240 million opioid prescriptions dispensed per year (450 million including refills) and commercial success of pain pills like Purdue’s OxyContin and Endo’s Opana, the opioid pain relief space is crowded with competitors. Numerous companies are now vying to develop the next billion dollar opioid capsule with technology that also combats abuse of painkillers, as shown in Figure 1, below.

Figure 1: Abuse-Deterrent Technologies in the Crowded Opioid Space

As shown above, Nektar (NKTR) and Elite Pharma (ELTP), as an example, must beat the odds by first overcoming regulatory hurdles to gain FDA approval and then distinguishing themselves in a highly competitive sector. To prove our point, look at Durect’s (DRRX) Remoxy, an extended-release version of oxycodone that was twice rejected by the FDA. Durect’s commercial partner, Pfizer, abandoned the partnership shortly afterwards.

LLTP is 1 of Just 3 Early Movers in Naloxone Space Expected to Grow From $50 Million to $1 Billion.

An article in International Business Times [3] does a great job shedding light on the impact nasal naloxone could have on the US overdose epidemic. With 2014 naloxone sales at just $53.2 million, investors have overlooked the [overdose] drug naloxone in favor of opportunities that are perceived to be more certain (but not necessarily less risky or more lucrative).

Figure 2: Investors Underestimate Actual Naloxone Sales Growth, Let Alone Future Growth. Naloxone Sales 2010-2014.

Lightlake’s nasal spray couldn’t have been commercialized at a better time. Doctors wrote 10,331 prescriptions for naloxone in 2014, a miniscule figure when considering that over 240 million opioid prescriptions are dispensed each year. Rite-Aid & CVS recently announced that they will sell naloxone over-the-counter [4], while Obama is tripling 2016 government purchases of naloxone to 400,000 units. Further, with the potential for naloxone to be co-prescribed with every dispensed painkiller, this creates tailwinds to drive sales momentum as the market for opioid overdose drugs (naloxone) expands to $1 billion. Asked about [the] potential of co-prescribing naloxone with painkillers, Daniel Raymond, Policy Director at Harm Reduction Coalition, a leading non-profit organization focused on public health reform, states:

“We’re hoping with these final guidelines, it sends a very strong signal that more doctors should start thinking about this.”

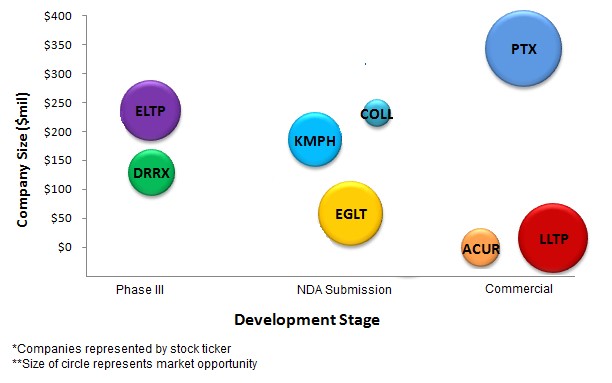

Lightlake’s Narcan is a commercial drug. But LLTP has a market capitalization of just $16 million, the smallest among 8 companies we selected based on exposure to the opioid opportunity, as shown in Figure 3, below.

Figure 3: LLTP Smallest in Size but Addressing One of Largest Opportunities in Opioid Market - Overdose

Durect and Elite Pharma are in Phase III of development and are commanding hundred million dollar plus valuations, whereas Egalet, KemPharm and Collegium have submitted their abuse deterrent candidates for FDA review and command valuations that are even larger. Companies positioned right-most in the graph, above, are furthest in product life-cycle; the larger bubbles represent larger market opportunities. Among the 8 companies represented in Figure 3, Lightlake has one of the most advanced products, addressing one of the largest opportunities, but commands the smallest valuation, suggesting a disconnect between fair value and market value.

1 in 2 Refer to Naloxone as “Narcan”. LLTP Bought “Narcan” Name to Own $1 Billion Naloxone Market

In late 2015, Lightlake received FDA approval for their nasal naloxone, giving the company first mover advantage with a disruptive non-needle product. To help with commercial rollout, Adapt Pharma, LLTP’s commercial partner, acquired the rights to Narcan’s brand name, which was naloxone’s original brand back in 1971, when the drug was initially approved. Matt Ruth, chief commercial officer for Adapt Pharma, says that more than 50 percent of current public references to naloxone actually still refer to ‘Narcan’ even though that product was discontinued in 2009, demonstrating the brand is used interchangeably with ‘naloxone’ and will create a huge competitive advantage for its owner – Adapt Pharma and Lightlake Therapeutics (LLTP).

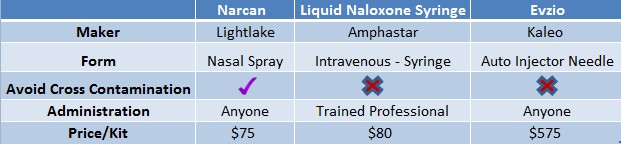

Figure 4: At $75/kit, Narcan Competitively Priced to Alternatives Already on the Market

Lightlake’s nasal naloxone is designed for the average person to use compared to naloxone in a syringe, which requires a trained medical professional to administer. Presumably, this convenience factor will drive sales as Narcan is the most laymen-friendly device on the market.

“For me, it would be unethical to use anything else”- saysDr. Phil Skolnick, who oversees medical treatments for addiction at NIDA, when commenting on physicians recommending Narcan nasal spray.

Peers Show LLTP Mispriced; Fair Value 3x Current Market Price

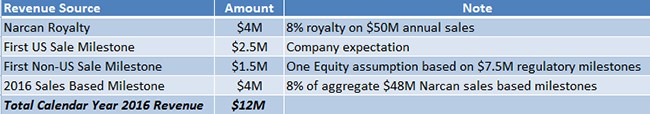

With projected revenues of $12 million in 2016, as shown in Figure 5, below, LLTP market cap of $16M is compelling, in our view. We conservatively assume that Lightlake’s Narcan will generate $50 million in 2016 sales (or capture 5% of the $1 billion opioid overdose market). Adapt agreed to license Narcan from LLTP in exchange for tiered royalties in the high-single to low double-digit range. We assumed 2016 royalty rate would be 8% based on a sensitivity analysis.

Figure 5: Breakdown of LLTP’s Expected CY 2016 Revenues of $12M

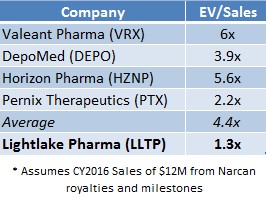

LLTP currently trades at 1.3x EV/Sales (on a forward basis), whereas a sample of specialty pharma peers on average command a 4.4x multiple (as shown in Figure 6, below). If LLTP were priced in line with the average EV/Sales multiple that specialty pharma companies command today, LLTP shares would be worth $30 (discussed in further detail here).

Figure 6: A Sample of Specialty Pharma Companies Show Average Valuation Is 4.4x EV/Sales. LLTP Trades At Just 1.3x EV/Sales.

LLTP Valuation Completely Discounts November 2015 Inflection Point. 3 Catalysts in 2016 Could Quickly Correct Mispricing.

Lightlake trades at a fraction of Elite Pharma and Durect, even though the latter names are in a fiercely competitive space and face regulatory uncertainty. LLTP, on the other hand, is positioned through commercial partner Adapt Pharma to become the leader in naloxone sales by offering Narcan, the most convenient form of [the] overdose drug available. LLTP has hurdled regulatory risk with FDA approval of Narcan in November 2015 (in our view, the ‘inflection’ point) and has shifted commercial risk to their partner Adapt. Who is Adapt? They’re a group of pharma entrepreneurs with a proven track-record of commercializing specialty drugs. They worked at Elan (acquired by Perrigo for $8.6B), then founded, built & sold specialty-pharma company Azur to Jazz Pharma for $500M in 2011 (a deal now worth $2 Billion).

We believe that 2016 will be the year that Lightlake’s (LLTP) mispricing will be corrected, representing potential upside of 240% as the company (i) pursues an up-listing to a national exchange (ii) conducts pivotal drug studies for its Binge Eating Disorder, Cocaine Addition, and Bulimia drug candidates and (iii) generates incoming royalties from [Adapt Pharma’s] Narcan sales.

References & Endnotes

[1] http://www.cdc.gov/drugoverdose/pdf/hhs_prescription_drug_abuse_report_09.2013.pdf

[2] Computation does not include Lightlake’s ~4.6 million cashless options. Using a net share settlement feature would allow the company to only deliver the difference between the market price and strike price in issued shares when the options are exercised. At $10, for example, a total of ~580,000 shares would be issued from exercised options, bringing the diluted shares outstanding figure to approximately 2.38 million. The dilutive effect will vary depending on market price at time of exercise.

[3] http://www.ibtimes.com/addiction-2016-heroin-use-escalates-new-drug-reverse-overdoses-hits-us-drugstores-2271924

[4] http://www.huffingtonpost.com/entry/cvs-naloxone-overdose-reversal_us_5602dba2e4b0fde8b0d0d189

[5] In our note we refer to ownership of certain trademarks, rights and other assets as belonging to Lightlake and Adapt Pharma interchangeably, unless specifically defined otherwise. We do this to simplify the fact that, for example, Adapt Pharma's acquisition of the trademark 'NARCAN' directly benefits Lightlake as a licensee receiving royalties from Adapt's commercialization efforts. 'NARCAN' gives Adapt an edge in selling Lightlake's nasal naloxone, and Lightlake in turn benefits from Adapt's edge.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Lightlake Therapeutics ("Lightlake" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and forty thousand dollars and seventeen thousand restricted shares of Lightlake for our services beginning in February 2015. We may receive up to ten thousand dollars per month and thirty three thousand restricted shares over the course of our agreement, ending on December 15, 2016. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we believe that we hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We believe our assessment of issuers prior to entering into a coverage agreement allows us to assess whether an issuer is truly undervalued and deserves greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/