59 million cyber-attacks in 2015 helped fuel a combined $20 Billion investment from U.S. government and private entities. The growing threat of cyber security spurred investment, growth in revenue and growing valuations for leading solution providers. As an example, combined, Zix Corp. (ZIXI), CyberArk (CYBR) and FireEye (FEYE) sported a peak valuation of $4.9 Billion in 2015. The silver lining to the growing cyber security threat is that new companies were born from a new need and their investors were financially rewarded.

The U.S. government is proposing to spend $1 Billion to fight a new threat – a 3.4x increase in opioid overdose deaths. To combat 240M+ scripts written each year for opioid drugs like OxyContin, Percocet, and Vicodin, the government is tripling its purchases of naloxone to 400,000 units in 2016. The silver lining in the opioid overdose epidemic is that whoever captures the naloxone market will reap the rewards of this growing billion dollar problem.

In our view, Opiant Pharmaceuticals (LLTP) will emerge as the clear front-runner in reversing America’s opioid overdose. Opiant (LLTP) trades at $9 per share. But its peers suggest fair value is closer to $20 per share.

Cyber Security Threat Drove Investment, Revenue and Valuation of Leading Cyber Security Firms

Since 2013, cyber-attacks on governments and businesses have doubled. To be better equipped against threats, Obama proposed a $19 billion spend on cyber security for fiscal 2017, an increase of $5 billion over 2016.

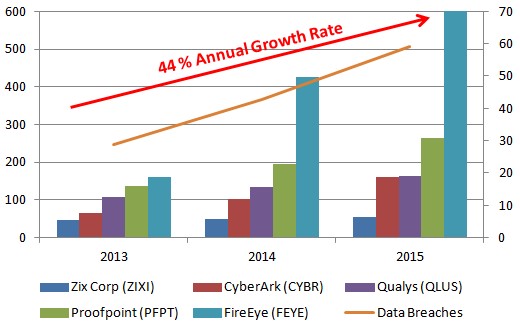

Growth in cyber security investment has been met with growth in actual sales, as cyber-security constituents have clearly shown (Figure 1, below).

Figure 1: Revenues Up 44% Per Year Since 2013

Zix, FireEye and CyberArk benefitted from a growing demand for their solutions, reflected in actual sales. Then their share prices reflected this, up 50%, 70% and 150%, respectively, at their June 2015 peak compared to the same period a year ago (Figure 2, below).

Figure 2: Shareholders Netted a 50% Minimum Return At The Peak

Opioid Overdose Epidemic Driving Increased Investment and Sales of Naloxone. Company Valuations to Follow?

Investment

The U.S. opioid overdose epidemic is already seeing hundreds of millions in private and public investment to improve access to naloxone, a drug used to reverse opioid overdose. The US government is allocating $133 Million to triple purchases of naloxone to 400,000 units in 2016. PDL BioPharma loaned kaleo $150M Million in 2014 to commercialize their automated injector version of naloxone. The National Institute of Health committed funds to co-develop a nasal version of naloxone with Opiant Pharma. Adapt Pharma then licensed the nasal naloxone candidate from Opiant for milestones of up to $55 Million and up to double digit royalties. Adapt Pharma is led by a group of pharma entrepreneurs with a proven track-record of commercializing specialty drugs These same executives founded, built & sold specialty-pharma company Azur to Jazz Pharma for $500M in 2011. The Azur/Jazz deal was worth over $2 Billion at its peak. Adapt Pharma raised close to $100 Million to support their in-licensing and commercializing of specialty drugs in the United States. Most of that capital came directly from the management team, suggesting Adapt has a strong vested interest in making Narcan very successful in the marketplace.

Sales Growth

Amphastar, the industry leader in naloxone sold in a syringe form, is expecting 2015 sales to double due to the rapid increase in number of overdoses. Given that Narcan is the most convenient form of naloxone, we expect [Adapt Pharma] will capture 5% of the $1 billion opioid overdose market and generate $50 million in 2016 sales. Accordingly, Opiant revenues from milestones and royalties could come in at $12 million (discussed in further detail here).

Constituent Valuations

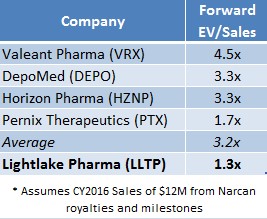

LLTP currently trades at 1.3x EV/Sales (on a forward basis), whereas a sample of specialty pharma peers on average command a 3.2x multiple (as shown in Figure 3, below). If LLTP were priced in line with the average forward EV/Sales multiple that specialty pharma companies command today, LLTP shares would be worth $20.20, or 118% higher than current market prices [1].

Figure 3: Sample of Specialty Pharma Companies Show Average Valuation Is 3.2x EV/ Forward Sales. LLTP Trades At Just 1.3x

Value Assigned to Indivior’s Nasal Spray Naloxone Shows LLTP Deeply Undervalued

A comparative transaction also indicates that Opiant is trading below fair value. Both Opiant and Indivior applied for regulatory approval of a nasal naloxone device around the same time in 2015. Analysts valued Indivior’s nasal naloxone product at roughly $160 Million. Opiant, on the other hand sports a market cap of just $17 Million. The FDA approved Opiant’s drug on November 18, 2015 and soon after issued Indivior a Complete Response Letter (rejection letter).

Headlines Acting as LLTP Tailwinds

1) Naloxone Sales Could Shift from Improvised Nasal Kits to Narcan

A study at London’s National Institute for Health Research (NIHR) concluded that Narcan should replace the improvised nasal kits due to the lack of information available [2]. Improvised nasal kits consist of standard naloxone syringes (developed and licensed for injections) that have a nasal atomizer attached, as seen in Figure 4, below.

Figure 4: Improvised Nasal Kit (left) vs Narcan Nasal Naloxone (right)

First responders (peers, family, police, etc.) may prefer nasal sprays to injectable naloxone, which originally led to the widespread use of the improvised kits. However, data has shown that these improvised kits have been non-responsive in as many as 26% of patients. Until Narcan’s approval, Amphastar’s (AMPH) syringe and improvised kits were considered the industry’s standard of care, generating sales north of $35 million.

The NIHR study argues that Narcan’s FDA approval demonstrates the necessary efficacy and safety profile to make improvised nasal naloxone obsolete. This superiority should completely shifts sales momentum away from Amphastar and in LLTP’s favor.

2) CVS & Walgreens Will Make Naloxone Easier for Patients to Buy in 35 States

CVS and Walgreens are giving patients access to Narcan by consulting an in-house pharmacist rather than requiring a prescription from a physician.

In 2016, CVS announced that it will be making naloxone available without prescription in 20 more states, in addition to already stocking the product in 15 states [3]. Similarly, Walgreens will make naloxone available without a prescription in 35 states throughout 2016 [4]. These moves sets a precedent for other nationwide pharmacies like Rite-Aid and Wal-Mart to follow suit and make naloxone available OTC.

3) Naloxone Could be Co-prescribed With Painkillers

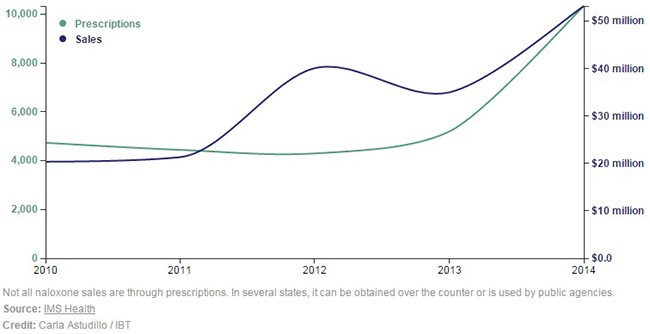

In 2014 only 10,331 naloxone scripts were written - compared to 240M opioid prescriptions - which signifies the vast opportunity for Narcan’s adoption. 2014 was an inflection point for naloxone prescriptions because they doubled from 2013 (Figure 5, below).

Figure 5: Naloxone Prescriptions Have Seen Rapid Growth in 2014

Guidelines from the American Medical Association suggest that naloxone should become a standard script accompanying the 240 million opioid scripts written every year in the US [5]. Recently, a California doctor received 30 years-to-life after being convicted of second degree murder of three patients who overdosed on opioids. To eliminate this liability, doctors will be more inclined to accompany every dispensed opioid script with a naloxone script.

Key Takeaways:

- Growth in cyber security spending was driven by a growing cyber security threat; innovators like FireEye benefitted first through (i) increased investment, followed by (ii) increased demand for their solutions, and inevitably (iii) demand for shares of their common stock.

- Growth in naloxone spending is being driven by increase in opioid drug overdose deaths. Until Opiant’s (LLTP) ‘Narcan’, there was no alternative for injection-administered naloxone.

- Government funding at the National Institutes of Health (NIH) helped Opiant develop nasally-administered naloxone or ‘Narcan’; Adapt Pharma is leveraging its $100M balance sheet to commercialize the product.

- Opiant Pharmaceuticals (LLTP) could receive $12M in a combination of milestone and royalty payments from partner Adapt Pharma in 2016

- Specialty Pharma companies like Valeant, Horizon BioPharma, DepoMed and Pernix trade at average 3.2 EV/Sales multiple.

- If Opiant Pharmaceuticals LLTP reports 2016 sales of $12M, fair value is $20/share, compared to a recent market price of around $9, implying 122% in potential upside.

References & Endnotes

[1] Computation does not include Opiant’s ~4.6 million cashless options. Using a net share settlement feature would allow the company to only deliver the difference between the market price and strike price in issued shares when the options are exercised. At $10, for example, a total of ~580,000 shares would be issued from exercised options, bringing the diluted shares outstanding figure to approximately 2.48 million. The dilutive effect will vary depending on market price at time of exercise.

[2] http://onlinelibrary.wiley.com/doi/10.1111/add.13209/full

[3] http://money.cnn.com/2016/02/04/news/companies/heroin-overdose-naloxone/

[4] http://www.dailyherald.com/article/20160209/news/160208854/

[5] http://prescribetoprevent.org/wp2015/wp-content/uploads/1naloxone-rev-8-14.pdf

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and fifty thousand dollars and seventeen thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional thirty three thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/