This past November, the FDA approved ‘NARCAN’, a nasally-administered version of naloxone, for opioid overdose. Prior to this, naloxone was only available as an injection, which limited its real-world use.

The maker of NARCAN is Opiant Pharmaceuticals (OPNT), an $18 million company addressing a naloxone market likely worth $1.3 billion, not $60 million - as reports of sales of the injectable naloxone drug suggest [1].

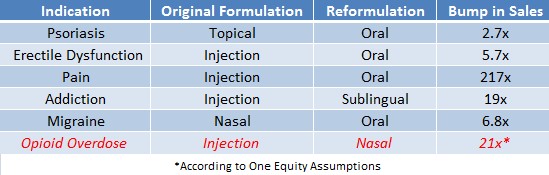

Drugs that are effective as injections are sometimes underutilized and limited in their real-world application for reasons ranging from convenience to access, as is the case with injected naloxone. When these underutilized drugs are reformulated and effective in oral or intranasal form, they often expand sales and market penetration.

Figure 1, below, shows a massive uptick in sales of drugs, like Pfizer’s (PFE) ‘Viagra’ for erectile dysfunction or Purdue Pharma’s ‘Oxycodone’ for pain, after the pharmaceuticals were reformulated from injection to oral delivery.

Figure 1: Sales Ballooned After Needed Drugs Were Made Available In Convenient and Accessible Form

Our research suggests that the market has underestimated the true size of the naloxone market by a factor of 21x. This creates a significant arbitrage opportunity in owning Opiant Pharmaceuticals (OPNT), who owns the only FDA-approved non-injection form of naloxone – NARCAN.

Opiant’s NARCAN was launched in late Q1 2016 in parallel to (i) an uptick in new government spending on naloxone, (ii) increased private investment and (iii) CVS and Walgreens announcing that naloxone would be made available over-the-counter in 35 states this year. On the basis of a conservative market penetration, we peg fair value for OPNT shares at $17. OPNT most recently traded just shy of $10 per share. If our estimates are met, owning OPNT represents potential upside of 77%.

Cynapsus’ Sublingual Levodopa Helps Explain Opportunity for Opiant’s Intranasal Naloxone

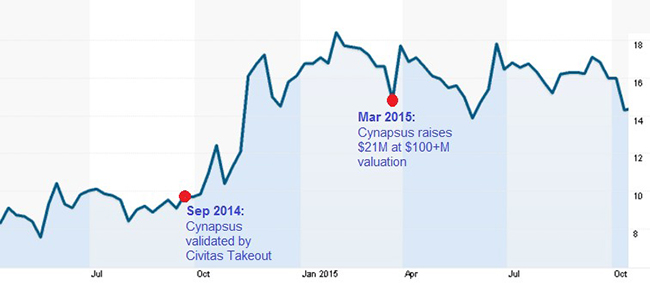

Before Civitas - the maker of an inhaled version of Levodopa - was acquired by Acorda Therapeutics (ACOR) for $525 Million, investors had assumed the total addressable opportunity for Levodopa was <$100 Million.

Cynapsus (CYNA), who is now in late-stages of testing a sublingual formulation of Levodopa, was then valued at $50 Million, because peak sales of injected Levodopa – branded ‘Apokyn’ – were just $50 Million worldwide. Cynapsus had conducted surveys of neurologists that clearly showed utilization of the injected Levodopa was in the single digits because patients requiring the drug had difficulty preparing the injection.

Investors grossly underestimated the addressable market for a convenient form of Levodopa. It wasn’t until Acorda bought inhaled-apomophine maker Civitas for more than half a billion dollars that investors finally started paying attention to the arbitrage in Cynapsus’ valuation (as shown in Figure 2, below). Cynapsus peaked at a valuation over $250 Million last year.

Figure 2: Reformulated Levodopa Buoys CYNA Shares After Market Validation from Civitas Acquisition

Opioid overdose is an epidemic in the U.S. Emerging companies like Elite Pharma (ELTP) are attempting to curb the opioid abuse with deterrent technology, but the only effective therapy to rescue an individual who has overdosed on opioids – which includes illicit drugs like heroin and prescription painkillers – is naloxone. Opiant Pharmaceuticals (OPNT) owns the only non-injected form of naloxone approved by the FDA.

FDA Report Suggests IMS Health Grossly Underestimated Size of Naloxone Market in 2014

IMS Health pegged sales of naloxone at $60 Million in 2014, but a flurry of data from the FDA, the CDC and other impartial sources suggest this grossly underestimates the actual size of the opportunity for a convenient and widely-accessible form of naloxone.

The FDA reports that naloxone makers - which include Amphastar (AMPH), Mylan (MYL) and Hospira (owned by Pfizer (PFE)) – increased the price of the injected drug to $30 on average, for a total of 3.2M vial sales in 2014 [2]. Total sales of naloxone were therefore $96M, compared to IMS Health’s estimate of $60M. This clearly shows that IMS Health under-estimated the size of the naloxone market by a factor of 1.6x in 2014.

Historically, Lack of ‘Layman-Friendly’ Naloxone Limited Its Real-World Use

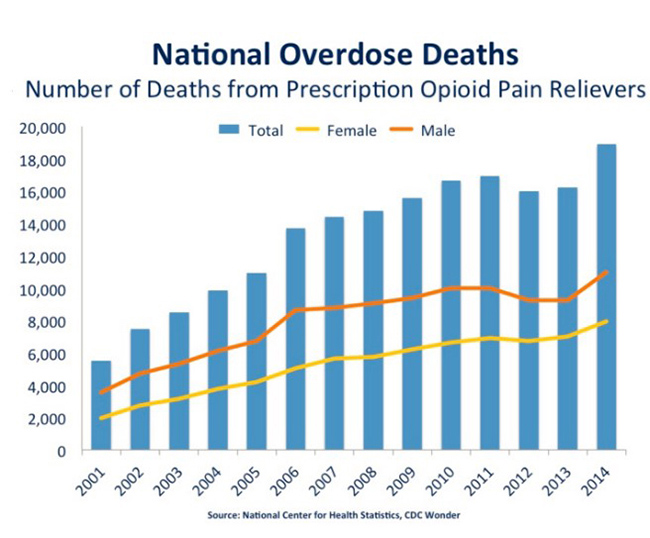

The problem is access. Syringe-administered naloxone is limited in use to first responders. Often, by the time first responders arrive on the scene of an opioid overdose, the patient has already died, making availability of the [injected] naloxone redundant. Figure 3, below, clearly shows that a ‘layman’ version of naloxone is necessary.

Figure 3: Overdose Deaths Have Risen 4-Fold Since 2001 To Epidemic Proportions

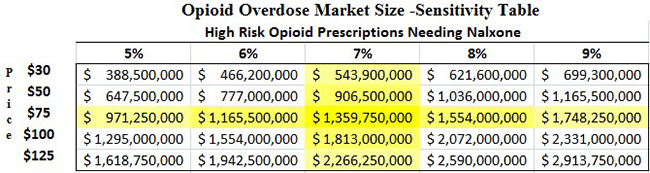

Here’s Why The Addressable Market For Naloxone Is $1.3 Billion in 2016, or 21x Larger Than Industry Reports Suggest

Guidelines from the American Society of Addiction Medicine suggest that naloxone should become a standard script accompanying the 260 million opioid scripts written every year in the US [3].

More than 7% of patients prescribed opioids are considered at high risk for abuse, according to a study published in the Journal of American Medical Association [4]. In our model (Figure 4, below) we assume that 7% of the 260 million opioid prescriptions dispensed are to patients with high-risk for abuse and require a naloxone co-prescription. A price of $75 per NARCAN kit (the “special interest” pricing offered to government buyers) would mean that the market size for NARCAN is $1.3 billion in 2016, or more than 21x larger than the $60 million reported by IMS in 2014.

Figure 4: Market for Opioid Overdose Could Be 21x Higher Than IMS Data Suggests

Here’s further proof the market is grossly underestimating the size of naloxone for opioid overdose:

- The U.S. Federal Government Is allocating $133 Million and tripling government purchases of naloxone to 400,000 Units

- kaleo raised $150 Million from PDL BioPharma to support commercialization of ‘auto-injected’ naloxone, branded ‘EVZIO’

- The Clinton Foundation agreed to subsidize the cost of EVZIO. They recently added NARCAN to the list of medicines that they’re making more affordable to those who need it but cannot access due to out-of-pocket cost.

- Adapt Pharma, OPNT’s commercialization partner, raised $95 Million to “in-license and commercialize specialty pharma drugs in the United States”. All funds were raised from personal investment from the group’s founders (more on Adapt later). The only product Adapt seems to have in-licensed and commercialized since inception is NARCAN for opioid overdose.

- CVS & Walgreen said they would make naloxone available over-the-counter (OTC) in 35 States in 2016

The most direct evidence that the size of the naloxone market being grossly underestimated comes from existing industry players:

- Amphastar is scrambling to develop an intranasal naloxone because the Company realizes this will greatly expand sales of their naloxone franchise. Amphastar has been criticized for selling an ‘improvised’ nasal kit which has been shown to be ineffective in as many as 26% of patients.

- Before OPNT’s NARCAN was approved by the FDA, Indivior, a $1.1 Billion dollar company who was also developing a nasal-spray naloxone, expected peak sales of their drug to be $100 Million.

- Sarah Potter, an analyst at Deutsche Bank, valued Indivior’s nasal naloxone at $160 Million if commercialized in 2016. Ultimately, Indivior’s nasal naloxone was rejected by the FDA over concerns of efficacy. Indivior’s failure to win FDA approval left OPNT as the only player with a non-needle form of naloxone with regulatory approval.

OPNT Fair Value is $17/Share, or 77% Higher Than Current Market Price

OPNT received a $2.5 million milestone payment from partner Adapt Pharma in March 2016 for the first commercial sale of NARCAN in the US. We expect calendar year 2016 sales to come in at $12 million [5].

OPNT currently trades at 1.3x EV/Sales (on a forward basis, assuming 2016 sales of $12 Million) compared to specialty pharma peers Valeant (VRX) and DepoMed (DEPO), at 2.6x. If OPNT were priced in-line with its peers, OPNT shares would be worth 77% higher than they are today.

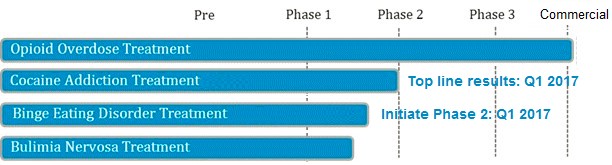

Opiant Pharmaceuticals is developing a pipeline of drugs based on its expertise in addictive behaviors. The company expects to report Phase 2 results for their National Institute on Drug Abuse (NIDA) sponsored cocaine use disorder drug in Q1 2017 [6]. If successful, we believe this study will draw collaboration interest from larger partners that will bring the drug-candidate to market, akin to Adapt commercializing NARCAN in exchange for a royalty and $55 Million in potential milestones payments to OPNT.

Figure 5: OPNT Valuation Completely Discounts ANY success with Pipeline Drug Candidates For Other Large Unmet Needs

What are the risks to owning Opiant Pharmaceuticals?

In Opiant’s 10-Q the Company discloses that it will need to raise additional capital to move its pipeline of drug candidates forward. However, historically, the Company has been able to develop products, notably NARCAN, through non-dilutive profit-interest sales and research grants. Options issued to management will have a dilutive effect on the number of shares outstanding, however, this has been balanced by value-creation, including a $55M+ licensing deal with Adapt Pharma and regulatory approval of their lead product. Follow-on drug candidates are de-risked, relatively speaking, since naloxone is both well-understood from an activity and safety viewpoint. Further, Opiant has proven its ability to navigate the FDA drug pathway.

Why Own OPNT Right Now? Because the market will correct.

We believe OPNT’s quotation on the OTCQX has led to an inefficient valuation of the Company. Further, we believe the market has grossly underestimated the size of the naloxone market for a layman-friendly and widely accessible form of naloxone, eg. nasal spray form. Investors familiar with MannKind (MNKD) might recall the maker of an inhaled version of insulin sporting a multi-billion dollar valuation on the premise that some patients would prefer this formulation over injection. So why wouldn’t investors assign an $18 Million market cap Company a higher valuation as it tackles a burgeoning unmet $1.3 Billion need with a disruptive formulation of a proven drug?

As Cynapsus and countless other mis-valued companies have shown, the market eventually corrects. OPNT’s commercialization partner Adapt Pharma brought NARCAN to market in late Q1 2016. Q2 results create a catalyst for OPNT and a reason to own the Company right now. Shares trade just below $10 but are worth upwards of $17, in our view, pointing to potential upside of 77%.

Key Takeaways:

- Naloxone is an effective treatment for opioid overdose; however, its real-world use is limited when administered as an injection

- In November 2015, Opiant’s (OPNT) NARCAN became the first and remains the only FDA-approved naloxone administered as a nasal-spray, versus competitors who all require needle injection

- Reformulations of effective drugs from injection to oral or nasal spray form have historically resulted in expansion of the reformulated drug’s sales, often 10-fold or greater.

- Our estimates suggest naloxone market size is actually $1.3 billion, versus the misconception that it is only $60 Million

- NARCAN was commercially launched in February 2016

- Misconception of nasal-spray naloxone market size creates an opportunity in owning OPNT at recent market prices

- OPNT has potential upside of 77%, with a compelling risk profile

References & Endnotes

[1] http://www.foxbusiness.com/features/2015/04/21/amphastar-and-others-are-providing-life-saving-naloxone-products.html

[2] http://www.fda.gov/downloads/Drugs/NewsEvents/UCM454757.pdf

[3] http://prescribetoprevent.org/wp2015/wp-content/uploads/1naloxone-rev-8-14.pdf

[4] http://archinte.jamanetwork.com/article.aspx?articleid=1840033

[5] http://ir.baystreet.ca/article.aspx?id=195

[6] http://finance.yahoo.com/news/opiant-pharmaceuticals-inc-reports-fiscal-123000286.html

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and fifty thousand dollars and seventeen thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional thirty three thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/